Location Analytics Market Report

RA00349

Location Analytics Market by Component Type (Solutions and Services), Location Type (Indoor Location and Outdoor Location), Deployment (Cloud and On-premise), Application (Remote Monitoring, Asset Management, Sales & Marketing Optimization, Facility Management, Risk Management, and Others), Vertical (BFSI, Retail, Healthcare, Hospitality, IT & Telecom, Government, Transport & Logistic, Media & Entertainment, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2028

Global Location Analytics Market Analysis

The global location analytics market is predicted to garner $38,078.9 million in the 2020–2028 timeframe, growing from $11,900.3 million in 2020 at a healthy CAGR of 15.8%.

Market Synopsis

The emergence of Internet of Things (IoT) and the growing importance of locational data for many organizations and governments are resulting in increased use of location analytics solutions.

However, awareness and expertise about the functioning of location analytic tools are scarce among organizations. This might restrain the market growth during the forecast period.

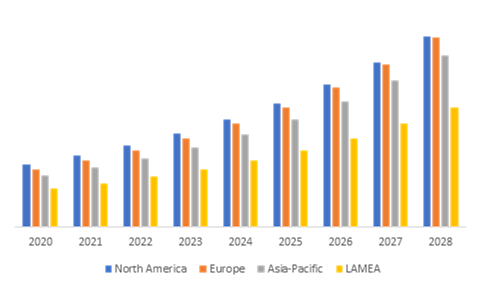

According to the regional analysis of the market, the Asia-Pacific location analytics market is anticipated to grow at a CAGR of 16.5% by generating a revenue of $9,728.9 million during the review period.

Location Analytics Overview

Location analytics states to the business intelligence (BI) that a system carries out to comprehend understandings from location-based enterprise facts. It lets in corporations and businesses merge 3D facts with traditional BI information. This spatial locational data is collected using different data sources. These resources include cameras, sensors cellular devices, global positioning systems (GPS), and social media channels. Location analytics adds a layer of geographical information to business’s to extract more valuable insights.

Impact Analysis of COVID-19 on the Global Location Analytics Market

Though the novel coronavirus pandemic has had a devastating effect on several industries, the location analytics market has been found to experience significant growth during this period. Locational data is playing an important part in the controlling of state emergency services during the coronavirus pandemic. The healthcare sector have been experiencing various difficulties and challenges. Moreover, ever since the pandemic outrage, hospitals were running at their maximum capacity. Also, the shortage of ventilators, masks, oxygen cylinders, and other important sanitary materials has become a challenge. Location analytics has become a major tool for facing these challenges as it provides useful data for better strategies. GIS has helped scientists to identify the occurrence of the disease against multiple parameters, like environment, geographic conditions, and previous occurrences of the virus, to understand and know the origin of outbreak, spreading patterns, and intensity to implement necessary protocols. Location analytics has been a helping hand for government bodies and healthcare organizations in mapping COVID-19 cases that are active and confirmed.

Increasing Use of Spatial Data and Analytical Tools are Anticipated to Drive The Market Growth

The obtainability of massive volumes of integrated location-based data across all sectors has made traditional BI tools ineffective for data correlation and analysis to comprehend altering business patterns and concerns across areas, companies require spatial data and analysis. This information is propelling the market forward. Customers can use geographic data to get answers to their questions concerning space assignment. Audits, design reviews, and other space-related tasks can all benefit from spatial data. These characteristics boost the utilization of geographical data in a variety of industries. Companies can utilize location analytics software to manage vast amounts of geographic data and gain real-time insights into changing customer preferences, company trends, and regulatory and compliance requirements. For example, locational data assists retailers in discovering the relationship between products, stores, customer preferences, needs, and customer types as they relate to various characteristics and metrics in the retail sub-segment. These variables and measurements have an impact on overall sales performance. Retailers can also use stock levels to efficiently manage warehouse deliveries to ensure adequate stock levels.

To know more about global location analytics market drivers, get in touch with our analysts here.

