Electric Vehicle Market Report

RA03109

Electric Vehicle Market by Type (Battery Electric Vehicle, Hybrid Electric Vehicle, and Plug-in Hybrid Electric Vehicle), Vehicle Type (Two-wheeler, Passenger Car, and Commercial Vehicle), Vehicle Class (Mid-priced and Luxury), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Electric Vehicle Market Analysis

The global electric vehicle market is anticipated to garner $812,888.1 million in the 2021–2028 timeframe, growing from $190,628.7 million in 2020 at a healthy CAGR of 19.8%

Market Synopsis

Technological advancements and company investments among market players, along with business expansions to attract customers and to enhance the geographical presence, is anticipated to drive the growth of the electric vehicle market.

However, high manufacturing cost involved in manufacturing of electric vehicles compared to conventional gas-powered vehicles due to presence of rechargeable lithium-ion batteries that are costly is anticipated to restrain the market growth.

According to the regional analysis of the market, the Asia-Pacific electric vehicle market is anticipated to grow at a CAGR of 18.0% by generating a revenue of $359,981.7 million during the review period.

Electric Vehicles Overview

Electric vehicles operate on an electric motor instead of internal-combustion engine that produces power by burning fuel or gases. The popularity of electric vehicles is growing rapidly as they contribute to pollution, global warming and carbon footprint to a much lesser extent than fuel-based vehicles.

Impact Analysis of COVID-19 on the Global Electric Vehicle Market

The novel coronavirus pandemic had a devastating effect on several industries and the electric vehicle market was one of the hardest hit owing to complete lockdown situations that led to supply chain disruptions due to shutting down of factories and shortage of labors. Also, the economic slowdown caused by COVID-19 has negatively impacted the electric vehicles market. In addition, shift in consumer preferences towards the purchase of affordable vehicles amid the COVID-19 crisis is leading to a decline in demand for electric vehicles. Delay in electric vehicles’ production due to import-export restrictions is negatively affecting the market growth as majority of the manufacturing components are imported from China. Tendency towards cash savings especially in developing countries due to lower disposable incomes and financial uncertainty caused by the pandemic are estimated to have a negative impact on the electric vehicles market during the pandemic.

Several companies, with their technological developments, innovations, and initiatives, are helping the society to recover from the chaotic situation. For instance, on April 7, 2020, Toyota Motor Corporation & Toyota Group, undertook support initiatives to help the frontline workers from medical sector. To address the shortage of medical face shields, Toyota, the largest automotive manufacturer, will produce 3D-printed medical face shields and injection mold. For this, Toyota’s Teiho Plant located in Japan, is working to produce injection mold medical face shields in a volume of 500 to 600 per week. Also, Toyota is taking additional measures to prevent the spread of virus and Toyota’s vehicles are being used to transport people from their home to the hospitals or quarantine areas. Furthermore, with regards to the Japan government request to a Japanese automaker through the Japan Automobile Manufacturers Association (JAMA), Toyota is working on manufacturing of hygiene products such as personal protective equipment (PPE), face masks, thermometers, and other essential goods. All these initiatives are estimated to help electric vehicle manufacturers in coping up with the present pandemic situation.

Stringent Government Regulations on Vehicle Emissions to Drive the Market Growth

The global electric vehicle industry is witnessing a rapid growth due to increasing government regulations on the emission of greenhouse gases in the atmosphere caused by Internal Combustion Engine (ICE) vehicles. To address this issue, government of various countries has taken several initiatives to promote the deployment of electric vehicles as they have zero exhaust emissions. The cost of electricity required to charge electric vehicle is 40% lower compared to the cost of petrol and this cost can be lowered further if the electric vehicle is powered by solar photovoltaic (PV) system. On March 14, 2019, the US Environmental Protection Agency (EPA) set the emission standards for engines and vehicles including the emission standards for greenhouse gas emissions (GHG). Various regulations included under this act are Certification and Compliance for Vehicles and Engines, Air Enforcement, Green Vehicle Guide, Gasoline Standards, Renewable Fuel Standard Program, and others. All such initiatives are anticipated to drive the electric vehicles market demand during the forecast period.

To know more about global electric vehicle market drivers, get in touch with our analysts here.

Lack of Charging Infrastructure To Restrain Market Growth

The lack of charging infrastructure is a hurdle that varies by location. For instance, you can charge your electric vehicle at home or at work. However, some apartments or cities are not equipped with the charging infrastructure and they must rely on public chargers present at shopping centers or parking garages. Even in this case, if the charging infrastructure is located at a convenient place, they might be occupied which may increase the wait time. These factors are predicted to restrain the electric vehicle market growth during the forecast period.

