Allulose Market Report

RA00257

Allulose Market by Nature (Organic and Conventional), Type (Powder, Liquid, and Crystal), Application (Food, Bakery and Confectionery, Dairy and Frozen Desserts, Sauces and Dressings, Beverages, and Others), and Regional Analysis (North America, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2032

Global Allulose Market Analysis

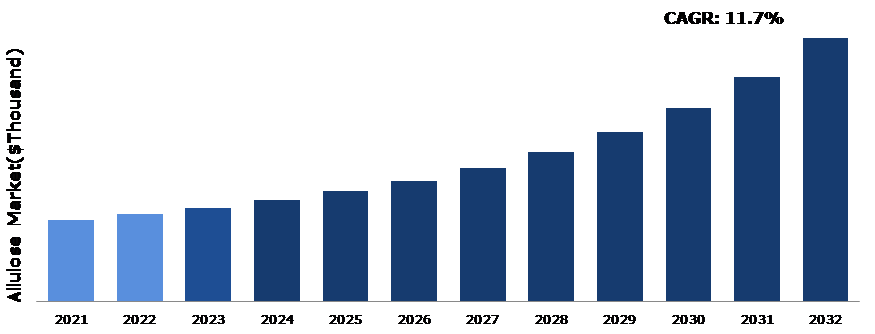

The Global Allulose Market Size was $95,400.0 thousand in 2021 and is predicted to grow with a CAGR of 11.7%, by generating a revenue of $308,182.9 thousand by 2032.

Global Allulose Market Synopsis

Diabetes, obesity, and heart diseases are on the rise, encouraging customers to look for healthier food options that contain less sugar, salt, fat, and calories. As per several studies, excessive meat consumption, particularly red meat, leads to an increase in the risk of cardiovascular diseases. Therefore, plant-based products are being preferred more frequently. Plant-based products are chosen over synthetic items by health-conscious consumers because they provide additional health benefits. The allulose market share is expected to grow as demand for plant-derived products rises. Sugar substitutes have recently gained popularity as people become more aware of the negative effects of excessive sugar consumption. Despite its higher price tag when compared to other sugar substitutes, allulose is expected to gain popularity among health-conscious consumers. Consumers are rapidly shifting from refined and processed foods toward allulose.

The increase in the availability of low-cost synthetic products and consumers' low purchasing power are the major factors restraining the market revenue growth during the forecast period. Furthermore, a lack of awareness about the advantages of plant-based allulose over synthetic products such as sugar is projected to hinder the growth of the allulose market size.

The growing demand for functional foods and convenience foods is driving up demand for functional ingredients such as allulose, which provides health benefits without compromising the taste or sensory quality of food products. Growing urbanization, rising living standards, and an increasing number of working professionals with hectic lifestyles have led to a preference for healthy and convenient food options among consumers. The demand for functional food as a meal replacement that meets consumers' energy and dietary needs is growing. These factors are projected to create excellent growth opportunities for the key players operating in the allulose market.

According to regional analysis, the Asia-Pacific allulose market accounted for a dominating market share in 2021. China is one of the biggest importers as well as retail markets for frozen, ready-to-eat, and bakery products. As allulose is being widely used in beverages, gelatins, puddings, bakery food, flavorings, dairy products, and others, its adoption is increasing rapidly in Asia-Pacific.

Allulose Overview

Allulose is a naturally derived rare sugar that is present in fruits such as raisins and figs with just 10% calories of standard sugar. Allulose is a monosaccharide sugar with 90% fewer calories than sucrose which makes it a calorie-free product. Researchers are working on new strategies for producing allulose on a large scale due to which allulose is expected to become a popular sweetener in the future.

