Organ Care System Market For Lungs Report

RA00036

Organ Care System Market For Lungs by Handling (Portable and Trolley based), Regional Outlook (North America, Europe, Asia-Pacific, LAMEA), Global Opportunity Analysis and Industry Forecast, 2019-2026

Update Available On-Demand

Organ care system market for Lung Growth 2026:

Organ care system market for lung forecasted to grow at a CAGR of 19.0% generating a revenue of $5.6 million by 2026.

Organ care system is a medical device that allow the donor organ to preserve for a longer period of time and it can be used during the transplantation. The OCS market for lung is estimated to have a significant growth in the forecast period. Increasing cases of lung diseases, especially among the old age population, will accelerate the organ care system for lung market, which control the disease consequences.

Most common diseases when the lung transplantation has to undergo are chronic bronchitis, Pulmonary Fibrosis, Idiopathic pulmonary arterial hypertension and many more.

Drivers of Organ care system market for Lung:

Rising cases of elderly population, adaptation of bad activities and lack of physical activity boost to the growth Organ care system market for Lung.

According to the International Society of Heart and Lung Transplantation “The total number of lung transplantation operated in the world is increasing, approximately 40000 cases annually are operated in the limited number of centers.” The major factors that drive the OCS market for lung is the growth of the adoption of bad habits such as smoking, and the increasing level of pollution. Additionally, lifestyle of the people also affects the health due to unhealthy food, improper diets and lack of physical activities. These factors are set to boost the overall market growth during the projected period. As per World Health Organization (WHO), it is estimated that the old age population may increase up to 2 billion by 2050. In developed countries such as U.S., UK. and Japan the old age population are increasing at a higher rate.

Market Restraints:

Cold Storage can be a severe threat to the growth of Organ care system market for Lung.

Cold storage is one of the biggest restrains in OCS lung market for the high rate of post-transplant complications that will negatively impact patient’s health consequences if the storage is not proper. Approximately 77% of the donor’s lungs left unutilized in the U.S. due to the limitations of the cold storage. Additionally, longer survival of the patient is not as promising as other transplant like kidney or liver. The availability of the donor is limited and is considered to be the one of the biggest restraints for the market.

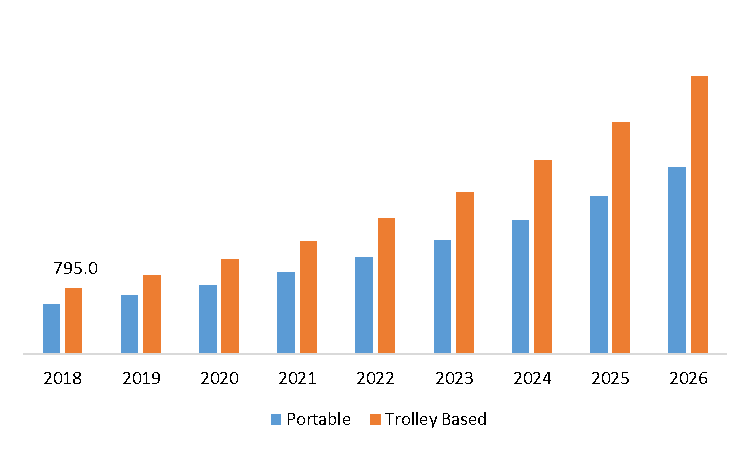

Organ care system market for Lung, by Handling:

Trolley based is predicted to be most profitable till the end of 2026

Source: Research Dive Analysis

Based on the handling the OCS market for lung is segmented into 2 types Portable and Trolley based. Trolley based held the largest market in 2018 by $795.0 thousands and is expected to exceed at a 19.7% CAGR in the forecast period. Trolley based is the most widely used and is widely used in all the organ storage centers. Portable OCS market size for lung is predicted to have a market share of $599.8 thousands in 2018 and is expected to grow at a 18.0% CAGR in the forecast period. Portable device, helps in time management while storing the organ, helps to improve the organ quality, and secured portable in carrying and operate, are the factors to expand the portable organ care system market for Lung globally.