Growing Demand for High Performance, Low-emission and Fuel-efficient Vehicles to Create Enormous Investment Opportunities

The demand for electric vehicles is growing rapidly due to lower emission of greenhouse gases thereby reducing the environmental impact. Electric vehicles can use renewable sources such as solar, wind, and others to generate electricity needed for charging the vehicle. In addition, solar panels can be installed at home to power the electric vehicle. As electric vehicles do not use gas engines, they don’t need oil, which means no oil changes. Hence, the maintenance and repairs associated with the use of gas engines can be reduced by the use of electric vehicles. Several government initiatives such as deduction on interest paid on loans, electric vehicles tax credits, and incentives for the use of plug-in electric vehicles are estimated to generate huge growth opportunities. For instance, as stated in Cleartax.in, that offers financial services, on May 12, 2021, the Indian government has announced the incentive for purchase of electric vehicle under union budget 2019. A new section 80EEB has been introduced for advanced battery and registered e-vehicles that offers deduction on interest on the electric vehicle loan for the assessment year 2020-2021. All these factors are estimated to generate huge growth opportunities during the forecast period.

To know more about global electric vehicle market opportunities, get in touch with our analysts here.

Global Electric Vehicle Market, by Type

Based on type, the market has been divided into battery electric vehicle, hybrid electric vehicle, and plug-in hybrid electric vehicle. Out of these, the hybrid electric vehicle sub-segment accounted for highest revenue share in 2020 and plug-in hybrid electric vehicle is projected to have the fastest growth during the analysis period.

Source: Research Dive Analysis

The hybrid electric vehicle sub-segment is anticipated to have a dominant market share, and it is predicted that the market shall generate a revenue of $295,602.6 million by 2028, growing from $76,321.7 million in 2020. The hybrid electric vehicle offers electric motor and conventional (petrol or diesel) engine. At lower speeds electric engine power is used and at higher speeds gas engine power is used, which not only conserves fuel but also has low carbon emissions. In addition, hybrid car features regenerative braking system which means every time when the brake is applied while driving, the electric battery charges a little. This mechanism eliminates the need to stop periodically to recharge the battery during long journeys. In addition, the hybrid electric vehicles have high resale value as gasoline fuels are becoming more expensive due to which people are switching towards hybrid vehicles. This is estimated to increase the price of hybrid vehicles. All these advantages are anticipated to boost the hybrid electric vehicle market demand and growth in the upcoming years.

The plug-in hybrid electric vehicle sub-segment is predicted to have a fastest growth in the global market and is expected to register a revenue of $335,644.0 million during the forecast period. The plug-in hybrid electric vehicle uses both the gasoline-powered engine and the electric engine. The plug-in hybrid vehicles consume 30 to 60% less petroleum than the Internal Combustion Engine (ICE) vehicles as electricity can be produced via renewable resources such as wind and solar energy. The plug-in hybrid electric vehicles can charge batteries through regenerative braking similar to that of hybrid vehicles but these vehicles have large batteries compared to the hybrid electric vehicle. Once, the electric power is exhausted, the plug-in hybrid electric vehicle acts as regular hybrid electric vehicle that can travel miles on gasoline fuel. There are many plug-in hybrid electric vehicles available in the market such as Audi A3 E-Tron, Ford Fusion Energi, BMWi8, Chevy Volt, Toyota Prius, Porsche Cayenne S E-Hybrid, and others. All the factors are predicted to drive the growth of plug-in hybrid electric vehicle sub-segment during the forecast period.

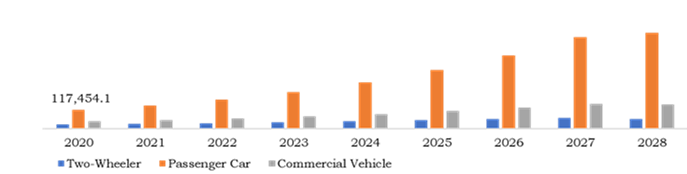

Global Electric Vehicle Market, by Vehicle Type

Based on vehicle type, the analysis has been divided into two-wheeler, passenger car, and commercial vehicle. Out of these, passenger car is predicted to be the most dominant sub-segment and account for the fastest growth in the global market.

