Global Electronic Protection Device Coatings Market Report

RA00205

Global Electronic Protection Device Coatings Market by Chemistry (Parylene, Urethene, Acrylic, Silicone, and Epoxy), Application (Aerospace & Defense, Automotive, Power & Renewable Energy, Consumer Electronics, Industrial, Medical, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Electronic Protection Device Coatings Overview

Electronic protection device coatings are specialized coatings designed to provide a barrier against various environmental factors and external influences that could potentially damage electronic devices. These coatings are applied to the surfaces of electronic components, such as circuit boards, connectors, sensors, and other sensitive electronic parts, to protect them from moisture, dust, chemicals, and mechanical stress. To ensure the durability and dependability of electronic components, circuit boards, connectors, and other sensitive parts, these coatings are applied to their surfaces. The demand for electronic protection device coatings is increasing owing to rising use of electronic products across a number of industries, including consumer electronics, automotive, aerospace, and healthcare. Conformal coatings are thin protective films that conform to the contours of the electronic device, providing a protective layer. They are usually made of materials such as acrylic, silicone, or urethane and are applied through processes like spraying, dipping, or brushing. Conformal coatings offer protection against moisture, dust, dirt, and chemicals. Encapsulation resins, also known as potting compounds, are liquid or semi-liquid materials that surround and encapsulate electronic components entirely. They provide a rugged, protective barrier against mechanical stress, moisture, vibration, and thermal shock. Common materials used for encapsulation resins include epoxy, polyurethane, and silicone. Hence, to improve the efficiency and long-term reliability of these equipment, producers and end users search for efficient coatings.

Global Electronic Protection Device Coatings Market Analysis

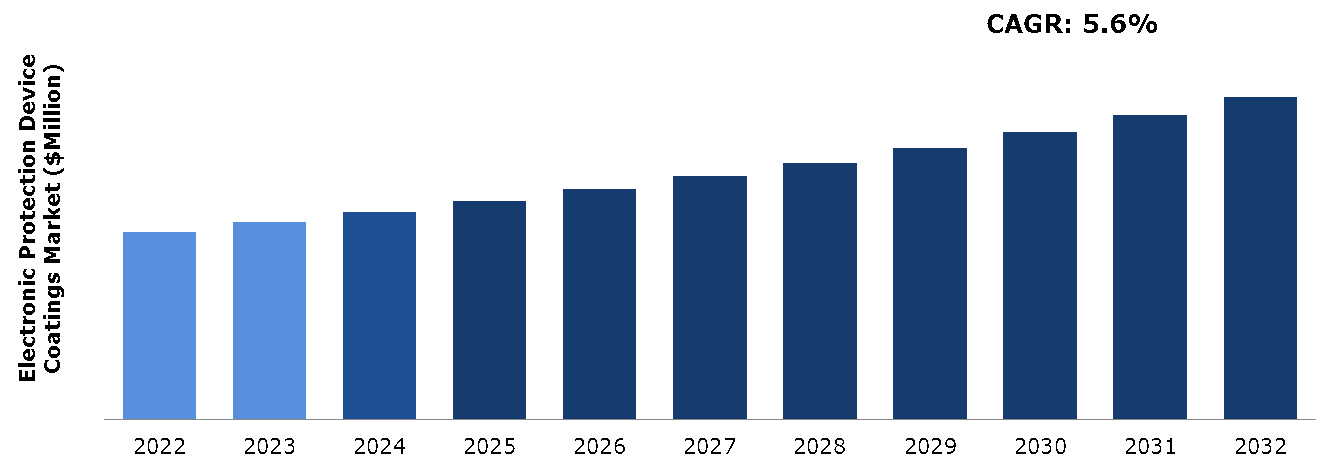

The Global Electronic Protection Device Coatings Market Size was $1,125.4 million in 2022 and is predicted to grow with a CAGR of 5.6%, by generating a revenue of $1,935.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Electronic Protection Device Coatings Market