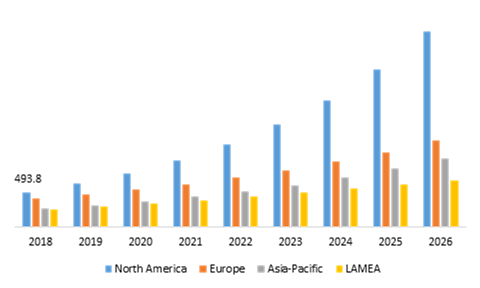

Organ care system market for Lung, by Region:

North America region will have enormous opportunities for the market investors to grow over the coming years

Source: Research Dive Analysis

North America Organ Care System Market for Lung growing at a CAGR 24%:

North America held the largest OCS lung market size in 2018 by $493.8 thousands and is expected to grow at a CAGR of 24.0% in the forecast period. Due to the increase in the lung diseases and presence of the larger old age population, North America is expected to have a huge market size in organ care system market for Lung. Similarly, Europe is considered to hold the largest OCS lung market share followed by the North America, due to the presence of an exceptionally large geriatric community and mostly the lung transplant takes place in old age people, Europe holds the major share in the lung infection, thus it is expected to grow at a CAGR of 15.0% and account for $1219.0 thousands in the forecast period.

Asia pacific Organ Care System Market for Lung Expected to grow at a CAGR 18%:

Asia pacific can be considered as a largest emerging market in the future, due to the lower diagnostic cases and lack of appropriate hospital facilities at present. It is expected to grow at $975.2 thousands by 2026 at a CAGR of 18%.

Key participants in the global Organ care system market for Lung:

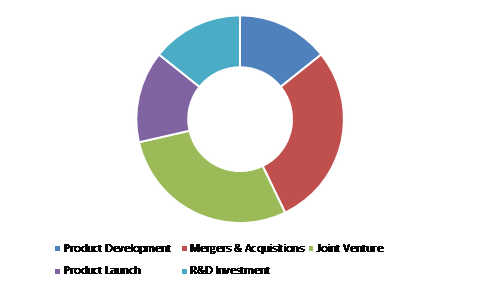

Technological enhancement and agreements are the key strategies opted by the operating companies in this market.

Source: Research Dive Analysis

Key companies operating in the Organ care system market for Lung are Transmedics, Xvivo Perfusion AB, Organ Assist B.V. The prominent key players are investing heavily in research and development to develop new product with technology advancement and upgrading the existing product with new technology. TransMedics developed an organ care system. The company stated, that the system could effectively improve the organ's function even after the organ was removed from the donor body. the donor body was removed. The company have supported the organ care system and have invested around $50 thousands.

Scope The Research Report:

| Aspect | Particulars |

| Historical Market Estimations | 2016-2018 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Handling |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What are the Current trends, opportunities, challenges in the organ care system market for Lung?

A. Storing lungs under specific temperature is predicted to be the biggest challenge for the Organ care system market for Lung. Technological advancement is predicted to create more growth opportunity for the Organ care system market for Lung.

Q2. What are the evaluation of recent industry developments in Organ Care System Market for Lung?

A. Improved post-transplant outcomes compared to cold storage is predicted to create more growth opportunity for the investors in the forecast period.

Q3. What are the Market segments and sub-segments of Organ Care System Market for Lung?

A. Organ care system market for Lung is segmented into handling and is further divided into portable and trolley based.

Q4. What determines organ compatibility?

A. Blood typing is the first step which determines organ compatibility.

Q5. What are the biggest restraints in the organ care system market for Lung?

A. Cold Storage

Q6. What are the Key Factors that will drive the organ care system market for Lung?

A. Rising cases of elderly population and adaptation of bad activities among the population is predicted to be biggest restraints for the Organ care system market for Lung.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Mode of Handling

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. Component

3.8.2. Distribution Channel

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Organ Care System Market for Lung, by Mode of Handling

4.1. Portable

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Trolley Based

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. Organ Care System Market for Lung, by Region