Source: Research Dive Analysis

The passenger car sub-segment of the global electric vehicle is anticipated to have fastest growth and surpass $598,466.0 million by 2028, with an increase from $117,454.1 million in 2020. The passenger cars such as Jaguar I-Pace, Tata Nexon EV, Mercedes-Benz EQC offer various benefits as these cars are entirely powered by electricity and no gas is required. Also, the passenger electric cars reduce the emission of harmful greenhouse gases that causes air pollution. These cares offer cost-efficiency as they can be fueled at low prices and new cars provides exciting offers and incentives for going green. These aspects are estimated to drive the growth of passenger car sub-segment during the forecast period.

The commercial vehicle sub-segment of the global electric vehicle is anticipated to have rapid growth and surpass $152,715.7 million by 2028, with an increase from $46,121.9 million in 2020. The growth in commercial vehicle sub-segment is attributed to low maintenance cost as these vehicles run on electric-power engine and there is no need to lubricate engine or change the oil that is required in gas-powered engines. Also, these vehicles reduce the noise pollution as they are much quieter and offers smooth drive with high acceleration for longer distances. The environmental impact of these vehicles is zero that ultimately reduces the carbon footprint. The various electric-powered commercial vehicles available in India are Tata Ultra T.7 Electric, Mahindra Treo, Atul Elite Cargo, and others. All these benefits are estimated to drive the growth for commercial vehicle sub-segment during the analysis timeframe.

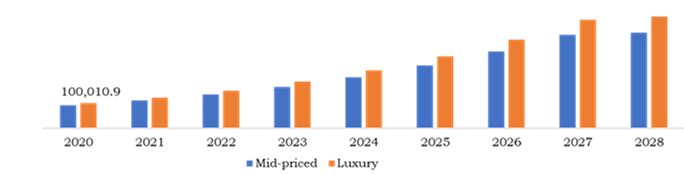

Global Electric Vehicle Market, by Vehicle Class

Based on vehicle class the analysis has been divided into mid-priced and luxury. Out of these, the luxury is the dominant sub-segment and it has accounted for the fastest growth in the global market.

Source: Research Dive Analysis

The luxury sub-segment of the global electric vehicle is anticipated to have dominant market share and surpass $438,183.3 million by 2028, with an increase from $100,010.9 million in 2020. The luxury car manufacturers such as Tesla, Porsche, BMW, and others are focusing on manufacturing best electric car that has excellent speed, range and advance features. For instance, Jaguar I-Pace is the most high-tech car that offers sleek design and high speed. This car offering highly engaging experience with a driving range of 253 miles and rapid charge time of 45 minutes for 0-80% battery. This car offers maximum torque and offers impressive performance even when driven off road and the engine is near-silent. All these benefits are anticipated to drive the growth of luxury sub-segment during the analysis period.

The mid-priced segment is estimated to grow at the significant rate registering a revenue of $374,726.1 million during the analysis timeframe owing to rising environmental concerns and increasing fuel prices. The emerging economies such as India, China are increasing the demand for mid-priced electric vehicle. The budget-friendly electric cars with excellent features available in India are Tata Nexon EV, Volvo XC40 Recharge, Mercedes-Benz EQC, Volkswagen ID 3, and others. The Volkswagen ID 3 is a mid-priced net carbon neutral car, with lightning-fast charging, super smart intelligent lightning concept, and many others. All these factors are estimated to boost the market growth in the upcoming years.

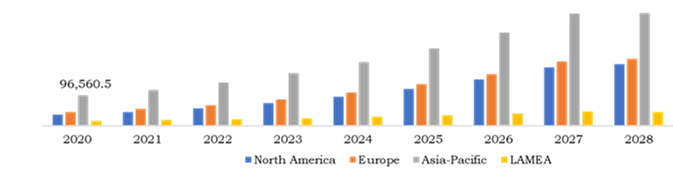

Global Electric Vehicle Market, Regional Insights:

The electric vehicle market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Electric Vehicle in Asia-Pacific to be the Most Dominant

The Asia-Pacific Electric Vehicle market accounted $96,560.5 million in 2020 and is projected to register a revenue of $359,981.7 million by 2028. The increasing government initiatives for reducing the carbon footprint and rapid increase in fuel prices. For instance, the rapid economic growth has enabled more consumers to purchase their own cars and Chinese government has launched various initiatives to boost the adoption of electric vehicles. For instance, as stated on January 5, 2021, in Fortune, the global media organization, China’s Ministry of Finance has cut down the subsidies for electric vehicle by 20% for hybrid, hydrogen-powered, and plug-in electric vehicles to boost the sale of electric vehicles. Such subsidies on the purchase of electric vehicles have helped China, to become world’s largest electric vehicle market accounting for 50% of the global sales. Tesla has become one of the leading electric vehicle providers in China and has gained lead over the local companies after the opening of Shanghai Gigafactory in 2019. These factors are estimated to boost the sales of electric vehicles in Asia-Pacific regions in the upcoming years.

