Automotive LiDAR Sensor Market Report

RA00146

Automotive LiDAR Sensor Market, by Type (Mechanical, Solid-State), Vehicle Type (Autonomous, Semi-Autonomous), Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global Automotive LiDAR Sensor Market Insights 2026:

Global Automotive LiDAR Sensor Market forecast will surpass $2,436.3 million by 2026, rising from $151.9 million in 2018, at a CAGR of 39.0%. Europe region is anticipated to reach $552.3 million during the projected timeframe. However, North America led the global automotive LiDAR sensor market in 2018 accounting for $86.6 million growing at a CAGR of 38.8% and is expected to reach $1,369.2 million by 2026.

Light Detecting and Range LiDAR is extensively used in applications such as measuring velocity, distance, and angle of the objects with great accuracy. It can be used for classifying objects, detecting lane markings, and can also be used for positioning an autonomous vehicle in a precise manner as compared to a high definition map. Basically, this device is a critical sensor used for empowering autonomous vehicles. Key players in the market are working on inventing and developing the next generation of LiDAR systems for automotive application by making use of scalable auto-grade LiDAR sensor, registered LiDAR Application-Specific Integrated Circuit (ASIC) engine, and core 3D software technology.

Automotive LiDAR Sensor Market Synopsis

Product development and joint ventures among market players, and the cutting-edge innovation of LiDAR sensors are expected to boost the growth of the automotive LiDAR sensor market.

On the other hand, the limitation in the usage of LiDAR sensors in bad weather conditions, such as the interference occurred by fog or rain is a growth-restricting factor for the market.

According to the regional analysis of the market, the North America automotive LiDAR sensor market is anticipated to observe lucrative growth by generating a revenue of $86.6 million at a CAGR of 38.8% during the review period.

Creation of 3D image of the object is the key factor driving the Global Automotive LiDAR Sensor Market

LiDAR was invented after RADAR and SONAR, however the cutting-edge innovation of LiDAR that was created by both NASA and US Military, it was first utilized by NASA in space missions to detect and locate the water droplets.

The rapid growth in the autonomous vehicles across the globe is the major key driving factor for the growth of automotive LiDAR sensor market. LiDAR sensors plays a very crucial role in driving the self-driving vehicles with more safety and avoid any kind of accidents. The OEM’s are preferring LiDAR over RADAR because of its enhanced features, such as the LiDAR sensor can make a 3D picture of any object with which the LiDAR sensor' pulses come in contact with. Also, these factors help in detecting the objects present in a range of 500-2,000 meters from the vehicle.

However, RADAR is the only substitute for LiDAR, but due to deficiency of detecting the objects on a shorter range is the major drawback for RADAR sensors due to which the automobile manufacturers are not opting for RADAR systems.

Usage limitation in extreme weather condition is the key restraining factor for Global Automotive LiDAR Sensor Market

LiDAR sensors does not exhibit better responses in bad weather conditions such as rain an d foggy climate. This is majorly due to the interference occurred by the rain and fog that is caused when they come in contact with laser light from the LIDAR sensor, majorly causing the system to detect objects that aren’t physically present. Sensors gets confused when such kind of incidences happen. This factors are expected to hamper the automotive LiDAR sensor market in the near future.

Sensor fusion technology is expected to create key growth opportunity for Global Automotive LiDAR Sensor Market

Sensor fusion is a technology that is widely used to detect the obstacles in LiDAR point clouds via segmentation and clustering. This further applies filter and thresholds to radar data in order to enhance the tracked objects, along with augmenting the perception by projecting camera images into 3D images and showcasing these images over the sensor data screen. This technology is expected to enhance the way LiDAR sensor system detects surrounding of the vehicles.

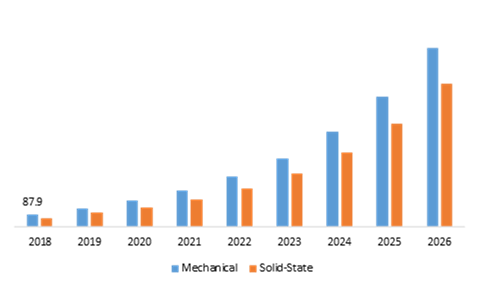

Automotive LiDAR Sensor Market, by Type:

The Solid-state segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The mechanical segment held the largest market share in 2018 accounting for a dominant share in the global market, at 57.8%, thereby accounting for $87.9 million. Moreover, the solid-state segment is anticipated to register a highest growth rate of more than 40.0% during the anticipated period. Rising preferences from the Original Equipment Manufacturers (OEMs), owing to the product’s enhanced abilities and precision, which will assist the vehicle to differentiate between moving objects and the stand still objects.