The COVID-19 pandemic caused significant disruptions in global supply chains and affected various markets, including the electronic protection device coatings market. Restrictions on international trade, lockdown measures, and temporary closures of manufacturing facilities resulted in delays in the supply of raw materials and components. This disrupted production schedules and affected the availability of coatings for electronic devices. The pandemic resulted in an increase in demand for electronic devices such as laptops, tablets, and smartphones due to remote work, online learning, and increased digital connectivity. This surge in demand indirectly benefited the electronic protection device coatings market as more devices needed protection from wear and tear. Many electronic device manufacturers faced challenges in sourcing components from regions majorly affected by the pandemic. This led to a shift in manufacturing locations, with some companies diversifying their supply chains and opting for regional or local production. This change impacted the electronic protection device coatings market demand in different regions.

Rising Demand for Electronic Protection Device Coatings in Various Industries to Drive the Market Growth

Electronic protection device coatings are used in various sectors such as automotive, medical, consumer electronics, and aerospace & defense.’ The demand for conformal coatings has increased owing to the rising adoption of electronic devices and miniaturized circuitry in contemporary printed circuit board (PCB)-related applications. It covers the substrate in a thin polymeric film that spreads out at a thickness of 25–250 m and takes the shape of the components it is covering, shielding them from moisture, chemicals, salt spray, and high temperatures. In aerospace and defense applications, electronic protection device coatings play a critical role in protecting electronic systems and components from extreme conditions, such as high temperatures, humidity, and vibration. These coatings are used on avionics systems, radar equipment, guidance systems, and other electronic devices to ensure their performance and durability. Moreover, electronic protection coatings are commonly found in consumer electronic devices like smartphones, tablets, laptops, and wearables. These coatings provide a protective barrier against moisture, dust, and scratches, thereby improving the device's reliability and longevity.

To know more about global electronic protection device coatings market drivers, get in touch with our analysts here.

Harmful Environmental Impact to Restrain the Market Growth

The engineering and production requirements for electronic protection coatings, volatile organic compounds are frequently used in large quantities. Increasing environmental regulations and restrictions on the use of hazardous substances can significantly impact the electronic protection device coatings market. Governments and regulatory bodies may impose stricter guidelines regarding the use of certain chemicals or materials that are harmful to the environment. Some electronic protection device coatings may contain toxic or harmful substances such as volatile organic compounds (VOCs), heavy metals, or other hazardous materials. These substances can have detrimental effects on human health and the environment, including air pollution, water contamination, and soil degradation. Increased awareness and concerns about these issues can lead to a decline in demand for coatings that are deemed environmentally harmful. The environment and those who come into direct contact with the volatile organic compounds can suffer severe harm if these components are discarded or disposed of in an open space. This is a major factor expected to impede the electronic protection device coatings market growth during the forecast period.

Wide Use of Electronic Protection Devices in the Automotive Industry to Create Excellent Opportunities

Coatings for electronic protection devices are widely used in the automotive industry. In the last few years, there has been a clear trend in this industry towards integrating cutting-edge technologies. In terms of sophistication and advancement, automotive electronics have become more dependable and functional. The demand for electronic protection device coatings has consciously increased as a result of these shifting trends in the global market. Electronic protection device coatings are extensively used in the automotive sector to safeguard sensitive electronic components from moisture, dust, and other environmental factors. These coatings help enhance the reliability and longevity of electronic control units (ECUs), sensors, connectors, and other automotive electronics. It is anticipated that these factors will generate exceptional growth opportunities in this market.

To know more about global electronic protection device coatings market opportunities, get in touch with our analysts here.

