Carrier Screening Market Report

RA01533

Carrier Screening Market by Type (Expanded Carrier Screening and Targeted Disease Carrier Screening), Technology (DNA Sequencing, Polymerase Chain Reaction, Microarrays, and Other Technologies), End-user (Hospitals, Reference Laboratories, Physician Offices & Clinics, and Other End-users), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Carrier Screening Market Analysis

The global carrier screening market size is predicted to garner $7,157.60 million in the 2021–2028 timeframe, growing from $2,168.40 million in 2020, at a healthy CAGR of 16.20%.

Market Synopsis

Strategic alliances among market players, along with growing demands for carrier screening across the globe, are expected to accelerate the growth of the carrier screening market.

However, lack of awareness about the benefits of carrier screening and accuracy issues are some of the growth-restricting factors for the market.

According to the regional analysis, the Asia-Pacific carrier screening market size is anticipated to grow during the review period and generate revenue of $1,410.10 million, with CAGR of 18.30% due to increasing genetic diseases in the region.

Carrier Screening Overview

Carrier screening is a type of genetic diagnosis test that can identify the genetic disorders or autosomal recessive diseases in the carrier person who has inherited from the parents. This type of test is mostly performed by couples who are parents to be, for determining the chances or risk of child inheriting the genetic disorders from the parents. This test is performed by blood sample.

Covid-19 Impact on Carrier Screening Market Shares

The novel coronavirus pandemic had a devastating effect on several industries. The global carrier screening market experienced a notable decline in growth during this period. Carrier screening market growth was affected because genetic counselors are unable to see patients personally along with closing down of laboratories and their test during the COVID-19 period. Furthermore, according to Centers for Medicaid Services (CMS), in 2020, genetic counsellors are not recognized as healthcare providers.

The above-stated factors show that the pandemic may have affected the market but resuming of all laboratories’ facilities will ultimately increase the sustainable opportunities for carrier screening market post-pandemic.

Increasing Prevalence of Genetic Disorders to Surge the Market Growth

The global carrier screening industry is witnessing a massive growth mainly due to increasing genetic disorders across the world owing to mutation in genes or chromosomes. The main reason for genetic mutation is a family history with defective genes or genetic abnormalities and a previous child birth with defect or miscarriage. Therefore, now-a-days pregnant women are performing carrier screening for determining the chances or risk of child inheriting the genetic disorders from the parents. All such aspects may boost expansions to fuel the growth of the global carrier screening market.

Furthermore, rising consciousness regarding the benefits of early detection and diagnosis of genetic diseases is providing market players to perform strategies across the globe. For instance, in January 2019, ArcherDX Inc., a molecular technology company, announced that they have acquired Baby Genes Inc., provider of carrier screening services. The main aim of this acquisition is to offer broad range of neonatal and carrier screening genetic testing services under the brand of ArcherDX Inc. These types of factors are predicted to drive the growth of the market.

To know more about global carrier screening market trends, drivers, get in touch with our analysts here.

High Cost Associated with Carrier Screening to Restrain the Market Growth

Carrier screening is very costly genetic test around $100 to $2,000 depending upon the test complexity. Also, there are many people across the globe that are unaware about the benefits of carrier screening. These are some of the factors anticipated to hinder the market value of the carrier screening in the next few years.

Rising Trends of Next-generation Sequencing (NGS) Technology in Carrier Screening to Create Massive Investment Opportunities

The global carrier screening market is spreading at a very fast pace due to increasing demand for NGS technology; this technology will help to understand the genome, epigenome, and transcriptome of the person. This technology is very helpful in understanding whole-genome sequencing for detecting the gene disorders. This is one of the factors that is positively affecting the carrier screening market growth.

Furthermore, carrier screening industry already has leading market players innovating strategies to attract customers. For example, Thermo Fisher Scientific Inc., American supplier of scientific products, in February 2020, announced that they have launched NGS-based test kit; it is a type of carrier screening approach in single solution that helps to scan the genetic disorders, including gene expression along with chromosome count. All such aspects may further lead to lucrative market opportunities for key players in the upcoming years.

