Rodent Control Market Report

RA08358

Rodent Control Market by Type (Products and Services), Technique (Chemical, Mechanical, Biological, and Others), Application (Residential, Commercial, Industrial, and Agriculture), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Rodent Control Market Analysis

The global rodent control market accounted for $3,209.8 million in 2020 and is predicted to grow with a CAGR of 4.9%, by generating a revenue of $4,659.7 million by 2028.

Market Synopsis

Rodent control market is gaining huge popularity owing to growing popularity of clean quality of living as most of the pests such as rodents, mosquitoes, and ticks are the carriers of infectious diseases. For instance, rats and mice can carry plague, hantavirus, and pulmonary syndrome which can be fatal for humans. Also, rodents can infest your bedrooms and kitchens by leaving feces on or near your food. Hence, rodent control is necessary to ensure safety and to maintain good health.

However, there are some disadvantages associated with the use of trapping rodent control methods such as the use of snap traps or live traps. For instance, snap traps can kill only one animal at a time, and it is useful for small scale industries. Similarly, in live traps, only few animals are captured and there is a need to kill the captured animals, for example, the rodents which is anticipated to restrain the market growth during the forecast period.

Latest developments in rodent control technologies that offer wide-options for dealing with rodents to generate excellent growth opportunities. For instance, electronic rodent monitoring (ERM) is a digital device that detects rodents, collects the data, and provides notification via sensors that are installed on this device. This device automatically monitors and reports the rodent entry which alerts the user or the facility regarding capture. This technology is becoming more popular in food facilities and is an innovative addition to pest management services.

According to regional analysis, the North America rodent control market accounted for $1,596.2 million in 2020 and is predicted to grow with a CAGR of 5.2% in the projected timeframe.

Rodent Control Overview

Rodents include the animals like rats, mice, moles, and squirrels. Rodent control includes carefully and strategically controlling the rats and mice by trapping or baiting. Rodent control is necessary as mice and rats are prolific breeders and uncontrolled rats and mice population can lead to disaster, and it becomes difficult to get rid of them. Rodent control safely removes these animals from your home that can lead to severe health issues and can cause property damage.

COVID-19 Impact on the Rodent Control Market

The global crisis and uncertainties led by COVID-19 pandemic led to severe impact on various industries. However, rodent control market which comes under pest control was deemed to be an essential service. Owing to this, the COVID-19 impact on rodent control market was neutral. Also, during this critical time, growing hygiene concerns to ensure the health & food safety had a positive impact on rodent control market demand. If left untreated, rodents can infest your property causing negative impact even on your health. In addition, the demand for rodent control products and services was high after the first lockdown. This is because rodents had become a huge problem for domestic and commercial businesses as everything was shut owing to lockdown restrictions across various countries. To meet the growing demand, various measures were taken by rodent control service providers such as the use of personal protective equipment (PPE) to prevent the spread of coronavirus. All these factors have led to positive impact on rodent control market size during the pandemic.

Various companies operating in rodent control market have implemented various measures to deal with the COVID-19 pandemic. For instance, Rollins, leading company in pest control, provided their employees and technicians who interact with customers with disposable protective equipment (PPE). These PPE products include gloves, shoe covers, masks, and protective outwear. Such initiatives ensure the safety and well-being of employees and customers. Also, the company employees were eligible for paid time off (PTO) for emergency leave during the pandemic.

Rapid Urbanization, Globalization, and Economic Growth to Drive the Market Growth

The world population is growing rapidly especially in urban areas and large cities. Also, by 2030, the global population in cities is estimated to account for 60%. Owing to this, pests such as rodents can spread faster in densely populated areas which increases the spreading rates owing to increase in prevalence of pests. Also, rapid globalization such as increased travel or trade of goods is a major factor that leads to spread of pests. In addition, economic growth has led to rise in disposable income and growing middle-class population has increased the demand for pest control services such as rodent control. This is because increase in the middle class population is a substantial driver for volume as well as price increase. In addition, as stated in October 2021, by SenesTech, Inc., popular pest control company, nearly 20% of the global stored food supply is destroyed due to rident consumption and contamination. Also, rodents such as rats and mice have caused enormous health issues during the COVID-19 pandemic as well as during the plague outbreaks. All these factors are anticipated to drive the rodent control market share during the analysis timeframe.