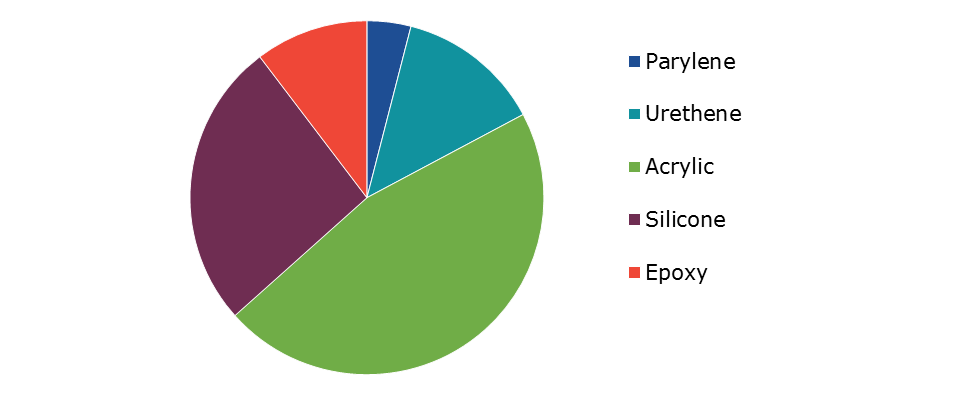

Global Electronic Protection Device Coatings Market Share, by Chemistry, 2022

Source: Research Dive Analysis

The acrylic sub-segment accounted for the highest electronic protection device coatings market share in 2022. The coatings that are based on acrylic polymers or acrylic resin systems are referred to as acrylic electronic protection device coatings. Acrylic coatings are frequently used in a variety of electronic applications owing to their superior qualities and performance characteristics. Acrylic coatings offer several advantages that make them suitable for electronic protection applications. These coatings exhibit good adhesion, flexibility, and resistance to moisture, chemicals, and UV radiation. They also provide excellent electrical insulation properties, making them ideal for protecting electronic components and circuitry. Acrylic coatings can be formulated to provide different levels of hardness and scratch resistance based on the specific application requirements.

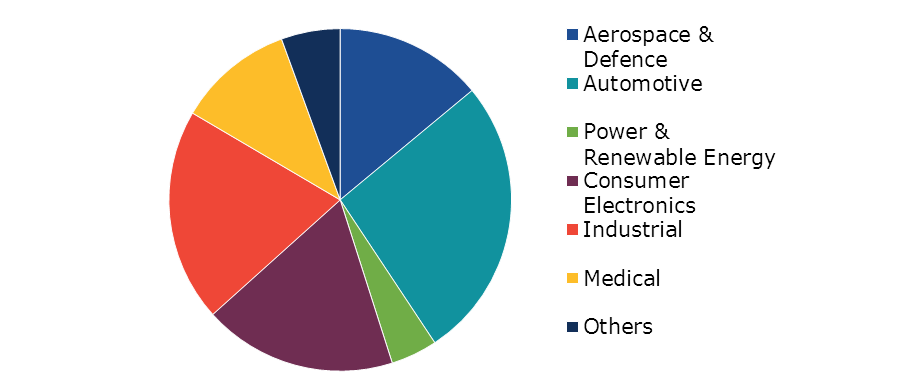

Global Electronic Protection Device Coatings Market Size, by Application, 2022

Source: Research Dive Analysis

The automotive sub-segment accounted for the highest electronic protection device coatings market share in 2022. The automotive industry is experiencing a significant shift towards connected cars, which rely heavily on electronic components and sensors to enable communication, navigation, and various other functions. Electronic protection device coatings are essential in safeguarding these components from moisture, dust, vibrations, and other external factors, ensuring seamless operation and durability of connected car technologies. The requirement for efficient protection against impacts from the environment and mechanical stress has become essential with the rising integration of electronic devices in modern vehicles. The growing trend towards vehicle electrification, including hybrid and electric vehicles, has led to a greater demand for electronic protection device coatings. These coatings are essential to safeguard sensitive electronic components from moisture, heat, chemicals, and other environmental factors, ensuring the reliability and longevity of electronic systems in electric vehicles. They provide protection against moisture, corrosive substances, road salt, and temperature variations. These coatings help to enhance the durability, reliability, and performance of electronics in vehicles.

