Human Recombinant Insulin Market Size Share Competitive Landscape And Trend Analysis Report Report

RA00803

Human Recombinant Insulin Market Size, Share, Competitive Landscape and Trend Analysis Report by Product Type, Distribution Channel, Application, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

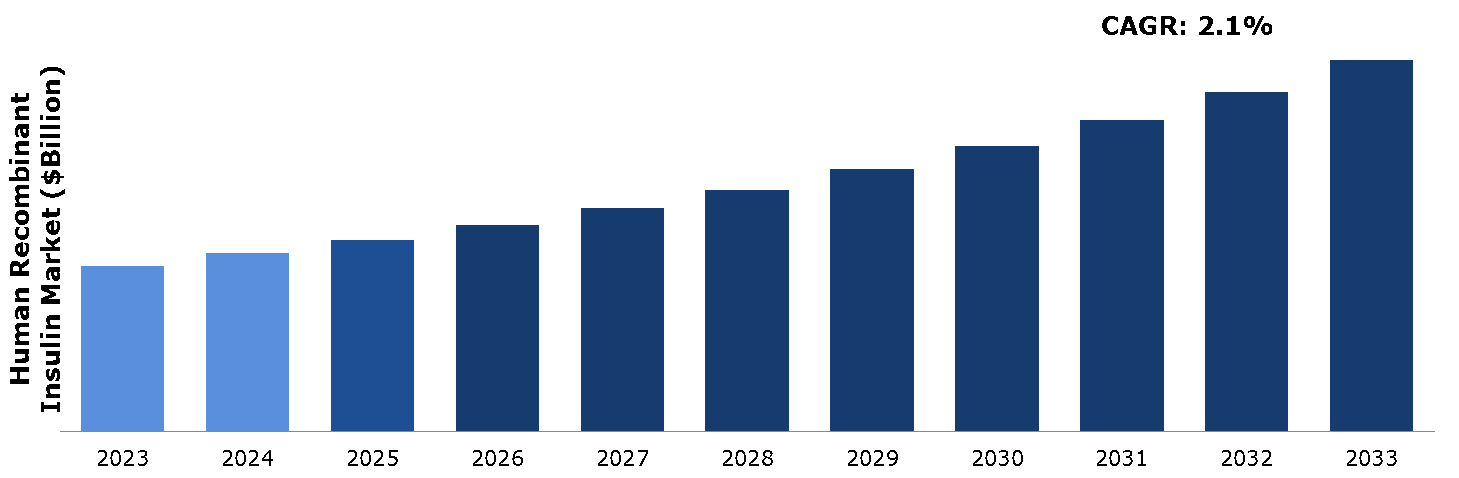

The human recombinant insulin market was valued at $26.95 billion in 2023 and is estimated to reach $33.01 billion by 2033, exhibiting a CAGR of 2.1% from 2024 to 2033.

Introduction of Human Recombinant Insulin

Human recombinant insulin, also known as insulin human AF, is a bioengineered protein derived from human insulin crystals. Produced through recombinant microbial expression in yeast, it plays a crucial role in regulating various cellular processes upon binding to its receptor. By initiating intracellular signaling pathways, insulin influences cell growth, differentiation, survival, and glucose uptake. Its impact extends to enhancing cell culture growth and protein yields in biopharmaceutical settings. Through modulation of transcription, DNA synthesis, replication, and protein translocation, insulin facilitates the production of monoclonal antibodies, virus vaccines, gene therapy drugs, and other biologic products. Widely utilized by biopharmaceutical companies globally, these innovations undergo rigorous evaluation and approval processes by regulatory agencies such as the FDA and EMA, ensuring their safety and efficacy for widespread use in medical treatments and therapies.

Key Takeaways

- The human recombinant insulin market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major human recombinant insulin industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In September 2023, Novo Nordisk announced a new partnership to establish human insulin production in South Africa as part of an expanded commitment toward providing life-saving treatment to people living with diabetes across the African continent. Novo Nordisk is reaching more than 500,000 people with diabetes across Sub-Saharan Africa. The new partnership would enable production of human insulin for the African continent. In 2024, there is expected to be a production of 16 million vials, equivalent to the yearly consumption of 1.1 million people. By 2026, this number is expected to escalate to 4.1 million people living with type 1 and type 2 diabetes across the African continent.