Legal Concerns and Data Privacy Issues May Restrict The Market Growth

Privacy issues occur if location data is combined with extra personal information. After businesses start collecting data profiles, the danger of identity theft rises, particularly, if the data isn't kept secure. Criminals can utilize location data to figure out a person's current or anticipated future location, and if the data contains information that can be used to identify a person, it can be used to attack the individual. As a result, before employing location data obtained by location analytics tools, organizations should thoroughly evaluate all legal and privacy risks.

Integration of Location Intelligence is Expected to Increase the Opportunities

The rise of the Internet of Things (IoT) and the increasing volume of data generated by linked devices has resulted in a rise in the use of location analytics software. To maintain their competitiveness and market value, developing businesses require long-term business strategies. Therefore, the demand for location intelligence that provide location-based data insights is increasing gradually. For instance, in the current COVID-19 pandemic, hospitals, governments and various other departments are depending on location intelligence to check the spread of virus, active cases, fatalities and recoveries. This way location intelligence is providing ample opportunities for location analytics market.

To know more about global location analytics market opportunities, get in touch with our analysts here.

Global Location Analytics Market, by Component Type

Based on component type, the market has been divided into solutions and services sub-segments of which the solutions sub-segment is projected to generate the maximum revenue and services sub-segment is predicted to show the fastest growth.

Source: Research Dive Analysis

The solutions sub-segment is predicted to have a dominating market share in the global market and register a revenue of $19,773.1 million during the forecast periodDue to its expanded viewpoint capabilities, spatial analysis is projected to see increasing usage in the solution market. It enables businesses to address complicated location-related issues and fosters fresh perceptions in order to improve decision-making. As a result, spatial analytics accounts for a major portion of revenue.

The services type is anticipated to have the fastest market growth, and it is predicted that the market shall generate a revenue of $18,305.8 million by 2028, growing from $5,126.3 million in 2020. Consulting, integration and implementation, and support and maintenance make up the services segment. Organizations can use support and maintenance services to learn about market trends, changing business conditions, consumer insights, and repair issues. Support and maintenance services are projected to be in high demand as a result of the creation of various custom applications and enhancements to existing products. These elements are propelling the services sub-segment forward.

Global Location Analytics Market, by Location Type

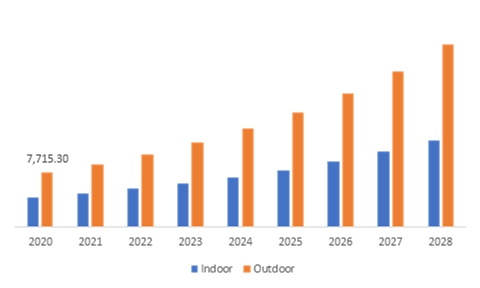

On the basis of location type, the market has been sub-segmented into indoor location and outdoor location. Among the mentioned sub-segments, the outdoor location sub-segment is predicted to show the fastest growth and garner a dominant market share.

Source: Research Dive Analysis

The outdoor location sub-segment of the global location analytics market is projected to have the fastest growth and it is projected to surpass $25,831.1 million by 2028, with an increase from $7,715.3 million in 2020. Outdoor analytics applications include weather forecasting, geographical maps, and land mapping. Location data is heavily used in the creation of multichannel marketing centers to enable offline campaigns, geo-marketing, customer location monitoring, data mapping, and logistics and transport management. The value of the sub-segment is driven by the development of these numerous outdoor apps that use geo-spatial and positioning services.

Global Location Analytics Market, by Deployment Type

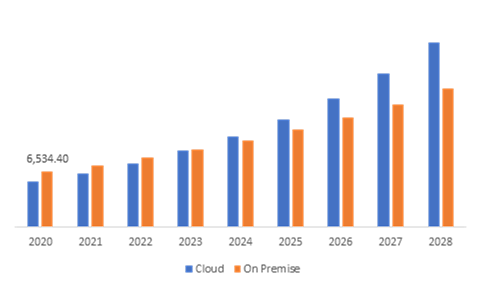

Based on deployment type, the market has been divided into cloud and on-premise sub-segments of which the on-premise sub-segment is projected to generate the maximum revenue and cloud sub-segment is predicted to show the fastest growth.

