Plant Based Meat Market Report

RA00306

Plant Based Meat Market, by Product Type (Tofu, Tempeh, Seitan, RTC/RTE, and Natto), Source (Soy-based Meat Alternatives, Wheat-based Meat Alternatives, Mycoprotein Meat Alternative, and Others), Distribution Channel (Direct and Indirect), and Regional Analysis (North America, Europe, Asia Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

The global plant based meat market forecast shall be $68,448.9 million by 2027, rising from $17,076.9 million in 2019 at a healthy rate of 19.1%. The North America plant based meat market is expected to surge at a CAGR of 24.3% by registering a revenue of $10,445.3 million, during the projected period. Growing importance of vegan diet products, along with increasing awareness about threat of consumption of tainted meat foods is projected to accelerate the market growth in the region.

Plant Based Meat Market Synopsis

Numerous health benefits provided by the plant based meat products including no cholesterol, no antibiotics, and less saturated fats, coupled with the increasing adoption of veganism amongst people, are expected to boost the growth of the plant based meat market.

On the other hand, there is a low product penetration in the underdeveloped countries, which is a growth-restricting factor for the market.

According to the regional analysis, the North America market for plant based meat is expected to garner a revenue of $10,445.3 million, holding the majority of market share during the review period.

Plant Based Meat Market Analysis:

Plant-based meat are food products produced from plant materials that are designed to mimic meat in every way, including appearance, smell, texture, and taste. These meat products include common ingredients such as legumes and grains, which are used as fiber, protein, and starch sources.

Impact Analysis of COVID-19 on the Global Plant Based Meat Market:

The outbreak of the Coronavirus disease (COVID-19) has positively impacted the global plant based meat market in the recent months. Increasing vegan population and growth in awareness regarding health benefits provided by vegan food are some of the major factors expected to accelerate the growth of the market in the forecast time.

In addition to this, certain innovative market leaders such as Impossible foods, Conagra, and others are entering into strategic collaboration in order to sustain in the COVID-19 situation. For instance, in April 2020, Impossible Foods, a significant US-based company that develops plant-based substitutes for meat products, teamed up with several organizations including Cheetah, a notable player in restaurants, small business food and grocery supplier, in order to adapt to the COVID-19 crisis. Furthermore, in July 2020, Imagine Meats collaborated with Archer Daniels Midland Company (ADM) in order to enhance plant-based innovations in India.

Such effective collaborations are providing lucrative market opportunities to the global plant based meat market during the COVID-19 situation.

Growing adoption of veganism among people owing to surge in obesity is expected to boost the plant based meat market

The enormous growth in plant based meat market is mainly attributed to the growing prevalence of chronic conditions such as obesity, cardiovascular diseases (CVDs) among the people, increasing adoption of vegan trend, and entry of innovative market leaders like Unilever in this industry. In recent years, companies dealing with food businesses have witnessed a notable growth in the sales of plant-derived meat products owing to health benefits provided by these products including no cholesterol, less saturated fats, and no antibiotics. For instance, according to records, in July 2020, the PLANT BASED FOODS ASSOCIATION. witnessed 23% growth in the sales of plant-based meat products, when these items were showcased in the meat stores.. Moving ahead, market leaders operating in the global industry are officially entering into the plant derived meat business, which may further create positive impact on the global market. For instance, in December 2018, Unilever, a British-Dutch multinational consumer goods company, acquired Vegetarian Butcher, a notable player in meat substitutes, in order to expand the plant-derived food offerings. Moreover, Unilever has expected to register $1.2 billion sales from plant-based meat and dairy alternatives in the coming 5 to 7 years.

To know more about global plant based meat market drivers, get in touch with our analysts here.

Lower product penetration in underdeveloped economies may restrain the growth of the global plant based meat industry

Lower product penetration in under-developed countries is also hampering the global plant based meat market. In addition to this, population allergic to plant-derived meat sources like wheat and soy may restrain the market growth, throughout the projected period.