COVID-19 Impact on Global Allulose Market

The coronavirus outbreak has led to several uncertainties and economic crises owing to lockdowns imposed across several countries. The allulose market has shown strong resilience to the COVID-19 pandemic as the pandemic’s impact on the market was considerably low. This is majorly owing to relaxations given by the government of several countries for the food manufacturing and processing sectors. In addition, during the post-pandemic, the allulose market is estimated to grow at a rapid pace as various companies operating in the market namely Samyang Corporation, South Korea, Matsutani Chemical Industry, Japan, Cosun Beet Company, based in Europe, and Ingredion, based in the U.S. have newly formed consortium named Allulose Novel Food Consortium (ANFC). This consortium aims to bring allulose into the European market as a ‘novel food’. As stated on May 09, 2021, by FoodNavigator-USA, the leading news platform, Tate & Lyle experienced a huge demand for allulose which is currently exceeding its supply. Tate & Lyle manufactures crystalline and liquid allulose from its manufacturing sites based in Tennessee and Loudon. Currently, only a few firms namely Ingredion, Matsutani, Tate & Lyle, Samyang Corporation, CJ CheilJedang, Shandong Bailong Chuangyuan Bio-tech Co., Ltd., and Shandong Baolingbao Biotechnology Co., Ltd. are producing allulose on a commercial scale. These factors are anticipated to boost the allulose demand in the post-pandemic period.

Increase in Demand for Low-Calorie Sweeteners to Drive the Market Growth

Allulose has roughly 0.4 calories per gram (g), which is much less than sugar's 4 calories per g, according to the Food and Drug Administration (FDA). In addition, allulose is calorie-free since the body absorbs it but does not convert it to glucose. The FDA states that allulose has little to no impact on insulin or blood glucose levels. Allulose can be created by scientists in the lab, but it can also be found naturally in some foods such as brown sugar, dried fruit, and maple syrup. Other names for allulose include d-psicose, d-allulose, psicose, or pseudo-fructose. Allulose, which is a rare sugar can be widely used as a sugar alternative as it does not affect insulin levels or blood sugar levels. Obesity and diabetes are one of the leading causes of death and nearly 1 in 3 adults are overweight and around 1 in 11 adults have severe obesity issues. Hence, substituting sugar with allulose will greatly help in reducing the risk of such chronic diseases. These factors are anticipated to boost the allulose market demand in the upcoming years.

To know more about global allulose market drivers, get in touch with our analysts here.

Growing Stringent Government Regulations Over Allulose and its High Cost to Restrain the Market Growth

There are stringent government norms concerning storage conditions of allulose as improper handling of the product can lead to food-borne diseases. Moreover, round-the-clock quality checks by food inspectors are conducted to ensure that prescribed rules and regulations are being followed. Huge markets including China impose hefty excise duties on imported foods for instance frozen candies, beverages, and desserts. The high cost of allulose compared to other sugar alternatives available in the market is estimated to hamper the market growth. This is because allulose is present only in small quantities in food such as figs, corn, wheat, and others. All these factors are projected to hamper the market revenue growth during the forecast period.

Growing Demand from the Pharmaceutical Industry to Drive Excellent Opportunities

The number of mergers and acquisitions in the pharmaceutical sector has surged recently. Most established businesses are merging in order to strengthen their position in the market amid intense competition. The pharmaceutical sector is increasingly using allulose because of its detoxifying and anti-oxidation properties as they look for ways to create new tonics to aid individuals in overcoming lifestyle disorders. To keep the sweetness in numerous cough syrups and vitamin supplements, allulose sugar can be used.

Numerous health benefits of allulose that helps in preventing the risk of cardiovascular diseases are estimated to boost the allulose demand. In addition to this, allulose aids in the reduction of digestive problems, ensures the regulation of the heart rate, promotes weight loss, lowers bad cholesterol, improves liver function, and strengthens the body's immune system. Allulose is frequently used by the pharmaceutical industry as a crucial component due to these advantages.

To know more about global allulose market opportunities, get in touch with our analysts here.