To know more about global carrier screening market trends, opportunities, get in touch with our analysts here.

Carrier Screening Market

By Type

Based on type, the market has been divided into Expanded Carrier Screening and targeted disease carrier screening sub-segments of which the Expanded Carrier Screening sub-segment is projected to generate the maximum revenue as well as show the fastest growth. Download PDF Sample Report

Source: Research Dive Analysis

The expanded carrier screening type sub-segment is predicted to have a dominating share as well as fastest market growth in the global market. The sub-segment is expected to register a revenue of $3,879.70 million during the forecast period. Expanded carrier screening is the test that uses single sample to diagnose the genetic disorders. This type of screening is done to women that are planning for pregnancy and have family history of genetic disorder. These factors and strategic alliances may bolster the growth of the sub-segment during the forecast period and increase the carrier screening market demand.

Carrier Screening Market

By TechnologyOn the basis of technology, the market has been sub-segmented into DNA Sequencing, polymerase chain reaction, microarrays, and other technologies. Among the mentioned sub-segments, the DNA Sequencing sub-segment is predicted to show the fastest growth as well as have the dominant market share.

Source: Research Dive Analysis

The DNA sequencing sub-segment of the global carrier screening market is projected to have the dominant share as well as fastest growth. It is also projected to surpass $2,911.20 million by 2028, with an increase from $854 million in 2020. This growth in the market can be attributed to growing demand for technologies such as sequencing because it provides more accuracy when compared to other technologies. All such elements may increase the demand for sub-segment and increase the carrier screening market demand.

Carrier Screening Market

By End-UserOn the basis of end-user, the market has been sub-segmented into Hospitals, reference laboratories, physician offices & clinics, and other end-users sub-segments. Among the mentioned sub-segments, the Hospitals sub-segment is predicted to show the dominant as well as fastest growth.

Source: Research Dive Analysis

The hospitals sub-segment is predicted to have a leading market share in carrier screening globally and it is forecast to register a revenue of $2,924.40 million during the analysis timeframe owing to availability of highly qualified doctors and technicians across the globe. Moreover, in hospitals, chances of medical reimbursement are higher which is expected to increase the demand for carrier screening in hospitals. Furthermore, hospital offers advanced diagnostic tests. Such factors may create huge opportunities for the sub-segment throughout the forecast period.

Carrier Screening Market

By RegionThe carrier screening market share was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Carrier Screening in North America to be the Most Dominant

The North America carrier screening market accounted $906.4 million in 2020 and is projected to register a revenue of $2,834.40 million by 2028. The extensive growth of the North America carrier screening market is mainly driven by factors such as prevalence of advanced screening tests mostly in Canada and the US. Also, in North American countries, people are aware of using mass genetic testing programs with existence of top leading companies augmenting the industry growth in the region. Moreover, growing demand for carrier screening across the US is one of the factors that is fueling the market growth across the globe. These factors will ultimately drive the demand in the carrier screening market across the region.

The Market for Carrier Screening in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific carrier screening market is expected to rise at a CAGR of 18.30%, by registering a revenue of $1,410.10 million by 2028. The growth shall be a result of rising population with genetic disorders along with growing trends of carrier screening test kits. Such aspects may bolster the demand for carrier screening market, in the upcoming years.