The increasing support from government bodies on plant based meat products may create lucrative opportunities for the global plant based meat market in the future

Increasing government initiatives to generate awareness about the importance of plant-based meats is estimated to boost the market growth and create significant growth opportunities for the global market in the upcoming years. For instance, in 2018, the Indian Ministry of Health and Family Welfare conducted a campaign called “Eat Right India” to promote a sustainable diet featuring plant-based foods to support the fight against climate change. This was a major step because animal agriculture is a leading cause of climate change; every year, agriculture produces about 32,000 million tons of carbon dioxide gas and accounts to nearly 18% of greenhouse gas emissions globally. In 2019, about 107 scientists and researchers prepared a report on global climate change for the United Nation’s Intergovernmental Panel on Climate Change (IPCC) and found the consumption of dairy, meat, and several other animals products to be significant contributors to global warming. These aspects are anticipated to fuel the plant-based meat products' industry growth and are predicted to surge the market growth in the coming years.

To know more about global plant based meat market opportunities, get in touch with our analysts here.

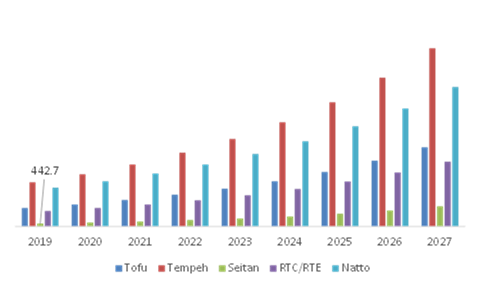

Global Plant Based Meat Market, by Product Type:

Seitan sub-segment for the plant based meat market shall generate a revenue of $2850.9 million by 2027 majorly because of rising demand for natural and fresh food products worldwide

Source: Research Dive Analysis

The seitan sub-segment will have a massive market growth and it is expected to generate a revenue of $2850.9 million by 2027, growing from $442.7 million in 2019. The increase in the demand for natural and fresh food products without compromising on meat-like food items is projected to boost the market in the near future. Moreover, some of the key factors boosting seitan’s market are that these food products can be stockpiled for months without losing texture or taste which gives it the upper hand compared to other meat alternatives such as tofu and tempeh.

The tempeh sub-segment will have a magnificent market share and is anticipated to register a revenue of $25,310.8 million by 2027, increasing from $6,283.2 million in 2019. Tempeh also contains probiotics, which help in improving the digestive health and reduces inflammation in the body. The rapid growth in consumer preferences is anticipated to boost the tempeh sub-segment in the upcoming years.

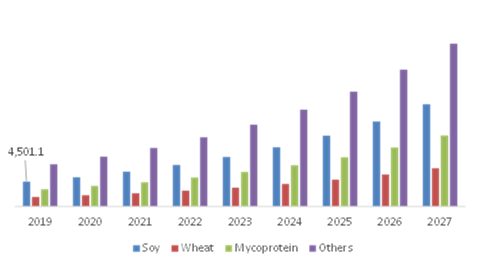

Global Plant Based Meat Market, by Source:

Soy Source for the plant based meat market shall have exponential market growth, in the coming years

Source: Research Dive Analysis

The soy source sub-segment for the global plant based meat industry will have the fastest market growth and is expected to surpass $18,697.6 million by 2027, with a notable surge from $4,501.1 million in 2019 at a remarkable 19.6% CAGR. In modern world, consumers across the globe are adopting more flexible attitudes and behavior regarding food. Hence, established as well as startup companies are serving various food products like mock meat tikkas and plant derived burgers for vegan consumers coupled with non-vegetarian people who are looking to switch for alternatives. For instance, Veggie Champ, an Indian startup dealing with a plant-based meat product, provides mock fish fillet, mock duck, vegan burger, and pepper salami produced with combinations of soy and exotic spices. Moreover, in September 2019, Hormel Foods Corporation., a global branded food establishment with presence in 75 countries worldwide, announced the official launch of its plant-based food range ‘Happy Little Plants’, to fulfill the changing consumer preferences toward veganism and vegetarianism. Under the brand, the company announced to promote and deliver plant-derived soy protein across multiple retail outlets. Such company initiatives and changing consumers preferences are further projected to accelerate the sub-segment growth, during the forecast period.