Source: Research Dive Analysis

The on-premise sub-segment is predicted to have a dominating market share in the global market and is expected to register a revenue of $16,338.3 million during the forecast period. The need for on-premise corporate application software is being driven by an increase in concerns about improving internal processes and systems, security risks connected to cloud deployment, and a growth in demand for enterprise application software across multiple industry verticals. On-premise enterprise application software's data privacy and security are predicted to give a variety of market growth prospects.

The cloud sub-segment is anticipated to have the fastest market growth and it is predicted that the market shall generate a revenue of $21,740.6 million by 2028, growing from $5,365.9 million in 2020. One of the main reasons why businesses favor cloud deployment is the ability to supply functionality with better efficiency and flexibility. Because of these advantages, cloud-based deployment is expected to develop at a quicker rate over the projected period.

Global Location Analytics Market, by Application Type

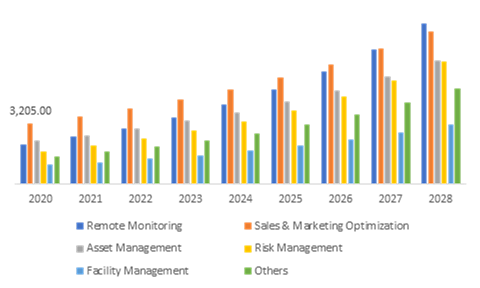

On the basis of application type, the market has been sub-segmented into remote monitoring, sales & marketing optimization, asset management, risk management and facility management. Among the mentioned sub-segments, the sales & marketing optimization sub-segment is projected to garner a dominant market share.

Source: Research Dive Analysis

The sales & marketing optimization sub-segment is anticipated to have a dominating market share in the global market and register a revenue of $8,118.9 million during the analysis timeframe. Businesses can benefit from location intelligence by gaining the ability to interpret and analyze geographical data in order to improve customer experience, cut expenses, and boost overall efficiency. As a result, the usage of these services in sales and marketing applications allows organizations to analyze consumer behavior, spending patterns, and estimate sales, helping them to maximize their business profitability.

Global Location Analytics Market, by Vertical Type:

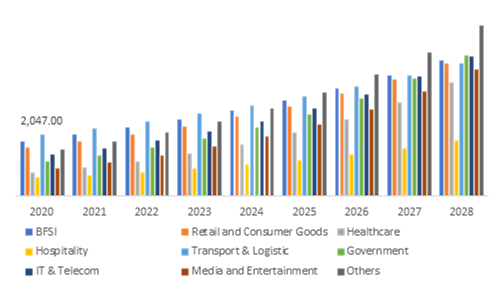

Based on application type the analysis has been divided into BFSI, retail, healthcare, hospitality, retail & consumer goods, transport & logistic, it & telecom, media and entertainment, government & defense, and others. Out of these, the transport & logistic sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The transport & logistic sub-segment of the global location analytics market is predicted to have rapid growth and it is expected to surpass $4,384.3 million by 2028, with an increase from $2,047.0 million in 2020. Market growth is fueled by factors such as the expanding e-commerce industry, as well as an increase in reverse logistics operations and trade agreements. In addition, the growing acceptance of IoT-enabled linked devices and the expansion of tech-driven logistics services are likely to propel the sub-segment forward.

Global Location Analytics Market, Regional Insights:

The location analytics market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Location Analytics in North America to be the Most Dominant

The North America location analytics market accounted $3,562.9 million in 2020 and is projected to register a revenue of $10,791.2 million by 2028. Rising technology developments, increased industry standards for location-based technology, and increased government support are all contributing to the expansion in North America. In the location analytics sector, the region has seen the birth of startups. These variables will ultimately fuel demand in the region's location analytics industry.

The Market for Location Analytics in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific location analytics market is anticipated to grow at a CAGR of 16.5% by registering a revenue of $9,728.9 million by 2028. The expansion will be fueled by a rise in the use of location analytic solutions among firms that will heavily rely on risk management. Risk management software aids in the reduction of various hazards such as cyber-attacks, financial fraud, and data theft, creating a potential market opportunity in this region.