- In December 2021, Eris Lifesciences announced the entry into India’s insulin market and GLP1 agonists market through Eris MJ Biopharm Ltd., a special purpose Joint Venture between Eris and Mumbai based MJ Biopharm Pvt. Ltd. The company expects significant growth in the segment, considering that diabetes is a progressive disease and GLP1 therapy is a reliable method for the treatment in developed countries.

Key Market Dynamics

The global human recombinant insulin market is experiencing a surge in growth owing to rising government initiatives targeting enhanced healthcare infrastructure and affordable access to crucial medications, like insulin. These initiatives foster infrastructure development, ensuring adequate healthcare facilities and distribution networks. By subsidizing essential medications, particularly insulin, governments mitigate financial barriers, broadening accessibility for patients in need.

Moreover, the production process for recombinant human insulin involves sophisticated biotechnological methods, leading to high manufacturing costs and potential supply chain complexities. These factors hamper the growth of recombinant human insulin market.

However, with a growing focus on patient-centered healthcare, there is an increasing demand for convenient insulin delivery methods and formulations. This trend provides a scope for innovation and product differentiation within the recombinant human insulin market.

Company Analysis

Novo Nordisk, a key player in the human recombinant insulin market, has intensified its efforts to enhance insulin access in Africa. Teaming up with South African pharmaceutical manufacturer Aspen Pharmaceuticals, the company is expected to boost production and distribution across the region. This strategic partnership, aligned with the World Health Organization's advocacy for sustainable and affordable medicine, aims to deliver over 60 million vials of human insulin by 2026. These efforts are integral to Novo Nordisk's Access to Insulin commitment, which has already benefitted 2.4 million individuals in 2023.

Operating within 77 low- and middle-income countries, the program ensures insulin availability at a ceiling price of $3 per vial. Novo Nordisk's dedication to expanding access is reflected in its increasing outreach, with an estimated 40.5 million full-year patients reached in 2023, up from 36.3 million in 2022. This growth is primarily attributed to advancements in the GLP-1 franchise, followed by the new-generation and human insulin franchises. In addition, the continued rollout of Wegovy in new markets has contributed to the expansion of the obesity care product segment. Key offerings in the human insulin portfolio include Insulatard, Actrapid, Mixtard 30, Mixtard 40, and Mixtard 50, catering to diverse patient needs.

Market Segmentation

The human recombinant insulin market is segmented into product type, distribution channel, application, and region. On the basis of product type, the market is divided into long-acting, short-acting, premixed, and intermediate-acting. As per distribution channel, the market is segregated into hospital pharmacies, online pharmacies, and retail pharmacies. By application, the market is classified on the basis of type I diabetes and type II diabetes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In China, the human recombinant insulin market is growing owing to the rising prevalence of diabetes, driven by lifestyle changes and aging population. According to Ministry of Civil Affairs, China's elderly population with age 60 and above reached 280.04 million by the end of 2022, accounting for 19.8% of the total population. This has significantly led to an increase in demand for effective insulin therapies. In addition, advancements in biotechnology and pharmaceutical manufacturing have enabled the production of high-quality recombinant insulin at lower costs, making it more accessible to a broader patient base. Government initiatives to improve healthcare infrastructure and expand insurance coverage for diabetes management further support market growth.

Moreover, increased awareness and early diagnosis of diabetes, along with ongoing efforts to enhance patient education on insulin usage, are expected to boost market growth. The presence of major domestic and international players investing in R&D to introduce innovative insulin products also contributes to the market's positive outlook.

- In October 2023, At the thematic forum on local cooperation during the Third International Forum of the Belt and Road Initiative, Pharmasyntez-Nord JSC and Gan & Lee Pharmaceuticals signed a Memorandum of Understanding. This agreement aims to produce medicinal products, including various types of insulins, at Pharmasyntez-Nord's facilities utilizing Gan & Lee Pharmaceuticals' technologies. The collaboration highlights a significant step in leveraging advanced insulin production techniques to enhance local manufacturing capabilities, ensuring a steady supply of essential medicines.

Competitive Landscape

The major players operating in the human recombinant insulin market include Sanofi S.A., Novo Nordisk A/S, Bioton S.A., Biocon Limited, Eli Lilly and Company, Wanbang Biopharmaceuticals Co., Ltd., Julphar Gulf Pharmaceutical Industries, Zhuhai United Laboratories Co., Ltd., Dongbao Enterprise Group Co., Ltd, Medtronic plc., Gan & Lee Pharmaceuticals, Ltd., and others.

