Healthcare Biometrics Market Report

RA01266

Healthcare Biometrics Market by Technology (Fingerprint Recognition, Face Recognition, Voice Recognition, Vein Recognition, Iris Recognition, Hand Recognition, and Others), Application (Medical Record and Data Center Security, Patient Identification and Tracking, Care Provider Authentication, Home/Remote Patient Monitoring, and Others), End-User (Hospitals, Clinics, Clinical Laboratories, and Healthcare Institutions), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Healthcare Biometrics Market Analysis

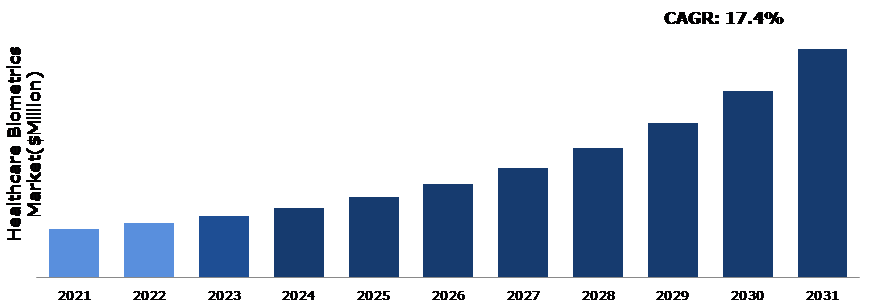

The Global Healthcare Biometrics Market Size was $5,226.4 million in 2021 and is predicted to grow with a CAGR of 17.4%, by generating a revenue of $24,942.7 million by 2031.

Global Healthcare Biometrics Market Synopsis

The growing huge amount of healthcare data, along with an increasing patient pool, will be a primary factor propelling the growth rate of the healthcare biometrics market. Another important aspect driving market development is the rise in digitization. The rise in medical identity theft or healthcare frauds, as well as improved quality treatment offered by healthcare institutions, are important drivers that will boost market growth. Other significant factors such as the increase in the number of applications of biometric devices in the healthcare industry, expanding awareness about security systems, and rising need for newborn security in hospitals would cushion the market growth rate. Growing healthcare infrastructure and rising disposable incomes in emerging and developed nations will enhance the acceptance rate of new technologies such as biometrics, influencing the growth rate of the healthcare biometrics market. These factors are anticipated to boost the healthcare biometrics industry growth in the upcoming years.

However, the cost of the healthcare biometric system is high, which requires additional funding from the administration of the hospitals and clinics. Because of this, patients must pay more for their care, which drives up the cost of the entire healthcare system. This appears to be a factor restricting the healthcare biometric market growth.

A significant possibility for the market's development is the adoption of a contactless biometric system. In order to improve their systems and offer the best protection for patient data and hospital information, large corporations and hospitals are implementing technologies including face recognition and retina scan. In order to match the superior facilities offered by the developed nations, the developing countries are quickly embracing the usage of the biometric system. This offers a chance for the biometric healthcare system to expand its limits globally. These many factors proved to be excellent opportunity for market growth.

According to regional analysis, the Asia-Pacific healthcare biometrics market is anticipated to show the fastest growth. This is because in China, for instance, in September 2018, The Jiangxi Provincial People's Hospital in China installed self-service payment terminals coupled with Alipay's face recognition technology for safe transactions. It is China's first hospital to offer face recognition-based medical bill payment services.

Healthcare Biometrics Overview

Biometrics in healthcare primarily refers to patient identification and user access control. Biometrics are also used to identify fraud and protect the information of people recruited for clinical trials. Healthcare insurers in the U.S. suffer a high level of fraud and manipulation of facts to claim as paid benefits. Healthcare biometrics is an excellent solution for data security and fraudulent claims, and it has the potential to save the government and healthcare insurers billions of dollars. Secure patient identification is required to manage logical access to centralized archives of digitized patients' data, limit physical access to hospital wards and structures, and identify medical professionals.

COVID-19 Impact on Global Healthcare Biometrics Market

The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world were standstill. This has ultimately lowered the demand for healthcare biometrics due to disruptions in supply chain, closure of manufacturing plants, as well as economic slowdown across several countries. Biometrics, artificial intelligence (AI), and machine learning were essential in reacting to the pandemic. Biometric systems have been incorporated and accepted as key instruments for COVID-19 early detection, medical screening, and public safety monitoring across the world. To counteract the spread of COVID-19, law enforcement agencies, several governments, and other businesses switched from touch-based biometric authentication to touchless biometric authentication technologies. As a consequence, Al and ML technologies and algorithms were pushed to their limits in order to create and refine cutting-edge contactless biometrics identification solutions.