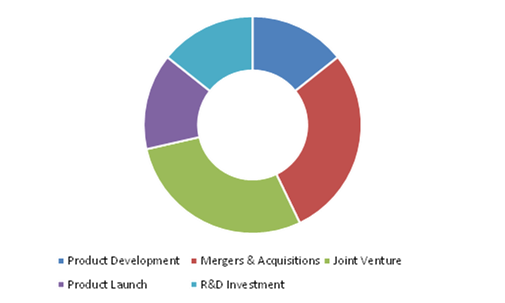

Competitive Scenario in the Global Location Analytics Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading location analytics market players are Google, Esri, Precisely, SAP SE, IBM Corporation, SAS Institute, Oracle, Microsoft, Cisco Systems, TomTom.

Porter’s Five Forces Analysis for the Global Location Analytics Market:

- Bargaining Power of Suppliers: The suppliers in the location analytics market are moderate in number. Several companies are working on product designs that use different raw materials to avoid changing the supplier if there is a hike in the price of a particular material. Thus, there is less threat from the suppliers.

Thus, the bargaining power of the suppliers is moderate. - Bargaining Power of Buyers: Buyers have huge bargaining power; they demand best services at low prices. This increases the pressure on the location analytics test providers to offer the best service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: Companies entering the location analytics testing market are adopting technological innovations such as developing an innovative software application to attract clients. Also, these companies are implementing various effective strategies such as offering discounts and value propositions. Yet, the investment cost is high.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: There are no alternative products for location analytics.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including IBM corporation, Cisco Systems, and Google. These companies are launching their location analytics products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast Timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Application Type |

|

| Segmentation by Deployment Type |

|

| Segmentation by Component Type |

|

| Segmentation by Location Type |

|

| Segmentation by Vertical type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global location analytics market?

A. The size of the global location analytics market was over $11,900.3 million in 2020 and is projected to reach $38,078.9 million by 2027.

Q2. Which are the major companies in the location analytics market?

A. IBM, Cisco Systems, and Oracle are some of the key players in the global location analytics market.

Q3. Which region, among others, possesses greater investment opportunities in the near future for the Location Analytics Market?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific location analytics market?

A. Asia Pacific location analytics market is anticipated to grow at 16.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the Location Analytics Market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices for the Location Analytics Market?

A. Hewlett Packard Enterprise Development LP and Cisco Systems are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By application type trends

2.3.By component type trends

2.4.By location type trends

2.5.By deployment type trends

2.6.By vertical type trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.by application type

3.8.2.by component type

3.8.3.By location type

3.8.4.By deployment type

3.8.5.By vertical type

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Locational Analytics Market, by application type

4.1.Remote Monitoring

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Sales & Marketing Optimization

