Antiviral Therapies Market Report

RA00078

Antiviral Therapies Market, by Drug Type (Herpes Antiviral Drugs, Hepatitis Antiviral Drugs, HIV Antiviral Drugs, Influenza Antiviral Drugs, Others), Distribution Channel (Hospital Pharmacy, Independent Pharmacy & Drug Stores, Online Pharmacy), Regional Analysis (North America, Europe, Asia-Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

According to a new study conducted by Research Dive, the global antiviral therapies market size will reacha bout $66,016.5 million till 2027, at a CAGR of 3.1%, increasing from $51,913.1 million in 2019.North America has dominated the global market share and is anticipated to account for $19,131.6 million by 2027. Asia-Pacific is expected to risevastly and is predicted to generate a revenue of $17,718.8 million by 2027.

COVID-19 Impact on Global Antiviral Therapies Market:

In the previous decades, the global antiviral therapies market has experienced a significant growth owing to increasing HIV prevalence as well as rising viral infections in the forecast period. In addition, the COVID-19 emergency period has had a positive impact on the global antiviral therapies market growth in 2020. This growth is majorly owing to rising R&D activities to find suitable antiviral drug for the coronavirus treatment. Furthermore, some of the manufacturers are following various tactics such as new technology introduction to gain a strong position in the global market. For instance, in January 2020, Johnson & Johnson Services, Inc. launched a multi-pronged response to the novel COVID-19 outbreak. As part of this project, the company has started efforts to design and develop an effective vaccine candidate to fight against 2019-nCoV and collaborated with other players to screen an antiviral therapies library. Further, the company aims to identify suitable compounds with high antiviral activity against COVID-19 virus to deliver immediate solution for the ongoing outbreak. This aspect is estimated to fuel the market growth in the crisis period.

Increasing demand for antiviral drugs in HIV treatment and growing prevalence of viral infections are the major drivers for the growth of the antiviral therapies market

Antiviral is a class of medication that is used to treat viral infections as well as minimize viruses’ reproduction. Antivirals can cure viral infections like hepatitis C and herpes. Rising utilization of antiviral drugs because of growing prevalence of viral infections and rise in use of antivirals in HIV treatment will significantly drive the growth of the market in the forecast years. According to WHO, about 71 million people have hepatitis C viral infection where the patient develops cirrhosis or liver cancer. This aspect is estimated to upsurge the demand for antiviral drugs and is predicted to fuel the market growth in the forecast years. Further, according to Centers for Disease Control and Prevention (CDC), around 13.1 million people were affected with flu in 2019 and antiviral therapies cured about 90% of the population. These aspects are projected to fuel the market growth in the coming years.

To know more about antiviral therapies market drivers, get in touch with our analysts here.

High cost of antiviral therapies is a major restraint for the growth of the antiviral therapies market

The process of launching novel antiviral drugs from developing stage to laboratory testing to experimental trials to manufacturing is lengthy one. Also, the price associated with the antiviral medicine’s development is very huge; these aspects are estimated to hamper the growth of the market in the forecast timeframe.

Incorporation of nanotechnology is a significant investment opportunity for the growth of the antiviral therapies market

In recent years, the incorporation of nanotechnology into antiviral drugs design and development to manufacture innovative and cost-effective drugs that will treat viral infections has been on a rise. This factor is predicted to generate huge opportunities for the market growth in the coming years. This growth is significantly owing to nanotechnology being one of the mostly capable technologies in the antiviral drugs development because of its capability to handle several viral infections effectively.

To know more about antiviral therapies market drivers, get in touch with our analysts here.