To know more about global rodent control market drivers, get in touch with our analysts here.

Regulations on the Use of Chemical-based Rodent Control Techniques to Restrain the Market Growth

Increasing regulations regarding the use of pesticides including rodent control products, import-export, manufacture, sale, and transport that can pose health risks to human and animal are anticipated to restrain the market growth. For instance, in India, all the insecticides have to undergo registration process with Central Insecticides Board & Registration Committee (CIB & RC) before they can be used or sold.

Technological Advancements and the Launch of Effective Rodent Control Technologies to Generate Excellent Opportunities

The leading companies operating in the rodent control market have come up with new technologies and products for enhanced rodent control. For instance, Bayer, the German multinational company, launched its Rodent Monitoring System in March 2020, which has small, sleek design and can fit into multiple bait stations. This upgraded system can count the bait station activity as an alternative to immediate alerts. This helps in producing activity heat maps that helps in analyzing the exterior rodent pressure that relates to the bait consumption. In addition, Bell Laboratories, the U.S.-based scientific development company, launched Fastrac Soft Bait in March 2020. Fastrac Soft Bait is an acute rodenticide that has oil-based formulation with a precise balance between saturated and unsaturated fats. Due to this, this rodenticide does not freeze in cold climates. These formulations help to knock down rodent infestations, require less bait, and are more effective compared to anticoagulants. This is because rodents consume less lethal dose in single night’s feeding thereby reducing the amount of bait required to achieve the control.

To know more about global rodent control market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Products and services. Among these, the Products sub-segment accounted for the highest revenue share in 2020 and services sub-segment is anticipated to show fastest growth during the forecast period. Download PDF Sample ReportRodent Control Market

By Type

Source: Research Dive Analysis

The products sub-type is anticipated to have a dominant market share and generate a revenue of $2,796.8 million by 2028, growing from $1,878.6 million in 2020. Rodent control products include snap trap, electronic trap, glue trap, rodenticides, and others. Rodent control products are gaining huge popularity as these products allow us in gaining the effectiveness of the treatment. For instance, the traps offer visual confirmation of captured rodent and reduce the need for rodenticides that are toxic and can pose threat to pets and children upon exposure. Also, electronic trap is a battery-powered trap that kills the rodents quickly via electric shock. This trap can kill both mice and rats. For instance, Ensystex, the popular pest control operator, offers Rodenthor line of products that includes soft bait, block bait, snap traps, and rat bait stations. These baits comprise of single-feeding active ingredient bromadiolone at a concentration of .005% and advanced anticoagulant. This can be used across industrial, residential, commercial, agricultural, public buildings, and manmade structures.

The services sub-type is anticipated to show the fastest growth and generate a revenue of $1,862.9 million by 2028, growing from $1,331.2 million in 2020. Rodent control services have shown significant growth in recent years as they keep your home safe and free from rodents. This is because rodent control services prevent the damage to your belongings and property. The leading companies namely Terminix, Orkin, Aptive, Hawx, and others offer excellent pest control services which also include rodent control. For instance, Terminix, the leading pest control company with more than 90 years of experience in pest control services, serves around 2.8 million residential and commercial customers globally. Some of the key features of their pest control and rodent control service include real-time chat function, ease offered by online customer service, and general as well as special pest control services.

Rodent Control Market

By TechniqueBased on technique, the market has been divided into Chemical, mechanical, biological, and others. Among these, the Chemical sub-segment accounted for the highest revenue share in 2020 and it is estimated to show the fastest growth during the forecast period.