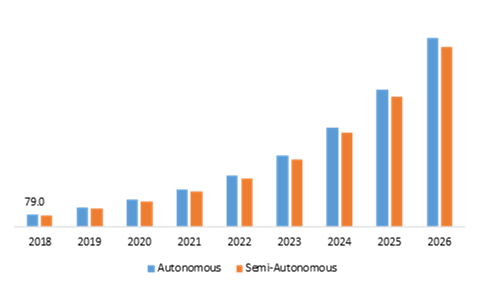

Automotive LiDAR Sensor Market, by Vehicle Type:

Semi-autonomous segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The autonomous segment held the largest market value in 2018 accounting for over $79.0 million and is anticipated to reach $1,246.8 million by 2026, growing at a CAGR of 38.7% during the forecast period. The growth is owing to the safety features that are delivered by the LiDAR sensor systems to the vehicle.

Automotive LiDAR Sensor Market, by Region:

Europe region will have enormous opportunities for the market investors to grow over the coming years

North America automotive LiDAR sensor industry held the largest share in the year 2018, and generated over $86.6 million, and is further anticipated to grow at a CAGR of 38.8% during the forecast period. On

the other hand, the Europe market is anticipated to experience a swift growth over the forecast period, majorly due to the growing adoption of electric vehicles across the region.

To explore more about the Automotive LiDAR Sensor Market, get in touch with our analysts here.

https://www.researchdive.com/connect-to-analyst/146

Key participants in the Global Automotive LiDAR Sensor Market:

Product development and joint ventures are the most common strategies followed by the market players

Source: Research Dive Analysis

Automotive LiDAR sensor market players include Robert Bosch GmbH, Continental AG, First Sensor AG, Hella KGaA Hueck & Co., Denso Corp, Novariant, Inc., Quanergy Systems, Inc., Laddartech, Phantom Intelligence, Velodyne LiDAR, Inc. among many others. Product development and acquisitions are some of the key strategies opted by the industry participants to retain their position in the global or regional markets. These key players are majorly concentrating on technology advancements in current technology, new product

launches, mergers & acquisitions, and geographical expansion. These are some of the growth strategies adopted by these companies.

Veoneer and Velodyne have joined hands to provide key machineries, technological expertise, and other intellectual assets required to commercialize the next generation of LiDAR systems. This newly invented system is expected to be cost effective and provide high performance LiDAR systems for the automotive sector.

Porter’s Five Forces Analysis for Automotive LiDAR Sensor Market:

1. Bargaining Power of Suppliers: There is a lack of key manufacturers in automotive LiDAR sensor.

The bargaining power of suppliers is Low.

2. Bargaining Power of Consumers:

In this market, the number of consumers is high. Aspects like lack of product knowledge is hindering the market growth.

The bargaining power of consumers is High.

3. Threat of New Entrants:

Government initiatives to develop autonomous vehicles and semi- autonomous vehicles is creating better opportunities for new entrant’s

The threat of new entrants is Low.

4. Threat of Substitutes:

Automotive LiDAR market has very few substitutes that provide the same of kind of information as LiDAR.

The threat of substitutes is Low.

5. Competitive Rivalry in the Industry:

This market contains a few market participants. Many of the key players are following similar strategies for the improvement of technologies.

The competitive rivalry in the industry is High.

| spect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Vehicle Type |

|

| Key Countries Covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Latin America, Middle East and Africa |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of the Automotive LiDAR Sensor market?

A. The global automotive LiDAR sensor market size was over $151.9 million in 2018, and is further anticipated to reach $2,436.30 million by 2026.

Q2. Which are the leading companies in the Automotive LiDAR Sensor market?

A. Velodyne LiDAR, Inc., and Robert Bosch GmbH are some of the key players in the global Automotive LiDAR Sensor market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Europe possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Europe Market?

A. Europe Automotive LiDAR Sensor market is projected to grow at 40.30% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more in R&D practices?

A. Robert Bosch GmbH, Continental AG, First Sensor AG are investing more in R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Type trends

2.3. Vehicle Type trends

3. Market overview

3.1. Market segmentation & definitions

3.2. key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Vehicle Type landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.9. Strategic overview

4. Automotive LiDAR Sensors Market, by Type

4.1. Mechanical

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Solid State

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. Automotive LiDAR Sensors Market, by Vehicle Type

5.1. Autonomous

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Semi-Autonomous

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

6. Automotive LiDAR Sensors Market, by Region

6.1. North America

6.2. Market size and forecast, by Type, 2016-2026

6.3. Market size and forecast, by Vehicle Type, 2016-2026

6.4. Market size and forecast, by country, 2016-2026

6.5. Comparative market share analysis, 2018 & 2026

6.5.1. U.S.

6.5.1.1. Market size and forecast, by Type, 2016-2026

6.5.1.2. Market size and forecast, by Vehicle Type, 2016-2026

6.5.1.3. Comparative market share analysis, 2018 & 2026

6.5.2. Canada

6.5.2.1. Market size and forecast, by Type, 2016-2026

6.5.2.2. Market size and forecast, by Vehicle Type, 2016-2026

6.5.2.3. Comparative market share analysis, 2018 & 2026

6.5.3. Mexico

6.5.3.1. Market size and forecast, by Type, 2016-2026

6.5.3.2. Market size and forecast, by Vehicle Type, 2016-2026

6.5.3.3. Comparative market share analysis, 2018 & 2026

6.6. Europe

6.6.1. Market size and forecast, by Type, 2016-2026

6.6.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.3. Market size and forecast, by country, 2016-2026

