Oil Condition Monitoring Market Report

RA00161

Oil Condition Monitoring Market, by Sampling Type (On-site Sampling and Off-site Sampling), Product Type (Turbines, Compressors, Engines, Gear Systems, and Hydraulic Systems), and End User (Transportation, Industrial, Oil & Gas, Power Generation, and Mining): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Oil Condition Monitoring Market Analysis

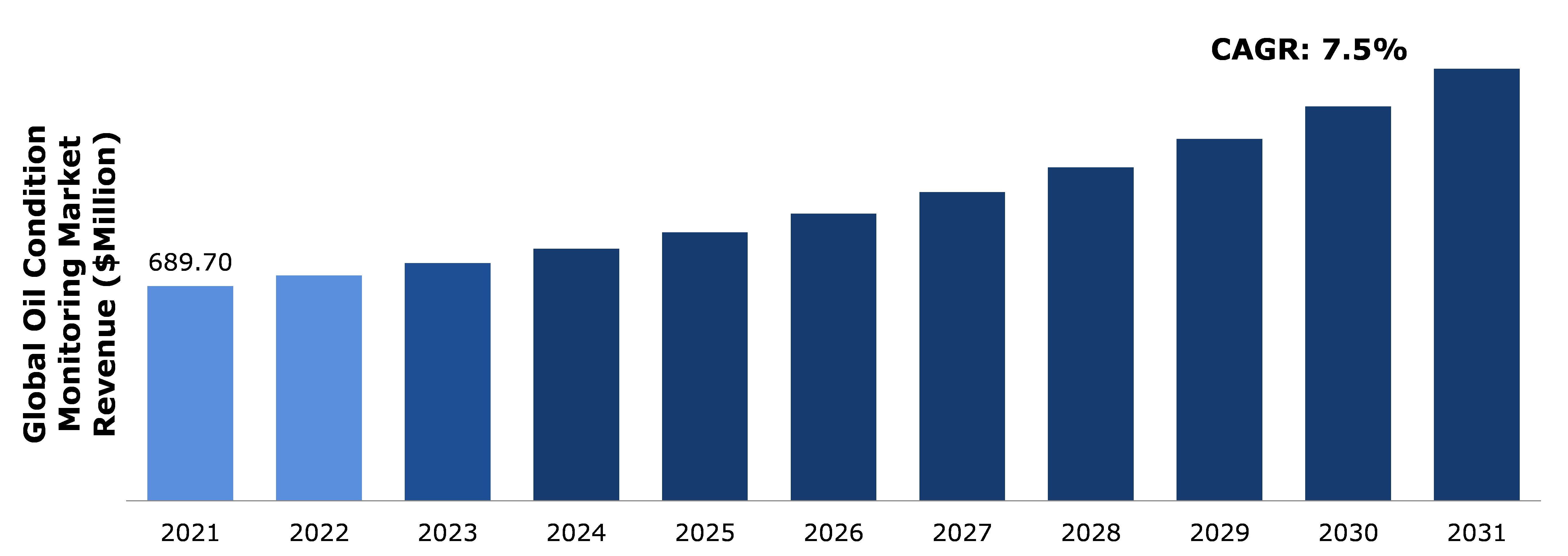

The Global Oil Condition Monitoring Market Size was $689.7 million in 2021 and is predicted to expand at a CAGR of 7.5%, generating a revenue of $1,387.5 million by 2031.

Global Oil Condition Monitoring Market Synopsis

The massive growth in the oil condition monitoring market is mainly attributed to the increase in awareness of extending the operational life of machines and equipment. The machines and equipment in various industries often undergo heavy wear and tear. These critical assets are prone to frequent breakdowns. Therefore, predictive maintenance is a crucial aspect of avoiding sudden wear and tear of these expensive pieces of equipment. Predictive maintenance is one of the important aspects of maintenance that helps in assessing the health of the assets and predicting when a particular machine or equipment is likely to fail and therefore, requires repair or replacement.

Even though predictive maintenance technologies such as oil condition monitoring require financial investment, it helps in saving the alternative cost of purchasing new equipment. Companies often find it difficult to maintain expensive machines and equipment, thus costing themselves unwarranted maintenance expenses. Oil condition monitoring technology helps in reducing unexpected downtime and extends the life of costly assets. Thus, an increase in awareness about extending the operational life of critical assets coupled with a rise in the prevalence of predictive maintenance is expected to boost the oil condition monitoring market size during the forecast period.