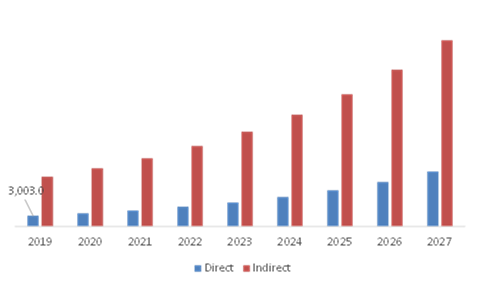

Global Plant Based Meat Market, by Distribution Channel:

Direct distribution channel for the plant based meat market will have exponential market growth in the coming years

Source: Research Dive Analysis

The direct distribution channel for the global plant based meat market will have lucrative growth and is predicted to cross $15,587.4 million by 2027, with an increase from $3,003.0 million in 2019 at a healthy growth rate of 22.9%. Direct distribution channel helps in eliminating intermediary expenses, increasing direct customer contact, and reducing distribution channel options. Furthermore, rise of direct-to-customer trend as well as growing consumer preference are some of the factors are expected to create significant impact on the direct distribution channel sub-segment.

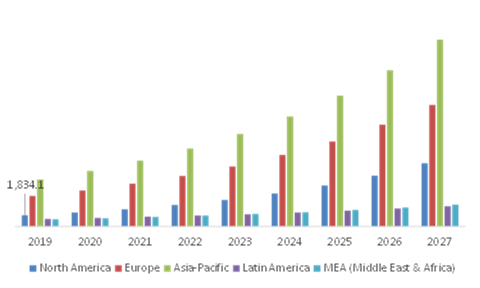

Regional Insights:

North America plant based meat market has a significant market share, and it will reach up to $10,445.3 million by the end of 2027 owing to increasing prevalence of chronic diseases such as CVDs and diabetes

Source: Research Dive Analysis

The North America market for plant based meat products accounted for $1,834.1 million in 2019 and it is expected to register a revenue of $10,445.3 million by the end 2027. Rising importance of vegan diet products over traditional meat foods along with increasing consumer interest and awareness related to threat of consumption of tainted meat foods and their derivates is estimated to fuel the growth of the market in the forecast years. In addition to this, increasing prevalence of chronic diseases such as CVDs is resulting rapid shift of Americans towards veganism. As per study conducted by CDC (Centers for Disease Control and Prevention) 1 person dies in every 36 seconds in the US due to CVDs. Furthermore, according to the online newsletter, around 58% of people in Canada want to decrease their consumption of meat in order to be healthier. Above-stated factors showcases that the need for veganism is expected to dramatically increase in the region, which may further eventually bolster the North America plant based meat market, throughout the forecast period.

Asia-Pacific plant based meat market share is expected to rise at a CAGR of 18.9% by registering a revenue of $30,938.9 million by 2027. This growth is mainly attributed to the supportive government policies, growing disposable income across the Asian countries, and technological innovation in food & beverages industry particularly in China, India, and Japan.

Competitive Scenario in the Global Plant Based Meat Market:

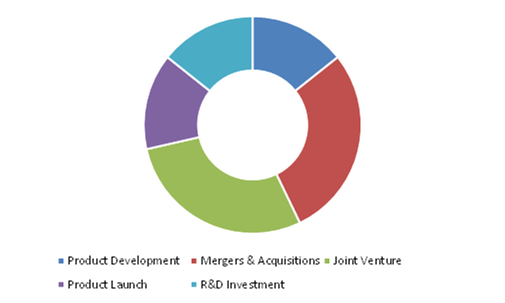

The advanced technology development coupled with mergers & acquisitions are the frequent strategies followed by the significant market players

Source: Research Dive Analysis

Some of the leading plant based meat market players include Pinnacle Foods Inc. (Conagra Brands, Inc.), Amy’s Kitchen, Inc., Atlantic Natural Foods, Inc., Lightlife Foods, Inc., Schouten Europe B.V., Sweet Earth, Inc., Impossible Foods Inc., The Kraft Heinz Company, Hain Celestial, Beyond Meat., Pacific Foods of Oregon, LLC, Monde Nissin, Kellogg’s Company, Fry Family Food, Nutrisoy Pty Ltd, Hügli Holding AG, Nasoya Foods, VBites Foods Ltd., Turtle Island Foods, Inc., and Taifun-Tofu GmbH.