6.6.4. Comparative market share analysis, 2018 & 2026

6.6.5. UK

6.6.5.1. Market size and forecast, by Type, 2016-2026

6.6.5.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.5.3. Comparative market share analysis, 2018 & 2026

6.6.6. Germany

6.6.6.1. Market size and forecast, by Type, 2016-2026

6.6.6.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.6.3. Comparative market share analysis, 2018 & 2026

6.6.7. France

6.6.7.1. Market size and forecast, by Type, 2016-2026

6.6.7.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.7.3. Comparative market share analysis, 2018 & 2026

6.6.8. Spain

6.6.8.1. Market size and forecast, by Type, 2016-2026

6.6.8.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.8.3. Comparative market share analysis, 2018 & 2026

6.6.9. Italy

6.6.9.1. Market size and forecast, by Type, 2016-2026

6.6.9.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.9.3. Comparative market share analysis, 2018 & 2026

6.6.10. Rest of Europe

6.6.10.1. Market size and forecast, by Type, 2016-2026

6.6.10.2. Market size and forecast, by Vehicle Type, 2016-2026

6.6.10.3. Comparative market share analysis, 2018 & 2026

6.7. Asia-Pacific

6.7.1. Market size and forecast, by Type, 2016-2026

6.7.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.3. Market size and forecast, by country, 2016-2026

6.7.4. Comparative market share analysis, 2018 & 2026

6.7.5. China

6.7.5.1. Market size and forecast, by Type, 2016-2026

6.7.5.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.5.3. Comparative market share analysis, 2018 & 2026

6.7.6. Japan

6.7.6.1. Market size and forecast, by Type, 2016-2026

6.7.6.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.6.3. Comparative market share analysis, 2018 & 2026

6.7.7. India

6.7.7.1. Market size and forecast, by Type, 2016-2026

6.7.7.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.7.3. Comparative market share analysis, 2018 & 2026

6.7.8. Australia

6.7.8.1. Market size and forecast, by Type, 2016-2026

6.7.8.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.8.3. Comparative market share analysis, 2018 & 2026

6.7.9. South Korea

6.7.9.1. Market size and forecast, by Type, 2016-2026

6.7.9.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.9.3. Comparative market share analysis, 2018 & 2026

