Lumpectomy Market Size Share Competitive Landscape And Trend Analysis Report Report

RA00829

Lumpectomy Market Size, Share, Competitive Landscape, and Trend Analysis Report by Product, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

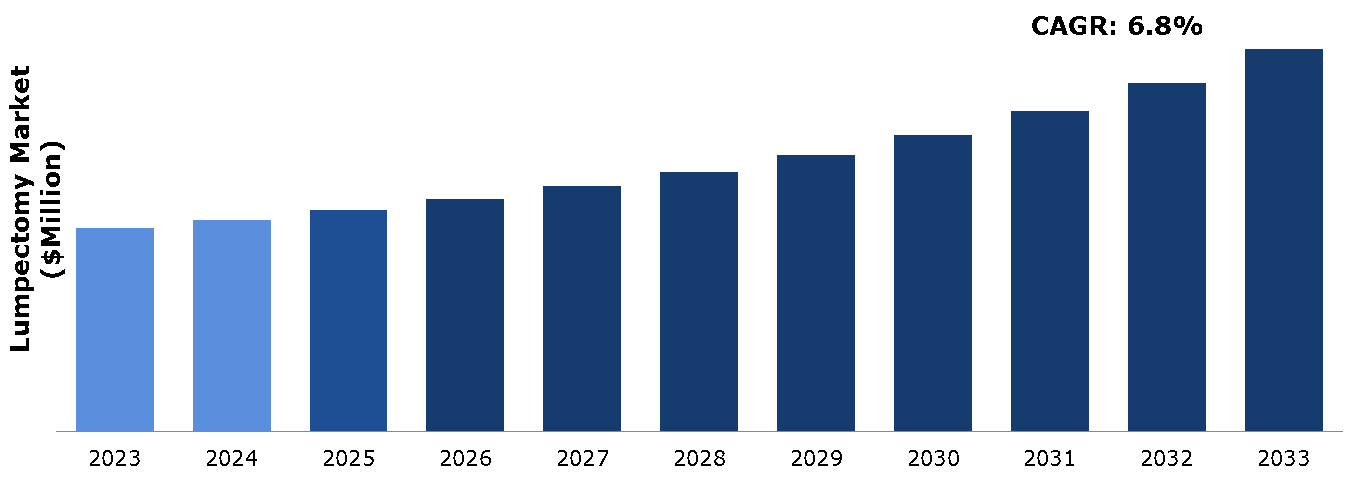

The lumpectomy market was valued at $1,658.8 million in 2023 and is estimated to reach $3,123.3 million by 2033, exhibiting a CAGR of 6.8% from 2024 to 2033.

Market Definition and Overview

Lumpectomy, also known as breast-conserving surgery or partial mastectomy, is a surgical procedure commonly used in the treatment of breast cancer. During a lumpectomy, the surgeon removes the tumor along with a margin of surrounding healthy tissue from the breast, aiming to preserve as much of the breast's appearance and function as possible while effectively treating the cancer. This approach contrasts with mastectomy, where the entire breast is removed. Lumpectomy is often followed by radiation therapy to further reduce the risk of cancer recurrence. It is a preferred option for many patients due to its potential for less physical and emotional impact compared to mastectomy.

Key Takeaways

- The lumpectomy market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major long term care industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In November 2021, AstraZeneca and Merck Sharpe & Dohme's joint application for Lynparza (Olaparib) gained Priority Review in the U.S. for adjuvant therapy in high-risk early breast cancer patients with BRCA mutations. This collaboration bolsters market positions and supplements lumpectomy procedures, providing a holistic approach to treating breast cancer.

- In May 2020, the Sarcoma Foundation of America (SFA) announced the distribution of $750,000 in research grants through its 2020 SFA Research Grant program. This effort addresses the pressing need for research funding in sarcoma, aligning with efforts to advance treatment options. By closing funding gaps, the foundation empowers scientists to explore innovative studies, potentially benefiting lumpectomy procedures and outcomes for patients with sarcoma.