Recent Key Strategies and Developments

- In June 2023, Gan & Lee Pharmaceuticals announced that the U.S. FDA has accepted the Biologics License Application (BLA) for their insulin Aspart injection, a proposed biosimilar for diabetes management. This submission follows a successful randomized, double-blind PK/PD study conducted in the U.S. and European Union, demonstrating equivalence to both U.S.-authorized Novolog and EU-licensed NovoRapid.

- In 2022, the global sales of NovoRapid reached approximately $2.22 billion, with $809 million in the U.S. market.

Key Sources Referred

- American Diabetes Association (ADA)

- Centers for Disease Control and Prevention (CDC)

- International Diabetes Federation (IDF)

- Novo Nordisk A/S

- Eli Lilly and Company

- Medtronic plc

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the human recombinant insulin market segments, current trends, estimations, and dynamics of the human recombinant insulin market analysis from 2023 to 2033 to identify the prevailing human recombinant insulin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the human recombinant insulin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global human recombinant insulin market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global human recombinant insulin market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by product type |

|

| Segmentation by Distribution Channel |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of manufacturers

4.3.2. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Human Recombinant Insulin Market Analysis, by Product Type

5.1. Overview

5.2. Long-Acting

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Short-Acting

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Premixed

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Intermediate-Acting

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Human Recombinant Insulin Market Analysis, by Distribution Channel

6.1. Overview

6.2. Hospital Pharmacies

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Online Pharmacies

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Retail Pharmacies

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2023-2033

6.4.3. Market share analysis, by country, 2023-2033

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Human Recombinant Insulin Market Analysis, by Application

7.1. Overview

7.2. Type I Diabetes

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Type II Diabetes

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Human Recombinant Insulin Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product Type, 2023-2033

8.1.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.1.3. Market size analysis, by Application, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Product Type, 2023-2033

8.1.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.2.3. Market size analysis, by Application, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product Type, 2023-2033

8.1.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.3.3. Market size analysis, by Application, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product Type, 2023-2033

8.2.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.1.3. Market size analysis, by Application, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Product Type, 2023-2033

8.2.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.2.3. Market size analysis, by Application, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Product Type, 2023-2033

8.2.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.3.3. Market size analysis, by Application, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Product Type, 2023-2033

8.2.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.4.3. Market size analysis, by Application, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Product Type, 2023-2033

8.2.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.5.3. Market size analysis, by Application, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product Type, 2023-2033

8.2.6.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.6.3. Market size analysis, by Application, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product Type, 2023-2033

8.3.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.1.3. Market size analysis, by Application, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Product Type, 2023-2033

8.3.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.2.3. Market size analysis, by Application, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Product Type, 2023-2033

8.3.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.3.3. Market size analysis, by Application, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Product Type, 2023-2033

8.3.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.4.3. Market size analysis, by Application, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Product Type, 2023-2033

8.3.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.5.3. Market size analysis, by Application, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Product Type, 2023-2033

8.3.6.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.6.3. Market size analysis, by Application, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product Type, 2023-2033

8.4.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.1.3. Market size analysis, by Application, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Product Type, 2023-2033

8.4.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.2.3. Market size analysis, by Application, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Product Type, 2023-2033

8.4.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.3.3. Market size analysis, by Application, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Product Type, 2023-2033

8.4.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.4.3. Market size analysis, by Application, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product Type, 2023-2033

8.4.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.5.3. Market size analysis, by Application, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Sanofi S.A.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Industry portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Novo Nordisk A/S

10.2.1. Overview

10.2.2. Business segments

10.2.3. Industry portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Bioton S.A.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Industry portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Biocon Limited

10.4.1. Overview

10.4.2. Business segments

10.4.3. Industry portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Eli Lilly and Company

10.5.1. Overview

10.5.2. Business segments

10.5.3. Industry portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Wanbang Biopharmaceuticals Co., Ltd.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Industry portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Julphar Gulf Pharmaceutical Industries

10.7.1. Overview

10.7.2. Business segments

10.7.3. Industry portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Zhuhai United Laboratories Co., Ltd.

10.8.1. Overview

10.8.2. Business segments

10.8.3. Industry portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Dongbao Enterprise Group Co., Ltd.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Industry portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Medtronic plc

10.10.1. Overview

10.10.2. Business segments

10.10.3. Industry portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com