The Market for Electric Vehicle in Europe to Acquire Significant Growth

The share of Europe electric vehicle market is anticipated to grow at a CAGR of 22.2% by registering a revenue of $213,566.4 million by 2028. Strict government regulations and growing demand for fuel-efficient, high-performance vehicles are anticipated to drive the demand for electric vehicle in the upcoming years. As stated on February 28,2021, in The Wall Street Journal, the American daily newspaper, Europe has become the world’s largest electric vehicle market as consumers are greatly influenced by government subsidies and new cars. In addition, the strict regulations laid down by the European Union (EU) on carbon emission has forced auto manufacturers to launch new electric vehicles for reducing the greenhouse emissions and avert the hefty fines of up to $37 billion. Such initiatives are driving the electric vehicle demand in the Europe region.

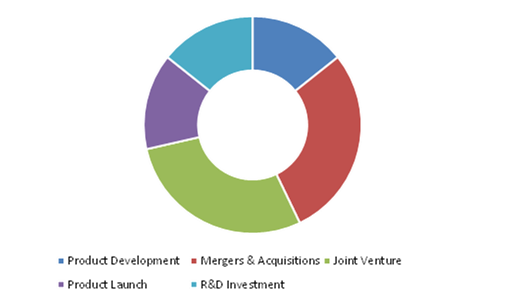

Competitive Scenario in the Global Electric Vehicle Market

Product launches, business expansions, and technological advancements are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading electric vehicle market players are Bayerische Motoren Werke Aktiengesellschaft, BYD Company Limited, Energica Motor Company S.p.A, Daimler AG, Ford Motor Company, Nissan Motor Co., Ltd., General Motors Company, Tesla, Inc., Volkswagen AG, Toyota Motor Corporation

Porter’s Five Forces Analysis for the Global Electric Vehicle Market:

- Bargaining Power of Suppliers: High cost is involved in manufacturing of electric vehicles due to the use of rechargeable lithium-ion batteries that are costly. In addition, technological advancements in electric vehicles such as connected vehicle experience with the use of smartphone reduces the buying power of suppliers.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: Buyers have low bargaining power; as electric vehicles are costly. The electric scooters are available at an affordable price but electric cars are still expensive. Even though, the customers are ready to buy electric vehicles all above-mentioned factors can act as a restraint.

Thus, the bargaining power of the buyers is low. - Threat of New Entrants: The major challenges for the new companies entering in this market are to provide excellent performance at an affordable price which is difficult as the electric cars which are not very expensive lacks in the user experience. Also, government has introduced various benefits such as subsidies to promote the manufacturing of electric vehicles still the manufacturing is costly as new technologies are being introduced in electric vehicles that increase the cost of production.

Thus, the threat of the new entrants is low. - Threat of Substitutes: The threat of substitutes is low as electric vehicles such as hybrid electric vehicles, plug-in hybrid electric vehicles are equipped with both electric engine and gas engine. Hence, the use of electric vehicle provides equivalent power and fuel efficiency.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is high. The growing demand for electric vehicle due to reduction in carbon footprint has encouraged market players to focus on expanding their business capacity and geographical presence.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Vehicle Type |

|

| Segmentation by Vehicle Class |

|

| Key Companies Profiled |

|

Q1. What is the size of the global electric vehicle market?

A. The size of the global Electric Vehicle market was over $190,628.7 million in 2020 and is projected to reach $812,888.1 million by 2028.

Q2. Which are the major companies in the electric vehicle market?

A. Bayerische Motoren Werke Aktiengesellschaft, BYD Company Limited, Energica Motor Company S.p.A, are some of the major players operating in the electric vehicle market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific electric vehicle market?