However, in September 2022, according to the report published in Hindawi, a commercial publisher of scientific, technical, and medical literature, the majority of biometric authentication in the healthcare industry goes toward patient tracking and monitoring.

Growing Technological Advancement in Biometrics Devices to Drive the Market Growth

The use of multimodal biometrics systems, which integrate several types of biometrics methods such as combined facial and iris recognition, is a fast-growing trend. Biometrics is a promising and rapidly expanding area in the realm of next generation personal authentication and security systems that is transforming the image and appearance of the healthcare business. Companies who invest extensively in creating automated biometrics systems with increased accuracy and reaction speed may reap larger rewards in the near future. The introduction of new low-cost products and the demonstration of the benefits and advanced capabilities of biometrics security solutions at various conference laboratories, web casting, trade shows, and electronic newsletters are expected to boost the growth of new competitors in the healthcare biometrics market share in the future.

To know more about global healthcare biometrics market drivers, get in touch with our analysts here.

Increasing High Cost of Healthcare Biometrics to Restrain the Market Growth

The cost of setting up biometric health records is significant. It has a big impact on the healthcare biometrics business. The majority of healthcare institutions prefer cost-effective options. Many consumers are enticed to the market's low-cost options. The biometrics system may regulate the market's entrances, elevators, critical care sections, and information room. It is difficult to install a biometric healthcare system at large facility. Connecting the biometric to the entire structure might cost a lot. These factors are expected to restrict the healthcare biometrics market size.

Increasing Adoption of Healthcare Biometric Authentication to Drive Excellent Opportunities

The increasing adoption of contactless biometric authentication is a significant driver of market development. Healthcare data breaches and medical identity theft are also driving market expansion. The increasing adoption of biometrics due to its cost-effectiveness, capacity to easily integrate cloud technology with healthcare services, and high-end assurance and security are some of the factors driving the market's growth. Many healthcare organizations have shifted away from traditional paper-based record management systems and toward cloud-based biometrics management. Additionally, technical advancements in cloud infrastructure have facilitated this change, resulting in a considerable increase in the market.

To know more about global healthcare biometrics market opportunities, get in touch with our analysts here.

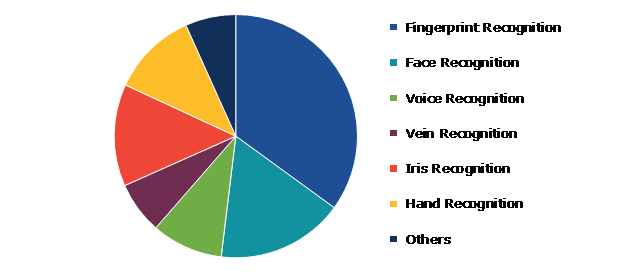

Global Healthcare Biometrics Market, by Technology

Based on technology, the market has been divided into fingerprint recognition, face recognition, voice recognition, vein recognition, iris recognition, hand recognition, and others. Among these, the fingerprint recognition sub-segment accounted for the highest market share in 2021 and it is estimated to show the fastest growth during the forecast period.

Global Healthcare Biometrics Market Share, by Technology, 2021

Source: Research Dive Analysis

The fingerprint recognition sub-type accounted for a dominating market share in 2021 and it is anticipated to show the fastest growth during the forecast period. The fingerprint identification market holds the largest share due to its higher reliability and ease of access. A higher security is provided to the system with the help of DNA recognition which is foreseen to facilitate the demand for biometrics system in the healthcare sector. The fingerprint recognition pattern is the most popular biometric technology around the world, and it is gaining traction in the small-scale industry as well. Fingerprint recognition is the component that has lately gained popularity among many industries as a result of modernization. This approach has aided in increasing resistance to fraud situations, therefore safeguarding patient data and information.