Source: Research Dive Analysis

The chemical sub-segment is anticipated to have a dominant market share and generate a revenue of $1,900.1 million by 2028, growing from $1,237.9 million in 2020. The chemical rodent control techniques can destroy the rodents, control their activity, and can prevent them from causing damage. These techniques involve the use of various chemical-based products such as rodenticides that are used to kill the rodents. Most of the rodenticides are easy-to-use and effective. They are cost-effective and single dose can kill the rodent, thereby controlling the infestation faster. For instance, the rodenticides namely Fast-KillⓇ Brand Disposable or Refillable Bait Station are ready to use rodenticides that save your time and help in overcoming the mice and rat problem. Gloves are also included with these rodenticides that keep you safe.

Rodent Control Market

By End UserBased on end-user, the market has been segmented into Residential, commercial, industrial, and agriculture. Among these, the Residential sub-segment accounted for the highest revenue share in 2020 and it is estimated to show the fastest growth during the forecast period.

Source: Research Dive Analysis

The residential sub-segment is anticipated to have a dominant market share and generate a revenue of $1,701.5 million by 2028, growing from $1,097.3 million in 2020. Rodent control methods are widely used across residential sector as the rodents like mice and rats cause property damage and transmit the disease. Most of the rodent species seek shelter indoors especially during winters. They can put your home at risk as gnawing of rodents through electric wires can cause fire. Also, these rodents serve as a vector for various parasites and bacteria such as salmonella which is commonly found on the bodies of rats and mice that contaminate kitchen equipment and food sources. In addition, the white-footed deer mouse can transmit potentially hazardous hantavirus. Thus, rodent control & management at residential places is important to stay away from fatal diseases.

Rodent Control Market

By RegionThe rodent control market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Rodent Control in North America to be the Most Dominant

The North America rodent control market accounted $1,596.2 million in 2020 and is projected to grow with a CAGR of 5.2%. Pest control which also includes rodent control is an important industry in the U.S. as it ensures health & safety of people as well as industries that are infected by pests such as rodents. Stringent government regulations across North America towards increased hygiene standards leading to growing inspection and documentation especially related to food safety are anticipated to drive the North America rodent control market share. Also, restrictions on the use of residential rodenticides have directed majority of U.S. population towards qualified pest control and rodent control providers. Also, rapid digitalization has led to increase in the demand for digitally-enabled rodent control services. This is because the digitally-enabled rodent control services facilitate remote monitoring, service optimization, and promote efficiency & effectiveness.

The Market for Rodent Control in Asia-Pacific to Show the Fastest Growing

The Asia-Pacific rodent control market accounted $741.5 million in 2020 and is projected to grow with a CAGR of 5.4%. Growing population especially in developing countries such as India and China along with rapid urbanization that has led to migration of people from urban to rural areas has increased the demand for rodent control services. For instance, urbanization had resulted in overpopulated cities due to rapid infrastructure developments as well as industrial developments, which has led overpopulated cities. The food & shopping centers are the breeding grounds for pests and rodents. Hence, regular pest control practices must be implemented at these places. In addition, the integrated pest management services which focus on early detection and elimination of pests including rodents to prevent their emergence all together are gaining huge popularity in the Asia-Pacific region. Also, China and India being the largest producers of agricultural products, the demand for pest control services is high in this region.