Competitive Scenario in the Global Carrier Screening Market

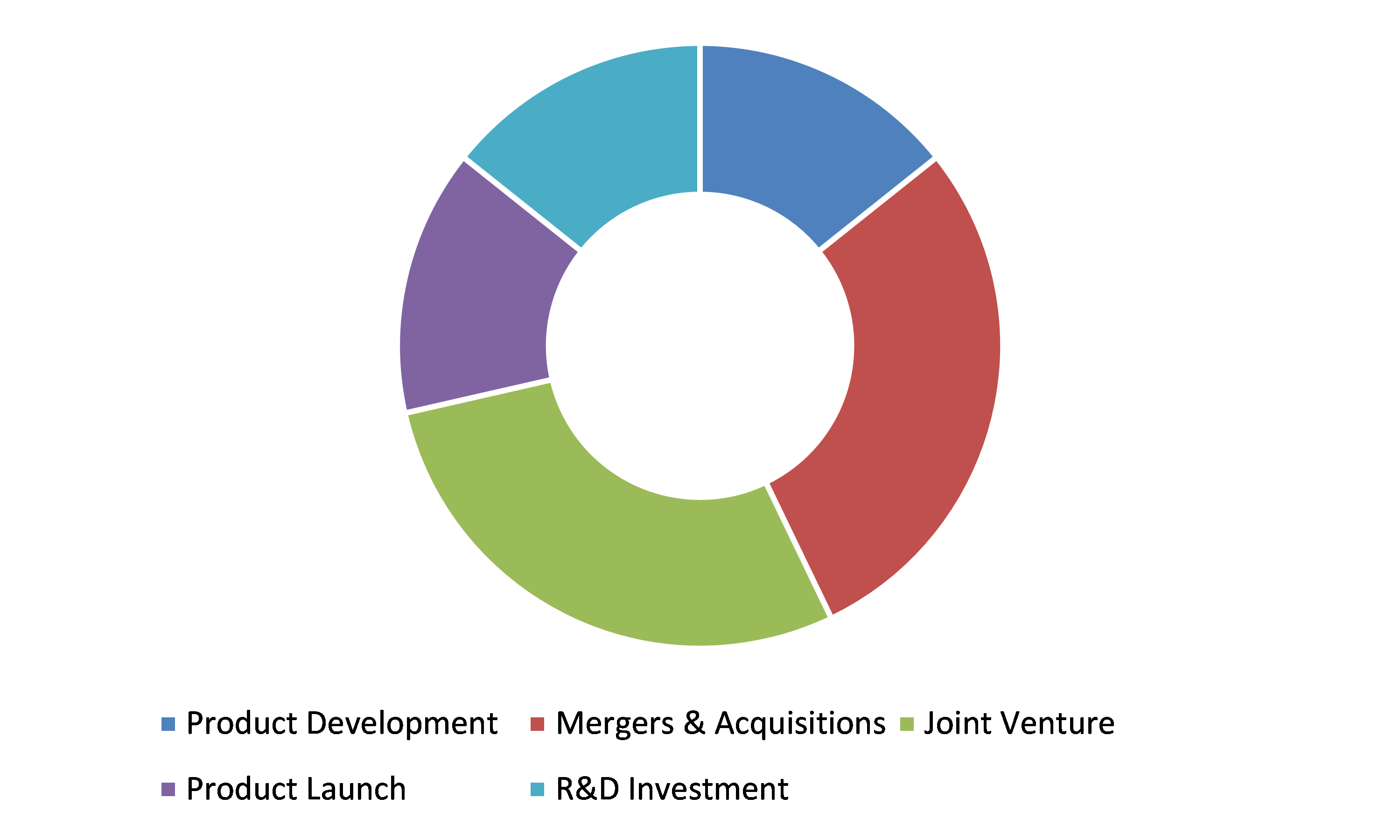

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading carrier screening market players are Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Eurofins Scientific, Invitae Corporation, Opko Health, Fulgent Genetics Inc., Natera Inc., Myriad Genetics, Illumina Inc., and Luminex Corporation.

Porter’s Five Forces Analysis for the Global Carrier Screening Market:

- Bargaining Power of Suppliers: The product suppliers of carrier screening market are high in number and are larger and more globalized. So, there will be less threat from the suppliers.

Thus, the bargaining power of suppliers is low. - Bargaining Power of Buyers: Buyers demand different types of carrier screening kits that are accurate and cost effective. This has increased the pressure on the carrier screening providers to offer the best carrier screening test kits. This gives the buyers the option to freely choose carrier screening products that best fit their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: Companies entering the carrier screening market are adopting various innovations such as developing carrier screening that are available for home testing.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: There are various substitutes available for carrier screening such as different types of genetic testing.