However, factors such as a shortage of skilled technical personnel can hinder market growth. Skilled technicians have specialized training and experience in extracting oil condition samples as well as doing a precise analysis of extracted samples. These expertise levels are attained through vigorous training and rich technical experience.

The rise in big data analytics and data storage mechanisms is expected to offer lucrative the oil condition monitoring market opportunity. The processing of large volumes of data can be performed efficiently with the use of big data analytics. This helps in the effective analysis of the data received by oil quality sensors.

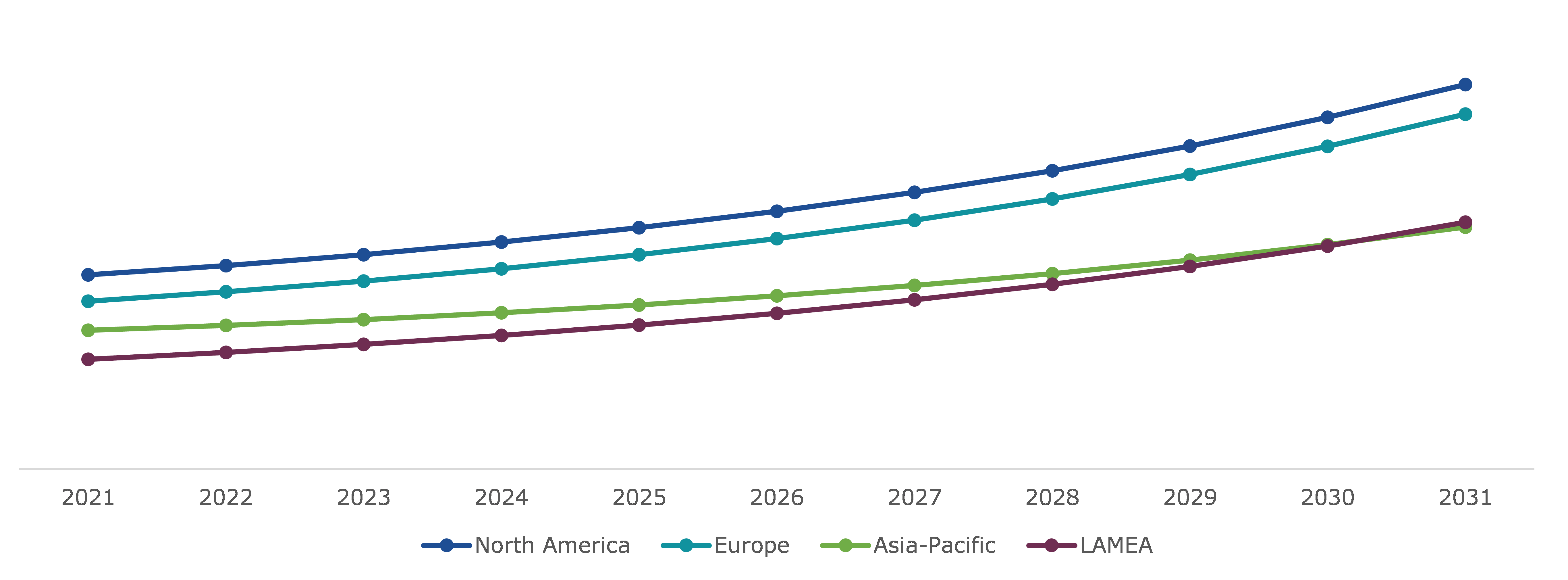

On the basis of regional analysis, North America is projected to lead the market during the forecast period at a CAGR of and is projected to reach high revenue by 2031.

Oil Condition Monitoring Overview

Oil condition monitoring is a type of predictive maintenance technique that identifies any problems with machinery and equipment. Precise oil condition monitoring helps in the analysis of the equipment's health and status. Regular oil condition monitoring helps in the detection of mechanical issues before they become catastrophic failures that can cause costly repairs or replacement of the machine.

COVID-19 Impact on Global Oil Condition Monitoring Market

The COVID-19 pandemic caused strict lockdown periods and social isolation across the globe. The Asia-Pacific region consists of the world’s most manufacturing hubs and the world's two most populated countries, China and India. During the COVID-19 pandemic, both China and India imposed stringent lockdowns and social isolation, which disturbed manufacturing operations for several weeks, resulting in the shrinking of the country's economy. The strict lockdown and disruption of numerous industrial equipment and machinery across both India and China negatively affected the market development across the Asia Pacific region.