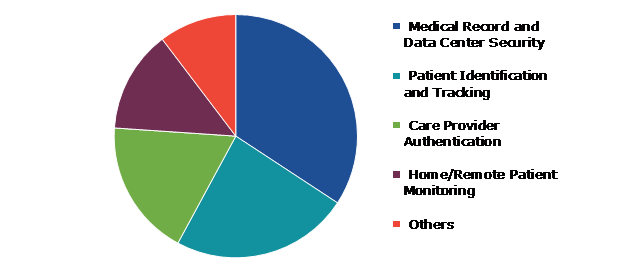

Global Healthcare Biometrics Market, by Application

Based on application, the market has been divided into medical record and data center security, patient identification and tracking, care provider authentication, home/remote patient monitoring, and others. Among these, the medical record and data center security sub-segment accounted for highest revenue share in 2021.

Global Healthcare Biometrics Market Size, by Application, 2021

Source: Research Dive Analysis

The medical record and data center security sub-segment accounted for a dominating market share in 2021. These factors are anticipated to boost the growth of healthcare biometrics market sub-segment during the analysis timeframe. The digital transformation of many healthcare companies has led in the transfer of their data to the cloud. For instance, Imprivata has connected its One Sign solution with Microsoft Azure, enabling its healthcare clients to access their data in the cloud using biometric fingerprint screening as a method of identification.

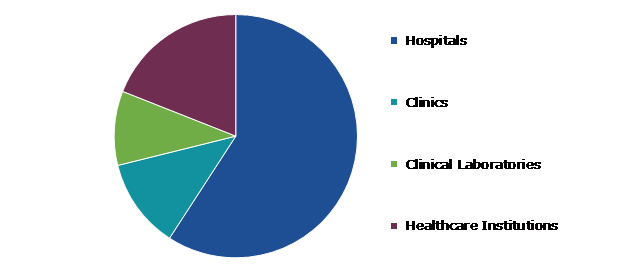

Global Healthcare Biometrics Market, by End-User

Based on end-user, the market has been divided into hospitals, clinics, clinical laboratories, and healthcare institutions. Among these, the hospitals sub-segment accounted for highest revenue share in 2021.

Global Healthcare Biometrics Market Growth, by End-User, 2021

Source: Research Dive Analysis

The hospitals sub-segment accounted for a dominating market share in 2021. Hospitals are using biometrics in healthcare mainly for employee and patient identification. This improves workflow, reduces duplication, and makes patients recognized throughout the health system. Since it becomes extremely difficult for the medical staff to operate when there is too much of confusion, the healthcare biometric system helps to authenticate the entry of the people by allowing only eligible people into the main premises of the hospitals. These factors are anticipated to boost the growth of the healthcare biometrics market in hospitals sub-segment during the analysis timeframe.

Global Healthcare Biometrics Market, Regional Insights

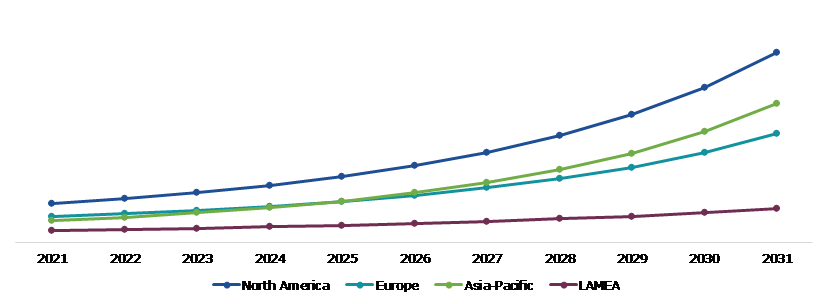

The healthcare biometrics market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Healthcare Biometrics Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Healthcare Biometrics in North America to be the Most Dominant

The North America healthcare biometrics market accounted for a dominating market share in 2021. The market for healthcare biometrics in North America is driven by biometrics' expanding acceptance among the main medical specialties and by hospitals, clinical labs, research labs, and other healthcare organizations. The reduction of healthcare fraud, protection of patient privacy and medical information, decrease in fictitious insurance claims, and faster identification and payment processing will cause biometric security systems to be quickly accepted. The frequency of fraudulent activities is expected to promote the adoption of these technologically advanced biometric technologies for collecting patient and registration data. Furthermore, the creation of new healthcare facilities such as hospitals and clinics may serve as a main driving force for the region's growth in this industry.

