Aesthetic Medicine Market Report

RA00664

Aesthetic Medicine Market, by Type (Surgical Procedures, Non-surgical Procedures), Product (Facial Aesthetic, Breast Aesthetics, Body Contouring Devices, Hair Removal Devices, Tattoo Removal Devices), End Use (Hospitals, Ambulatory Surgical Centers, Beauty Centers & Medical Spas, Dermatology Clinics, Home Settings, Others), Gender (Male, Female): Global Opportunity Analysis and Industry Forecast, 2024-2033

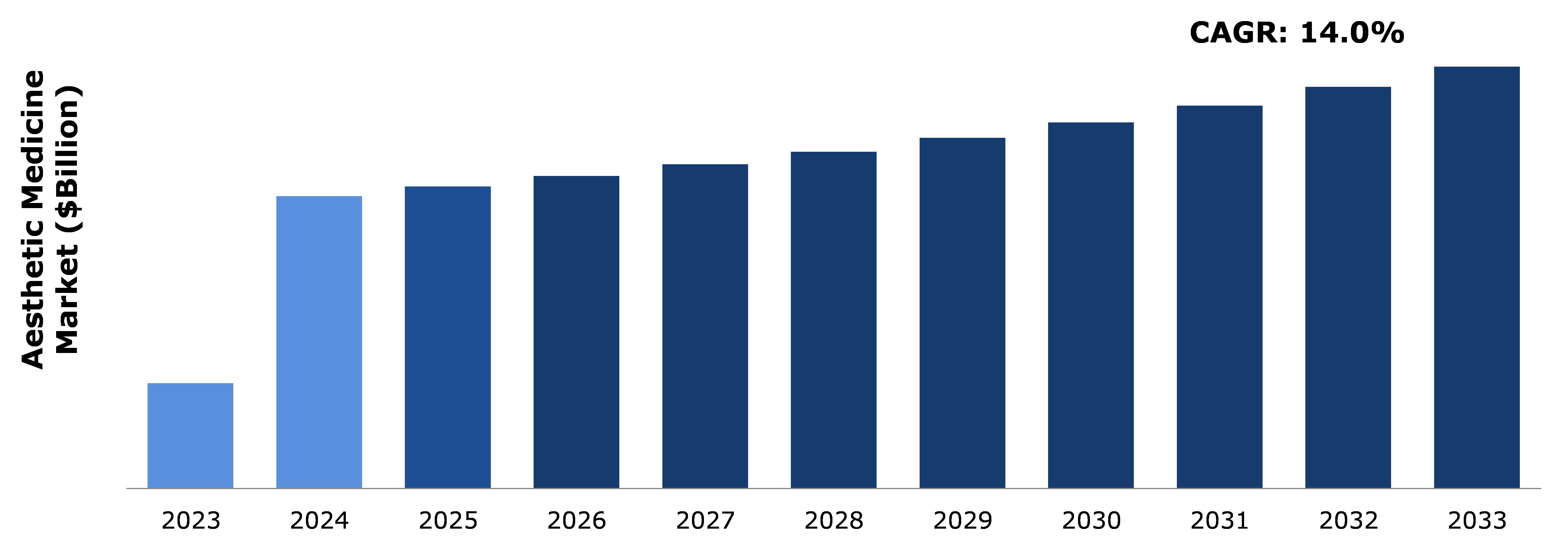

The aesthetic medicine market was valued at $130.3 billion in 2023 and is estimated to reach $482.8 billion by 2033, exhibiting a CAGR of 14.0% from 2024 to 2033.

Market Definition and Overview

Aesthetic medicine encompasses a wide range of modern medicines designed to enhance a patient's physical appearance and satisfaction through minimally invasive means. This emerging field, embraced by practitioners across various specialties, caters to the growing demand for non-surgical interventions to combat the effects of aging and promote well-being. Procedures range from injections of neurotoxins and dermal fillers to cosmetic dermatology treatments and body contouring techniques. Patients seek these elective procedures not out of necessity but to proactively manage the aging process and improve self-confidence. With its emphasis on patient satisfaction and minimal risk, aesthetic medicine presents a lucrative opportunity for doctors to expand their practice while meeting the evolving needs of a health-conscious clientele.