Thus, the threat of substitutes is high. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Eurofins Scientific and Invitae Corporation. These companies are launching their value-added services in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Technology |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global carrier screening market?

A. The size of the global carrier screening market was over $2,168.40 million in 2020 and is projected to reach $7,157.60 million by 2028.

Q2. Which are the major companies in the carrier screening market?

A. Thermo Fisher Scientific Inc. and Quest Diagnostics Incorporated are some of the key players in the global carrier screening market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific Carrier screening market?

A. Asia-Pacific carrier screening market is anticipated to grow at 18.30% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By type trends

2.3.By technology trends

2.4.By end-user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.8.1.Stress point analysis

3.8.2.Raw technology analysis

3.8.3.Manufacturing process

3.8.4.Technology analysis

3.8.5.Operating vendors

3.8.5.1.Raw technology suppliers

3.8.5.2.type manufacturers

3.8.5.3.type distributors

3.9.Strategic overview

4.Carrier Screening Market, by Type

4.1.Overview

4.1.1.Market size and forecast, by type

4.2.Expanded Carrier Screening

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country 2020 & 2028

4.3.Targeted Disease Carrier Screening

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country 2020 & 2028

5.Carrier Screening Market, by Technology

5.1.Overview

5.1.1.Market size and forecast, by Technology

5.2.DNA Sequencing

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country 2020 & 2028

5.3.Polymerase Chain Reaction

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country 2020 & 2028

5.4.Microarrays

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country 2020 & 2028

5.5.Other Technologies

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2020-2028

5.5.3.Market share analysis, by country 2020 & 2028

6.Carrier Screening Market, by Region

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by type , 2020-2028

6.2.3.Market size and forecast, by Technology , 2020-2028

6.2.4.Market size and forecast, by End-User , 2020-2028

6.2.5.Market size and forecast, by country, 2020-2028

6.2.6.U.S.

