Industrial Robotics Market Report

RA00237

Industrial Robotics Market, by Type (Articulated Robots, Cylindrical Robots, Selective Compliant Assembly Robot Arm (SCARA) Robots, Cartesian Robots, Others), End-Use Industry (Automotive, Electrical & Electronics, Chemical, Rubber & Plastics, Machinery, Metals, Food & Beverages, Precision & Optics, others), Function (Soldering & Welding, Materials Handling, Assembling & Disassembling, Painting & Dispensing, Milling, Cutting & Processing, Others) : Global Opportunity Analysis and Industry Forecast, 2019–2026

Industrial Robotics Market Analysis-

Industrial robotics is the automatic/smart machinery controlled by artificial intelligence (AI) and used in the manufacturing outlets to decrease cost, non-stop production, and increase profit. Robotics is a complex-machinery capable of performing multiple tasks at the same time without any human intervention and is operated using multiple complex algorithms. In addition, majority of the market leaders are emphasizing more on developments in the robotics market, which are solely aimed at revolutionizing the automation world. These innovations are capable of enhancing the workplace.

An increase in the industry revolution is one of the significant drivers for the global industrial robotics market.

The growing emphasis on the innovations in heavy engineering firms, the automobile sector, and FMCG firms are anticipated to drive the need for industrial robotics, which will eventually boost the growth of the global robotics market. Small-scale industries and business houses are now highly opting to use specially designed robotics for their indigenous usage and production. Furthermore, the increased need for automation has led to a vast opportunity for various key players in the industrial robotics market. Industries globally have become more cost-conscious and are opting automation to reduce labor borne costs, which have significantly increased due to government-induced labor laws. These supportive governmental policies may positively impact the growth of the global industrial robotics market during the forecast period. In addition, technological advancement is on a high rise, with new technologies and upgrades appearing in the market with a better version. For instance, the automation company Omron is planning to develop an industrial robot that has a built-in artificial intelligence (AI) technology. The company has announced that its new Omron i4 is equipped with pre-installed AI capable of monitoring the overall performance and the machinery condition during the day to day tasks. These factors may create a huge impact on the global industrial robotics market during the forecast period.

Lack of awareness about robotics, along with high investment and maintenance costs, are some factors negatively affecting the growth of the industrial robotics market.

Less knowledge regarding the robotics and unavailability of skilled technicians/engineers are anticipated to decline the growth of the global industrial robotics market, in the projected period. Furthermore, the increased cost of production and extensive investment of time and money to create one specialized robot is also hampering the global market growth.

Recent innovations and upgradations in industrial robotics are expected to boost the growth of the global market

With the recent upgradations related to artificial intelligence and microprocessor, the industrial robotics sector has drastically changed due to the increased capacity to perform complex and flexible tasks. The development of smart robots are much more responsive to commands due to added intelligence has been a major breakthrough, the most recent example of which could be the AIBO robotic dog by SONY. Robotic technology is converging with a wide variety of complementary technologies – speech recognition, force sensing, machine vision, and advanced mechanics. These recent advancements and technological upgradations have opened up a wide market opportunity for robotics to grow.

Industrial Robotics Market, by Type:

Articulated robots segment held the largest market share in the global market

Articulated robots will have a dominating share in the global market, and they are expected to register a significant revenue during the forecast timeframe. Articulated robots are the most preferred type of robots in industries as they are capable of performing multiple activities all by themselves. Articulated robots are much flexible and versatile in workplaces and can be mounted on walls or ceilings along with they are available in multiple ranges.

Cylindrical robots segment is also growing exponentially, in the global marketplace

The cylindrical robot shall have the fastest growth in the global market and is projected to generate considerable revenue during the period of forecast. Cylindrical robots are highly popular amongst manufacturing units as they provide greater flexibility and are capable of performing various actions like assembly, spot welding, handling of machine tools, and die-cast machines. All these factors provide a manufacturing unit to perform multiple actions at a compact space with the help of cylindrical robots and thus are of vital use for efficient production activities.