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Asset Management

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

4.4.Risk Management

4.4.1.Market size and forecast, by region, 2020-2028

4.4.2.Comparative market share analysis, 2020 & 2028

4.5.Facility Management

4.5.1.Market size and forecast, by region, 2020-2028

4.5.2.Comparative market share analysis, 2020 & 2028

4.6.Others

4.6.1.Market size and forecast, by region, 2020-2028

4.6.2.Comparative market share analysis, 2020 & 2028

5.Locational Analytics Market, by component type

5.1.Solution

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Services

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

6.Locational Analytics Market, by location type

6.1.Indoor location

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.Outdoor location

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

7.Locational Analytics Market, by deployment type

7.1.cloud

7.1.1.Market size and forecast, by region, 2020-2028

7.1.2.Comparative market share analysis, 2020 & 2028

7.2.On-premises

7.2.1.Market size and forecast, by region, 2020-2028

7.2.2.Comparative market share analysis, 2020 & 2028

8.Locational Analytics Market, by vertical type

8.1.BFSI

8.1.1.Market size and forecast, by region, 2020-2028

8.1.2.Comparative market share analysis, 2020 & 2028

8.2.Retail

8.2.1.Market size and forecast, by region, 2020-2028

8.2.2.Comparative market share analysis, 2020 & 2028

8.3.Healthcare

8.3.1.Market size and forecast, by region, 2020-2028

8.3.2.Comparative market share analysis, 2020 & 2028

8.4.Hospitality

8.4.1.Market size and forecast, by region, 2020-2028

8.4.2.Comparative market share analysis, 2020 & 2028

8.5.Transport & Logistic

8.5.1.Market size and forecast, by region, 2020-2028

8.5.2.Comparative market share analysis, 2020 & 2028

8.6.Government

8.6.1.Market size and forecast, by region, 2020-2028

8.6.2.Comparative market share analysis, 2020 & 2028

8.7.IT & Telecom

8.7.1.Market size and forecast, by region, 2020-2028

8.7.2.Comparative market share analysis, 2020 & 2028

8.8.Media & Entertainment

8.8.1.Market size and forecast, by region, 2020-2028

8.8.2.Comparative market share analysis, 2020 & 2028

8.9.Others

8.9.1.Market size and forecast, by region, 2020-2028

8.9.2.Comparative market share analysis, 2020 & 2028

9.Location Analytics Market, by Region

9.1.North America

9.1.1.Market size and forecast, by application type, 2020-2028

9.1.2.Market size and forecast, by component type, 2020-2028

9.1.3.Market size and forecast, by location type, 2020-2028

9.1.4.Market size and forecast, by deployment type, 2020-2028

9.1.5.Market size and forecast, by vertical type, 2020-2028

9.1.6.Market size and forecast, by country, 2020-2028

9.1.7.Comparative market share analysis, 2020 & 2028

9.1.8.U.S.