However, the lack of skilled personnel, global supply chain disruption, and unprecedented demand for various goods during the COVID-19 pandemic prompted companies to take extra care of their equipment and machinery to increase the operational life of machines. Many companies are adopting big data analytics, smart sensors, and Industry Internet of Things (IIoT) solutions to keep watch on the health and efficiency of critically important machinery to avoid costly production downtimes. These advanced techniques are mostly used in developed countries, including the U.S., European nations, and some developed economies in the Asia Pacific and the Middle East. For example, in August 2021, Shell partnered with Baker Hughes and introduced state-of-the-art analytics-based oil condition monitoring platform and machinery health service for the marine industry, named VitalyX.

Increase in Use of Predictive Maintenance to Boost Global Oil Condition Monitoring Market Growth

In recent times, the use of predictive maintenance practices has increased significantly in various industries owing to the need for maximizing asset availability, reducing maintenance costs, and avoiding unexpected machine downtimes. Oil condition monitoring is a type of maintenance strategy that employs data management solutions to avoid any critical maintenance events. Oil condition monitoring helps to determine trends in wear and tear and also identifies any changes in the physical properties of lubricants, fuels, and coolants. Contaminations in lubricants, fuels, acid, or coolants can lead to oil losing its lubrication properties and can cause subsequent equipment damage. Hence, companies are increasingly employing oil condition monitoring to maintain the good health of critical equipment.

To know more about the global oil condition monitoring market drivers, get in touch with our analysts here.

Lack of Skilled Personnel to Restrain the Market Growth

Oil condition monitoring cannot deliver the best results due to various factors such as poor analysis strategies, poor sampling techniques, flawed interpretation of the tests, etc. Taking the correct oil samples is vital in the oil analysis chain, so it requires skilled personnel to make sure that the oil samples being extracted are correct and are analyzed efficiently to get the best results. However, the required skills of oil analysis can easily be developed with a minimal investment in training and certification of personnel responsible for oil condition monitoring.

Utilization of Big Data Analytics Expected to Create Lucrative Opportunities for the Oil Condition Monitoring Market

Oil condition monitoring results in the generation of a large volume of datasets and managing these datasets effectively is pivotal for successful oil analysis. Data can present a perfect analysis of oil if it is processed efficiently. Big data analytics helps in processing large volumes of datasets extracted from oil condition monitoring. The utilization of big data is becoming prominent owing to the increasing amount of data generated and recorded in various industries. Big data-enabled oil quality monitoring helps companies manage their critical assets much more efficiently. The utilization of big data is becoming prominent owing to the increasing amount of data generated and recorded in various industries.

To know more about the global oil condition monitoring market opportunities, get in touch with our analysts here.