Plant based meat market players are emphasizing on capacity expansion, advanced technical developments, product promotion, and strategic tie-ups in order to strengthen their position in the global market.

Porter’s Five Forces Analysis for Plant Based Meat Market:

- Bargaining Power of Suppliers: The suppliers of plant based meat market are high in number. Hence, the negotiation power of suppliers will be minimal. Therefore, there will be less threat from the supplier. Therefore, the bargaining power of the supplier is Moderate

- Bargaining Power of Buyer: Majority of the key players working in the global plant based meat market have initiated to deliver the best food products in reasonable prices. Therefore, buyers may have various options to select a convenient option that best fits their preferences. So, the bargaining power of the buyer will be HIGH

- Threat of New Entrants: The companies entering into the plant based meat market are preferring strategies including capacity expansion, technological advancements, and novel product launches. Hence, it is possible to them attract consumers easily. Thus, the threat of the new entrants will be High

- Threat of Substitutes: There is no alternative product for the plant-based meat. Thus, the threat of substitutes is Low

- Competitive Rivalry in the Market: The competitive rivalry in the market players is rather intense, particularly between the food manufacturers such as Unilever, Conagra, and Beyond Meat. Such players are launching their value-added product portfolio in the worldwide and capturing global industry. Hence, competitive rivalry in the market is High

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, MEA, and Latin America |

| Segmentation by Product Type

|

|

| Segmentation by Source |

|

| Segmentation by Distribution Channel |

|

| Key Countries Covered | The U.S., Canada, Germany, France, Spain, Italy, Russia, Poland, Rest of Europe, China, Australia, Japan, India, ASEAN, New-Zealand, Rest of Asia-Pacific, Mexico, Latin America, Middle East, and South Africa, GCC, Rest of Latin America, Brazil, North Africa |

| Key Companies Profiled |

|

Q1. What is the size of the global plant based meat market?

A. The global plant based meat market size was over $17,076.9 million in 2019 and is projected to reach $68,448.9 million by 2027.

Q2. Which are the major companies in the plant based meat market?

A. Impossible Food Inc., Taifun-Tofu GmbH and Lightlife Foods, Inc. are some of the key players in the global plant based meat market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The North America region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What is the growth rate of the North America Plant based meat Market?

A. North America plant based meat market is anticipated to grow at 24.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovation and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Beyond Meat. and Conagra Brands, Inc. companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Product type trends