A. Asia Pacific Electric Vehicle market is anticipated to grow at 18.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launch, business expansions, investments are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Bayerische Motoren Werke Aktiengesellschaft , BYD Company Limited, Energica Motor Company S.p.A, are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Vehicle Type trends

2.4.Vehicle Class trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Electric Vehicle Market, by Type

4.1.Battery Electric Vehicle

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Hybrid Electric Vehicle

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Plug-in Hybrid Electric Vehicle

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.Electric Vehicle Market, by Vehicle Type

5.1.Two-wheeler

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Passenger Car

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Commercial Vehicle

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

6.Electric Vehicle Market, by Vehicle Class

6.1.Mid-priced

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.Luxury

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

7.Electric Vehicle Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Type, 2020-2028

7.1.2.Market size and forecast, by Vehicle Type, 2020-2028

7.1.3.Market size and forecast, by Vehicle Class, 2020-2028

7.1.4.Market size and forecast, by country, 2020-2028

7.1.5.Comparative market share analysis, 2020 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2020-2028

7.1.6.2.Market size and forecast, by Vehicle Type, 2020-2028

7.1.6.3.Market size and forecast, by Vehicle Class, 2020-2028

7.1.6.4.Comparative market share analysis, 2020 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2020-2028

7.1.7.2.Market size and forecast, by Vehicle Type, 2020-2028

7.1.7.3.Market size and forecast, by Vehicle Class, 2020-2028

7.1.7.4.Comparative market share analysis, 2020 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2020-2028

7.1.8.2.Market size and forecast, by Vehicle Type, 2020-2028

7.1.8.3.Market size and forecast, by Vehicle Class, 2020-2028

7.1.8.4.Comparative market share analysis, 2020 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Type, 2020-2028

7.2.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.4.Market size and forecast, by country, 2020-2028

7.2.5.Comparative market share analysis, 2020 & 2028

7.2.6.Germany

7.2.6.1.Market size and forecast, by Type, 2020-2028

7.2.6.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.6.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.6.4.Comparative market share analysis, 2020 & 2028

7.2.7.France

7.2.7.1.Market size and forecast, by Type, 2020-2028

7.2.7.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.7.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.7.4.Comparative market share analysis, 2020 & 2028

7.2.8.UK

7.2.8.1.Market size and forecast, by Type, 2020-2028

7.2.8.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.8.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.8.4.Comparative market share analysis, 2020 & 2028

7.2.9.Netherlands

7.2.9.1.Market size and forecast, by Type, 2020-2028

7.2.9.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.9.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.9.4.Comparative market share analysis, 2020 & 2028

7.2.10.Norway

7.2.10.1.Market size and forecast, by Type, 2020-2028

7.2.10.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.10.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.10.4.Comparative market share analysis, 2020 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2020-2028

7.2.11.2.Market size and forecast, by Vehicle Type, 2020-2028

7.2.11.3.Market size and forecast, by Vehicle Class, 2020-2028

7.2.11.4.Comparative market share analysis, 2020 & 2028

7.3.Asia Pacific

7.3.1.Market size and forecast, by Type, 2020-2028

7.3.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.4.Market size and forecast, by country, 2020-2028

7.3.5.Comparative market share analysis, 2020 & 2028

7.3.6.China

7.3.6.1.Market size and forecast, by Type, 2020-2028

7.3.6.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.6.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.6.4.Comparative market share analysis, 2020 & 2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Type, 2020-2028

7.3.7.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.7.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.7.4.Comparative market share analysis, 2020 & 2028

7.3.8.Singapore

7.3.8.1.Market size and forecast, by Type, 2020-2028

7.3.8.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.8.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.8.4.Comparative market share analysis, 2020 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2020-2028

7.3.9.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.9.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.9.4.Comparative market share analysis, 2020 & 2028

7.3.10.Rest of Asia Pacific

7.3.10.1.Market size and forecast, by Type, 2020-2028

7.3.10.2.Market size and forecast, by Vehicle Type, 2020-2028

7.3.10.3.Market size and forecast, by Vehicle Class, 2020-2028

7.3.10.4.Comparative market share analysis, 2020 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Type, 2020-2028

7.4.2.Market size and forecast, by Vehicle Type, 2020-2028

7.4.3.Market size and forecast, by Vehicle Class, 2020-2028

7.4.4.Market size and forecast, by country, 2020-2028

7.4.5.Comparative market share analysis, 2020 & 2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Type, 2020-2028

7.4.6.2.Market size and forecast, by Vehicle Type, 2020-2028

7.4.6.3.Market size and forecast, by Vehicle Class, 2020-2028

7.4.6.4.Comparative market share analysis, 2020 & 2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Type, 2020-2028

7.4.7.2.Market size and forecast, by Vehicle Type, 2020-2028

7.4.7.3.Market size and forecast, by Vehicle Class, 2020-2028

7.4.7.4.Comparative market share analysis, 2020 & 2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Type, 2020-2028

7.4.8.2.Market size and forecast, by Vehicle Type, 2020-2028

7.4.8.3.Market size and forecast, by Vehicle Class, 2020-2028

7.4.8.4.Comparative market share analysis, 2020 & 2028

8.Company profiles

8.1.Bayerische Motoren Werke Aktiengesellschaft

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.BYD Company Limited

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Energica Motor Company S.p.A

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Daimler AG

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Ford Motor Company

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Nissan Motor Co., Ltd.