Global Oil Condition Monitoring Market, by Sampling Type

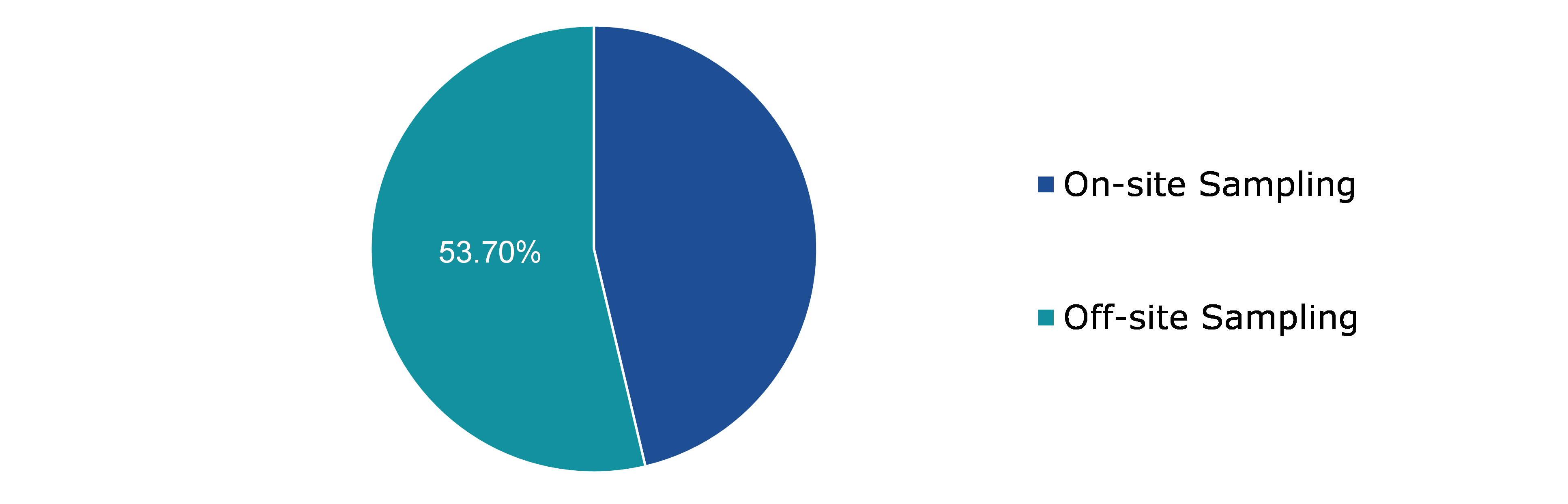

On the basis of sampling type, the market is divided into on-site sampling and off-site sampling. Among these, the off-site sampling segment accounted for the highest market share in 2021 and is projected to dominate the market during the forecast period.

Global Oil Condition Monitoring Market Share, by Sampling Type, 2021

Source: Research Dive Analysis

The off-site sampling segment is anticipated to have a dominant market share and is projected to generate a revenue in 2021. Off-site oil condition monitoring is carried out at service centers, which are equipped with state-of-the-art analytical equipment. The samples of oil or lubricant are gathered from the machinery and undergo off-site analysis by a team of highly skilled personnel to analyze the health of the machine. Off-site oil condition monitoring involves various techniques such as FTIR spectroscopy, Karl Fischer titration, and gas chromatography. Off-site oil condition monitoring is used extensively across various sectors such as transportation, industrial, oil & gas, power generation, and mining. In addition to this, sectors that operate in extreme climatic conditions such as Arctic natural gas processing plants and humid mine sites are utilizing off-site sampling methods for oil condition analysis.

Global Oil Condition Monitoring Market, by Product Type

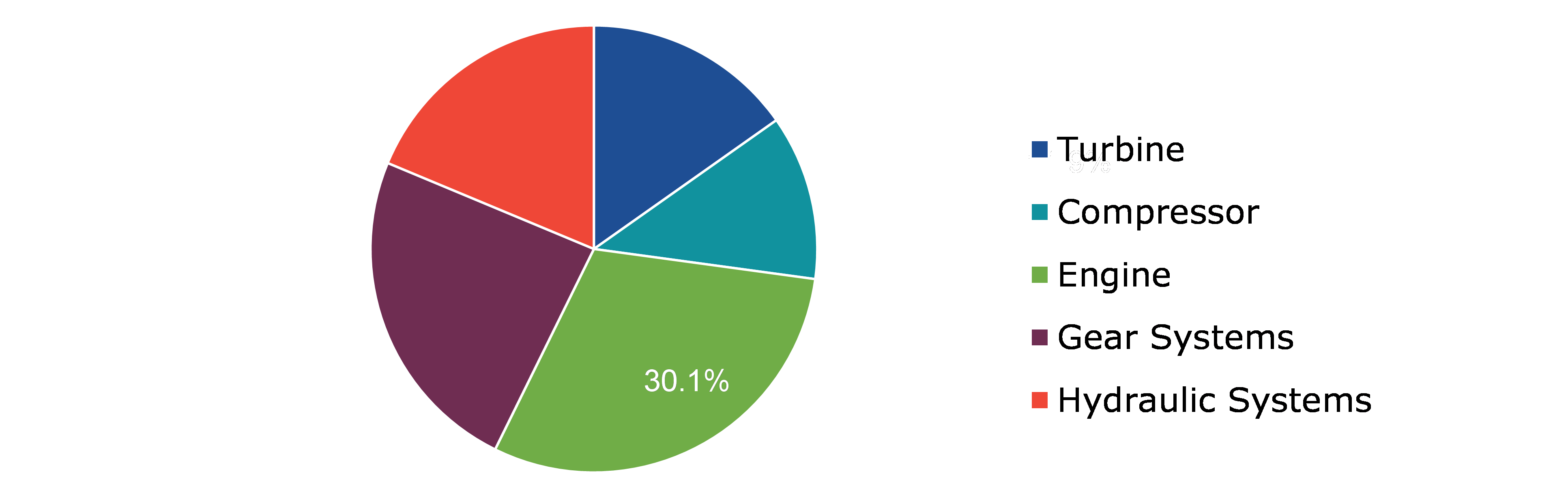

On the basis of product type, the market is divided into turbines, compressor, engines, gear systems, and hydraulic systems. Among these, the engine segment accounted for highest revenue share in 2021, whereas the hydraulic segment is estimated to show the fastest growth during forecast period.