2.3. Source trends

2.4. Distribution channel trends

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.9. Strategic overview

4. Plant based meat market, by Product type

4.1. Tofu

4.1.1. Market size and forecast, by region, 2019-2027

4.1.2. Comparative market share analysis, 2019&2027

4.2. Tempeh

4.2.1. Market size and forecast, by region, 2019-2027

4.2.2. Comparative market share analysis, 2019&2027

4.3. Seitan

4.3.1. Market size and forecast, by region, 2019-2027

4.3.2. Comparative market share analysis, 2019&2027

4.4. RTC/RTE

4.4.1. Market size and forecast, by region, 2019-2027

4.4.2. Comparative market share analysis, 2019&2027

4.5. Natto

4.5.1. Market size and forecast, by region, 2019-2027

4.5.2. Comparative market share analysis, 2019&2027

5. Plant based meat market, by Source

5.1. Soy based meat alternatives

5.1.1. Market size and forecast, by region, 2019-2027

5.1.2. Comparative market share analysis, 2019&2027

5.2. Wheat based meat alternatives

5.2.1. Market size and forecast, by region, 2019-2027

5.2.2. Comparative market share analysis, 2019&2027

5.3. Mycoportein meat alternatives

5.3.1. Market size and forecast, by region, 2019-2027

5.3.2. Comparative market share analysis, 2019&2027

5.4. Other source of meat alternatives

5.4.1. Market size and forecast, by region, 2019-2027

5.4.2. Comparative market share analysis, 2019&2027

6. Plant based meat market, by Distribution channel

6.1. Direct

6.1.1. Market size and forecast, by region, 2019-2027

6.1.2. Comparative market share analysis, 2019&2027

6.2. Indirect

6.2.1. Market size and forecast, by region, 2019-2027

6.2.2. Comparative market share analysis, 2019&2027

7. Plant based meat market, by Region

7.1. North America

7.1.1. Market size and forecast, by product type, 2019-2027

7.1.2. Market size and forecast, by source, 2019-2027

7.1.3. Market size and forecast, by distribution channel, 2019-2027

7.1.4. Market size and forecast, by country, 2019-2027

7.1.5. Comparative market share analysis, 2019&2027

7.1.6. U.S.

7.1.6.1. Market size and forecast, by product type, 2019-2027

7.1.6.2. Market size and forecast, by source, 2019-2027

7.1.6.3. Market size and forecast, by distribution channel, 2019-2027

7.1.6.4. Comparative market share analysis, 2019&2027

7.1.7. Canada

7.1.7.1. Market size and forecast, by product type, 2019-2027

7.1.7.2. Market size and forecast, by source, 2019-2027

7.1.7.3. Market size and forecast, by distribution channel, 2019-2027

7.1.7.4. Comparative market share analysis, 2019&2027

7.2. Europe

7.2.1. Market size and forecast, by product type, 2019-2027

7.2.2. Market size and forecast, by source, 2019-2027

7.2.3. Market size and forecast, by distribution channel, 2019-2027

7.2.4. Market size and forecast, by country, 2019-2027

7.2.5. Comparative market share analysis, 2019&2027

7.2.6. Germany

7.2.6.1. Market size and forecast, by product type, 2019-2027

7.2.6.2. Market size and forecast, by source, 2019-2027

7.2.6.3. Market size and forecast, by distribution channel, 2019-2027

7.2.6.4. Comparative market share analysis, 2019&2027

7.2.7. Russia

7.2.7.1. Market size and forecast, by product type, 2019-2027

7.2.7.2. Market size and forecast, by source, 2019-2027

7.2.7.3. Market size and forecast, by distribution channel, 2019-2027

7.2.7.4. Comparative market share analysis, 2019&2027

7.2.8. France

7.2.8.1. Market size and forecast, by product type, 2019-2027

7.2.8.2. Market size and forecast, by source, 2019-2027

7.2.8.3. Market size and forecast, by distribution channel, 2019-2027

7.2.8.4. Comparative market share analysis, 2019&2027

7.2.9. Spain

7.2.9.1. Market size and forecast, by product type, 2019-2027

7.2.9.2. Market size and forecast, by source, 2019-2027

7.2.9.3. Market size and forecast, by distribution channel, 2019-2027

7.2.9.4. Comparative market share analysis, 2019&2027

7.2.10. Italy

7.2.10.1. Market size and forecast, by product type, 2019-2027

7.2.10.2. Market size and forecast, by source, 2019-2027

7.2.10.3. Market size and forecast, by distribution channel, 2019-2027

7.2.10.4. Comparative market share analysis, 2019&2027

7.2.11. Poland

7.2.11.1. Market size and forecast, by product type, 2019-2027

7.2.11.2. Market size and forecast, by source, 2019-2027