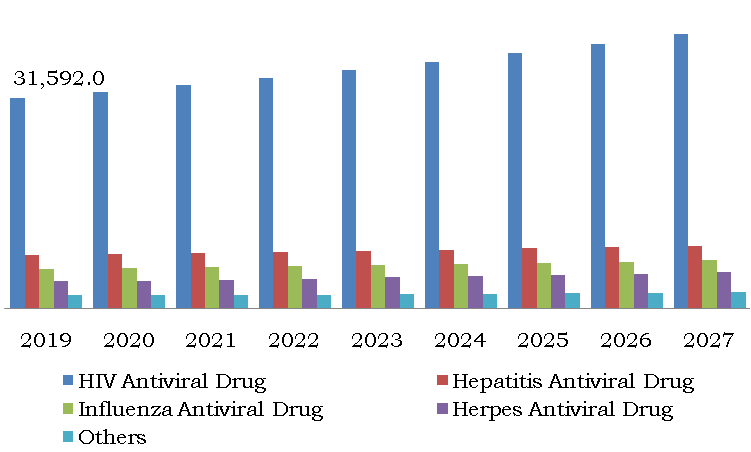

HIV antiviral drug registered for majority of the market share in 2019

Source: Research Dive Analysis

HIV antiviral drug sub-segment accounted for largest share of the antiviral therapies market in 2019, which was 60.9% and is estimated to continue its rise in the forecast time. Rise in the prevalence of HIV cases is anticipated to be the major enhancing factor for the sub-segment market growth in the estimated period. According to UNAIDS, in 2019, about 38 million people in the world were suffering from HIV, of which 36.2 million were adults and rest were children below 15 years of age. This factor is directly increasing the demand for HIV antiviral drugs in the forecast time.

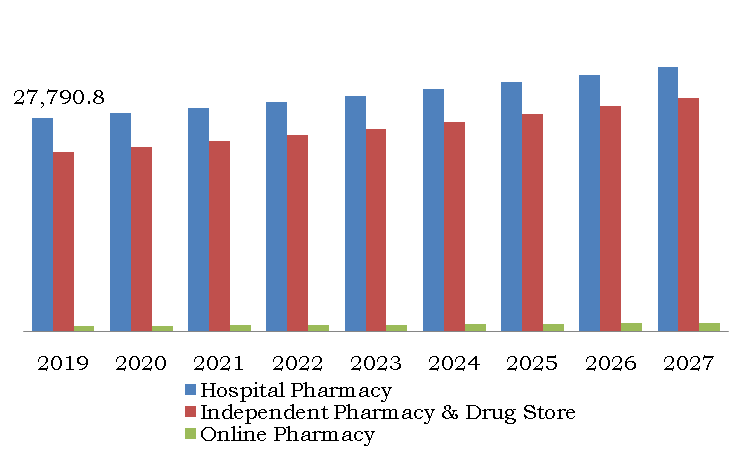

Hospital pharmacy sub-segment held a significant market share in 2019

Source: Research Dive Analysis

The market for hospital pharmacy held a significant antiviral therapies market size; it was valued at $27,790.8 million in 2019 and is predicted to rise at a 2.8% CAGR in the projected period. Increasing geriatric population and aging population is predicted to drive the hospital pharmacy sub-segment market in the estimated period. Hospital pharmacies will provide quality medicines to patients by purchasing directly from manufacturers thus avoiding the problem of fake medicines along with easy availability of the drugs, which is predicted to fuel the market growth in the forecast period.

North America market accounted significant market share in 2019

North America region accounted the highest antiviral therapies market size in 2019; it was about $15,636.2 million and is estimated to continue its steady growth over the global industry throughout the forecast time. Rising geriatric population and growth in viral infection across American countries have led to an augment in the demand of antiviral drugs, which is estimated to drive the region market size in the forecast period. As per WebMD, every year, about 3% to 11% of U.S. population is affected from influenza and about 5% to 20% people suffer with flu. Further, swift growth in the R&D activities by the prominent pharmaceutical companies to develop innovative antiviral drugs to meet patient requirements is estimated to create huge growth opportunity for the North America market in the analysis period.

To know more about antiviral therapies market drivers, get in touch with our analysts here.

Major Players in the Global Antiviral Therapies Market:

Source: Research Dive Analysis

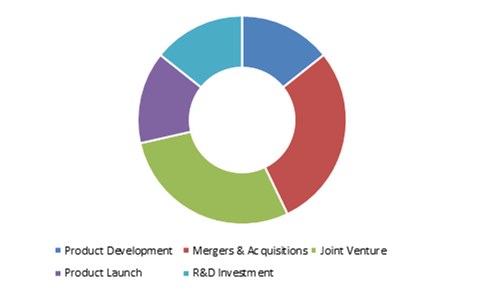

The major antiviral therapies market players include GlaxoSmithKline plc, Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb Company, Abbott, AstraZeneca, AbbVie Inc., Aurobindo Pharma, Merck & Co., Inc., and Johnson & Johnson Services, Inc. These players are focusing on organic and inorganic progressiontacticsincludejoint ventures, geographical expansions, and new technology launches to strengthen their presence in the overall market.