Global Oil Condition Monitoring Market Analysis, by Product Type, 2021

Source: Research Dive Analysis

The engine segment is anticipated to have a dominant market share in 2021. One of the major areas of R&D in the automobile sector is the oil and lubricant condition monitoring of engines. The massive growth in engine oil condition monitoring systems is occurring to analyze the engine oil and lubricant degradation level to reduce unwanted breakdowns. There is an urgent need to determine oil quality and provide complementary oil condition information.

The hydraulic segment is anticipated to show the fastest growth in 2031. Hydraulic systems are widely incorporated in automation and heavy industry sectors. Oil condition monitoring of hydraulic systems is essential in ensuring reliable equipment operation and optimum performance levels. Close observation of the oil condition provides an understanding of the exact operating condition of the hydraulic equipment. Knowing the accurate condition of oil in real-time allows immediate and precise analysis of the overall equipment condition.

Global Oil Condition Monitoring Market, by End Use

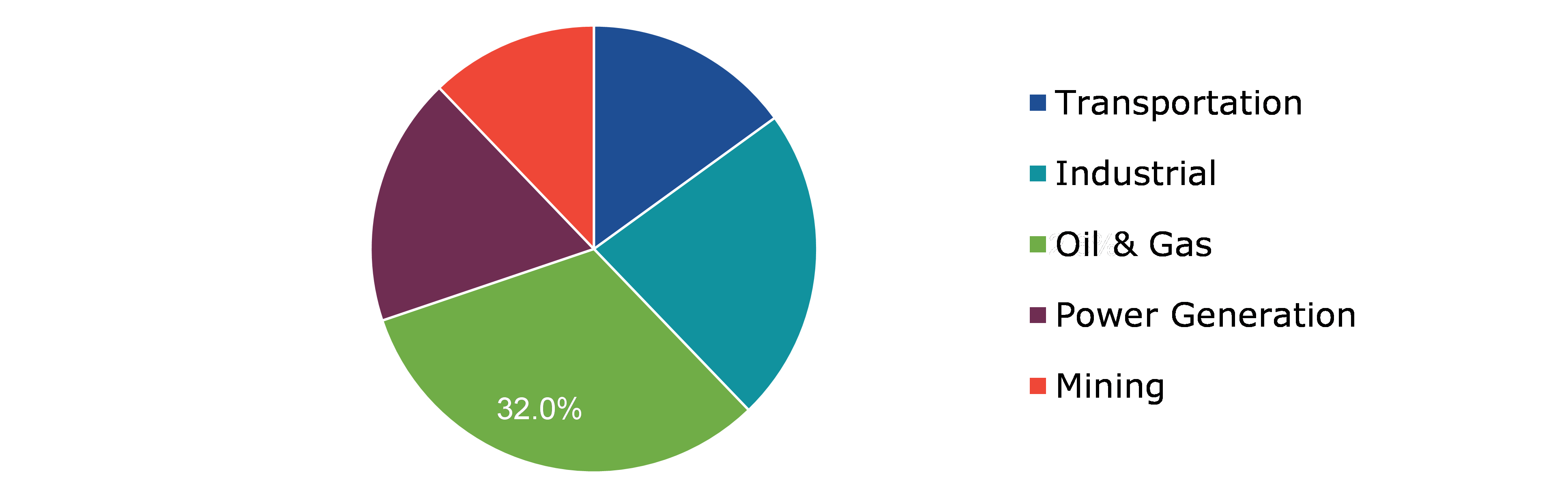

On the basis of end use, the market is segmented into transportation, industrial, oil & gas, power generation, and mining. Among these, the oil & gas segment accounted for the highest revenue share in 2021.

Global Oil Condition Monitoring Market Statistics, by End Use, 2021

Source: Research Dive Analysis

The oil & gas segment is projected to have a dominant market share and generate a substantial revenue in 2021. The oil & gas sector plays a pivotal role in the global economy as it is the world's primary fuel source. Monitoring the health of machines and equipment has become very crucial to avoid unnecessary breakdowns as oil and gas refineries work 24/7. Hence, companies are increasingly investing in machinery and equipment oil condition monitoring to increase productivity and efficiency.

Oil Condition Monitoring Market, Regional Insights

The oil condition monitoring market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Oil Condition Monitoring Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

Market for Oil Condition Monitoring in North America to be the Most Dominant

The North America oil condition monitoring market share accounted for highest market share in 2021. Some of the factors attributed to the substantial growth of the oil condition monitoring market across North America are the presence of major players and a rise in the adoption of predictive maintenance in the U.S. The market in the Middle East region is also witnessing significant growth owing to rapid industrialization and urbanization. In addition to that, the increase in usage of oil condition monitoring services for industrial applications drives the market in the region.