6.2.6.1.Market size and forecast, by type , 2020-2028

6.2.6.2.Market size and forecast, by Technology , 2020-2028

6.2.6.3.Market size and forecast, by End-User , 2020-2028

6.2.7.Canada

6.2.7.1.Market size and forecast, by type , 2020-2028

6.2.7.2.Market size and forecast, by Technology , 2020-2028

6.2.7.3.Market size and forecast, by End-User , 2020-2028

6.2.8.Mexico

6.2.8.1.Market size and forecast, by type , 2020-2028

6.2.8.2.Market size and forecast, by Technology , 2020-2028

6.2.8.3.Market size and forecast, by End-User , 2020-2028

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by type , 2020-2028

6.3.3.Market size and forecast, by Technology , 2020-2028

6.3.4.Market size and forecast, by End-User , 2020-2028

6.3.5.Market size and forecast, by country, 2020-2028

6.3.6.Germany

6.3.6.1.Market size and forecast, by type , 2020-2028

6.3.6.2.Market size and forecast, by Technology , 2020-2028

6.3.6.3.Market size and forecast, by End-User , 2020-2028

6.3.7.UK

6.3.7.1.Market size and forecast, by type , 2020-2028

6.3.7.2.Market size and forecast, by Technology , 2020-2028

6.3.7.3.Market size and forecast, by End-User , 2020-2028

6.3.8.France

6.3.8.1.Market size and forecast, by type , 2020-2028

6.3.8.2.Market size and forecast, by Technology , 2020-2028

6.3.8.3.Market size and forecast, by End-User , 2020-2028

6.3.9.Spain

6.3.9.1.Market size and forecast, by type , 2020-2028

6.3.9.2.Market size and forecast, by Technology , 2020-2028

6.3.9.3.Market size and forecast, by End-User , 2020-2028

6.3.10.Italy

6.3.10.1.Market size and forecast, by type , 2020-2028

6.3.10.2.Market size and forecast, by Technology , 2020-2028

6.3.10.3.Market size and forecast, by End-User , 2020-2028

6.3.11.Rest of Europe

6.3.11.1.Market size and forecast, by type , 2020-2028

6.3.11.2.Market size and forecast, by Technology , 2020-2028

6.3.11.3.Market size and forecast, by End-User , 2020-2028

6.4.Asia Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by type , 2020-2028

6.4.3.Market size and forecast, by Technology , 2020-2028

6.4.4.Market size and forecast, by End-User , 2020-2028

6.4.5.Market size and forecast, by country, 2020-2028

6.4.6.China

6.4.6.1.Market size and forecast, by type , 2020-2028

6.4.6.2.Market size and forecast, by Technology , 2020-2028

6.4.6.3.Market size and forecast, by End-User , 2020-2028

6.4.7.Japan

6.4.7.1.Market size and forecast, by type , 2020-2028

6.4.7.2.Market size and forecast, by Technology , 2020-2028

6.4.7.3.Market size and forecast, by End-User , 2020-2028

6.4.8.India

6.4.8.1.Market size and forecast, by type , 2020-2028

6.4.8.2.Market size and forecast, by Technology , 2020-2028

6.4.8.3.Market size and forecast, by End-User , 2020-2028

6.4.9.South Korea

6.4.9.1.Market size and forecast, by type , 2020-2028

6.4.9.2.Market size and forecast, by Technology , 2020-2028

6.4.9.3.Market size and forecast, by End-User , 2020-2028

6.4.10.Australia

6.4.10.1.Market size and forecast, by type , 2020-2028

6.4.10.2.Market size and forecast, by Technology , 2020-2028

6.4.10.3.Market size and forecast, by End-User , 2020-2028

6.4.10.4.Comparative market share analysis, 2020 & 2028

6.4.11.Rest of Asia Pacific

6.4.11.1.Market size and forecast, by type , 2020-2028

6.4.11.2.Market size and forecast, by Technology , 2020-2028

6.4.11.3.Market size and forecast, by End-User , 2020-2028

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by type , 2020-2028

6.5.3.Market size and forecast, by Technology , 2020-2028

6.5.3.1.Market size and forecast, by End-User , 2020-2028

6.5.4.Market size and forecast, by country, 2020-2028

6.5.5.Latin America

6.5.5.1.Market size and forecast, by type , 2020-2028

6.5.5.2.Market size and forecast, by Technology , 2020-2028

6.5.5.3.Market size and forecast, by End-User , 2020-2028

6.5.5.4.Market size and forecast, by End-User , 2020-2028

6.5.6.Middle East

6.5.6.1.Market size and forecast, by type , 2020-2028

6.5.6.2.Market size and forecast, by Technology , 2020-2028

6.5.6.3.Market size and forecast, by End-User , 2020-2028

6.5.7.Africa

6.5.7.1.Market size and forecast, by type , 2020-2028

6.5.7.2.Market size and forecast, by Technology , 2020-2028

6.5.7.3.Market size and forecast, by End-User , 2020-2028

7.Company profiles

7.1.Thermo Fisher Scientific Inc.

7.1.1.Company overview

7.1.2.Operating business segments

7.1.3.Type portfolio

7.1.4.Financial Performance

7.1.5.Recent strategic moves & developments

7.2.Quest Diagnostics Incorporated

7.2.1.Company overview

7.2.2.Operating business segments

7.2.3.Type portfolio

7.2.4.Financial Performance

7.2.5.Recent strategic moves & developments

7.3. Eurofins Scientific

7.3.1.Company overview

7.3.2.Operating business segments

7.3.3.Type portfolio

7.3.4.Financial Performance

7.3.5.Recent strategic moves & developments

7.4.Invitae Corporation

7.4.1.Company overview

7.4.2.Operating business segments

7.4.3.Type portfolio

7.4.4.Financial Performance

7.4.5.Recent strategic moves & developments

7.5.Opko Health

7.5.1.Company overview

7.5.2.Operating business segments

7.5.3.Type portfolio

7.5.4.Financial Performance

7.5.5.Recent strategic moves & developments

7.6.Fulgent Genetics Inc.