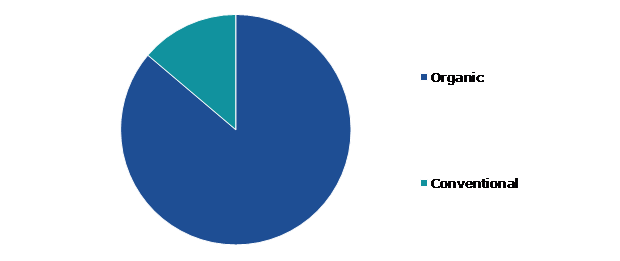

Global Allulose Market, by Nature

Based on nature, the market has been divided into organic and conventional. Among these, the organic sub-segment accounted for the highest market share in 2021, whereas the conventional sub-segment is estimated to show the fastest growth during the forecast period.

Global Allulose Market Size, by Nature, 2021

Source: Research Dive Analysis

The organic sub-segment accounted for a dominant market share in 2021. Organic allulose is produced from organically sourced grains. Organic raw materials are derived from natural resources and are free from harmful chemicals. Organic allulose is free from synthetic pesticides, colors, and preservatives. These grains are a good source of iron and plant-based protein, although not gluten-free. An increase in awareness regarding various benefits of organic products as compared to their conventional counterparts resulted in an upsurge in its demand. The demand for products free from harsh chemicals, petrochemicals, and preservatives has been growing over the past few years. The rise in demand for organic food products by consumers primarily owing to growing health consciousness has generated significant demand for organic allulose.

The conventional sub-segment is anticipated to witness the fastest growth by 2032. Conventional allulose is commonly sprayed with pesticides and fertilizers before harvest. It is a more common and largely available type of allulose and accounts for a higher market share as compared to the organic segment. Conventionally sourced allulose is economical for large-scale production and thus is widely adopted by manufacturers. The increasing use of conventional allulose, as an essential ingredient in food and beverages, is fueling the growth of the segment. In addition, the rising awareness about health benefits associated with the consumption of allulose is also contributing to the growth of the segment.

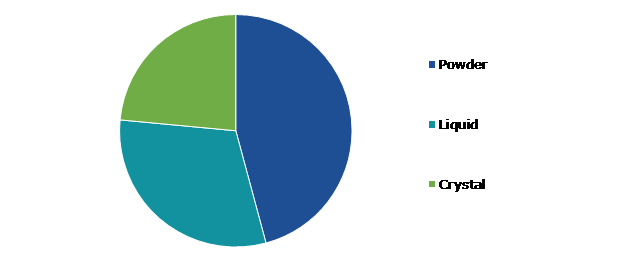

Global Allulose Market, by Type

Based on type, the market has been divided into powder, liquid, and crystal. Among these, the powder sub-segment accounted for the highest revenue share in 2021.

Global Allulose Market Share, by Type, 2021

Source: Research Dive Analysis

The powder sub-segment accounted for a dominant market share in 2021. Allulose is widely used in a variety of products such as beverages, bakery food, and chewing gums owing to its low-calorie content and sweetness which is the same as sugar. As a thickening and stabilizing ingredient, powdered allulose is widely used in bakery items such as biscuits, cakes, rye bread, and meat dishes. Allulose in powder form is immensely popular. Powdered foods go well in smoothies and other beverages. The market for powdered allulose products is predicted to increase rapidly in the upcoming years.

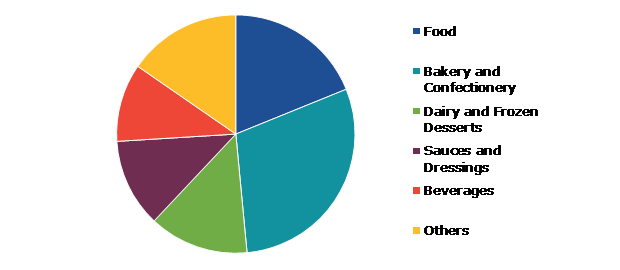

Global Allulose Market, by Application

Based on application, the market has been divided into food, bakery and confectionery, dairy and frozen desserts, sauces and dressings, beverages, and others. Among these, the bakery and confectionery sub-segment accounted for the highest revenue share in 2021.