Industrial Robotics Market, by End-Use Industry:

Food & beverage industries are investing heavily on automation

The food & beverage sector for the global robotics market will have rapid growth and is predicted to generate noteworthy revenue during the analysis period. The food & beverage sector could be said to be the most competitive sector in today’s scenario because of the excessive market competition. Industries in these sectors are extremely price-sensitive and are on a continuous lookout for advancements that can prove to be fruitful in longer runs. These industries have increased their investments in the robotics sector and are open to automation. Rising raw material costs and high manual labor wages have caused a lot of cost load, and these robotics are proving to be cost-efficient as they are capable of round the day production keeping the quality intact.

Automotive sector’s dependency on robotics will majorly contribute to the industrial robotics market growth

The automotive sector for the global market will have the fastest growth during the forecast period, and it will register a significant revenue. The automotive sector is a highly labor-intensive sector, and it requires a lot of manual energy. It is feasibly impossible to manufacture vehicles in large numbers only using manual labors, even if they are in huge numbers. The huge significance of automation in material handling, metal cutting, soldering, welding, fixing joint and bolts, paintwork is expected to drive the growth of this segment in the global market. In addition, to strengthen the global footprint in the global market, key players are focusing mainly on technological innovations and product development. For instance, Tesla, the significant automobile manufacturer, has the first completely automatic manufacturing setup with no human presence at any point. Furthermore, General Motors has also incorporated over 40,000 such robotics in their manufacturing process, and further GM is continuously trying to upgrade these robotics as they have helped significantly in lowering the cost incurred in production.

Industrial Robotics Market, by Function:

Material handling segment will register maximum growth

The materials handling segment for the global market will have rapid growth in the analysis period, and it will register a significant revenue. Material handling robots have become important in manufacturing outlets as they are faster in transferring material from one place to another, and this ensures optimum utilization of resources. Material handling robots are capable of performing various actions such as palletizing/depalletizing and pick and place. They ensure the effective and efficient utilization of resources and are both cost-effective and time efficient.

Industrial Robotics Market, by Region:

Europe has seen a spike in the automation of industries, during the forecast period

Europe will have the dominating market share during the forecast period and is expected to register massive revenue in the global market. The European market has many sectors that are highly dependent on robotics like automotive, food and beverage, electrical, and others. Automotive market players of this region, such as Audi, Rolls Royce, and Porsche, are now using additive manufacturing technology to print metal prototypes and spare parts for their vehicles. Moreover, companies operating in this field are highly concerned with product development. For instance, Universal Robots, one of the leading companies in collaborative robots, launched its UR16e. This robot is designed to automate many processes, including packaging, palletizing, nut & screw driving, and others. This factor may drive the growth of the industrial robotics market during the forecast period. In addition, the rising strict labor laws regarding wages and working hours are affecting the overall production capacity negatively. Thus, firms are finding it better to invest in robotics rather than labor as not only are they free to produce as much as the market demand, it is also cost-efficient.

Asia-Pacific region possess the capacity to grow exponentially in the industrial robotics market

Asia-Pacific industrial robotics market will have exponential market growth and is expected to generate huge revenue during the forecast period. The growth of this market is mainly attributed to the massive technological advancement and high investments by key players. For instance, in December 2019, Fanuc, the worldwide leader in factory automation technology, has released its lightweight collaborative robot, CRX-10iA, for industrial applications. The CRX-10iA is designed with “sensitive contact detection,” which ensures workplace safety of people in manufacturing jobs. The CRX-10iA is used for picking and placing small parts.

Key Participants in the Industrial Robotics Market:

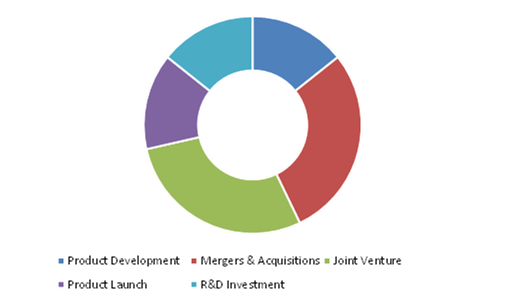

Merger & acquisition and advanced product development are the frequent strategies followed by the market players

Some of the significant Industrial robotics market players include Mitsubishi Electric Corporation, ABB, b+m Surface Systems GmbH, Omron Corporation, FANUC Robotics, Yaskawa Electric Corporation, Kuka

AG, Epson America, Inc, Kawasaki Heavy Industries Ltd., Stäubli International AG.