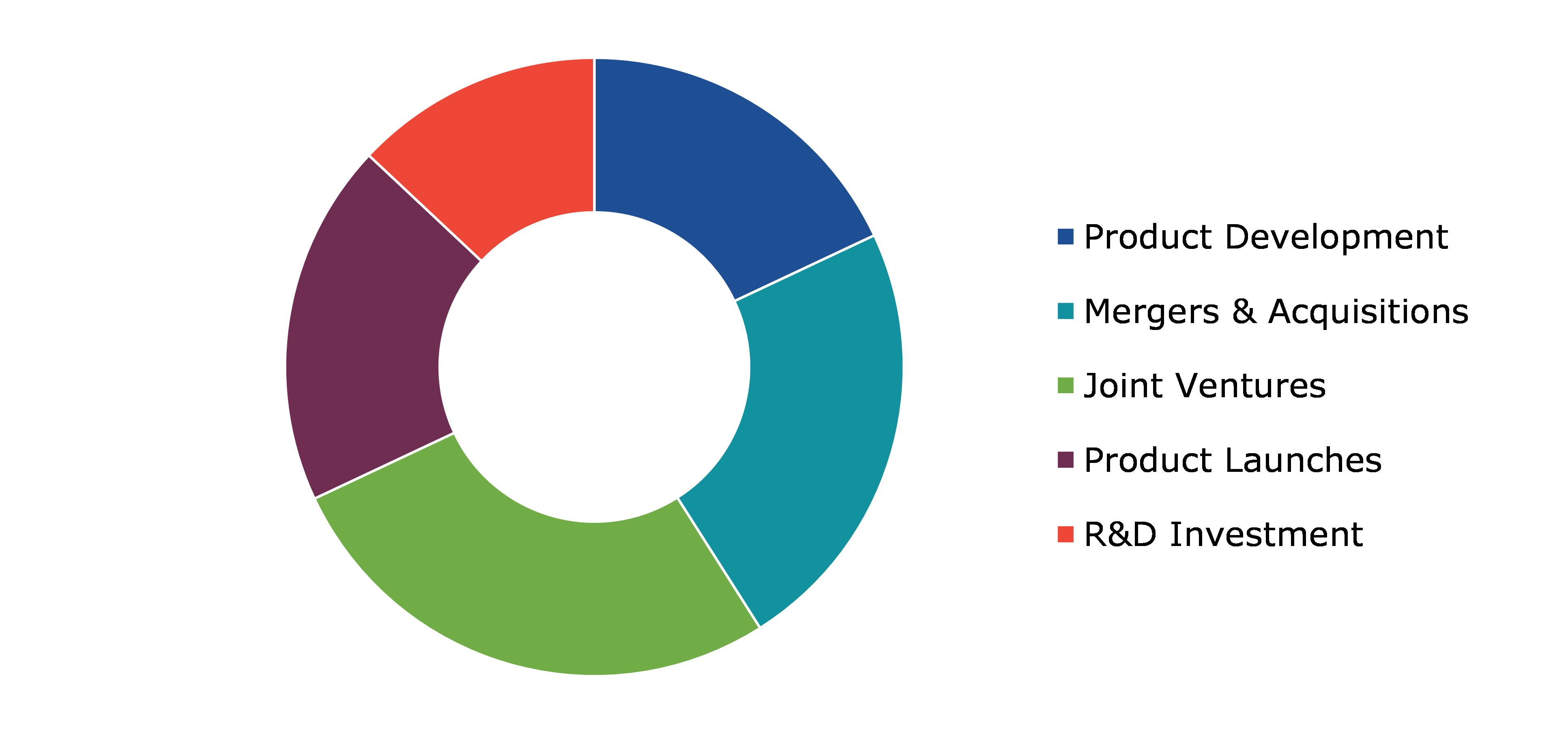

Competitive Scenario in the Global Oil Condition Monitoring Market

Investment, agreement, product launches and developments, and partnerships are some of the common strategies followed by major market players. For example, in December 2019, Shell, one of the major oil and gas companies in the world, introduced an IT platform for its oil analysis program, known as Shell Lube Analyst. This platform is a simpler sample management process than the manual method, which in turn minimizes the chances of human errors.

Source: Research Dive Analysis

Some of the leading oil condition monitoring market players are Celanese Corporation, Chevron Corporation., PARKER HANNIFIN CORP, General Electric, BP p.l.c., Shell, Eaton, Intertek Group plc, SGS SA, and Bureau Veritas.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Sampling Type |

|

| Segmentation by Product Type |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global oil condition monitoring market?