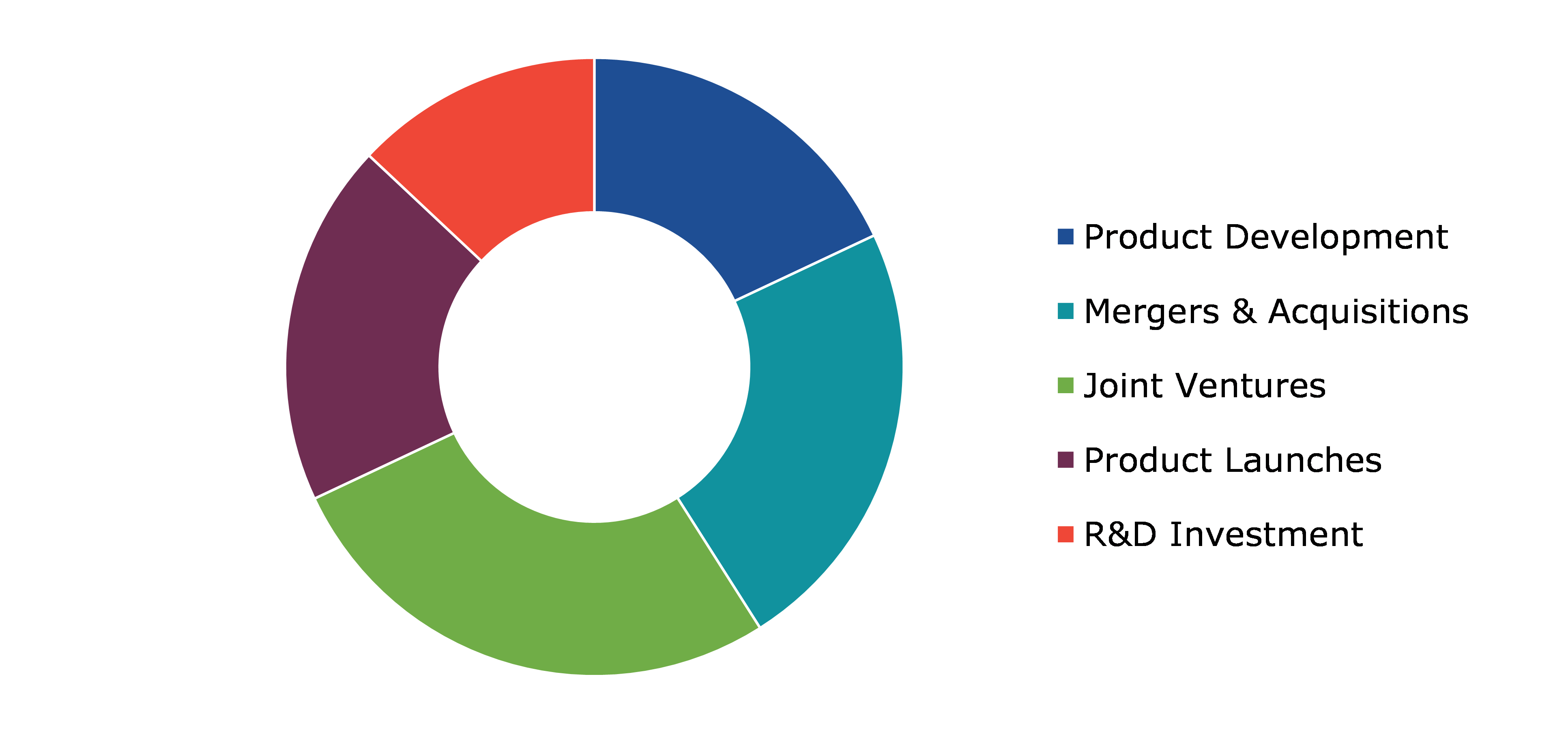

Competitive Scenario in the Global Healthcare Biometrics Market

Investment and agreement are common strategies followed by major market players. For instance, in August 2021, a biometric security technology called SoundPass had been introduced by RAIsonance. The SoundPass software package transforms audio signatures into biometric signal signatures. Using artificial intelligence, it erects a biometric perimeter security wall around establishments including enterprises, amusement parks, places of public gathering, and university campuses.

Source: Research Dive Analysis

Some of the leading healthcare biometrics market players are Zotero, NEC CORPORATION, Crossmatch Technologies, Fujitsu Limited, Bio-Key International, 3M Cogent, Inc., Suprema Inc., IDEMIA (Morpho), Imprivata, Inc., and Integrated Biometrics.

| Aspect | Particulars |

| Historical Market Estimation | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Segmentation by End-User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global healthcare biometrics market?