Market Players prefer inorganic growth strategies to expand into local markets.

Industrial Robotics market players are emphasizing more on merger & acquisition and advanced product development. These are the frequent strategies followed by established organizations. To emphasize more on the competitor analysis of market players, the Porter’s five force model is explained in the report.

|

Aspect |

Particulars |

|

Historical Market Estimations |

2018-2019 |

|

Base Year for Market Estimation |

2018 |

|

Forecast timeline for Market Projection |

2019-2026 |

|

Geographical Scope |

North America, Europe, Asia-Pacific, LAMEA |

|

Segmentation by Type |

|

|

Segmentation by End-Use Industry |

|

|

Segmentation by Function |

|

|

Key Countries Covered |

U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

|

Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. Which are the leading companies in the industrial robotics market?

A. Fanuc Robotics, ABB, Yaskawa Electric Corporation are the leading companies in the industrial robotics market.

Q2. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q3. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures, are the key strategies opted by the operating companies in this market.

Q4. Which companies are investing more in R&D practices?

A. Fanuc Robotics and ABB are investing more in R&D practices.

-

1. RESEARCH METHODOLOGY

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

-

2. REPORT SCOPE

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on Global Industrial Robotics Market

-

3. EXECUTIVE SUMMARY

-

4. MARKET OVERVIEW

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on Industrial Robotics Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