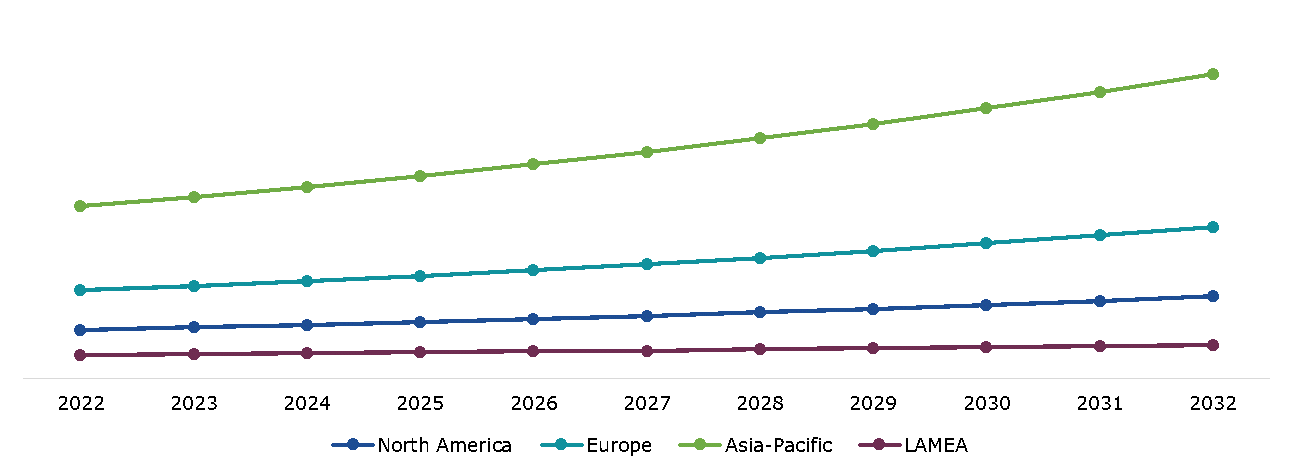

Global Electronic Protection Device Coatings Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific electronic protection device coatings market size generated the highest revenue in 2022. Asia-Pacific is a significant region in the electronic protection device coatings market, both in terms of production and consumption. Asia-Pacific has a large and developing consumer electronics market. There is a high demand for electronic devices such as tablets, smartphones and house appliances owing to a rising middle class population, increasing disposable income, and technological advancements. The production and use of these devices create opportunities for electronic protection coatings in the region. Asia-Pacific is experiencing significant growth due to the presence of several major automobile producers such as China, Japan, India, and South Korea. The demand for electronic protection coatings in the automotive sector is expected to increase as vehicles become more advanced with electronic systems and components.