Market Dynamics

The lumpectomy market growth is driven by various factors such as the rising preference among patients for breast-conserving surgeries. This trend is boosted by the desire for better cosmetic outcomes and reduced emotional impact compared to more invasive options like mastectomies. Patients value the preservation of their breast tissue and appearance, which lumpectomies offer while effectively treating breast cancer. In addition, advancements in surgical techniques and technologies have enhanced the success rates and safety of lumpectomies, further encouraging their adoption. This preference highlights a shift towards patient-centered care and contributes significantly to the continued growth of the lumpectomy market.

Surgical complications is a significant factor projected to restrain the lumpectomy market. While the procedure is generally safe, risks including bleeding, infection, and tissue damage can impact patient outcomes and satisfaction. Concerns about these potential complications may influence patient decision-making, leading to hesitation or alternative treatment choices. Addressing these risks through improved surgical techniques and post-operative care is essential for enhancing patient confidence and optimizing lumpectomy outcomes.

The lumpectomy market expected to witness favorable growth opportunities due to growing awareness and screening programs for breast cancer. As awareness about the disease increases and the significance of early detection becomes widely recognized, there is a corresponding surge in demand for lumpectomies. Patients increasingly opt for this less invasive surgical option, encouraged by its efficacy and preservation of breast tissue. With a proactive approach to screening and increased awareness, the lumpectomy market stands to benefit significantly, offering a vital solution in the fight against breast cancer while promoting better outcomes and condition of life for patients.

Patent Analysis for Global Lumpectomy Market

Analyzing patents related to the global lumpectomy market offers valuable insights into technological advancements, innovation trends, and competitive landscapes within the industry. By examining patent data, researchers and market analysts can identify emerging technologies, key players, and potential areas for investment or collaboration.

- In October 2023, in the U.S., Theresa Abbazia, an innovative designer and entrepreneur introduced a groundbreaking invention: the lumpectomy shower bra device. This innovative creation is tailored to enhance the showering experience for lumpectomy patients, enabling them to comfortably and autonomously shower. The device features a racerback style with shoulder straps and a front closure, along with soft, lily pad-like cups that provide breast support and shield the incision site from water pressure.

- In October 2020, in the U.S., Jeannette Power-Cooper, an innovator known for creating the lumpectomy bra, patented a post-lumpectomy breast implant design. This implant features a spherical outer shell made of medical-grade silicone and an inner chamber filled with medical-grade silicone gel. The combined volume of the outer shell and inner chamber is less than 100 cc.

Market Segmentation

The market is segmented into product, end user, and region. On the basis of product, the market is divided into surgical tools and lumpectomy systems. As per end user, the market is classified into hospitals, clinics, and ambulatory surgical centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The advancements in medical technology and surgical techniques have enhanced the efficacy and safety of lumpectomy procedures, increasing patient confidence and demand. The rising awareness about breast cancer screening programs and early detection initiatives has led to a higher incidence of diagnosed cases, necessitating more surgical interventions in North America. In addition, favorable reimbursement policies and improved healthcare infrastructure further facilitate access to lumpectomy procedures for patients. Moreover, the growing emphasis on minimally invasive surgeries and faster recovery times has boosted the adoption of lumpectomies as a preferred treatment option.

- In April 2023, JUNE Medical finalized an agreement with a prominent U.S. hospital consortium, providing Galaxy II self-retaining surgical retractors to more than 1,600 hospitals across the country. This advanced tool offers improved safety and efficiency in surgical retraction, which is crucial in lumpectomy procedures. Its ergonomic design simplifies surgeries, making it an attractive choice for hospitals aiming to enhance patient care and optimize surgical outcomes while managing costs effectively.

- In February 2023, Gilead Sciences, Inc. received FDA approval for Trodelvy, expanding treatment options for inoperable locally advanced or metastatic breast cancer. This milestone marks a substantial progression in breast cancer therapy, potentially impacting lumpectomy decisions. With Trodelvy's approval, patients with advanced breast cancer gain additional therapeutic avenues, potentially altering treatment strategies, including lumpectomy considerations.

Competitive Landscape

The major players operating in the lumpectomy market include Vector Surgical, Novian Health, Inc, ClearCut Medical, Dune Medical Devices, Sanarus, iCAD, Hologic, Inc., Medtronic PLC, Hologic, and ZEISS.