Porter’s Five Forces Analysis for Antiviral Therapies Market:

- Bargaining Power of Suppliers: This market has of high number suppliers and the price difference between suppliers expected to be high, delivering high selling power. Thereby, the bargaining power of suppliers is HIGH.

- Bargaining Power of Consumers: Antiviral therapies market has high concentration of consumers, and price of antiviral therapies products is high, resulting in HIGH negotiating power of the consumers.

- Threat of New Entrants: Huge spending is required for developing of antiviral drugs and rising consumer demand is creating huge investment opportunities, resulting in MODERATE threat of new participants.

- Threat of Substitutes: The availability of substitute products and consumers shifting to substitutes due to high price of antiviral drugs will result in MODERATE threat of substitutes.

- Rivalry Among Market Players: Antiviral therapies market has high number of key manufacturers. These key manufacturers are underlining on product launch and investments to fortify their position in overall marketplace,delivering HIGH rivalry among the market participants.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Drug Type

|

|

| Segmentation by Distribution Channel |

|

| Key Countries covered | U.S., Canada, Germany, UK, Italy, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil,Argentina, GCC and Saudi Arabia |

| Key Companies Profiled |

|

Q1. What is the size of Antiviral Therapies market?

A. The global Antiviral Therapies market size was over $51,913.1million in 2019 and is further anticipated to reach $66,016.5 million by 2027.

Q2. Who are the leading companies in the Antiviral Therapies market?

A. Johnson & Johnson Services, Inc., Abbott, AstraZeneca, GlaxoSmithKline plc and Gilead Sciences, Inc. are some of the key players in the global Antiviral Therapies market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific antiviral therapies market is anticipated to grow at 4.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and partnership are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Johnson & Johnson Services, Inc., AbbVie Inc., GlaxoSmithKline plc and Gilead Sciences, Inc. are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data drug types

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Drug type trends

2.3.Distribution channel trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Antiviral Therapies Market, by Drug Type

4.1.HIV Antiviral Drug

4.1.1.Market size and forecast, by region, 2019 - 2027

4.1.2.Comparative market share analysis, 2019 & 2027

4.2.Hepatitis Antiviral Drug

4.2.1.Market size and forecast, by region, 2019 - 2027

4.2.2.Comparative market share analysis, 2019 & 2027

4.3.Influenza Antiviral Drug

4.3.1.Market size and forecast, by region, 2019 - 2027

4.3.2.Comparative market share analysis, 2019 & 2027

4.4.Herpes Antiviral Drug

4.4.1.Market size and forecast, by region, 2019 - 2027

4.4.2.Comparative market share analysis, 2019 & 2027

4.5.Others

4.5.1.Market size and forecast, by region, 2019 - 2027

4.5.2.Comparative market share analysis, 2019 & 2027

5.Antiviral Therapies Market, by Distribution channel

5.1.Hospital Pharmacy

5.1.1.Market size and forecast, by region, 2019 - 2027

5.1.2.Comparative market share analysis, 2019 & 2027

5.2.Independent Pharmacy & Drug Store

5.2.1.Market size and forecast, by region, 2019 - 2027

5.2.2.Comparative market share analysis, 2019 & 2027

5.3.Online Pharmacy

5.3.1.Market size and forecast, by region, 2019 - 2027

5.3.2.Comparative market share analysis, 2019 & 2027

6.Antiviral Therapies Market, by Region

6.1.North America

6.1.1.Market size and forecast, by drug type, 2019 - 2027

6.1.2.Market size and forecast, by distribution channel, 2019 - 2027

6.1.3.Market size and forecast, by country, 2019 - 2027

6.1.4.Comparative market share analysis, 2019 & 2027

6.1.5.U.S.