A. The size of the global healthcare biometrics market was over $5,226.4 million in 2021 and is projected to reach $24,942.7 million by 2031.

Q2. Which are the major companies in the healthcare biometrics market?

A. Zotero, NEC CORPORATION, and Crossmatch Technologies are some of the key players in the global healthcare biometrics market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific healthcare biometrics market?

A. Asia-Pacific healthcare biometrics market is anticipated to grow at 20.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Zotero, NEC CORPORATION, and Crossmatch Technologies are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global healthcare biometrics market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on healthcare biometrics market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Healthcare Biometrics Market, by Technology

5.1.Overview

5.1.1.Market size and forecast, by Technology

5.2.Fingerprint Recognition

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2021-2031

5.2.3.Market share analysis, by country 2021 & 2031

5.3.Face Recognition

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2021-2031

5.3.3.Market share analysis, by country 2021 & 2031

5.4.Voice Recognition

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2021-2031

5.4.3.Market share analysis, by country 2021 & 2031

5.5.Vein Recognition

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2021-2031

5.5.3.Market share analysis, by country 2021 & 2031

5.6.Iris Recognition

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region, 2021-2031

5.6.3.Market share analysis, by country 2021 & 2031

5.7.Hand Recognition

5.7.1.Key market trends, growth factors, and opportunities

5.7.2.Market size and forecast, by region, 2021-2031

5.7.3.Market share analysis, by country 2021 & 2031

5.8.Others

5.8.1.Key market trends, growth factors, and opportunities

5.8.2.Market size and forecast, by region, 2021-2031

5.8.3.Market share analysis, by country 2021 & 2031

5.9.Research Dive Exclusive Insights

5.9.1.Market attractiveness

5.9.2.Competition heatmap

6.Healthcare Biometrics Market, by Application

6.1.Overview

6.1.1.Market size and forecast, by Application

6.2.Medical Record and Data Center Security

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2021-2031

6.2.3.Market share analysis, by country 2021 & 2031

6.3.Patient Identification and Tracking

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2021-2031

6.3.3.Market share analysis, by country 2021 & 2031

6.4.Care Provider Authentication

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2021-2031

6.4.3.Market share analysis, by country 2021 & 2031

6.5.Home/Remote Patient Monitoring

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region, 2021-2031

6.5.3.Market share analysis, by country 2021 2031

6.6.Others

6.6.1.Key market trends, growth factors, and opportunities

6.6.2.Market size and forecast, by region, 2021-2031

6.6.3.Market share analysis, by country 2021 2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Healthcare Biometrics Market, by End-User

7.1.Overview

7.1.1.Market size and forecast, by end-user

7.2.Hospitals

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2021-2031

7.2.3.Market share analysis, by country 2021 & 2031

7.3.Clinics

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2021-2031

7.3.3.Market share analysis, by country 2021 & 2031

7.4.Clinical Laboratories

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region, 2021-2031

7.4.3.Market share analysis, by country 2021 & 2031

7.5.Healthcare Institutions

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region, 2021-2031

7.5.3.Market share analysis, by country 2021 & 2031

7.6.Research Dive Exclusive Insights

7.6.1.Market attractiveness

7.6.2.Competition heatmap

8.Healthcare Biometrics Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Technology