9.1.8.1.Market size and forecast, by application type, 2020-2028

9.1.8.2.Market size and forecast, by component type, 2020-2028

9.1.8.3.Market size and forecast, by location type, 2020-2028

9.1.8.4.Market size and forecast, by deployment type, 2020-2028

9.1.8.5.Market size and forecast, by vertical type, 2020-2028

9.1.8.6.Comparative market share analysis, 2020 & 2028

9.1.9.Canada

9.1.9.1.Market size and forecast, by application type, 2020-2028

9.1.9.2.Market size and forecast, by component type, 2020-2028

9.1.9.3.Market size and forecast, by location type, 2020-2028

9.1.9.4.Market size and forecast, by deployment type, 2020-2028

9.1.9.5.Market size and forecast, by vertical type, 2020-2028

9.1.9.6.Comparative market share analysis, 2020 & 2028

9.1.10.Mexico

9.1.10.1.Market size and forecast, by application type, 2020-2028

9.1.10.2.Market size and forecast, by component type, 2020-2028

9.1.10.3.Market size and forecast, by location type, 2020-2028

9.1.10.4.Market size and forecast, by deployment type, 2020-2028

9.1.10.5.Market size and forecast, by vertical type, 2020-2028

9.1.10.6.Comparative market share analysis, 2020 & 2028

9.2.Europe

9.2.1.Market size and forecast, by application type, 2020-2028

9.2.2.Market size and forecast, by component type, 2020-2028

9.2.3.Market size and forecast, by location type, 2020-2028

9.2.4.Market size and forecast, by deployment type, 2020-2028

9.2.5.Market size and forecast, by vertical type, 2020-2028

9.2.6.Market size and forecast, by country, 2020-2028

9.2.7.Comparative market share analysis, 2020 & 2028

9.2.8.Germany

9.2.8.1.Market size and forecast, by application type, 2020-2028

9.2.8.2.Market size and forecast, by component type, 2020-2028

9.2.8.3.Market size and forecast, by location type, 2020-2028

9.2.8.4.Market size and forecast, by deployment type, 2020-2028

9.2.8.5.Market size and forecast, by vertical type, 2020-2028

9.2.8.6.Comparative market share analysis, 2020 & 2028

9.2.9.UK

9.2.9.1.Market size and forecast, by application type, 2020-2028

9.2.9.2.Market size and forecast, by component type, 2020-2028

9.2.9.3.Market size and forecast, by location type, 2020-2028

9.2.9.4.Market size and forecast, by deployment type, 2020-2028

9.2.9.5.Market size and forecast, by vertical type, 2020-2028

9.2.9.6.Comparative market share analysis, 2020 & 2028

9.2.9.7.Market size and forecast, by component type, 2020-2028

9.2.9.8.Market size and forecast, by location type, 2020-2028

9.2.9.9.Market size and forecast, by deployment type, 2020-2028

9.2.9.10.Market size and forecast, by vertical type, 2020-2028

9.2.9.11.Comparative market share analysis, 2020 & 2028

9.2.10.France

9.2.10.1.Market size and forecast, by application type, 2020-2028

9.2.10.2.Market size and forecast, by component type, 2020-2028

9.2.10.3.Market size and forecast, by location type, 2020-2028

9.2.10.4.Market size and forecast, by deployment type, 2020-2028

9.2.10.5.Market size and forecast, by vertical type, 2020-2028

9.2.10.6.Comparative market share analysis, 2020 & 2028

9.2.11.Spain

9.2.11.1.Market size and forecast, by application type, 2020-2028

9.2.11.2.Market size and forecast, by component type, 2020-2028

9.2.11.3.Market size and forecast, by location type, 2020-2028

9.2.11.4.Market size and forecast, by deployment type, 2020-2028

9.2.11.5.Market size and forecast, by vertical type, 2020-2028

9.2.11.6.Comparative market share analysis, 2020 & 2028

9.2.12.Italy

9.2.12.1.Market size and forecast, by application type, 2020-2028

9.2.12.2.Market size and forecast, by component type, 2020-2028

9.2.12.3.Market size and forecast, by location type, 2020-2028

9.2.12.4.Market size and forecast, by deployment type, 2020-2028

9.2.12.5.Market size and forecast, by vertical type, 2020-2028

9.2.12.6.Comparative market share analysis, 2020 & 2028

9.2.13.Rest of Europe

9.2.13.1.Market size and forecast, by application type, 2020-2028

9.2.13.2.Market size and forecast, by component type, 2020-2028

9.2.13.3.Market size and forecast, by location type, 2020-2028

9.2.13.4.Market size and forecast, by deployment type, 2020-2028

9.2.13.5.Market size and forecast, by vertical type, 2020-2028

9.2.13.6.Comparative market share analysis, 2020 & 2028

9.3.Asia-Pacific

9.3.1.Market size and forecast, by application type, 2020-2028

9.3.2.Market size and forecast, by component type, 2020-2028

9.3.3.Market size and forecast, by location type, 2020-2028

9.3.4.Market size and forecast, by deployment type, 2020-2028

9.3.5.Market size and forecast, by vertical type, 2020-2028

9.3.6.Market size and forecast, by country, 2020-2028

9.3.7.Comparative market share analysis, 2020 & 2028

9.3.8.China

9.3.8.1.Market size and forecast, by application type, 2020-2028

9.3.8.2.Market size and forecast, by component type, 2020-2028

9.3.8.3.Market size and forecast, by location type, 2020-2028