-

5. Industrial Robotics Market, By Type

5.1. Overview

5.2 Traditional Industrial Robots

5.2.1 Definition, key trends, growth factors, and opportunities

5.2.2 Market size analysis, by region, 2020-2027

5.2.3 Market share analysis, by country, 2020-2027

5.3 Collaborative Industrial Robots

5.3.1 Definition, key trends, growth factors, and opportunities

5.3.2 Market size analysis, by region, 2020-2027

5.3.3 Market share analysis, by country, 2020-2027

5.4 Research Dive Exclusive Insights

5.4.1 Market attractiveness

5.4.2 Competition heatmap

-

6. Industrial Robotics Market, By Application

6.1. Overview

6.2 Handling

6.2.1 Definition, key trends, growth factors, and opportunities

6.2.2 Market size analysis, by region, 2020-2027

6.2.3 Market share analysis, by country, 2020-2027

6.3 Assembling & Disassembling

6.3.1 Definition, key trends, growth factors, and opportunities

6.3.2 Market size analysis, by region, 2020-2027

6.3.3 Market share analysis, by country, 2020-2027

6.4 Welding & Soldering

6.4.1 Definition, key trends, growth factors, and opportunities

6.4.2 Market size analysis, by region, 2020-2027

6.4.3 Market share analysis, by country, 2020-2027

6.5 Dispensing

6.5.1 Definition, key trends, growth factors, and opportunities

6.5.2 Market size analysis, by region, 2020-2027

6.5.3 Market share analysis, by country, 2020-2027

6.6 Processing

6.6.1 Definition, key trends, growth factors, and opportunities

6.6.2 Market size analysis, by region, 2020-2027

6.6.3 Market share analysis, by country, 2020-2027

6.7 Others

6.7.1 Definition, key trends, growth factors, and opportunities

6.7.2 Market size analysis, by region, 2020-2027

6.7.3 Market share analysis, by country, 2020-2027

6.8 Research Dive Exclusive Insights

6.8.1 Market attractiveness

6.8.2 Competition heatmap

-

7. Industrial Robotics Market, By Vertical

7.1. Overview

7.2 Automotive

7.2.1 Definition, key trends, growth factors, and opportunities

7.2.2 Market size analysis, by region, 2020-2027

7.2.3 Market share analysis, by country, 2020-2027

7.3 Electrical & Electronics

7.3.1 Definition, key trends, growth factors, and opportunities

7.3.2 Market size analysis, by region, 2020-2027

7.3.3 Market share analysis, by country, 2020-2027

7.4 Metals & Machinery

7.4.1 Definition, key trends, growth factors, and opportunities

7.4.2 Market size analysis, by region, 2020-2027

7.4.3 Market share analysis, by country, 2020-2027

7.5 Plastics, Rubber, & Chemicals

7.5.1 Definition, key trends, growth factors, and opportunities

7.5.2 Market size analysis, by region, 2020-2027

7.5.3 Market share analysis, by country, 2020-2027

7.6 Food & Beverages

7.6.1 Definition, key trends, growth factors, and opportunities

7.6.2 Market size analysis, by region, 2020-2027

7.6.3 Market share analysis, by country, 2020-2027

7.7 Precision Engineering & Optics

7.7.1 Definition, key trends, growth factors, and opportunities

7.7.2 Market size analysis, by region, 2020-2027

7.7.3 Market share analysis, by country, 2020-2027

7.8 Pharmaceuticals & Cosmetics

7.8.1 Definition, key trends, growth factors, and opportunities

7.8.2 Market size analysis, by region, 2020-2027

7.8.3 Market share analysis, by country, 2020-2027

7.9 Others

7.9.1 Definition, key trends, growth factors, and opportunities

7.9.2 Market size analysis, by region, 2020-2027

7.9.3 Market share analysis, by country, 2020-2027

7.10 Research Dive Exclusive Insights

7.10.1 Market attractiveness

7.10.2 Competition heatmap

-

8. Industrial Robotics Market, By Payload

8.1. Overview

8.2 Up to 16.00 Kg

8.2.1 Definition, key trends, growth factors, and opportunities

8.2.2 Market size analysis, by region, 2020-2027

8.2.3 Market share analysis, by country, 2020-2027

8.3 16.01–60.00 Kg

8.3.1 Definition, key trends, growth factors, and opportunities

8.3.2 Market size analysis, by region, 2020-2027

8.3.3 Market share analysis, by country, 2020-2027

8.4 60.01–225.00 Kg