7.6.1.Company overview

7.6.2.Operating business segments

7.6.3.Type portfolio

7.6.4.Financial Performance

7.6.5.Recent strategic moves & developments

7.7.Natera Inc.

7.7.1.Company overview

7.7.2.Operating business segments

7.7.3.Type portfolio

7.7.4.Financial Performance

7.7.5.Recent strategic moves & developments

7.8.Myriad Genetics,

7.8.1.Company overview

7.8.2.Operating business segments

7.8.3.Type portfolio

7.8.4.Financial Performance

7.8.5.Recent strategic moves & developments

7.9.Illumina Inc.

7.9.1.Company overview

7.9.2.Operating business segments

7.9.3.Type portfolio

7.9.4.Financial Performance

7.9.5.Recent strategic moves & developments

7.10.Luminex Corporation.

7.10.1.Company overview

7.10.2.Operating business segments

7.10.3.Type portfolio

7.10.4.Financial Performance

7.10.5.Recent strategic moves & developments

Carrier screening is diagnosis test of genetic disorders or abnormal chromosomal diseases in the carrier person who has inherited one abnormal gene from their parents. The test determines whether a healthy person carries the recessive gene of genetic diseases such as sickle cell disease, cystic fibrosis, and others. Carrier screening test is mostly performed by couples who are parents to be in order to determine the chances of the child’s risk inheriting the genetic disorders from the parents. The demand for carrier screening is increasing over the last few years and thus the manufacturing companies are focusing on developing technologically advanced carrier screening products.

COVID-19 Impact on Carrier Screening Market

The outbreak of COVID-19 across the globe has drastically impacted the global carrier screening market growth. The low growth of the market is majorly owing to the closing down of hospitals and laboratories for non-essential treatments. Besides, people across the carrier screening industry are facing issues related to the less availability of counselors or lab technicians for carrier testing, which is resulting in decreased demand for carrier screening during the pandemic period.

However, reopening of hospitals, laboratories, and the availability of counselors for carrier screening test are the factors expected to boost the carrier screening market growth post-pandemic.

Carrier Screening Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global carrier screening market growth in the upcoming years.

For instance, in February 2020, Thermo Fisher Scientific, announced the launch of a new NGS-based test kit in order to enable researchers in the reproductive health field for better analyzing of wide range of key genetic markers. The ‘Ion Torrent CarrierSeq ECS Kit’ consolidates a multi-platform approach to ECS (expanded carrier screening) into a single solution that extends the reproductive health research portfolio of the company, which includes tools for postnatal, prenatal, newborn screening analysis, and invitro fertilization.

In September 2021, NxGen MDx, a leading healthcare company delivering comprehensive genetic testing, created an Early Advantage Panel by taking an innovative approach to genetic carrier screening panel design. Being first of its size, the panel fully incorporates screening recommendation from the U.S. Department of HHS (Health and Human Services). The aim of the company is to focus on improving pregnancy as well as newborn health outcomes for families everywhere.

Forecast Analysis of Global Carrier Screening Market

The global carrier screening market is projected to witness an exponential growth over the forecast period, owing to the technological advancements in carrier screening, such as the rising trend of next-generation sequencing (NGS) technology. Conversely, the lack of awareness among people regarding the benefits of carrier screening is expected to hamper the market growth in the projected timeframe.

The growing prevalence of genetic disorders across the world due to mutation in genes or chromosomes and the growing consciousness among people regarding the benefits of early detection & diagnosis of genetic diseases are the significant factors and carrier screening market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global carrier screening market is expected to garner $7,157.60 million during the forecast period (2021-2028). Regionally, the North America market is estimated to observe dominant growth by 2028, owing to the rising prevalence of advanced screening tests mostly in the U.S. and Canada, and the awareness among people using mass genetic testing programs in the region.

Key Players in the Global Carrier Screening Market

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated,

- Eurofins Scientific

- Invitae Corporation

- Opko Health

- Fulgent Genetics Inc.

- Natera Inc.

- Myriad Genetics,

- Illumina Inc.,

- Luminex Corporation.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com