Global Allulose Market Growth, by Application, 2021

Source: Research Dive Analysis

The bakery and confectionery sub-segment accounted for a dominant market share in 2021. The bakery & confectionery industry possesses high growth potential and is anticipated to garner a remarkable position in the food processing sector. This is attributed to a surge in demand for confectionery items, owing to a busy lifestyle and an increase in preference for fresh & ready-to-eat convenience foods comprising high nutritional values. The upsurge in the consumption of confectionery products, especially the packaged variety, has augmented the demand for allulose, thereby supplementing the growth of the global allulose market.

Global Allulose Market, Regional Insights

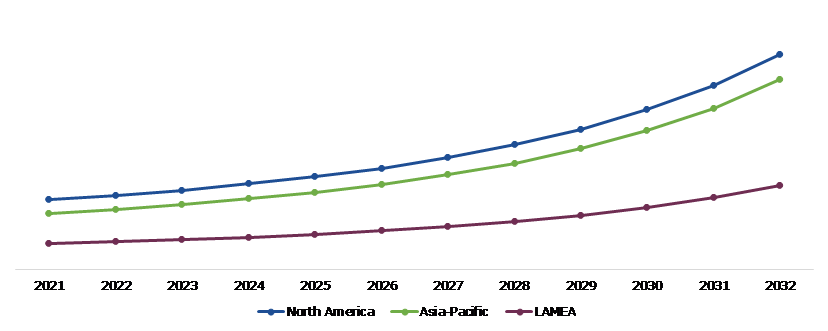

The allulose market was investigated across North America, Asia-Pacific, and LAMEA.

Global Allulose Market Size & Forecast, by Region, 2021-2032 ($Thousand)

Source: Research Dive Analysis

The Market for Allulose in North America to be the Most Dominant

The North America allulose market accounted for a dominant market share in 2021. Allulose is utilized by a variety of producers throughout the world to improve the thickening of various savory goods. Allulose is also utilized in a variety of pharmaceutical treatments and medicines as a stabilizing ingredient. Allulose's use in the pharmaceutical sector is growing because of its detoxifying and anti-oxidation properties, as companies look for new ways to assist patients to overcome lifestyle disorders. To retain the sweetness of cough syrups and vitamin supplements, allulose sugar can be used.

According to the National Center for Biotechnology Information (NCBI), trade liberalization policies show that increased rates of obesity and chronic diseases such as cardiovascular disease and cancer have resulted from urbanization over the last two decades. Furthermore, rising urbanization and a growing working population are resulting in the growth of the allulose industry. Allulose supplements, according to the National Center for Biotechnology Information, balance body weight by regulating human body metabolism, which is useful for obesity-related disorders.