Key Takeaways

- The aesthetic medicine market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major aesthetic medicine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In April 2024, Cynosure and Lutronic formed merger agreement to combine their strengths and create a global leader in medical aesthetics technology. The merger leverages Cynosure and Lutronic's global presence, innovative product portfolios, and enhanced R&D capabilities. This strategic move aims to offer customers and patients worldwide a broader range of energy-based medical aesthetic treatment systems and services. Both companies express excitement about the partnership, which promises to drive innovation and provide superior products and customer service in the aesthetics industry.

- In January 2024, Alpha Aesthetics Partners, a Thurston Group portfolio company, announced its partnership with Anne Therese Aesthetic Medicine, a renowned practice led by Dr. Anne Therese Stubbs. With locations in Columbus, Ohio, and Cape Coral, Florida, Anne Therese Aesthetic Medicine is acclaimed for its exceptional patient care and Dr. Stubbs' expertise in aesthetic medicine. This collaboration signifies a mutual commitment toward excellence, leveraging Alpha's resources and Anne Therese's personalized approach to elevate patient experiences. Dr. Stubbs emphasizes the partnership's value in enhancing training and outcomes, while Alpha's CEO, John Wheeler, welcomes the esteemed practice into their network, reinforcing their dedication to top-tier aesthetic care.

- In January 2024, Viper Partners, a prominent investment banking firm in healthcare, announced its role in the acquisition of Wave Plastic Surgery and Aesthetic Laser Center (Wave), leading a new era in aesthetic medicine. With increasing investor interest in expansive practices offering diverse procedures, the acquisition signifies a significant shift in the plastic surgery landscape.

Key Market Dynamics

The growing demand for minimally invasive cosmetic procedures caters to patients seeking enhanced beauty with minimal downtime, thereby driving the aesthetic medicine market share. Also, the lucrative nature of aesthetic treatments provides a substantial revenue stream for healthcare providers. Integrating aesthetic medicine into practices not only capitalizes on growing patient demand but also enhances professional capabilities, making it an attractive avenue for practitioners looking to expand their skillset and knowledge base.

Although aesthetic medicine offers transformative changes, it has several limitations and considerations. For instance, the high cost of these medicines makes it financially inaccessible for many customers. Moreover, the potential for addiction poses serious mental health risks, such as body dysmorphic disorder, while the possibility of complications, including death, highlight the significance of undergoing such procedures.

Innovations in the field of aesthetic medicine such as AviClear for acne treatment, Juvederm Volux XC for jawline definition, and DAXXIFY for long-lasting wrinkle reduction presents significant opportunities for the market expansion. Emerging treatments like Renuva for fat transfer and RF microneedling for skin rejuvenation, along with trends in combination therapies and body sculpting, cater to diverse patient needs. The increasing popularity of procedures like LED light therapy and laser hair removal further boosts the market growth. This evolving landscape offers clinics numerous avenues to enhance patient satisfaction and drive growth in the aesthetic industry.

Global Aesthetic Medicine Market Ecosystem Analysis

The ISAPS Global Survey 2022 revealed an 11.2% rise in aesthetic procedures worldwide, with over 33.7 million procedures performed. Surgical procedures, particularly liposuction and breast augmentation, saw significant increase, while non-surgical treatments like botulinum toxin and chemical peels also gained popularity. The U.S. accounted for around 22% of total procedures, followed by Brazil and Japan in 2022. This growth highlights a rising global demand for aesthetic enhancements, driven by advances in safety and technology.

Global Aesthetic Procedures Statistics (2022)

| Procedure Type | Total Procedures (Millions) | Increase from 2021 |

| Surgical Procedures | 14.9 | 16.7% |

| Non-Surgical Procedures | 18.8 | 7.2% |

| Total Procedures | 33.7 | 11.2% |

Popular Procedures by Age Group

| Age Group | Most Popular Procedures |

| 18-34 | Breast Augmentation, Rhinoplasty |

| 35-50 | Botulinum Toxin, Liposuction |

Gender Statistics

| Gender | Percentage of Total Procedures | Most Common Procedures |

| Women | 85.7% | Botulinum Toxin, Hyaluronic Acid, Hair Removal, Chemical Peel, Non-Surgical Fat Reduction, and Others |