A. The size of the global oil condition monitoring market was over $689.7 million in 2021 and is projected to reach $1,387.5million by 2031.

Q2. Which are the major companies in the oil condition monitoring market?

A. Chevron Corporation, Eaton, and Shell are some of the key players in the global oil condition monitoring market.

Q3. Which region, among others, will possess great investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific oil condition monitoring market?

A. Asia-Pacific oil condition monitoring market is anticipated to expand at a 6.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreements and investments are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more in R&D practices?

A. BP p.l.c., Eaton, and SGS SA are the companies investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global oil condition monitoring market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on global oil condition monitoring market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Oil Condition Monitoring Market Analysis, by Sampling Type

5.1.Overview

5.2.On-site Sampling

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2022-2031

5.2.3.Market share analysis, by country,2022-2031

5.3.Off-site Sampling

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2022-2031

5.3.3.Market share analysis, by country,2022-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Oil Condition Monitoring Market, by Product Type

6.1.Turbines

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2022-2031

6.1.3.Market share analysis, by country,2022-2031

6.2.Compressors

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2022-2031

6.2.3.Market share analysis, by country,2022-2031

6.3.Engines

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2022-2031

6.3.3.Market share analysis, by country,2022-2031

6.4.Gear Systems

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2022-2031

6.4.3.Market share analysis, by country,2022-2031

6.5.Hydraulic Systems

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region,2022-2031

6.5.3.Market share analysis, by country,2022-2031

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Oil Condition Monitoring Market, by End-use

7.1.Transportation

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region,2022-2031

7.1.3.Market share analysis, by country,2022-2031

7.2.Industrial

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2022-2031

7.2.3.Market share analysis, by country,2022-2031

7.3.Oil & Gas

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region,2022-2031

7.3.3.Market share analysis, by country,2022-2031

7.4.Power Generation

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region,2022-2031

7.4.3.Market share analysis, by country,2022-2031

7.5.Mining

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region,2022-2031

7.5.3.Market share analysis, by country,2022-2031

7.6.Research Dive Exclusive Insights

7.6.1.Market attractiveness

7.6.2.Competition heatmap

8.Oil Condition Monitoring Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Sampling Type,2022-2031

8.1.1.2.Market size analysis, by Product Type,2022-2031

8.1.1.3.Market size analysis, by End-use,2022-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Sampling Type,2022-2031

8.1.2.2.Market size analysis, by Product Type,2022-2031

8.1.2.3.Market size analysis, by End-use,2022-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Sampling Type,2022-2031

8.1.3.2.Market size analysis, by Product Type,2022-2031

8.1.3.3.Market size analysis, by End-use,2022-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Sampling Type,2022-2031

8.2.1.2.Market size analysis, by Product Type,2022-2031

8.2.1.3.Market size analysis, by End-use,2022-2031

8.2.2.U.K.

8.2.2.1.Market size analysis, by Sampling Type,2022-2031

8.2.2.2.Market size analysis, by Product Type,2022-2031

8.2.2.3.Market size analysis, by End-use,2022-2031

8.2.3.France

8.2.3.1.Market size analysis, by Sampling Type,2022-2031

8.2.3.2.Market size analysis, by Product Type,2022-2031

8.2.3.3.Market size analysis, by End-use,2022-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Sampling Type,2022-2031

8.2.4.2.Market size analysis, by Product Type,2022-2031

8.2.4.3.Market size analysis, by End-use,2022-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Sampling Type,2022-2031

8.2.5.2.Market size analysis, by Product Type,2022-2031

8.2.5.3.Market size analysis, by End-use,2022-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Sampling Type,2022-2031

8.2.6.2.Market size analysis, by Product Type,2022-2031

8.2.6.3.Market size analysis, by End-use,2022-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Sampling Type,2022-2031

8.3.1.2.Market size analysis, by Product Type,2022-2031

8.3.1.3.Market size analysis, by End-use,2022-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Sampling Type,2022-2031

8.3.2.2.Market size analysis, by Product Type,2022-2031

8.3.2.3.Market size analysis, by End-use,2022-2031

8.3.3.India

8.3.3.1.Market size analysis, by Sampling Type,2022-2031

8.3.3.2.Market size analysis, by Product Type,2022-2031

8.3.3.3.Market size analysis, by End-use,2022-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Sampling Type,2022-2031

8.3.4.2.Market size analysis, by Product Type,2022-2031

8.3.4.3.Market size analysis, by End-use,2022-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Sampling Type,2022-2031