Recent Key Strategies and Developments

- In April 2023, Lumicell, Inc. disclosed the outcomes of its pivotal INSITE trial, highlighting pioneering fluorescence-guided imaging for cancer surgery. Published in NEJM Evidence and slated for presentation at the American Society of Breast Surgeons (ASBrS), the findings assess the safety and effectiveness of the Lumicell DVS system in detecting residual breast cancer during lumpectomy procedures. This signifies a notable stride in intraoperative tumor identification.

- In October 2021, Susan G. Komen granted $1.5 million to fund three research projects dedicated to metastatic breast cancer. This financial support boosts progress in comprehending and treating the disease's advanced stages, augmenting lumpectomy by broadening the scope of breast cancer care and management.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Lumpectomy Investment & Trade Reports

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the lumpectomy market segments, current trends, estimations, and dynamics of the lumpectomy market analysis from 2023 to 2033 to identify the prevailing lumpectomy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lumpectomy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global lumpectomy market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global lumpectomy market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Lumpectomy market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Lumpectomy Market Analysis, by Product

5.1. Overview

5.2. Surgical Tools

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Lumpectomy Systems

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Lumpectomy Market Analysis, by End User

6.1. Overview

6.2. Hospital

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Clinics

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Ambulatory Surgical Centers

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Lumpectomy Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Product, 2024-2033

7.1.1.2. Market size analysis, by End User, 2024-2033

7.1.2. Canada

7.1.2.1. Market size analysis, by Product, 2024-2033

7.1.2.2. Market size analysis, by End User, 2024-2033

7.1.3. Mexico

7.1.3.1. Market size analysis, by Product, 2024-2033

7.1.3.2. Market size analysis, by End User, 2024-2033

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Product, 2024-2033

7.2.1.2. Market size analysis, by End User, 2024-2033

7.2.2. UK

7.2.2.1. Market size analysis, by Product, 2024-2033

7.2.2.2. Market size analysis, by End User, 2024-2033

7.2.3. France

7.2.3.1. Market size analysis, by Product, 2024-2033

7.2.3.2. Market size analysis, by End User, 2024-2033

7.2.4. Spain

7.2.4.1. Market size analysis, by Product, 2024-2033

7.2.4.2. Market size analysis, by End User, 2024-2033

7.2.5. Italy

7.2.5.1. Market size analysis, by Product, 2024-2033

7.2.5.2. Market size analysis, by End User, 2024-2033

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Product, 2024-2033

7.2.6.2. Market size analysis, by End User, 2024-2033

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Product, 2024-2033

7.3.1.2. Market size analysis, by End User, 2024-2033

7.3.2. Japan

7.3.2.1. Market size analysis, by Product, 2024-2033

7.3.2.2. Market size analysis, by End User, 2024-2033

7.3.3. India

7.3.3.1. Market size analysis, by Product, 2024-2033

7.3.3.2. Market size analysis, by End User, 2024-2033

7.3.4. Australia

7.3.4.1. Market size analysis, by Product, 2024-2033

7.3.4.2. Market size analysis, by End User, 2024-2033

7.3.5. South Korea

7.3.5.1. Market size analysis, by Product, 2024-2033

7.3.5.2. Market size analysis, by End User, 2024-2033

7.3.6. Rest of Asia Pacific

7.3.6.1. Market size analysis, by Product, 2024-2033

7.3.6.2. Market size analysis, by End User, 2024-2033

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Product, 2024-2033

7.4.1.2. Market size analysis, by End User, 2024-2033

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Product, 2024-2033

7.4.2.2. Market size analysis, by End User, 2024-2033

7.4.3. UAE

7.4.3.1. Market size analysis, by Product, 2024-2033

7.4.3.2. Market size analysis, by End User, 2024-2033

7.4.4. South Africa

7.4.4.1. Market size analysis, by Product, 2024-2033

7.4.4.2. Market size analysis, by End User, 2024-2033

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Product, 2024-2033

7.4.5.2. Market size analysis, by End User, 2024-2033

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2023

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2023

9. Company Profiles

9.1. Vector Surgical

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. iCAD

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Novian Health, Inc

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. ClearCut Medical

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. ZEISS

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Dune Medical Devices

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Sanarus

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Hologic, Inc.

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Medtronic PLC

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Hologic

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com