Competitive Scenario in the Global Rodent Control Market

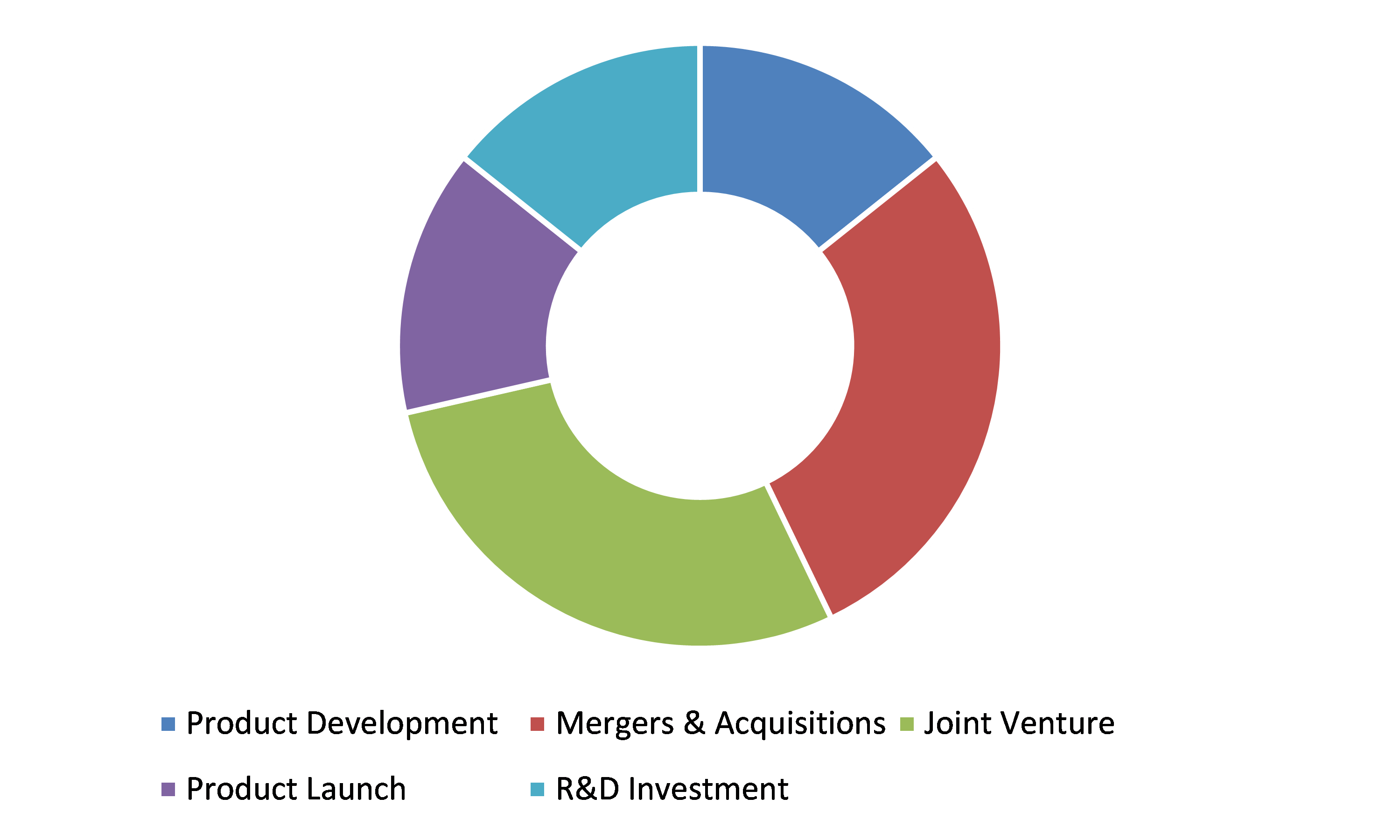

Product launch and business expansion are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading rodent control market players are Anticimex, BASF SE, Bayer AG, Rentokil Initial Plc, Ecolab Inc., Neogen Corporation, PelGar International, Rollins Inc., SenesTech Inc., and Syngenta AG.

Porter’s Five Forces Analysis for the Global Rodent Control Market:

- Bargaining Power of Suppliers: The companies operating in rodent control market buy various raw materials such as catalysts, solvents, and acidic or basic reagents from numerous suppliers. Thus, suppliers have bargaining power up to certain extent and can use their negotiating power to extract higher profits from the firm.

Thus, the bargaining power of suppliers is moderate. - Bargaining Power of Buyers: The bargaining power of buyers is high as the demand for rodent control is high especially across residential, commercial, industrial, and agriculture sector.