9.3.8.4.Market size and forecast, by deployment type, 2020-2028

9.3.8.5.Market size and forecast, by vertical type, 2020-2028

9.3.8.6.Comparative market share analysis, 2020 & 2028

9.3.9.Japan

9.3.9.1.Market size and forecast, by application type, 2020-2028

9.3.9.2.Market size and forecast, by component type, 2020-2028

9.3.9.3.Market size and forecast, by location type, 2020-2028

9.3.9.4.Market size and forecast, by deployment type, 2020-2028

9.3.9.5.Market size and forecast, by vertical type, 2020-2028

9.3.9.6.Comparative market share analysis, 2020 & 2028

9.3.10.India

9.3.10.1.Market size and forecast, by application type, 2020-2028

9.3.10.2.Market size and forecast, by component type, 2020-2028

9.3.10.3.Market size and forecast, by location type, 2020-2028

9.3.10.4.Market size and forecast, by deployment type, 2020-2028

9.3.10.5.Market size and forecast, by vertical type, 2020-2028

9.3.10.6.Comparative market share analysis, 2020 & 2028

9.3.11.Australia

9.3.11.1.Market size and forecast, by application type, 2020-2028

9.3.11.2.Market size and forecast, by component type, 2020-2028

9.3.11.3.Market size and forecast, by location type, 2020-2028

9.3.11.4.Market size and forecast, by deployment type, 2020-2028

9.3.11.5.Market size and forecast, by vertical type, 2020-2028

9.3.11.6.Comparative market share analysis, 2020 & 2028

9.3.12.South Korea

9.3.12.1.Market size and forecast, by application type, 2020-2028

9.3.12.2.Market size and forecast, by component type, 2020-2028

9.3.12.3.Market size and forecast, by location type, 2020-2028

9.3.12.4.Market size and forecast, by deployment type, 2020-2028

9.3.12.5.Market size and forecast, by vertical type, 2020-2028

9.3.12.6.Comparative market share analysis, 2020 & 2028

9.3.13.Rest of Asia Pacific

9.3.13.1.Market size and forecast, by application type, 2020-2028

9.3.13.2.Market size and forecast, by component type, 2020-2028

9.3.13.3.Market size and forecast, by location type, 2020-2028

9.3.13.4.Market size and forecast, by deployment type, 2020-2028

9.3.13.5.Market size and forecast, by vertical type, 2020-2028

9.3.13.6.Comparative market share analysis, 2020 & 2028

9.4.LAMEA

9.4.1.Market size and forecast, by application type, 2020-2028

9.4.2.Market size and forecast, by component type, 2020-2028

9.4.3.Market size and forecast, by location type, 2020-2028

9.4.4.Market size and forecast, by deployment type, 2020-2028

9.4.5.Market size and forecast, by vertical type, 2020-2028

9.4.6.Market size and forecast, by country, 2020-2028

9.4.7.Comparative market share analysis, 2020 & 2028

9.4.8.Latin America

9.4.8.1.Market size and forecast, by application type, 2020-2028

9.4.8.2.Market size and forecast, by component type, 2020-2028

9.4.8.3.Market size and forecast, by location type, 2020-2028

9.4.8.4.Market size and forecast, by deployment type, 2020-2028

9.4.8.5.Market size and forecast, by vertical type, 2020-2028

9.4.8.6.Comparative market share analysis, 2020 & 2028

9.4.9.Middle East

9.4.9.1.Market size and forecast, by application type, 2020-2028

9.4.9.2.Market size and forecast, by component type, 2020-2028

9.4.9.3.Market size and forecast, by location type, 2020-2028

9.4.9.4.Market size and forecast, by deployment type, 2020-2028

9.4.9.5.Market size and forecast, by vertical type, 2020-2028

9.4.9.6.Comparative market share analysis, 2020 & 2028

9.4.10.Africa

9.4.10.1.Market size and forecast, by application type, 2020-2028

9.4.10.2.Market size and forecast, by component type, 2020-2028

9.4.10.3.Market size and forecast, by location type, 2020-2028

9.4.10.4.Market size and forecast, by deployment type, 2020-2028

9.4.10.5.Market size and forecast, by vertical type, 2020-2028

9.4.10.6.Comparative market share analysis, 2020 & 2028

10.Company profiles

10.1.Google

10.1.1.Business overview

10.1.2.Financial performance

10.1.3.Product portfolio

10.1.4.Recent strategic moves & developments

10.1.5.SWOT analysis

10.2.Esri

10.2.1.Business overview

10.2.2.Financial performance

10.2.3.Product portfolio

10.2.4.Recent strategic moves & developments

10.2.5.SWOT analysis

10.3.Precisely

10.3.1.Business overview

10.3.2.Financial performance

10.3.3.Product portfolio

10.3.4.Recent strategic moves & developments

10.3.5.SWOT analysis

10.4.SAP SE

10.4.1.Business overview

10.4.2.Financial performance

10.4.3.Product portfolio

10.4.4.Recent strategic moves & developments

10.4.5.SWOT analysis

10.5.IBM Corporation

10.5.1.Business overview

10.5.2.Financial performance

10.5.3.Product portfolio

10.5.4.Recent strategic moves & developments

10.5.5.SWOT analysis

10.6.SAS Institute

10.6.1.Business overview

10.6.2.Financial performance

10.6.3.Product portfolio

10.6.4.Recent strategic moves & developments

10.6.5.SWOT analysis

10.7.Oracle

10.7.1.Business overview

10.7.2.Financial performance

10.7.3.Product portfolio