8.4.1 Definition, key trends, growth factors, and opportunities

8.4.2 Market size analysis, by region, 2020-2027

8.4.3 Market share analysis, by country, 2020-2027

8.5 More Than 225.00 Kg

8.5.1 Definition, key trends, growth factors, and opportunities

8.5.2 Market size analysis, by region, 2020-2027

8.5.3 Market share analysis, by country, 2020-2027

8.6 Research Dive Exclusive Insights

8.6.1 Market attractiveness

8.6.2 Competition heatmap

9. Industrial Robotics Market, By Region

9.1 North America

9.1.1 U.S

9.1.1.1 Market size analysis, By Type, 2020-2027

9.1.1.2 Market size analysis, By Application, 2020-2027

9.1.1.3 Market size analysis, By Vertical, 2020-2027

9.1.1.4 Market size analysis, By Payload, 2020-2027

9.1.2 Canada

9.1.2.1 Market size analysis, By Type, 2020-2027

9.1.2.2 Market size analysis, By Application, 2020-2027

9.1.2.3 Market size analysis, By Vertical, 2020-2027

9.1.2.4 Market size analysis, By Payload, 2020-2027

9.1.3 Mexico

9.1.3.1 Market size analysis, By Type, 2020-2027

9.1.3.2 Market size analysis, By Application, 2020-2027

9.1.3.3 Market size analysis, By Vertical, 2020-2027

9.1.3.4 Market size analysis, By Payload, 2020-2027

9.1.4 Research Dive Exclusive Insights

9.1.4.1 Market attractiveness

9.1.4.2 Competition heatmap

9.2 Europe

9.2.1 Germany

9.2.1.1 Market size analysis, By Type, 2020-2027

9.2.1.2 Market size analysis, By Application, 2020-2027

9.2.1.3 Market size analysis, By Vertical, 2020-2027

9.2.1.4 Market size analysis, By Payload, 2020-2027

9.2.2 UK

9.2.2.1 Market size analysis, By Type, 2020-2027

9.2.2.2 Market size analysis, By Application, 2020-2027

9.2.2.3 Market size analysis, By Vertical, 2020-2027

9.2.2.4 Market size analysis, By Payload, 2020-2027

9.2.3 France

9.2.3.1 Market size analysis, By Type, 2020-2027

9.2.3.2 Market size analysis, By Application, 2020-2027

9.2.3.3 Market size analysis, By Vertical, 2020-2027

9.2.3.4 Market size analysis, By Payload, 2020-2027

9.2.4 Spain

9.2.4.1 Market size analysis, By Type, 2020-2027

9.2.4.2 Market size analysis, By Application, 2020-2027

9.2.4.3 Market size analysis, By Vertical, 2020-2027

9.2.4.4 Market size analysis, By Payload, 2020-2027

9.2.5 Italy

9.2.5.1 Market size analysis, By Type, 2020-2027

9.2.5.2 Market size analysis, By Application, 2020-2027

9.2.5.3 Market size analysis, By Vertical, 2020-2027

9.2.5.4 Market size analysis, By Payload, 2020-2027

9.2.6 Rest of Europe

9.2.6.1 Market size analysis, By Type, 2020-2027

9.2.6.2 Market size analysis, By Application, 2020-2027

9.2.6.3 Market size analysis, By Vertical, 2020-2027

9.2.6.4 Market size analysis, By Payload, 2020-2027

9.2.7 Research Dive Exclusive Insights

9.2.7.1 Market attractiveness

9.2.7.2 Competition heatmap

9.3 Asia-Pacific

9.3.1 China

9.3.1.1 Market size analysis, By Type, 2020-2027

9.3.1.2 Market size analysis, By Application, 2020-2027

9.3.1.3 Market size analysis, By Vertical, 2020-2027

9.3.1.4 Market size analysis, By Payload, 2020-2027

9.3.2 Japan

9.3.2.1 Market size analysis, By Type, 2020-2027

9.3.2.2 Market size analysis, By Application, 2020-2027

9.3.2.3 Market size analysis, By Vertical, 2020-2027

9.3.2.4 Market size analysis, By Payload, 2020-2027

9.3.3 India

9.3.3.1 Market size analysis, By Type, 2020-2027

9.3.3.2 Market size analysis, By Application, 2020-2027

9.3.3.3 Market size analysis, By Vertical, 2020-2027

9.3.3.4 Market size analysis, By Payload, 2020-2027

9.3.4 Australia

9.3.4.1 Market size analysis, By Type, 2020-2027

9.3.4.2 Market size analysis, By Application, 2020-2027

9.3.4.3 Market size analysis, By Vertical, 2020-2027

9.3.4.4 Market size analysis, By Payload, 2020-2027

9.3.5 South Korea

9.3.5.1 Market size analysis, By Type, 2020-2027

9.3.5.2 Market size analysis, By Application, 2020-2027

9.3.5.3 Market size analysis, By Vertical, 2020-2027

9.3.5.4 Market size analysis, By Payload, 2020-2027

9.3.6 Rest of Asia-Pacific