6.1.5.1.Market size and forecast, by drug type, 2019 - 2027

6.1.5.2.Market size and forecast, by distribution channel, 2019 - 2027

6.1.5.3.Comparative market share analysis, 2019 & 2027

6.1.6.Canada

6.1.6.1.Market size and forecast, by drug type, 2019 - 2027

6.1.6.2.Market size and forecast, by distribution channel, 2019 - 2027

6.1.6.3.Comparative market share analysis, 2019 & 2027

6.1.7.Mexico

6.1.7.1.Market size and forecast, by drug type, 2019 - 2027

6.1.7.2.Market size and forecast, by distribution channel, 2019 - 2027

6.1.7.3.Comparative market share analysis, 2019 & 2027

6.2.Europe

6.2.1.Market size and forecast, by drug type, 2019 - 2027

6.2.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.3.Market size and forecast, by country, 2019 - 2027

6.2.4.Comparative market share analysis, 2019 & 2027

6.2.5.Germany

6.2.5.1.Market size and forecast, by drug type, 2019 - 2027

6.2.5.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.5.3.Comparative market share analysis, 2019 & 2027

6.2.6.UK

6.2.6.1.Market size and forecast, by drug type, 2019 - 2027

6.2.6.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.6.3.Comparative market share analysis, 2019 & 2027

6.2.7.France

6.2.7.1.Market size and forecast, by drug type, 2019 - 2027

6.2.7.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.7.3.Comparative market share analysis, 2019 & 2027

6.2.8.Spain

6.2.8.1.Market size and forecast, by drug type, 2019 - 2027

6.2.8.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.8.3.Comparative market share analysis, 2019 & 2027

6.2.9.Italy

6.2.9.1.Market size and forecast, by drug type, 2019 - 2027

6.2.9.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.9.3.Comparative market share analysis, 2019 & 2027

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by drug type, 2019 - 2027

6.2.10.2.Market size and forecast, by distribution channel, 2019 - 2027

6.2.10.3.Comparative market share analysis, 2019 & 2027

6.3.Asia Pacific

6.3.1.Market size and forecast, by drug type, 2019 - 2027

6.3.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.3.Market size and forecast, by country, 2019 - 2027

6.3.4.Comparative market share analysis, 2019 & 2027

6.3.5.China

6.3.5.1.Market size and forecast, by Product, 2019 - 2027

6.3.5.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.5.3.Comparative market share analysis, 2019 & 2027

6.3.6.India

6.3.6.1.Market size and forecast, by drug type, 2019 - 2027

6.3.6.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.6.3.Comparative market share analysis, 2019 & 2027

6.3.7.Japan

6.3.7.1.Market size and forecast, by drug type, 2019 - 2027

6.3.7.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.7.3.Comparative market share analysis, 2019 & 2027

6.3.8.Australia

6.3.8.1.Market size and forecast, by drug type, 2019 - 2027

6.3.8.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.8.3.Comparative market share analysis, 2019 & 2027

6.3.9.South Korea

6.3.9.1.Market size and forecast, by drug type, 2019 - 2027

6.3.9.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.9.3.Comparative market share analysis, 2019 & 2027

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by drug type, 2019 - 2027

6.3.10.2.Market size and forecast, by distribution channel, 2019 - 2027

6.3.10.3.Comparative market share analysis, 2019 & 2027

6.4.LAMEA

6.4.1.Market size and forecast, by drug type, 2019 - 2027

6.4.2.Market size and forecast, by distribution channel, 2019 - 2027

6.4.3.Market size and forecast, by country, 2019 - 2027

6.4.4.Comparative market share analysis, 2019 & 2027

6.4.5.Latin America

6.4.5.1.Market size and forecast, by drug type, 2019 - 2027

6.4.5.2.Market size and forecast, by distribution channel, 2019 - 2027

6.4.5.3.Comparative market share analysis, 2019 & 2027

6.4.6.Middle East

6.4.6.1.Market size and forecast, by drug type, 2019 - 2027

6.4.6.2.Market size and forecast, by distribution channel, 2019 - 2027

6.4.6.3.Comparative market share analysis, 2019 & 2027

6.4.7.Africa

6.4.7.1.Market size and forecast, by drug type, 2019 - 2027

6.4.7.2.Market size and forecast, by distribution channel, 2019 - 2027

6.4.7.3.Comparative market share analysis, 2019 & 2027

7.Company profiles

7.1.GlaxoSmithKline plc

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Gilead Sciences, Inc.

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.F. Hoffmann-La Roche Ltd

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.Bristol-Myers Squibb Company

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Abbott

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.AstraZeneca

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.AbbVie Inc.

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.Aurobindo Pharma

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Merck & Co., Inc.

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.Johnson & Johnson Services, Inc.