6.7.10. Rest of Asia-Pacific

6.7.10.1. Market size and forecast, by Type, 2016-2026

6.7.10.2. Market size and forecast, by Vehicle Type, 2016-2026

6.7.10.3. Comparative market share analysis, 2018 & 2026

6.8. LAMEA

6.8.1. Market size and forecast, by Type, 2016-2026

6.8.2. Market size and forecast, by Vehicle Type, 2016-2026

6.8.3. Market size and forecast, by country, 2016-2026

6.8.4. Comparative market share analysis, 2018 & 2026

6.8.5. Brazil

6.8.5.1. Market size and forecast, by Type, 2016-2026

6.8.5.2. Market size and forecast, by Vehicle Type, 2016-2026

6.8.5.3. Comparative market share analysis, 2018 & 2026

6.8.6. Saudi Arabia

6.8.6.1. Market size and forecast, by Type, 2016-2026

6.8.6.2. Market size and forecast, by Vehicle Type, 2016-2026

6.8.6.3. Comparative market share analysis, 2018 & 2026

6.8.7. South Africa

6.8.7.1. Market size and forecast, by Type, 2016-2026

6.8.7.2. Market size and forecast, by Vehicle Type, 2016-2026

6.8.7.3. Comparative market share analysis, 2018 & 2026

6.8.8. Rest of LAMEA

6.8.8.1. Market size and forecast, by Type, 2016-2026

6.8.8.2. Market size and forecast, by Vehicle Type, 2016-2026

6.8.8.3. Comparative market share analysis, 2018 & 2026

1. Company profiles

1.1. Robert Bosch GmbH

1.1.1. Business overview

1.1.2. Financial performance

1.1.3. Type portfolio

1.1.4. Recent strategic moves & developments

1.1.5. SWOT analysis

1.2. Continental AG

1.2.1. Business overview

1.2.2. Financial performance

1.2.3. Type portfolio

1.2.4. Recent strategic moves & developments

1.2.5. SWOT analysis

1.3. Denso Corp

1.3.1. Business overview

1.3.2. Financial performance

1.3.3. Type portfolio

1.3.4. Recent strategic moves & developments

1.3.5. SWOT analysis

1.4. First Sensor AG

1.4.1. Business overview

1.4.2. Financial performance

1.4.3. Type portfolio

1.4.4. Recent strategic moves & developments

1.4.5. SWOT analysis

1.5. Hella KGaA Hueck & Co.

1.5.1. Business overview

1.5.2. Financial performance

1.5.3. Type portfolio

1.5.4. Recent strategic moves & developments

1.5.5. SWOT analysis

1.6. Leddartech

1.6.1. Business overview

1.6.2. Financial performance

1.6.3. Type portfolio

1.6.4. Recent strategic moves & developments

1.6.5. SWOT analysis

1.7. Novariant, Inc.

1.7.1. Business overview

1.7.2. Financial performance

1.7.3. Type portfolio

1.7.4. Recent strategic moves & developments

1.7.5. SWOT analysis

1.8. Phantom Intelligence

1.8.1. Business overview

1.8.2. Financial performance

1.8.3. Type portfolio

1.8.4. Recent strategic moves & developments

1.8.5. SWOT analysis

1.9. Quanergy Systems, Inc.

1.9.1. Business overview

1.9.2. Financial performance

1.9.3. Type portfolio

1.9.4. Recent strategic moves & developments

1.9.5. SWOT analysis

1.10. Velodyne LiDAR, Inc.

1.10.1. Business overview

1.10.2. Financial performance

1.10.3. Type portfolio

1.10.4. Recent strategic moves & developments

1.10.5. SWOT analysis

Light detection and ranging (LiDAR) is a vital sensing technology for enabling autonomous cars and vehicles. LiDAR uses a pulsed laser to detect angle, velocity, and distance with high precision. LiDAR can sense lane markings, classify objects, and can be also used to correctly position an autonomous vehicle.

The Research Dive published blog states that when compared with the conventional methods, automotive LiDAR sensors have made the inspection, mapping, and detection of objects easier. Precise and accurate data points can be delivered with laser light in short time. This sensor also has an ability to provide 3D scanning of images and extremely accurate data in a shorter time.

Trends and Recent Developments in Automotive LiDAR Sensors

In order to be beneficial for autonomous driving, automotive LiDAR sensor has to swoop the environment to build a useable 3D map. A LiDAR technology company, Velodyne has two different technologies for producing a 3D map. Surround View is one platform which achieves a 360-degree view around the sensor. This platform uses a solid-state LiDAR electronic engine, which is basically rotated on a spindle.

The other platform of Velodyne is Vellaray, which is an embeddable small form factor. This platform uses frictionless beam steering, which can be swept in two axes. However, as its field of view is limited to 120o in the horizontal plane, it is not physically rotated.

The resolution of modern automotive LiDAR sensor is good enough to differentiate between various objects. Besides distance, LiDAR sensor can also examine the reflectivity of an object. In stop signs, the background is in red and the word “stop” is in white. Thus, by the virtue of reflectivity, the LiDAR system can determine its nature and just not the presence of a sign. The lane markings are also more reflective than the road signs

The next generation of LiDAR system is now being developed and commercialized by Veoneer for automotive application using scalable auto-grade automotive LiDAR sensor and 3D software technology of Velodyne. Both companies will contribute technologies, key components, know-how, and other logical property that is required to improve the next generation of high performance and affordable LiDARs for the automotive market.

Hence, automotive LiDAR sensor provides a view of the world independent of radar and cameras. Although, cameras and radar cannot be replaced. As a backup, there will always be a necessity for a redundant sensor modality in cases where the LiDAR sensor fails.

Forecast Analysis of Automotive LiDAR Sensor Market

Global automotive LiDAR sensor market is anticipated to witness a progressive growth during the forecast period from 2019 to 2026. The improved automated processing ability of automotive LiDAR sensors in terms of data processing capabilities and image resolutions is a major factor that is presently driving the market growth. However, the high cost of the system owing to low demand will restraint the market growth. The requirement of LiDAR sensor is likely to increase in the future, which will reduce the cost restraint.

Rapid growth advancements in autonomous vehicles all over the globe is projected to escalate the growth of global market in the coming years. As per the Research Dive statistics of research report, the global automotive LiDAR sensor market is anticipated to rise at a CAGR of 39.0% during the forecast period. The top gaining players of the global market are adopting various strategies such as mergers, product

development, acquisitions, and joint ventures to upsurge the growth of the global market.

In the next few years, ADAS and autonomous cars are poised to become standard technologies, which will further increase the need for improved sensing technologies. Automotive LiDAR sensor is becoming increasingly sophisticated and will be a major partner in automotive sensing along with radar and cameras.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com