9.3.6.1 Market size analysis, By Type, 2020-2027

9.3.6.2 Market size analysis, By Application, 2020-2027

9.3.6.3 Market size analysis, By Vertical, 2020-2027

9.3.6.4 Market size analysis, By Payload, 2020-2027

9.3.7 Research Dive Exclusive Insights

9.3.7.1 Market attractiveness

9.3.7.2 Competition heatmap

9.4 LAMEA

9.4.1 Brazil

9.4.1.1 Market size analysis, By Type, 2020-2027

9.4.1.2 Market size analysis, By Application, 2020-2027

9.4.1.3 Market size analysis, By Vertical, 2020-2027

9.4.1.4 Market size analysis, By Payload, 2020-2027

9.4.2 Saudi Arabia

9.4.2.1 Market size analysis, By Type, 2020-2027

9.4.2.2 Market size analysis, By Application, 2020-2027

9.4.2.3 Market size analysis, By Vertical, 2020-2027

9.4.2.4 Market size analysis, By Payload, 2020-2027

9.4.3 UAE

9.4.3.1 Market size analysis, By Type, 2020-2027

9.4.3.2 Market size analysis, By Application, 2020-2027

9.4.3.3 Market size analysis, By Vertical, 2020-2027

9.4.3.4 Market size analysis, By Payload, 2020-2027

9.4.4 South Africa

9.4.4.1 Market size analysis, By Type, 2020-2027

9.4.4.2 Market size analysis, By Application, 2020-2027

9.4.4.3 Market size analysis, By Vertical, 2020-2027

9.4.4.4 Market size analysis, By Payload, 2020-2027

9.4.5 Rest of LAMEA

9.4.5.1 Market size analysis, By Type, 2020-2027

9.4.5.2 Market size analysis, By Application, 2020-2027

9.4.5.3 Market size analysis, By Vertical, 2020-2027

9.4.5.4 Market size analysis, By Payload, 2020-2027

9.4.6 Research Dive Exclusive Insights

9.4.6.1 Market attractiveness

9.4.6.2 Competition heatmap

10. Competitive Landscape

10.1 Top winning strategies, 2020-2027

10.1.1 By strategy

10.1.2 By year

10.2 Strategic overview

10.3 Market share analysis, 2020-2027

11. Company Profiles

11.1 ABB

11.1.1 Overview

11.1.2 Business segments

11.1.3 Product portfolio

11.1.4 Financial performance

11.1.5 Recent developments

11.1.6 SWOT analysis

11.2 YASKAWA

11.2.1 Overview

11.2.2 Business segments

11.2.3 Product portfolio

11.2.4 Financial performance

11.2.5 Recent developments

11.2.6 SWOT analysis

11.3 FANUC

11.3.1 Overview

11.3.2 Business segments

11.3.3 Product portfolio

11.3.4 Financial performance

11.3.5 Recent developments

11.3.6 SWOT analysis

11.4 KUKA

11.4.1 Overview

11.4.2 Business segments

11.4.3 Product portfolio

11.4.4 Financial performance

11.4.5 Recent developments

11.4.6 SWOT analysis

11.5 Mitsubishi Electric

11.5.1 Overview

11.5.2 Business segments

11.5.3 Product portfolio

11.5.4 Financial performance

11.5.5 Recent developments

11.5.6 SWOT analysis

11.6 Kawasaki Heavy Industries

11.6.1 Overview

11.6.2 Business segments

11.6.3 Product portfolio

11.6.4 Financial performance

11.6.5 Recent developments

11.6.6 SWOT analysis

11.7 DENSO

11.7.1 Overview

11.7.2 Business segments

11.7.3 Product portfolio

11.7.4 Financial performance

11.7.5 Recent developments

11.7.6 SWOT analysis

11.8 NACHI-FUJIKOSHI

11.8.1 Overview

11.8.2 Business segments

11.8.3 Product portfolio

11.8.4 Financial performance

11.8.5 Recent developments

11.8.6 SWOT analysis

11.9 EPSON

11.9.1 Overview

11.9.2 Business segments

11.9.3 Product portfolio

11.9.4 Financial performance

11.9.5 Recent developments

11.9.6 SWOT analysis

11.10 Dürr

11.10.1 Overview

11.10.2 Business segments

11.10.3 Product portfolio

11.10.4 Financial performance

11.10.5 Recent developments

11.10.6 SWOT analysis

11.11 Universal Robots

11.11.1 Overview

11.11.2 Business segments

11.11.3 Product portfolio

11.11.4 Financial performance

11.11.5 Recent developments

11.11.6 SWOT analysis

11.12 Omron Adept

11.12.1 Overview

11.12.2 Business segments

11.12.3 Product portfolio

11.12.4 Financial performance

11.12.5 Recent developments

11.12.6 SWOT analysis

11.13 Surface Systems

11.13.1 Overview

11.13.2 Business segments

11.13.3 Product portfolio

11.13.4 Financial performance

11.13.5 Recent developments

11.13.6 SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com