| Men | 14.3% | Surgical Reduction of Male Breast |

Market Segmentation

The aesthetic medicine market is segmented into procedure type and region. On the basis of procedure type, the market is divided into invasive procedures (breast augmentation, liposuction, nose reshaping, eyelid surgery, tummy tuck, and others) and non-invasive procedures (Botox injections, soft tissue fillers, chemical peel, laser hair removal, microdermabrasion, and others). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In 2021, the U.S. saw a total of 1,992,296 surgical aesthetic procedures, reflecting a strong demand for cosmetic enhancements. The most common surgical procedures included liposuction (381,000), breast augmentation (378,700), abdominoplasty (228,000), and breast lift (167,395). Facial procedures were also prevalent, with eyelid surgery (149,668), rhinoplasty (76,128), and facelift (87,007) among the top choices. Overall, facial and head procedures accounted for 517,163 surgeries, body and extremities procedures totaled 746,422, and breast procedures reached 728,711.

These statistics indicate a robust market for surgical aesthetic procedures, driven by both body contouring and facial rejuvenation needs. Liposuction and breast augmentation alone constituted nearly 40% of all surgical procedures, highlighting a significant focus on body reshaping and enhancement. In addition, the popularity of procedures like abdominoplasty and breast lifts highlights the ongoing interest in post-weight loss and postpartum body contouring.

This sustained demand is likely to continue driving the aesthetic medicine market, as more individuals seek surgical solutions to improve their appearance. Advances in surgical techniques, reduced recovery times, and increasing societal acceptance are further expected to boost this growth. Consequently, the aesthetic medicine industry in the U.S. is poised for continued expansion, with a growing emphasis on personalized and safe treatment options.

Competitive Landscape

Some of the major players operating in the aesthetic medicine market include AbbVie Inc., Cynosure Aesthetics, Solta Medical, Evolus Inc., Lumenis Be Ltd., Revance Galderma, Alma Lasers, Candela Corporation, Cutera, Inc., Merz Pharma, and others.

Recent Key Strategies and Developments

- On May 10, 2024, ColoWell America launched comprehensive medical aesthetics treatments, blending health enhancement with aesthetic innovation. EMFACE offers a non-surgical facelift with up to 23% improvement in lifted facial features. Exion Microneedling Radiofrequency ensures comfortable facial rejuvenation, with 93% patient satisfaction. Emsculpt NEO provides non-invasive body contouring, reducing fat by 30% and increasing muscle depth by 25%.

- In April 2024, Healthsprings Group introduced Healthsprings Connect, a telemedicine app providing medical consultation and personalized treatment plans, including aesthetic medicine services. Users can access a range of healthcare services such as online GP consultations, skin condition teleconsultations, slimming treatments, diet management programs, health screenings, and others. The app aims to make medical skin health accessible to everyone, offering aesthetic consultation services for various skin concerns and personalized dietary plans.

Key Sources Referred

- American Association of Aesthetic Medicine and Surgery (AAAMS)

- Aesthetic Medicine India Magazine

- AmSpa

- WorldMetrics.org

- National Laser Institute

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the aesthetic medicine market segments, current trends, estimations, and dynamics of the aesthetic medicine market analysis from 2023 to 2033 to identify the prevailing aesthetic medicine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aesthetic medicine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aesthetic medicine market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aesthetic medicine market trends, key players, market segments, application areas, and market growth strategies.

The report offers comprehensive analysis of key players operating in the global market by analyzing their business performance, product portfolio, business segments, revenue, and strategic moves to showcase the competitive scenario in the industry.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Procedure Type |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market Definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on the Aesthetic Medicine Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Aesthetic Medicine Market Analysis, by Procedure Type

5.1. Overview

5.2. Invasive Procedures

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Non-invasive Procedures

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Aesthetic Medicine Market, by Region