Thus, buyer’s bargaining power will be high. - Threat of New Entrants: The threat of new entrants is moderate as the companies operating in rodent control market bring innovation via new value propositions and low pricing strategy. However, rodent control industry is governed by various regulations to minimize the harmful impact of rodent control products such as rodenticides on humans and environment.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: The threat of substitute if low as there are no alternatives to rodent control products which include mechanical, chemical, biological, and sanitation practices.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry is high as the companies operating in this market offer both rodent control services as well as products. Also, owing to intense rivalry the product price decreases which in turn reduces the overall profitability.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Technique |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global rodent control market?

A. The size of the global rodent control market was over $3,209.8 million in 2020 and is projected to reach $4,659.7 million by 2028.

Q2. Which are the major companies in the rodent control market?

A. Anticimex, BASF SE, and Bayer AG are some of the key players in the global rodent control market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific rodent control market?

A. Asia-Pacific rodent control market is anticipated to grow at 5.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launch and business expansion are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Rentokil Initial Plc, Ecolab Inc., and Neogen Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Technique trends

2.4.End User trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Rodent Control Market, by Type

4.1.Products

4.1.1.Key market trends, growth factors, and opportunities

4.1.2.Market size and forecast, by region, 2020-2028

4.1.3.Market share analysis, by country, 2020 & 2028

4.2.Services

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country, 2020 & 2028

5.Rodent Control Market, by Technique

5.1.Chemical

5.1.1.Key market trends, growth factors, and opportunities

5.1.2.Market size and forecast, by region, 2020-2028

5.1.3.Market share analysis, by country, 2020 & 2028

5.2.Mechanical

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country, 2020 & 2028

5.3.Biological

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country, 2020 & 2028

5.4.Others

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country, 2020 & 2028

6.Rodent Control Market, by End User

6.1.Residential

6.1.1.Key market trends, growth factors, and opportunities

6.1.2.Market size and forecast, by region, 2020-2028

6.1.3.Market share analysis, by country, 2020 & 2028

6.2.Commercial

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2020-2028

6.2.3.Market share analysis, by country, 2020 & 2028

6.3.Industrial

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2020-2028

6.3.3.Market share analysis, by country, 2020 & 2028

6.4.Agriculture

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2020-2028

6.4.3.Market share analysis, by country, 2020 & 2028

7.Rodent Control Market, by Region

7.1.North America

7.1.1.Key market trends, growth factors, and opportunities

7.1.2.Market size and forecast, by Type, 2020-2028

7.1.3.Market size and forecast, by Technique, 2020-2028

7.1.4.Market size and forecast, by End User, 2020-2028

7.1.5.Market size and forecast, by country, 2020-2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2020-2028

7.1.6.2.Market size and forecast, by Technique, 2020-2028

7.1.6.3.Market size and forecast, by End User, 2020-2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2020-2028

7.1.7.2.Market size and forecast, by Technique, 2020-2028

7.1.7.3.Market size and forecast, by End User, 2020-2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2020-2028

7.1.8.2.Market size and forecast, by Technique, 2020-2028

7.1.8.3.Market size and forecast, by End User, 2020-2028

7.2.Europe

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by Type, 2020-2028

7.2.3.Market size and forecast, by Technique, 2020-2028

7.2.4.Market size and forecast, by End User, 2020-2028

7.2.5.Market size and forecast, by country, 2020-2028

7.2.6.Germany

7.2.6.1.Market size and forecast, by Type, 2020-2028

7.2.6.2.Market size and forecast, by Technique, 2020-2028

7.2.6.3.Market size and forecast, by End User, 2020-2028

7.2.7.UK

7.2.7.1.Market size and forecast, by Type, 2020-2028

7.2.7.2.Market size and forecast, by Technique, 2020-2028

7.2.7.3.Market size and forecast, by End User, 2020-2028

7.2.8.France

7.2.8.1.Market size and forecast, by Type, 2020-2028

7.2.8.2.Market size and forecast, by Technique, 2020-2028

7.2.8.3.Market size and forecast, by End User, 2020-2028

7.2.9.Italy

7.2.9.1.Market size and forecast, by Type, 2020-2028

7.2.9.2.Market size and forecast, by Technique, 2020-2028

7.2.9.3.Market size and forecast, by End User, 2020-2028

7.2.10.Spain

7.2.10.1.Market size and forecast, by Type, 2020-2028

7.2.10.2.Market size and forecast, by Technique, 2020-2028

7.2.10.3.Market size and forecast, by End User, 2020-2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2020-2028