8.3.5.2.Market size analysis, by Product Type,2022-2031

8.3.5.3.Market size analysis, by End-use,2022-2031

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Sampling Type,2022-2031

8.3.6.2.Market size analysis, by Product Type,2022-2031

8.3.6.3.Market size analysis, by End-use,2022-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Sampling Type,2022-2031

8.4.1.2.Market size analysis, by Product Type,2022-2031

8.4.1.3.Market size analysis, by End-use,2022-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Sampling Type,2022-2031

8.4.2.2.Market size analysis, by Product Type,2022-2031

8.4.2.3.Market size analysis, by End-use,2022-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Sampling Type,2022-2031

8.4.3.2.Market size analysis, by Product Type,2022-2031

8.4.3.3.Market size analysis, by End-use,2022-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Sampling Type,2022-2031

8.4.4.2.Market size analysis, by Product Type,2022-2031

8.4.4.3.Market size analysis, by End-use,2022-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Sampling Type,2022-2031

8.4.5.2.Market size analysis, by Product Type,2022-2031

8.4.5.3.Market size analysis, by End-use,2022-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.Celanese Corporation

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Chevron Corporation.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.PARKER HANNIFIN CORP

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.General Electric

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.BP P.L.C

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Shell

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Eaton

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Intertek Group plc

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.SGS SA

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Bureau Veritas

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Oil condition monitoring or used oil analysis, as it is popularly called, is a predictive maintenance technique used to measure, monitor, and analyze lubricants or fuel oils used by machines and equipment. This analysis is done to check the contamination levels of the used oil and lubricant, check its chemical content, and track and monitor its degradation. This predictive maintenance mechanism helps to enhance performance and reliability of the machine substantially.

Forecast Analysis of the Oil Condition Monitoring Market

Over the years, there has been an increase in the use of predictive maintenance practices owing to the need for maximizing asset availability and reducing maintenance costs. This growing use of predictive maintenance practices is predicted to push the oil condition monitoring market forward in the forecast years. Along with this, rising awareness regarding extending the operational life of machines and equipment is expected to boost the market further. Furthermore, utilization of big data analytics to process large volumes of datasets extracted from oil condition monitoring is predicted to offer numerous growth opportunities to the market in the analysis timeframe. However, lack of skilled personnel may hamper the growth of the oil condition monitoring market in the 2022-2031 timeframe.

Regionally, the oil condition monitoring market in the North America region is expected to have the most dominant market share in the forecast period. The presence of major players using oil condition monitoring techniques is expected to be the primary growth driver of the market in this region.

As per a report by Research Dive, the global oil condition monitoring market is expected to reach a revenue of $1,387.5 million in the 2022–2031 timeframe, thereby growing at a stunning CAGR of 7.5% by 2031. Some prominent market players include Celanese Corporation, BP p.l.c., Intertek Group plc, Chevron Corporation., Shell, SGS SA, PARKER HANNIFIN CORP, Eaton, Bureau Veritas, General Electric, and many others.

Covid-19 Impact on the Oil Condition Monitoring Market

The Covid-19 pandemic and the subsequent lockdowns have had a catastrophic impact on various businesses and markets worldwide. The oil condition monitoring market, too, faced tremendously negative impact of the pandemic. The shutdown of industries and manufacturing companies to curb the spread of the virus led to a massive decline in the use of oil condition monitoring mechanism to check on the health and status of machines and equipment. This decreased use led to slowing down of the growth rate of the market in the pandemic period.

Significant Market Developments

The key players of the market are adopting various business strategies such as partnerships, mergers & acquisitions, and launches to gain a leading position in the market, thus helping the oil condition monitoring market to flourish. For instance:

- In December 2020, NSK Ltd., a machinery manufacturing company, announced the acquisition of Brüel & Kjaer Vibro Gmbh, a leading provider of condition monitoring solutions. This acquisition by NSK Ltd. is predicted to boost the market share of the company and will help the company to cater to the demands of the manufacturing sector in a much better way.

- In January 2021, SGS, a global giant in testing, inspection, and certification, announced the acquisition of SYNLAB Analytics & Services (A&S), a European environmental and food testing company. The acquisition is expected to expand the oil condition monitoring portfolio of SGS and increase its footprint in the market in the coming period.

- In August 2021, Shell, a leading oil and gas company, announced the launch of VitalyX, an advanced analytics-based oil condition monitoring service designed and developed specifically for the marine sector. This product launch by Shell is done with the help of Baker Hughes, a petroleum business company. The launch of the oil condition monitoring service is predicted to aid the company to consolidate its position as the leader of the oil condition monitoring market in the near future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com