5.1. North America

5.1.1. Market size and forecast, by mode of handling, 2016-2026

5.1.2. Market size and forecast, by country, 2016-2026

5.1.3. Comparative market share analysis, 2018 & 2026

5.1.4. U.S.

5.1.4.1. Market size and forecast, by mode of handling, 2016-2026

5.1.4.2. Comparative market share analysis, 2018 & 2026

5.1.5. Canada

5.1.5.1. Market size and forecast, by mode of handling, 2016-2026

5.1.5.2. Comparative market share analysis, 2018 & 2026

5.1.6. Mexico

5.1.6.1. Market size and forecast, by mode of handling, 2016-2026

5.1.6.2. Comparative market share analysis, 2018 & 2026

5.2. Europe

5.2.1. Market size and forecast, by mode of handling, 2016-2026

5.2.2. Market size and forecast, by country, 2016-2026

5.2.3. Comparative market share analysis, 2018 & 2026

5.2.4. Germany

5.2.4.1. Market size and forecast, by mode of handling, 2016-2026

5.2.4.2. Comparative market share analysis, 2018 & 2026

5.2.5. Spain

5.2.5.1. Market size and forecast, by mode of handling, 2016-2026

5.2.5.2. Comparative market share analysis, 2018 & 2026

5.2.6. France

5.2.6.1. Market size and forecast, by mode of handling, 2016-2026

5.2.6.2. Comparative market share analysis, 2018 & 2026

5.2.7. Italy

5.2.7.1. Market size and forecast, by mode of handling, 2016-2026

5.2.7.2. Comparative market share analysis, 2018 & 2026

5.2.8. Rest of the Europe

5.2.8.1. Market size and forecast, by mode of handling, 2016-2026

5.2.8.2. Comparative market share analysis, 2018 & 2026

5.3. Asia-Pacific

5.3.1. Market size and forecast, by mode of handling, 2016-2026

5.3.2. Market size and forecast, by country, 2016-2026

5.3.3. Comparative market share analysis, 2018 & 2026

5.3.4. China

5.3.4.1. Market size and forecast, by mode of handling, 2016-2026

5.3.4.2. Comparative market share analysis, 2018 & 2026

5.3.5. Japan

5.3.5.1. Market size and forecast, by mode of handling, 2016-2026

5.3.5.2. Comparative market share analysis, 2018 & 2026

5.3.6. India

5.3.6.1. Market size and forecast, by mode of handling, 2016-2026

5.3.6.2. Comparative market share analysis, 2018 & 2026

5.3.7. Australia

5.3.7.1. Market size and forecast, by mode of handling, 2016-2026

5.3.7.2. Comparative market share analysis, 2018 & 2026

5.3.8. South Korea

5.3.8.1. Market size and forecast, by mode of handling, 2016-2026

5.3.8.2. Comparative market share analysis, 2018 & 2026

5.3.9. Rest of the Asia Pacific

5.3.9.1. Market size and forecast, by mode of handling, 2016-2026

5.3.9.2. Comparative market share analysis, 2018 & 2026

5.4. LAMEA

5.4.1. Market size and forecast, by mode of handling, 2016-2026

5.4.2. Market size and forecast, by country, 2016-2026

5.4.3. Comparative market share analysis, 2018 & 2026

5.4.4. Brazil

5.4.4.1. Market size and forecast, by mode of handling, 2016-2026

5.4.4.2. Comparative market share analysis, 2018 & 2026

5.4.5. Saudi Arabia

5.4.5.1. Market size and forecast, by mode of handling, 2016-2026

5.4.5.2. Comparative market share analysis, 2018 & 2026

5.4.6. South Africa

5.4.6.1. Market size and forecast, by mode of handling, 2016-2026

5.4.6.2. Comparative market share analysis, 2018 & 2026

5.4.7. Rest of LAMEA

5.4.7.1. Market size and forecast, by mode of handling, 2016-2026

5.4.7.2. Comparative market share analysis, 2018 & 2026

6. Company profiles

6.1. TransMedics Inc.

6.1.1. Business overview

6.1.2. Financial performance

6.1.3. Product portfolio

6.1.4. Recent strategic moves & developments

6.1.5. SWOT analysis

6.2. XVIVO Perfusion AB

6.2.1. Business overview

6.2.2. Financial performance

6.2.3. Product portfolio

6.2.4. Recent strategic moves & developments

6.2.5. SWOT analysis

6.3. Organ Assist B.V.

6.3.1. Business overview

6.3.2. Financial performance

6.3.3. Product portfolio

6.3.4. Recent strategic moves & developments

6.3.5. SWOT analysis

Prevalence of lung diseases such as idiopathic pulmonary fibrosis and chronic obstructive pulmonary disease has been shown to increase significantly with age. The rapid growth of the aging population in the world has made it indispensable to understand the complex process of aging. This will certainly help to develop strategies that will improve the health period of this group of patients. Aging is associated with increased vulnerability to several chronic diseases, and lung diseases are no exception. Respiratory disorders are the leading causes of death and impairment worldwide.