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

Antiviral therapies involve the usage of drugs for treating diseases caused by viruses only. Most antiviral therapies target specific viruses, but a broad-spectrum antiviral is effective against several viruses. Antiviral drugs inhibit the development of the viruses instead of eliminating them. Antiviral drugs are capable of entering infected cells of the human body and act against the virus and prevent the disease from spreading. Some of the common drugs used in antiviral therapies are amantadine, zanamivir, rimantadine, oseltamivir, ribavirin, and peramivir.

Forecast Analysis of Antiviral Therapies Market

The antiviral therapies market is predicted to grow significantly in the upcoming years due to the augmented usage of antiviral drugs and high rate of viral infections prevailing in today’s time. For instance, according to an article published on WHO (World Health Organization) website, there are almost 390 million cases of dengue infections per year. In addition, the dengue cases reported to WHO seem to have enhanced over eight-fold from the last two decades, from 505,430 patients in 2000 to 2.4 million in 2010, followed by 4.2 million in 2019. Many other viral infections such as HIV or Hepatitis C too have risen in the recent years. These factors pave way for antiviral therapies at a higher rate, thus increasing the global market share.

In another study conducted by CDC (Center for Disease Control), approximately 13.1 million were infected with flu in 2019 and antiviral drugs have proven to be useful in curing 90% of the people infected with the flu. Such examples directly indicate that the antiviral therapies market is expected to boost in the recent years. However, the lengthy process of preparing antiviral drugs and cost associated with it is anticipated to restrain the market growth in the upcoming years. On the other hand, utilization of nanotechnology in the development of cost effective and efficient drugs is likely to create opportunities for the market in the upcoming years. According to a newest report published by Research Dive, the global antiviral therapies market is expected to upsurge with a healthy CAGR of 3.1% from 2020 to 2027. Furthermore, the North American market is projected to witness rapid growth in the recent years due to a substantial rise in the geriatric population.

Latest Developments of the Antiviral Therapies Market

The leading players of the global antiviral therapies market are basically opting for out of the box strategies such as mergers & acquisitions, new product announcements, building product portfolios, fund raising for developments, and financing in research & development projects. These strategies are helping the companies in gaining edge in the global market.

In October 2020, the FDA (U.S. Food and Drugs Administration) approved an antiviral drug called as Veklury (remdesivir) which is developed by Gilead Sciences, Inc., a biotechnology company. This drug helps in the treatment of hospitalized Covid-19 patients by stopping the replication of SARS-CoV-2 virus. This drug is the first of its kind that has been approved by the FDA in the United States of America.

In August 2020, Abbott, a medical device company, revealed a new antiviral drug - ‘Favipiravir’ which has been approved under the emergency conditions of Covid-19 pandemic. Moreover, Abbott has also launched two tests, namely, SARS-CoV-2 EUA test for infectious diseases and Abbott SARS-CoV-2 IgG test for large-scale antibody testing.

In August 2020, Dr. Reddy’s laboratories, a generic drug maker, launched the antiviral drug Avigan (favipiravir) which is manufactured by Fujifilm Toyama Chemical Co, a pharmaceutical company, for the treatment of mild to moderate Covid-19 disease.

In July 2020, Glenmark Pharmaceuticals, a research based global pharmaceutical company, has launched an antiviral drug named Favipiravir under the brand name ‘FabiFlu’ for the treatment of mild to moderate Covid-19 infection.

Covid-19 Impact on the Antiviral Therapies Market

The global antiviral therapies market is estimated to enhance significantly during the Covid-19 pandemic due to rise in usage of antiviral drugs for treating Covid-19 patients. Moreover, the growth is also attributed to increase in research & development activities for producing a suitable medicine for the treatment of coronavirus disease. For instance, in January 2020, Johnson & Johnson Services, Inc. a healthcare products company launched a project for responding against the Covid-19 pandemic. Under this project, the company is developing a vaccine candidate to tackle 2019-nCoV and also partnering with other key players for screening the antiviral therapies library.

Future Scope of the Market

The antiviral therapies market has reached a significant height due to the outbreak of the Covid-19 disease. This upsurge in the market is anticipated to linger for a long time in the forthcoming years due to prevalence of other viral infections such as HIV or dengue. This market has tremendous scope in the future as the viruses will probably never stop attacking the human race.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com