7.2.11.3. Market size and forecast, by distribution channel, 2019-2027

7.2.11.4. Comparative market share analysis, 2019&2027

7.2.12. Rest of Europe

7.2.12.1. Market size and forecast, by product type, 2019-2027

7.2.12.2. Market size and forecast, by source, 2019-2027

7.2.12.3. Market size and forecast, by distribution channel, 2019-2027

7.2.12.4. Comparative market share analysis, 2019&2027

7.3. Asia Pacific

7.3.1. Market size and forecast, by product type, 2019-2027

7.3.2. Market size and forecast, by source, 2019-2027

7.3.3. Market size and forecast, by distribution channel, 2019-2027

7.3.4. Market size and forecast, by country, 2019-2027

7.3.5. Comparative market share analysis, 2019&2027

7.3.6. China

7.3.6.1. Market size and forecast, by product type, 2019-2027

7.3.6.2. Market size and forecast, by source, 2019-2027

7.3.6.3. Market size and forecast, by distribution channel, 2019-2027

7.3.6.4. Comparative market share analysis, 2019&2027

7.3.7. India

7.3.7.1. Market size and forecast, by product type, 2019-2027

7.3.7.2. Market size and forecast, by source, 2019-2027

7.3.7.3. Market size and forecast, by distribution channel, 2019-2027

7.3.7.4. Comparative market share analysis, 2019&2027

7.3.8. Japan

7.3.8.1. Market size and forecast, by product type, 2019-2027

7.3.8.2. Market size and forecast, by source, 2019-2027

7.3.8.3. Market size and forecast, by distribution channel, 2019-2027

7.3.8.4. Comparative market share analysis, 2019&2027

7.3.9. Australia

7.3.9.1. Market size and forecast, by product type, 2019-2027

7.3.9.2. Market size and forecast, by source, 2019-2027

7.3.9.3. Market size and forecast, by distribution channel, 2019-2027

7.3.9.4. Comparative market share analysis, 2019&2027

7.3.10. New Zealand

7.3.10.1. Market size and forecast, by product type, 2019-2027

7.3.10.2. Market size and forecast, by source, 2019-2027

7.3.10.3. Market size and forecast, by distribution channel, 2019-2027

7.3.10.4. Comparative market share analysis, 2019&2027

7.3.11. ASEAN

7.3.11.1. Market size and forecast, by product type, 2019-2027

7.3.11.2. Market size and forecast, by source, 2019-2027

7.3.11.3. Market size and forecast, by distribution channel, 2019-2027

7.3.11.4. Comparative market share analysis, 2019&2027

7.3.12. Rest of Asia Pacific

7.3.12.1. Market size and forecast, by product type, 2019-2027

7.3.12.2. Market size and forecast, by source, 2019-2027

7.3.12.3. Market size and forecast, by distribution channel, 2019-2027

7.3.12.4. Comparative market share analysis, 2019&2027

7.4. MEA

7.4.1. Market size and forecast, by product type, 2019-2027

7.4.2. Market size and forecast, by source, 2019-2027

7.4.3. Market size and forecast, by distribution channel, 2019-2027

7.4.4. Market size and forecast, by country, 2019-2027

7.4.5. Comparative market share analysis, 2019&2027

7.4.6. GCC

7.4.6.1. Market size and forecast, by product type, 2019-2027

7.4.6.2. Market size and forecast, by source, 2019-2027

7.4.6.3. Market size and forecast, by distribution channel, 2019-2027

7.4.6.4. Comparative market share analysis, 2019&2027

7.4.7. South Africa

7.4.7.1. Market size and forecast, by product type, 2019-2027

7.4.7.2. Market size and forecast, by source, 2019-2027

7.4.7.3. Market size and forecast, by distribution channel, 2019-2027

7.4.7.4. Comparative market share analysis, 2019&2027

7.4.8. North Africa

7.4.8.1. Market size and forecast, by product type, 2019-2027

7.4.8.2. Market size and forecast, by source, 2019-2027

7.4.8.3. Market size and forecast, by distribution channel, 2019-2027

7.4.8.4. Comparative market share analysis, 2019&2027

7.5. Latin America

7.5.1. Market size and forecast, by product type, 2019-2027

7.5.2. Market size and forecast, by source, 2019-2027

7.5.3. Market size and forecast, by distribution channel, 2019-2027

7.5.4. Market size and forecast, by country, 2019-2027

7.5.5. Comparative market share analysis, 2019&2027

7.5.6. Brazil

7.5.6.1. Market size and forecast, by product type, 2019-2027

7.5.6.2. Market size and forecast, by source, 2019-2027

7.5.6.3. Market size and forecast, by distribution channel, 2019-2027

7.5.6.4. Comparative market share analysis, 2019&2027

7.5.7. Mexico

7.5.7.1. Market size and forecast, by product type, 2019-2027