10.7.4.Recent strategic moves & developments

10.7.5.SWOT analysis

10.8.Microsoft

10.8.1.Business overview

10.8.2.Financial performance

10.8.3.Product portfolio

10.8.4.Recent strategic moves & developments

10.8.5.SWOT analysis

10.9.Cisco systems

10.9.1.Business overview

10.9.2.Financial performance

10.9.3.Product portfolio

10.9.4.Recent strategic moves & developments

10.9.5.SWOT analysis

10.10.TomTom

10.10.1.Business overview

10.10.2.Financial performance

10.10.3.Product portfolio

10.10.4.Recent strategic moves & developments

10.10.5.SWOT analysis

The extensive amount of data available on the internet today has resulted in businesses not being able to acquire the right kind of information. All the details that are processed online such as events, people, or transactions are marked geographically and for a company to be able to extract this data requires location related data. The process of attaching a geographical location to the data provided is known as location analytics.

COVID-19 Impact on the Global Location Analytics Market

The entire world endured a rough patch due to the COVID-19 virus as it led to a breakdown of the entire system. Right from healthcare to manufacturing industries, each sector had to undergo severe losses that resulted in shut down of multiple companies. Additionally, the travel ban was one of the major causes for the supply chain being affected as the transport of various raw materials and other products couldn’t be fulfilled.

The global location analytics market gained momentum during this time as the use of location analytics technology was beneficial in various causes. The location data that was extracted helped various health agencies as well the government in pinpointing and creating an outline of the total number of fatalities, active cases, as well as hotspots for the COVID-19 infections. This form of technology is also used by retailers to provide tailored products and information to customers using their geospatial data.

Key Developments in the Industry

Several industries are working on building up their presence in the market while also involving in researchwhich is a part of the efforts. The innovative methodologies by organizations of creating better products are also used, keeping in mind satisfaction of customers or companies in terms of quality.

For instance, in February 2021, Geospatial from Skyhook, a world renowned location technology expertwas acquired by Place IQ, a provider of data and technology for critical businesses which include location data, analytics and insight for marketing decisions. The acquisition is set to contribute to providing precise data such as commercial foot traffic metrics or consumer segmentation.

Similarly, Esri, a globally recognized expert in location intelligence initiated the use of their ArcGIS enterprise for Microsoft’s Tactical Edge Platform. In June 2019 they announced that cloud service technology can be used by defence professionals to ensure safety in case of domestic emergencies.

Forecast Analysis of the Global Location Analytics Market

The latest report by Research Dive, states that the global location analytics market is predicted to witness a surge in revenue of $38,078.9 million at a steady CAGR of 15.8% from 2020-2028. The North American region is set to dominate the market due to the multiple technological advancements. Additionally, the rising number of start-ups in the North America region has also led to the market growth.

Spatial data has become crucial for understanding varying business trends which make it necessary for companies to analyze it to overcome hurdles. Customer queries pertaining to space assignment information are also resolved with the help of spatial data. It also proves to be useful in audits, design reviews and space related projects. These factors have contributed to the immense growth of the global location analytics market. However, the risk associated with the theft of personally identifiable information (PII) grows exponentially with the increase in the collection of location data. This is one of the primary restraining factors limiting the growth of the market.

The growth of the Internet of Things (IoT) devices has led to a vast number of intertwined devices which increase the use of location data. Businesses manufacturing IoT devices need to make efficient and effective use of location analytics to maintain their market foothold. This has provided an opportunity of growth for the location analytics market.

Furthermore, various key players such as Esri, SAP SE, SAS Institute, Microsoft, Tom Tom, Precisely, IBM Corporation, Oracle, and Cisco Systems have been working to implement even better versions of the location analytics technology by creating new products, initiating mergers, partnerships and more, which is estimated to help the market grow in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com