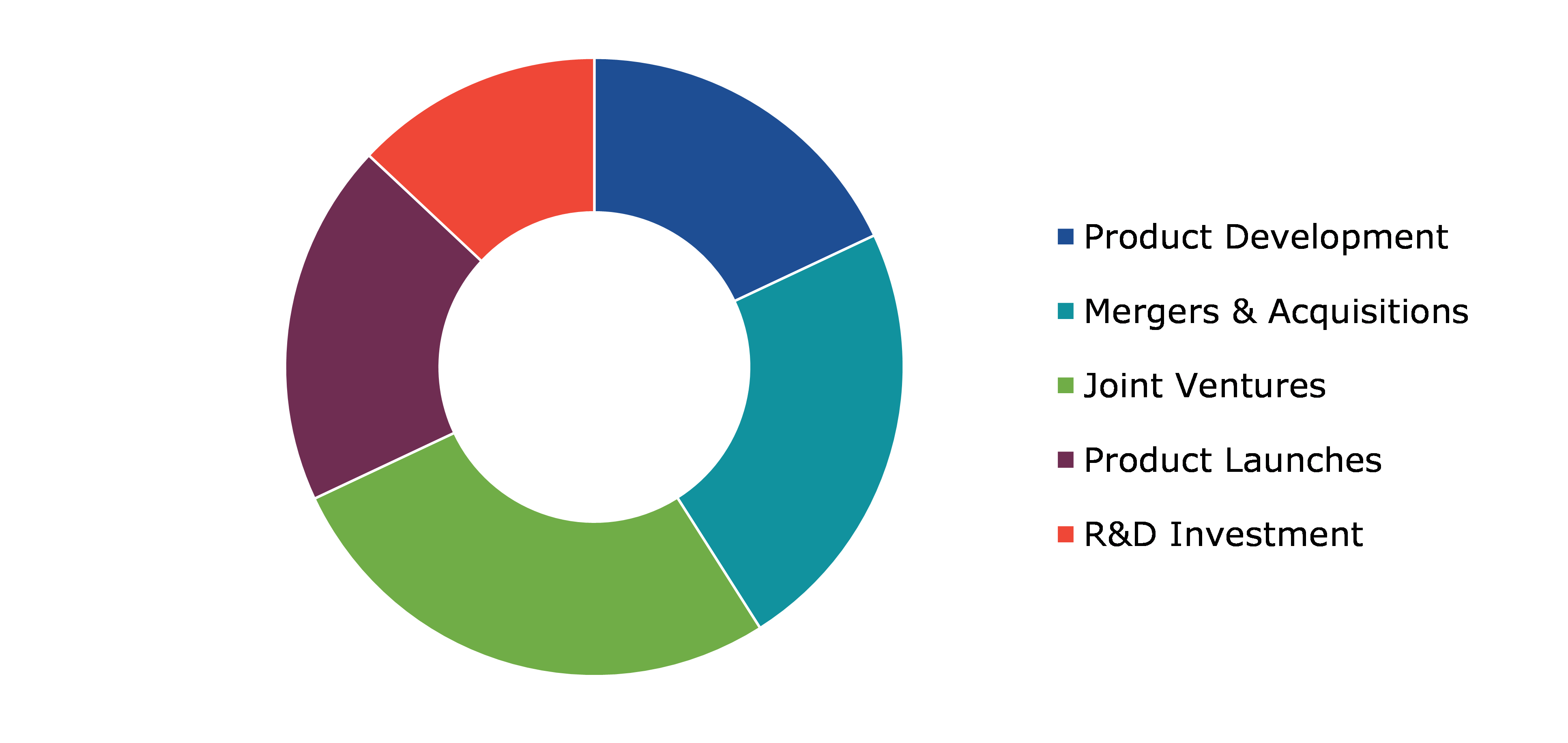

Competitive Scenario in the Global Allulose Market

Investment and agreement are common strategies followed by major market players. For instance, in July 2020, Samyang Corp., the leading Korean food company, obtained kosher certification from Orthodox Union for its food brand Trusweet Allulose. The company introduced its liquid allulose product in 2017 and since then many allulose-based products including Trusweet Allulose are being launched by the company.

Source: Research Dive Analysis

Some of the leading allulose market players are Matsutani Chemical Industry Co. Ltd, Tate & Lyle PLC, CJ Cheil Jedang, Bonumose LLC, Cargill Inc, Ingredion Incorporated, Samyang Corporation, Anderson Global Group, Quest Nutrition, and Apura Ingredients.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2032 |

| Geographical Scope | North America, Asia-Pacific, and LAMEA |

| Segmentation by Nature |

|

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global allulose market?

A. The size of the global allulose market was over $95,400.0 thousand in 2021 and is projected to reach $308,182.9 thousand by 2032.