6.1. North America

6.1.1. U.S.

6.1.1.1. Market size analysis, by Procedure Type, 2023-2033

6.1.2. Canada

6.1.2.1. Market size analysis, by Procedure Type, 2023-2033

6.1.3. Mexico

6.1.3.1. Market size analysis, by Procedure Type, 2023-2033

6.1.4. Research Dive Exclusive Insights

6.1.4.1. Market attractiveness

6.1.4.2. Competition heatmap

6.2. Europe

6.2.1. Germany

6.2.1.1. Market size analysis, by Procedure Type, 2023-2033

6.2.2. UK

6.2.2.1. Market size analysis, by Procedure Type, 2023-2033

6.2.3. France

6.2.3.1. Market size analysis, by Procedure Type, 2023-2033

6.2.4. Spain

6.2.4.1. Market size analysis, by Procedure Type, 2023-2033

6.2.5. Italy

6.2.5.1. Market size analysis, by Procedure Type, 2023-2033

6.2.6. Rest of Europe

6.2.6.1. Market size analysis, by Procedure Type, 2023-2033

6.2.7. Research Dive Exclusive Insights

6.2.7.1. Market attractiveness

6.2.7.2. Competition heatmap

6.3. Asia-Pacific

6.3.1. China

6.3.1.1. Market size analysis, by Procedure Type, 2023-2033

6.3.2. Japan

6.3.2.1. Market size analysis, by Procedure Type, 2023-2033

6.3.3. India

6.3.3.1. Market size analysis, by Procedure Type, 2023-2033

6.3.4. Australia

6.3.4.1. Market size analysis, by Procedure Type, 2023-2033

6.3.5. South Korea

6.3.5.1. Market size analysis, by Procedure Type, 2023-2033

6.3.6. Rest of Asia-Pacific

6.3.6.1. Market size analysis, by Procedure Type, 2023-2033

6.3.7. Research Dive Exclusive Insights

6.3.7.1. Market attractiveness

6.3.7.2. Competition heatmap

6.4. LAMEA

6.4.1. Brazil

6.4.1.1. Market size analysis, by Procedure Type, 2023-2033

6.4.2. UAE

6.4.2.1. Market size analysis, by Procedure Type, 2023-2033

6.4.3. Saudi Arabia

6.4.3.1. Market size analysis, by Procedure Type, 2023-2033

6.4.4. South Africa

6.4.4.1. Market size analysis, by Procedure Type, 2023-2033

6.4.5. Rest of LAMEA

6.4.5.1. Market size analysis, by Procedure Type, 2023-2033

6.4.6. Research Dive Exclusive Insights

6.4.6.1. Market attractiveness

6.4.6.2. Competition heatmap

7. Competitive Landscape

7.1. Top winning strategies, 2023

7.1.1. By strategy

7.1.2. By year

7.2. Strategic overview

7.3. Market share analysis, 2023

8. Company Profiles

8.1. AbbVie Inc.

8.1.1. Overview

8.1.2. Business segments

8.1.3. Product portfolio

8.1.4. Financial performance

8.1.5. Recent developments

8.1.6. SWOT analysis

8.2. Cynosure Aesthetics

8.2.1. Overview

8.2.2. Business segments

8.2.3. Product portfolio

8.2.4. Financial performance

8.2.5. Recent developments

8.2.6. SWOT analysis

8.3. Solta Medical

8.3.1. Overview

8.3.2. Business segments

8.3.3. Product portfolio

8.3.4. Financial performance

8.3.5. Recent developments

8.3.6. SWOT analysis

8.4. Evolus Inc.

8.4.1. Overview

8.4.2. Business segments

8.4.3. Product portfolio

8.4.4. Financial performance

8.4.5. Recent developments

8.4.6. SWOT analysis

8.5. Lumenis Be Ltd.

8.5.1. Overview

8.5.2. Business segments

8.5.3. Product portfolio

8.5.4. Financial performance

8.5.5. Recent developments

8.5.6. SWOT analysis

8.6. Revance Galderma

8.6.1. Overview

8.6.2. Business segments

8.6.3. Product portfolio

8.6.4. Financial performance

8.6.5. Recent developments

8.6.6. SWOT analysis

8.7. Alma Lasers

8.7.1. Overview

8.7.2. Business segments

8.7.3. Product portfolio

8.7.4. Financial performance

8.7.5. Recent developments

8.7.6. SWOT analysis

8.8. Candela Corporation

8.8.1. Overview

8.8.2. Business segments

8.8.3. Product portfolio

8.8.4. Financial performance

8.8.5. Recent developments

8.8.6. SWOT analysis

8.9. Cutera, Inc.

8.9.1. Overview

8.9.2. Business segments

8.9.3. Product portfolio

8.9.4. Financial performance

8.9.5. Recent developments

8.9.6. SWOT analysis

8.10. Merz Pharma

8.10.1. Overview

8.10.2. Business segments

8.10.3. Product portfolio

8.10.4. Financial performance

8.10.5. Recent developments

8.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com