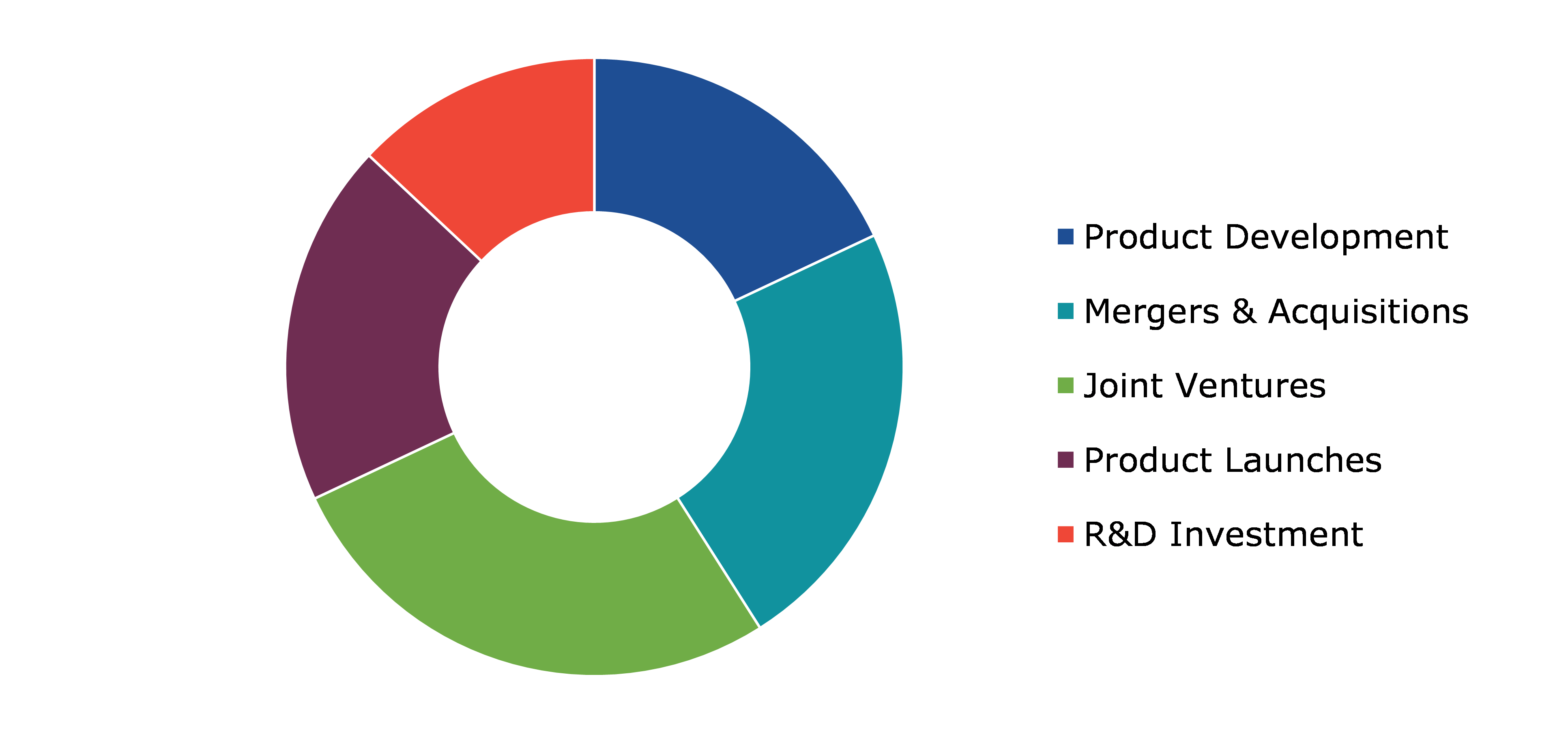

Competitive Scenario in the Global Electronic Protection Device Coatings Market

Investment and agreement are common strategies followed by major market players. On April 12, 2022, a trade show event in Southern New England was hosted by Electronic Coating Technologies (ECT), a prominent supplier of protective materials and application services for the electronics industry. In order to help protect electronics, ECT has been providing turnkey application and sub-contract services for conformal coatings, encapsulants, and other circuit board chemistries. In more recent times, ECT has started distributing coatings and adhesives used by equipment manufacturers and suppliers of electronic components.

Source: Research Dive Analysis

Some of the leading electronic protection device coatings market analysis players are 3M, Henkel Corporation, P2i Ltd. ENDURA, Specialty Coating Systems Inc., Electronic Coating Technologies, MATERIAL SCIENCES CORPORATION, Aculon, ABB, and Electrolube.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Chemistry |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global electronic protection device coatings market?

A. The size of the global electronic protection device coatings market was over $1,125.4 million in 2022 and is projected to reach $1,935.3 million by 2032.

Q2. Which are the major companies in the electronic protection device coatings market?

A. 3M, Henkel Corporation, and P2i Ltd. are some of the key players in the global electronic protection device coatings market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific electronic protection device coatings market?

A. Asia-Pacific electronic protection device coatings market is anticipated to grow at 5.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. 3M, Henkel Corporation, and P2i Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Electronic Protection Device Coatings market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Electronic Protection Device Coatings market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Electronic Protection Device Coatings Market Analysis, by Chemistry