7.2.11.2.Market size and forecast, by Technique, 2020-2028

7.2.11.3.Market size and forecast, by End User, 2020-2028

7.3.Asia Pacific

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by Type, 2020-2028

7.3.3.Market size and forecast, by Technique, 2020-2028

7.3.4.Market size and forecast, by End User, 2020-2028

7.3.5.Market size and forecast, by country, 2020-2028

7.3.6.China

7.3.6.1.Market size and forecast, by Type, 2020-2028

7.3.6.2.Market size and forecast, by Technique, 2020-2028

7.3.6.3.Market size and forecast, by End User, 2020-2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Type, 2020-2028

7.3.7.2.Market size and forecast, by Technique, 2020-2028

7.3.7.3.Market size and forecast, by End User, 2020-2028

7.3.8.India

7.3.8.1.Market size and forecast, by Type, 2020-2028

7.3.8.2.Market size and forecast, by Technique, 2020-2028

7.3.8.3.Market size and forecast, by End User, 2020-2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2020-2028

7.3.9.2.Market size and forecast, by Technique, 2020-2028

7.3.9.3.Market size and forecast, by End User, 2020-2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Type, 2020-2028

7.3.10.2.Market size and forecast, by Technique, 2020-2028

7.3.10.3.Market size and forecast, by End User, 2020-2028

7.3.11.Rest of Asia Pacific

7.3.11.1.Market size and forecast, by Type, 2020-2028

7.3.11.2.Market size and forecast, by Technique, 2020-2028

7.3.11.3.Market size and forecast, by End User, 2020-2028

7.4.LAMEA

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by Type, 2020-2028

7.4.3.Market size and forecast, by Technique, 2020-2028

7.4.4.Market size and forecast, by End User, 2020-2028

7.4.5.Market size and forecast, by country, 2020-2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Type, 2020-2028

7.4.6.2.Market size and forecast, by Technique, 2020-2028

7.4.6.3.Market size and forecast, by End User, 2020-2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Type, 2020-2028

7.4.7.2.Market size and forecast, by Technique, 2020-2028

7.4.7.3.Market size and forecast, by End User, 2020-2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Type, 2020-2028

7.4.8.2.Market size and forecast, by Technique, 2020-2028

7.4.8.3.Market size and forecast, by End User, 2020-2028

8.Company profiles

8.1.Anticimex

8.1.1.Company overview

8.1.2.Operating business segments

8.1.3.Product portfolio

8.1.4.Financial performance

8.1.5.Key strategy moves and development

8.2.BASF SE

8.2.1.Company overview

8.2.2.Operating business segments

8.2.3.Product portfolio

8.2.4.Financial performance

8.2.5.Key strategy moves and development

8.3.Bayer AG

8.3.1.Company overview

8.3.2.Operating business segments

8.3.3.Product portfolio

8.3.4.Financial performance

8.3.5.Key strategy moves and development

8.4.Rentokil Initial Plc

8.4.1.Company overview

8.4.2.Operating business segments

8.4.3.Product portfolio

8.4.4.Financial performance

8.4.5.Key strategy moves and development

8.5.Ecolab Inc.

8.5.1.Company overview

8.5.2.Operating business segments

8.5.3.Product portfolio

8.5.4.Financial performance

8.5.5.Key strategy moves and development

8.6.Neogen Corporation

8.6.1.Company overview

8.6.2.Operating business segments

8.6.3.Product portfolio

8.6.4.Financial performance

8.6.5.Key strategy moves and development

8.7.PelGar International

8.7.1.Company overview

8.7.2.Operating business segments

8.7.3.Product portfolio

8.7.4.Financial performance

8.7.5.Key strategy moves and development

8.8.Rollins Inc.