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End-user

8.1.2.Canada

8.1.2.1.Market size analysis, by Technology

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End-user

8.1.3.Mexico

8.1.3.1.Market size analysis, by Technology

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End-user

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Technology

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by End-user

8.2.2.UK

8.2.2.1.Market size analysis, by Technology

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End-user

8.2.3.France

8.2.3.1.Market size analysis, by Technology

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End-user

8.2.4.Spain

8.2.4.1.Market size analysis, by Technology

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End-user

8.2.5.Italy

8.2.5.1.Market size analysis, by Technology

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End-user

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Technology

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End-user

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Technology

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End-user

8.3.2.Japan

8.3.2.1.Market size analysis, by Technology

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End-user

8.3.3.India

8.3.3.1.Market size analysis, by Technology

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End-user

8.3.4.Australia

8.3.4.1.Market size analysis, by Technology

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End-user

8.3.5.South Korea

8.3.5.1.Market size analysis, by Technology

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End-user

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Technology

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End-user

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.3.8.LAMEA

8.3.9.Brazil

8.3.9.1.Market size analysis, by Technology

8.3.9.2.Market size analysis, by Application

8.3.9.3.Market size analysis, by End-user

8.3.10.Saudi Arabia

8.3.10.1.Market size analysis, by Technology

8.3.10.2.Market size analysis, by Application

8.3.10.3.Market size analysis, by End-user

8.3.11.UAE

8.3.11.1.Market size analysis, by Technology

8.3.11.2.Market size analysis, by Application

8.3.11.3.Market size analysis, by End-user

8.3.12.South Africa

8.3.12.1.Market size analysis, by Technology

8.3.12.2.Market size analysis, by Application

8.3.12.3.Market size analysis, by End-user

8.3.13.Rest of LAMEA

8.3.13.1.Market size analysis, by Technology

8.3.13.2.Market size analysis, by Application

8.3.13.3.Market size analysis, by End-user

8.3.14.Research Dive Exclusive Insights

8.3.14.1.Market attractiveness

8.3.14.2.Competition heatmap

9.Competitive Landscape

9.1.1.Top winning strategies, 2021

9.1.1.1.By strategy

9.1.1.2.By year

9.1.2.Strategic overview

9.1.3.Market share analysis, 2021

10.Company Profiles

10.1.1.Zotero

10.1.1.1.Overview

10.1.1.2.Business segments

10.1.1.3.Product portfolio

10.1.1.4.Financial performance

10.1.1.5.Recent developments

10.1.1.6.SWOT analysis

10.1.2.NEC CORPORATION

10.1.2.1.Overview

10.1.2.2.Business segments

10.1.2.3.Product portfolio

10.1.2.4.Financial performance

10.1.2.5.Recent developments

10.1.2.6.SWOT analysis

10.1.3.Crossmatch Technologies

10.1.3.1.Overview

10.1.3.2.Business segments

10.1.3.3.Product portfolio

10.1.3.4.Financial performance

10.1.3.5.Recent developments

10.1.3.6.SWOT analysis

10.1.4.Fujitsu Limited

10.1.4.1.Overview

10.1.4.2.Business segments

10.1.4.3.Product portfolio

10.1.4.4.Financial performance

10.1.4.5.Recent developments

10.1.4.6.SWOT analysis

10.1.5.Bio-Key International

10.1.5.1.Overview

10.1.5.2.Business segments

10.1.5.3.Product portfolio

10.1.5.4.Financial performance

10.1.5.5.Recent developments

10.1.5.6.SWOT analysis

10.1.6.3M Cogent, Inc.

10.1.6.1.Overview

10.1.6.2.Business segments

10.1.6.3.Product portfolio

10.1.6.4.Financial performance

10.1.6.5.Recent developments

10.1.6.6.SWOT analysis

10.1.7.Suprema Inc.

10.1.7.1.Overview

10.1.7.2.Business segments

10.1.7.3.Product portfolio

10.1.7.4.Financial performance

10.1.7.5.Recent developments

10.1.7.6.SWOT analysis

10.1.8.IDEMIA (Morpho)

10.1.8.1.Overview

10.1.8.2.Business segments

10.1.8.3.Product portfolio

10.1.8.4.Financial performance

10.1.8.5.Recent developments

10.1.8.6.SWOT analysis

10.1.9.Imprivata, Inc.

10.1.9.1.Overview

10.1.9.2.Business segments

10.1.9.3.Product portfolio

10.1.9.4.Financial performance

10.1.9.5.Recent developments

10.1.9.6.SWOT analysis

10.1.10.Integrated Biometrics

10.1.10.1.Overview

10.1.10.2.Business segments

10.1.10.3.Product portfolio

10.1.10.4.Financial performance

10.1.10.5.Recent developments

10.1.10.6.SWOT analysis

11.Appendix

11.1.1.1.Parent & peer market analysis

11.1.1.2.Premium insights from industry experts

11.1.1.3.Related reports

The adoption of the Personal Health Record (PHR) has made individual health information more available to a wide variety of consumers. However, the security, privacy, and confidentiality of personalized health information are in danger due to growing PHR accessibility. Hence, the requirement for strong and trustworthy authentication methods is of the utmost importance. Biometric authentication is currently a well-known technique among healthcare professionals.