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.General Motors Company

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.Tesla, Inc.

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Volkswagen AG

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Toyota Motor Corporation

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Electric vehicle is the next big thing in the automobile industry worldwide. An electric vehicle or EV works on an electric motor. It does not require an internal-combustion engine that burns a mixture of fuel and gases to generate power. This is the reason why electric vehicles are attracting the new-generation customers. These vehicles, which are being considered as environment-friendly, are greatly preferred to combat the global warming, air pollution, and overuse of natural resources. The concept of electric vehicles is not a brand new one. However, because of the rising carbon footprint and climate concerns, it has attracted a significant amount of interest in the last decade.

Some Factors Propelling Growth of the Market

As mentioned earlier, the global electric vehicle industry is experiencing a swift growth in recent years. Internal Combustion Engine (ICE) vehicles emit a huge portion of greenhouse gases into the atmosphere. In order to control the carbon emission in the air, the governments of various countries have taken many initiatives to promote the necessity of deploying electric vehicles. Moreover, the charging cost of an electric vehicle is almost 40% lesser as compared to the cost of petrol or diesel. This cost can be reduced further, if the electric vehicle is powered by solar photovoltaic (PV) system.

These are main factors behind the growth of the electric vehicles market during the forthcoming years.

Recent Development and Trends

- Bayerische Motoren Werke Aktiengesellschaft

- BYD Company Limited

- Daimler AG

- Energica Motor Company S.p.A

- Ford Motor Company

- General Motors Company

- Nissan Motor Co., Ltd.

- Tesla, Inc.

- Volkswagen AG

- Toyota Motor Corporation

These industry players are investing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology.

Some of the recent developments of the market are as follows:

- In January 2021, BYD UK along with Alexander Dennis Limited (ADL), announced that both of the companies will commence the design and assembly of chassis for the BYD ADL partnership's electric single and double deck buses for the British market, ensuring completed vehicles are built in ADL's facilities in the UK.

Alexander Dennis Limited or ADL is a subsidiary of leading independent global bus manufacturer NFI Group Inc. (NFI), while BYD is a global leader in batteries, energy management and electric mobility.

The rising demand for zero emission vehicles is the reason behind this huge step by the BYD company.

- In May 2021, American multinational automaker company, Ford, introduced a new product- 2022 F-150 Lightning® Pro. This is the first-ever all-electric F-Series truck purpose-built for commercial customers. The lightning pro joins E-Transit in the growing lineup of Ford work-ready electric vehicles, backed by a network offering EV-certified fleet sales, service, and financing, thus enabling zero emission.

- In April 2021, Japan's Nissan Motor Co, a global manufacturer of automobile, displayed a restructured version of its X-Trail model, which is expected to reduce cost and speed up industry growth. At the auto show hold in Shanghai, China, the company also announced their strategy for a green car.

- In April 2021, Toyota Motor Corporation, a global automobile manufacturer, announced the arrival of Toyota bZ, its newly recognized series of battery electric vehicles (BEVs), in establishment of a full line-up of electrified vehicles. Toyota unveiled a concept version of the Toyota bZ4X at the Auto Shanghai, a motor show held in Shanghai, China. This version will be the first model in the bZ series.

Impact Analysis of Covid-19 on the Electric Vehicle Market

The coronavirus pandemic affected the electric vehicle market in a drastic way like any other automotive businesses. In addition, the market is also experiencing a decline in growth rate because of the high prices of electric vehicles. Lockdown and restrictions imposed across the nations in order to curb the spread of coronavirus pandemic have further impacted the market with declining demand and production rate.

Most of the leading companies of the market have come forward to help the society during this catastrophic situation. For instance, as part of a recent initiative, Kokoro of Nagoya Health & Welfare Bureau and Toyota Tsusho Corporation provided 10,000 sets of medical personal protective equipment (isolation gowns) to the City of Nagoya Health & Welfare Bureau. This initiative was started by Toyota Motor Corporation and other Toyota Group companies in December 2020, which is still working toward offering essential help to the frontline health workers.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com