7.5.7.2. Market size and forecast, by source, 2019-2027

7.5.7.3. Market size and forecast, by distribution channel, 2019-2027

7.5.7.4. Comparative market share analysis, 2019&2027

7.5.8. Rest of Latin America

7.5.8.1. Market size and forecast, by product type, 2019-2027

7.5.8.2. Market size and forecast, by source, 2019-2027

7.5.8.3. Market size and forecast, by distribution channel, 2019-2027

7.5.8.4. Comparative market share analysis, 2019&2027

8. Company profiles

8.1. Pinnacle Foods Inc. (Conagra Brands, Inc.)

8.1.1. Business overview

8.1.2. Financial performance

8.1.3. Product type portfolio

8.1.4. Recent strategic moves & developments

8.1.5. SWOT analysis

8.2. Amy’s Kitchen, Inc.

8.2.1. Business overview

8.2.2. Financial performance

8.2.3. Product type portfolio

8.2.4. Recent strategic moves & developments

8.2.5. SWOT analysis

8.3. Atlantic Natural Foods, Inc.

8.3.1. Business overview

8.3.2. Financial performance

8.3.3. Product type portfolio

8.3.4. Recent strategic moves & developments

8.3.5. SWOT analysis

8.4. Impossible Foods Inc.

8.4.1. Business overview

8.4.2. Financial performance

8.4.3. Product type portfolio

8.4.4. Recent strategic moves & developments

8.4.5. SWOT analysis

8.5. Hain Celestial

8.5.1. Business overview

8.5.2. Financial performance

8.5.3. Product type portfolio

8.5.4. Recent strategic moves & developments

8.5.5. SWOT analysis

8.6. Beyond Meat

8.6.1. Business overview

8.6.2. Financial performance

8.6.3. Product type portfolio

8.6.4. Recent strategic moves & developments

8.6.5. SWOT analysis

8.7. Pacific Foods of Oregon, LLC

8.7.1. Business overview

8.7.2. Financial performance

8.7.3. Product type portfolio

8.7.4. Recent strategic moves & developments

8.7.5. SWOT analysis

8.8. Monde Nissin

8.8.1. Business overview

8.8.2. Financial performance

8.8.3. Product type portfolio

8.8.4. Recent strategic moves & developments

8.8.5. SWOT analysis

8.9. Kellogg’s Company

8.9.1. Business overview

8.9.2. Financial performance

8.9.3. Product type portfolio

8.9.4. Recent strategic moves & developments

8.9.5. SWOT analysis

8.10. Fry Family Food

8.10.1. Business overview

8.10.2. Financial performance

8.10.3. Product type portfolio

8.10.4. Recent strategic moves & developments

8.10.5. SWOT analysis

8.11. Nutrisoy Pty Ltd

8.11.1. Business overview

8.11.2. Financial performance

8.11.3. Product type portfolio

8.11.4. Recent strategic moves & developments

8.11.5. SWOT analysis

8.12. Nasoya Foods

8.12.1. Business overview

8.12.2. Financial performance

8.12.3. Product type portfolio

8.12.4. Recent strategic moves & developments

8.12.5. SWOT analysis

8.13. Hügli Holding AG

8.13.1. Business overview

8.13.2. Financial performance

8.13.3. Product type portfolio

8.13.4. Recent strategic moves & developments

8.13.5. SWOT analysis

8.14. Sweet Earth, Inc.

8.14.1. Business overview

8.14.2. Financial performance

8.14.3. Product type portfolio

8.14.4. Recent strategic moves & developments

8.14.5. SWOT analysis

8.15. VBites Foods Ltd

8.15.1. Business overview

8.15.2. Financial performance

8.15.3. Product type portfolio

8.15.4. Recent strategic moves & developments

8.15.5. SWOT analysis

8.16. The Kraft Heinz Company (KHC)

8.16.1. Business overview

8.16.2. Financial performance

8.16.3. Product type portfolio

8.16.4. Recent strategic moves & developments

8.16.5. SWOT analysis

8.17. Schouten Europe B.V.

8.17.1. Business overview

8.17.2. Financial performance

8.17.3. Product type portfolio

8.17.4. Recent strategic moves & developments

8.17.5. SWOT analysis

8.18. Turtle Island Foods, Inc.

8.18.1. Business overview

8.18.2. Financial performance

8.18.3. Product type portfolio

8.18.4. Recent strategic moves & developments

8.18.5. SWOT analysis

8.19. Lightlife Foods, Inc.

8.19.1. Business overview

8.19.2. Financial performance

8.19.3. Product type portfolio

8.19.4. Recent strategic moves & developments

8.19.5. SWOT analysis

8.20. Taifun-Tofu GmbH

8.20.1. Business overview

8.20.2. Financial performance

8.20.3. Product type portfolio

8.20.4. Recent strategic moves & developments

8.20.5. SWOT analysis