Q2. Which are the major companies in the allulose market?

A. Matsutani Chemical Industry Co. Ltd, Tate & Lyle PLC, CJ Cheil Jedang, Bonumose LLC, and Cargill Inc are some of the key players in the global allulose market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific allulose market?

A. Asia-Pacific allulose market is anticipated to grow at 11.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Matsutani Chemical Industry Co. Ltd, Tate & Lyle PLC, CJ Cheil Jedang, Bonumose LLC, and Cargill Inc are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global allulose market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Allulose market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Allulose Market, by Nature

5.1.Overview

5.1.1.Market size and forecast, by Nature

5.2.Organic

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Conventional

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Allulose Market, by Type

6.1.Overview

6.1.1.Market size and forecast, by Type

6.2.Powder

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Liquid

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Crystal

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2022-2032

6.4.3.Market share analysis, by country, 2022-2032

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.Allulose Market, by Application

7.1.Overview

7.1.1.Market size and forecast, by Application

7.2.Food

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Bakery and Confectionery

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2022-2032

7.3.3.Market share analysis, by country, 2022-2032

7.4.Dairy and Frozen Desserts

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region, 2022-2032

7.4.3.Market share analysis, by country, 2022-2031

7.5.Sauces and Dressings

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region, 2022-2032

7.5.3.Market share analysis, by country, 2022-2032

7.6.Beverages

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast, by region, 2022-2032

7.6.3.Market share analysis, by country, 2022-2032

7.7.Others

7.7.1.Key market trends, growth factors, and opportunities

7.7.2.Market size and forecast, by region, 2022-2032

7.7.3.Market share analysis, by country, 2022-2032

7.8.Research Dive Exclusive Insights

7.8.1.Market attractiveness

7.8.2.Competition heatmap

8.Allulose Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Nature

8.1.1.2.Market size analysis, by Type

8.1.1.3.Market size analysis, by Application

8.1.2.Mexico

8.1.2.1.Market size analysis, by Nature

8.1.2.2.Market size analysis, by Type

8.1.2.3.Market size analysis, by Application

8.1.3.Research Dive Exclusive Insights

8.1.3.1.Market attractiveness

8.1.3.2.Competition heatmap

8.2.Asia-Pacific

8.2.1.China

8.2.1.1.Market size analysis, by Nature

8.2.1.2.Market size analysis, by Type

8.2.1.3.Market size analysis, by Application

8.2.2.Japan

8.2.2.1.Market size analysis, by Nature

8.2.2.2.Market size analysis, by Type

8.2.2.3.Market size analysis, by Application

8.2.3.India

8.2.3.1.Market size analysis, by Nature

8.2.3.2.Market size analysis, by Type

8.2.3.3.Market size analysis, by Application

8.2.4.Australia

8.2.4.1.Market size analysis, by Nature

8.2.4.2.Market size analysis, by Type

8.2.4.3.Market size analysis, by Application

8.2.5.South Korea

8.2.5.1.Market size analysis, by Nature

8.2.5.2.Market size analysis, by Type

8.2.5.3.Market size analysis, by Application

8.2.6.Rest of Asia-Pacific

8.2.6.1.Market size analysis, by Nature

8.2.6.2.Market size analysis, by Type

8.2.6.3.Market size analysis, by Application

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.LAMEA

8.3.1.Brazil

8.3.1.1.Market size analysis, by Nature

8.3.1.2.Market size analysis, by Type

8.3.1.3.Market size analysis, by Application

8.3.2.Saudi Arabia

8.3.2.1.Market size analysis, by Nature

8.3.2.2.Market size analysis, by Type

8.3.2.3.Market size analysis, by Application

8.3.3.UAE

8.3.3.1.Market size analysis, by Nature

8.3.3.2.Market size analysis, by Type

8.3.3.3.Market size analysis, by Application

8.3.4.South Africa

8.3.4.1.Market size analysis, by Nature

8.3.4.2.Market size analysis, by Type

8.3.4.3.Market size analysis, by Application

8.3.5.Rest of LAMEA

8.3.5.1.Market size analysis, by Nature

8.3.5.2.Market size analysis, by Type

8.3.5.3.Market size analysis, by Application

8.3.6.Research Dive Exclusive Insights

8.3.6.1.Market attractiveness

8.3.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Matsutani Chemical Industry Co. Ltd