Approximately 3 million people die each year from chronic obstructive pulmonary disease (COPD) making it the world's third leading cause of death and 65 million suffer from chronic obstructive pulmonary disease. The International Society of Heart and Lung Transplantation has reported that the total number of lung transplants in the world is growing, with about 40,000 procedures performed worldwide in a limited number of centers.

The main drivers of the OCS lung industry are the rise in the introduction of bad habits, such as smoking, and the increase in emissions. Through the fact that people's behavior often impacts their wellbeing due to unsafe food, poor diets and lack of physical activity. These factors are intended to boost overall market growth over the projected period. According to the World Health Organization (WHO), it is projected that the demographics of aging may rise to 2 billion by 2050.

Inaccessibility of lungs is one of the main limitations, since organs are not readily available which adversely affect the demand for the organ care system in the heart. Approximately 77% of the donor's lungs are left unused in the U.S. due to the limitations of cold storage. The availability of the donor is restricted and is perceived to be one of the greatest constraints on the sector. The survival duration is not as prolonged and not as good as other transplants such as the kidney or liver. Cold storage is one of the main constraints on the OCS lung industry for the high rate of post-transplant problems that will adversely affect the health of the recipient if storage is not sufficient. Cold Storage may pose a serious threat to the growth of the demand for the Lung Organ Care System.

This state-of-the-art technology enables hospitals and doctors to maximize the potential of a donor lung pair and to track the lungs throughout the entire process, ensuring that transplant teams may sustain organs in an optimal condition. TransMedics has established an organ care system, a medical device named the Organ Care System (OCS) preserves the integrity of the organ by supplying an externally controlled atmosphere that induces near-normal physiological conditions.

Based on the handling of the pulmonary OCS market, it is segmented into 2 Portable based handling and Trolley based handling are the two types of demand for lung organ care systems. Trolley based is expected to be most profitable by the end of 2026.

Trolley based is a transplantation system that has been commonly used and is used in a maximum number of centers. Trolley based handling market retained the largest market by $795.0 thousand in 2018. OCS-based Trolley's market size for lung is projected to grow by 19.7% at the CAGR and generate revenue of $3354.6 thousand by 2026.

Portable based handling is effective in terms of increasing the efficiency of organs, aiding in successful organ transplantation, compact and easy to carry within the timeline is the main factor in the growth of portable based organs. Portable OCS market size for lung is estimated to have a market share of $599.8 thousand in 2018. A CAGR of 18% is expected to generate sales of $2254.4 thousand by 2026. Portable based handling devices, helping to control the time when holding the organ, helping to improve the efficiency of organs and maintaining efficient storage and service are factors that contribute to the global expansion of the demand for portable organ care systems for the Lung.

The OCS lung is the only system currently approved by the FDA, which adds to the survival of post-harvesting lung by the donor. The OCS Lung Solution protects the lungs without any adverse effects compared to the traditional cold storage system. It maintains the lungs moist and ventilated through automated blood perfusion and monitoring system. It allows the lungs to function outside the human body. OCS lungs shield the lung through transport, leaving it less susceptible to losses.

In July 2018, TransMedics announced the completion of two successful lung transplants using its OCS Lung technology. The surgery was performed by a donor lung from Hawaii that was initially rejected for the procedure due to the time and distance limitations of the standard cold storage.

Transmedics, Xvivo Perfusion AB, Organ Aid B.V. are the main companies operating in the sector for organ care systems for Lung. These major players are investing heavily in research and development to develop a new product through technology advancement and update the existing product with new technology. Transmedics has stated that the device could successfully enhance the functionality of the organ even after the organ had been separated from the donor body. The donor body has been withdrawn. The company has sponsored the organ care system and has spent about $50 thousand.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com