8.8.1.Company overview

8.8.2.Operating business segments

8.8.3.Product portfolio

8.8.4.Financial performance

8.8.5.Key strategy moves and development

8.9.SenesTech Inc.

8.9.1.Company overview

8.9.2.Operating business segments

8.9.3.Product portfolio

8.9.4.Financial performance

8.9.5.Key strategy moves and development

8.10.Syngenta AG

8.10.1.Company overview

8.10.2.Operating business segments

8.10.3.Product portfolio

8.10.4.Financial performance

8.10.5.Key strategy moves and development

Rodents are small mammals that have upper and lower pairs of ever-growing rootless incisor teeth, such as rats, mice, squirrels, moles, and many more. These rodents impart an important role in balancing the environment in fields and forests. Rodent control is a strategic method of controlling the access of rodents inside the homes of individuals by baiting or trapping. Rodent control is essential for homes because an uncontrolled population of rodents can cause harmful diseases, severe illnesses in humans.

Forecast Analysis of the Global Rodent Control Market

Rodents can spread faster in densely populated areas. With the increasing urbanization and globalization, the market is expected to see prominent growth in the coming years. Besides, the rising disposable incomes among individuals and the growing middle-class population have uplifted the demand for rodent control services, which is the factor expected to foster the growth of the market in the years to come. Moreover, the continuous technological advancements and launching of effective rodent monitoring systems by leading companies are expected to create expansive growth opportunities for the market in the future. However, the regulations on the use of chemical-based rodent control technologies may impede the growth of the market.

According to the report published by Research Dive, the global rodent control market is anticipated to generate a revenue of $4,659.7 million and grow at a healthy CAGR of 4.9% during the analysis timeframe from 2021-to 2028. The major players of the market include Neogen Corporation, Ecolab Inc., PelGar International, Rentokil Initial Plc., Rollins Inc., Bayer AG, SenesTech Inc., BASF SE, Syngenta AG, Anticimex, and many more.

Key Developments of the Global Rodent Control Market

The leading companies functioning in the industry are implementing several growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global rodent control market to grow exponentially.

For instance, in July 2021, Anticimex, a leading international modern pest control company, announced its collaboration with Novacura, a human-centric IT-company building powerful and user-friendly enterprise applications. With this collaboration, Novacura supported Anticimex to strengthen its organization with advanced technology, project management systems, and modern integration to reinforce customer satisfaction.

In October 2020, Bayer AG, a leading German multinational pharmaceutical and life sciences company, acquired Asklepios BioPharmaceutical, a leading clinical-stage adeno-associated virus (AAV) gene therapy company, focused on improving the lives of patients suffering from rare health disorders and diseases. With this acquisition, the companies aimed to develop and manufacture various gene therapies to treat neuromuscular, cardiovascular, and various metabolic diseases.

In October 2021, PICA Product Development, a leading U.S.-based company specializing in electronic and mechanical custom manufacturing services, launched the latest IoT solution named Rodent Recon, powered by the Skyhawk platform to monitor the rodent control traps with a remote. This is a cost-effective and user-friendly solution that can solve the problem of hard-to-reach locations for finding rodent traps. Rodent Recon can also be operated with a phone application to quickly solve the rodent issue in individuals' home.

Most Profitable Region of the Global Rodent Control Market

The Asia-Pacific region is predicted to hold the largest share of the market and is expected to grow at a CAGR of 5.4% during the estimated period. This is mainly due to the increasing population in the developing countries of this region, which results in rapid infrastructure and industrial developments. Moreover, the popularity of integrated pest management services in this region, which mainly focus on the early detection of rodents and preventing their emergence, is expected to drive the growth of the market.

Covid-19 Impact on the of the Rodent Control Market

The outbreak of the Covid-19 pandemic has devastated many industries. However, it has had a positive impact on the global rodent control market, owing to the growing hygiene concerns among people to ensure health and food safety. Furthermore, the increasing demand for the rodent control products and services such as personal protective equipment (PPE) which includes masks, shoe covers, gloves, and protective outwear, has effectively driven the growth of the market during the period of crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com