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Tate & Lyle PLC

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.CJ Cheil Jedang

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Bonumose LLC

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Cargill Inc

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Ingredion Incorporated

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Samyang Corporation

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Anderson Global Group

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Quest Nutrition

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Apura Ingredients

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Allulose is a type of sugar that bears a close resemblance to fructose. With 90% lesser calories than regular sugar or sucrose, allulose is 70% as sweet as sucrose. Thus, allulose is a virtually calorie-free sweetener. Just like glucose, fructose, and ribose, allulose is a monosaccharide, meaning it has a single sugar molecule.

Forecast Analysis of the Allulose Market

Over the years, especially since the outbreak of the COVID-19 pandemic, there has been a general growth in the awareness among people regarding the importance of maintaining a healthy lifestyle and a healthy dietary routine. This has led people to cut down their sugar intake and instead opt for sugar-free sweeteners. This is expected to boost the growth of allulose market in the 2022-2032 timeframe. Along with this, an increasing incidence of chronic ailments like diabetes, obesity, and heart-related diseases is predicted to boost the market even further. Moreover, investments by food products manufacturing companies, especially the small-sized and medium-sized ones, of this industry is estimated to offer numerous growth opportunities to the market in the analysis timeframe. However, government regulations with respect to storage of food products might create hindrances in the growth of the allulose market.

According to the report published by Research Dive, the global allulose market is expected to gather a revenue of $308,182.9 thousand by 2032 and grow at 11.7% CAGR in the 2022–2032 timeframe. Some prominent market players include Matsutani Chemical Industry Co. Ltd, CJ Cheil Jedang, Tate & Lyle PLC, Bonumose LLC, Ingredion Incorporated, Cargill Inc, Samyang Corporation, Quest Nutrition, Anderson Global Group, Apura Ingredients, and many others.

Allulose Market Trends and Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the allulose market to flourish. For instance:

- In January 2021, Codexis Inc., a leading protein engineering company, announced their partnership with Tate & Lyle, a British food ingredients supplier. Under the terms of the partnership, Codexis will help Tate and Lyle in launching its two new products, viz., Dolcia Prima Allulose and Tasteva M Stevia Sweetener.

- In October 2021, Apura Ingredients, a US-based ingredients’ supplier company, announced their partnership with EPC Natural Products Company. This partnership is expected to help both the companies to integrate their operations and increase their footprint in the industry by catering to the demands of a much larger consumer base.

- In December 2021, four ingredient companies, viz., Europe-based Cosun Beet Company, US-based Ingredion, Samyang Corporation from South Korea, and Japan-based Matsutani Chemical Company, have announced a new consortium to help bring allulose to the UK and EU markets. The new consortium is called the Allulose Novel Food Consortium (ANFC).

COVID-19 Impact on the Market

The outbreak of the COVID-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The lockdowns and travel restrictions resulted in the upsetting of almost all supply chains across the world which led to disruptions in production and distribution cycles. However, the allulose market faced a growth in the pandemic years as people started and shifting to white sugar substitutes. This shift was mainly due to the growing awareness regarding the need to boost immunity so as to ward off the possible COVID-19 infection.

Most Profitable Region

The allulose market in the North America region is expected to have the most dominant market share during the forecast period, mainly owing to the huge consumer base of frozen food, especially the US. Besides, the growing prevalence of obesity, increasing working populatio, and rising urbanization in the countries of this region is expected to help the market to grow further in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com