5.1.Overview

5.2.Parylene

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2022-2032

5.2.3.Market share analysis, by country,2022-2032

5.3.Urethene

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2022-2032

5.3.3.Market share analysis, by country,2022-2032

5.4.Acrylic

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region,2022-2032

5.4.3.Market share analysis, by country,2022-2032

5.5.Silicone

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region,2022-2032

5.5.3.Market share analysis, by country,2022-2032

5.6.Epoxy

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region,2022-2032

5.6.3.Market share analysis, by country,2022-2032

5.7.Research Dive Exclusive Insights

5.7.1.Market attractiveness

5.7.2.Competition heatmap

6.Electronic Protection Device Coatings Market Analysis, by Application

6.1.Overview

6.2.Aerospace & Defense

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2022-2032

6.2.3.Market share analysis, by country,2022-2032

6.3.Automotive

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2022-2032

6.3.3.Market share analysis, by country,2022-2032

6.4.Power & Renewable Energy

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2022-2032

6.4.3.Market share analysis, by country,2022-2032

6.5.Consumer Electronics

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region,2022-2032

6.5.3.Market share analysis, by country,2022-2032

6.6.Industrial

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region,2022-2032

6.6.3.Market share analysis, by country,2022-2032

6.7.Medical

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region,2022-2032

6.7.3.Market share analysis, by country,2022-2032

6.8.Others

6.8.1.Definition, key trends, growth factors, and opportunities

6.8.2.Market size analysis, by region,2022-2032

6.8.3.Market share analysis, by country,2022-2032

6.9.Research Dive Exclusive Insights

6.9.1.Market attractiveness

6.9.2.Competition heatmap

7.Electronic Protection Device Coatings Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Chemistry,2022-2032

7.1.1.2.Market size analysis, by Application,2022-2032

7.1.2.Canada

7.1.2.1.Market size analysis, by Chemistry,2022-2032

7.1.2.2.Market size analysis, by Application,2022-2032

7.1.3.Mexico

7.1.3.1.Market size analysis, by Chemistry,2022-2032

7.1.3.2.Market size analysis, by Application,2022-2032

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Chemistry,2022-2032

7.2.1.2.Market size analysis, by Application,2022-2032

7.2.2.UK

7.2.2.1.Market size analysis, by Chemistry,2022-2032

7.2.2.2.Market size analysis, by Application,2022-2032

7.2.3.France

7.2.3.1.Market size analysis, by Chemistry,2022-2032

7.2.3.2.Market size analysis, by Application,2022-2032

7.2.4.Spain

7.2.4.1.Market size analysis, by Chemistry,2022-2032

7.2.4.2.Market size analysis, by Application,2022-2032

7.2.5.Italy

7.2.5.1.Market size analysis, by Chemistry,2022-2032

7.2.5.2.Market size analysis, by Application,2022-2032

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Chemistry,2022-2032

7.2.6.2.Market size analysis, by Application,2022-2032

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Chemistry,2022-2032

7.3.1.2.Market size analysis, by Application,2022-2032

7.3.2.Japan

7.3.2.1.Market size analysis, by Chemistry,2022-2032

7.3.2.2.Market size analysis, by Application,2022-2032

7.3.3.India

7.3.3.1.Market size analysis, by Chemistry,2022-2032

7.3.3.2.Market size analysis, by Application,2022-2032

7.3.4.Australia

7.3.4.1.Market size analysis, by Chemistry,2022-2032

7.3.4.2.Market size analysis, by Application,2022-2032

7.3.5.South Korea

7.3.5.1.Market size analysis, by Chemistry,2022-2032

7.3.5.2.Market size analysis, by Application,2022-2032

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Chemistry,2022-2032

7.3.6.2.Market size analysis, by Application,2022-2032

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Chemistry,2022-2032

7.4.1.2.Market size analysis, by Application,2022-2032

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Chemistry,2022-2032

7.4.2.2.Market size analysis, by Application,2022-2032

7.4.3.UAE

7.4.3.1.Market size analysis, by Chemistry,2022-2032

7.4.3.2.Market size analysis, by Application,2022-2032

7.4.4.South Africa

7.4.4.1.Market size analysis, by Chemistry,2022-2032

7.4.4.2.Market size analysis, by Application,2022-2032

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Chemistry,2022-2032

7.4.5.2.Market size analysis, by Application,2022-2032

7.4.6.Research Dive Exclusive Insights

7.4.7.Market attractiveness

7.4.8.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2022

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2022

9.Company Profiles

9.1.3M

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Henkel Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.P2i Ltd

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.ENDURA

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Specialty Coating Systems Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Electronic Coating Technologies

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.MATERIAL SCIENCES CORPORATION.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Aculon

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.ABB

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Electrolube.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com