Plant based meat products are derived from plants and are a replica of meat in terms of texture, taste, appearance, and smell. These products are available as burgers, ground meat, sausages and crumbles, sea-food like fish or shrimp, and nuggets. Plant based meat products are trending foods in today’s life, especially for the vegan population. Basically, there are two types of plant based meats – restructured meat and whole muscle meat. Food items that resemble ground beef, sausages, meatball, and nuggets fall under restructured meat, whereas products that mimic chicken breast, steak or any other animal muscle are whole muscle meat.

Some of the common ingredients that are used for making plant based meat are legumes and grains as these contain fibers, proteins, and starch.

Forecast Analysis of Plant Based Meat Market

The growth of the plant based meat market is due to occurrence of chronic health conditions such as cardiovascular diseases and obesity to name a few. Also, the ongoing vegan trend amongst the people and entry of innovative industrial leaders is predicted to play a vital role in the market growth. Companies that are into food businesses noted a rise in the sales of plant based meat items because of several health benefits attributed by these food items. Less saturated fats, no cholesterol, and zero antibiotics are some of the health related advantages associated with the plant based meat products. Apart from this, people who are allergic to plant based meat products such as soy and wheat are likely to restrain the market growth. Moreover, less penetration of products in under developed countries is expected to hinder the market.

On the other hand, various government initiatives to create awareness about plant based meat products is estimated to open up opportunities for the market in recent years. Research Dive’s new report on plant based meat market reveals that the growth rate is expected to be 19.1% during forecast period. The market is expected to boom in North America due to preference of vegan products over traditional food items. Furthermore, Americans are favoring vegan food due to rise in cardiovascular diseases and threat related to the intake of tainted meat food products. The North American plant based meat market is anticipated to garner $10,445.3 million by 2027. Some of the well-known and prominent players of the global plant based meat market are Turtle Island Foods, Inc., Amy’s Kitchen, Inc., Pinnacle Foods Inc. (Conagra Brands, Inc.), Atlantic Natural Foods, Inc., Schouten Europe B.V., Lightlife Foods, Inc., and Sweet Earth, Inc.

Recent Developments of the Plant Based Meat Market

The leading market players of the global plant based meat market are focusing on developing their strategies in recent years for gaining competitive upper hand in the market. Launching new products, collaborating for business expansion, investing in research and development, and improving existing products are some of the plans adopted by the companies.

In December 2020, Nestle, which is one of the largest food manufacturing companies, announced the launch of Harvest Gourmet brand in China for the first time. The product will include plant based sausages, burgers, mince, and nuggets. According to Nestle, the products are available in both out-of-home sector and retail space.

In August 2020, Beyond Meat, a plant based meat substitutes company announced the launch of its e-commerce website for selling plant based meat foods directly to the consumers.

In November 2020, McDonald’s Corp. and American Fast Food Company announced that it is all set to develop its very own faux meat, initiating with a substitute burger. This new plant based meat product is called as McPlant and will consist of faux meat and chicken for breakfast sandwiches.

Covid-19 Impact on Plant Based Meat Market

Plant based meat market is positively affected during the coronavirus outbreak due to an increase in vegan population and rise in awareness about health. These two factors are boosting the market in upcoming years. Moreover, beneficial and effective collaborations amongst companies is also contributing in fueling the market growth during the Covid-19 crises. For instance, in April 2020, Impossible Foods, that develops plant based substitutes has partnered with organizations like Cheetah, small food businesses, and grocery supplier to tackle Covid-19 situation.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com