Biometrics in healthcare primarily refers to patient identification and user access control. Biometrics are used to detect fraud and safeguard the data of patients in clinical trials. Healthcare biometrics is a great solution for data protection and preventing fraudulent claims, and it can save the government and healthcare insurance companies billions of dollars. Secure patient identification is essential to regulate logical access to centrally archived digitized patient data, prohibit physical access to hospital wards and structures, and verify medical staff. Currently, the global healthcare biometrics market is continuously evolving with new technologies and practices.

Recent Trends in the Healthcare Biometrics Market

Face recognition is becoming extremely popular in the healthcare biometrics sector, especially for patient identification and authentication. Face recognition technology can rapidly and precisely identify patients, assisting healthcare providers in reducing errors, improving patient safety, and enhancing the patient experience. Additionally, in healthcare, voice recognition technology is also utilized to improve patient authentication and identification. A patient can use their voice to verify their identity when accessing medical records or interacting with healthcare practitioners, which can increase patient safety and reduce errors. All these novel advancements in healthcare biometrics technology are fueling the growth of the healthcare biometrics market.

Newest Insights in the Healthcare Biometrics Market

As per a report by Research Dive, the global healthcare biometrics market is expected to grow at a CAGR of 17.4% and generate revenue of $24,942.7 million by 2031. The primary factors driving the growth of the market are the huge amount of medical information and an expanding patient pool. In addition, the growing use of biometrics owing to its affordability, the ease of integrating cloud technology with healthcare services, and the high level of assurance and security are some of the factors driving the market's growth. However, the cost of the biometric healthcare system is high, requiring additional money from hospital and clinic management, which is expected to hinder the market growth.

The healthcare biometrics market in North America is expected to remain dominant in the coming years. The region's high revenue in 2021 was driven by the growing acceptance of biometrics by hospitals, clinical laboratories, research labs, and other healthcare organizations.

How are Market Players Responding to the Rising Demand for Healthcare Biometrics?

Market players are responding to the rising demand for healthcare biometrics by investing in research and development to create a more advanced and efficient cloud infrastructure. Many healthcare businesses have moved from using traditional paper-based record management systems to managing biometrics in the cloud.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the healthcare biometrics market are NEC CORPORATION, Zotero, Crossmatch Technologies, Bio-Key International, Fujitsu Limited, 3M Cogent, Inc., IDEMIA (Morpho), Integrated Biometrics, Suprema Inc., Imprivata, Inc., and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance,

- In May 2021, Imprivata, a Waltham-based business specializing in digital identity security, launched face biometrics for healthcare through a collaboration between Aware and IDEMIA. The new mobile facial biometrics technology is designed to simplify self-enrolment for EPCS (electronic prescriptions for controlled substances) in accordance with US Drug Enforcement Agency (DEA) rules.

- In August 2021, RAIsonance, a family of businesses committed to offering AI/ML-based solutions for the biometrics, safety, medical diagnostics, digital health, and big data markets, launched the SoundPass Biometric Security Tool. SoundPass helps create a biometric perimeter security bubble around entertainment and consumer venues, companies, and college campuses using AI (artificial intelligence).

- In February 2022, rf IDEAS, a leading manufacturer of credential readers for logical access and authentication, announced a partnership with ID R&D, a biometric technology company, to incorporate its cutting-edge biometric authentication and anti-spoofing solutions into the rf IDEAS range.

COVID-19 Impact on the Global Healthcare Biometrics Market

The COVID-19 pandemic made a moderate impact on the global healthcare biometrics market. The pandemic created several uncertainties, resulting in significant economic losses as various enterprises around the world came to a halt. This eventually reduced the need for healthcare biometrics owing to supply chain disruptions, the closing of manufacturing facilities, and the global economic slump. However, biometrics, AI (artificial intelligence), and machine learning were important in responding to the pandemic. Biometric technologies were integrated and approved as critical tools for COVID-19 early detection, medical screening, and public safety monitoring across the globe. Moreover, law enforcement agencies, governments, and other organizations shifted from touch-based biometric verification to contactless biometric authentication to combat the spread of the deadly virus. As a result, Al and ML technologies and algorithms were used up to their full potential to develop and improve cutting-edge contactless biometric identification solutions, which fueled the growth of the healthcare biometrics market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com