Mobile Device Management Market Report

RA00412

Mobile Device Management Market, by Deployment Type (Cloud and On-premise), by Organization Size (Small and Medium Enterprise and Large), Vertical (BFSI, Healthcare, IT & Telecom, Retail and Others), Regional Outlook (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2027

Mobile device management market accounted for $3,019.9 million in 2019 and is predicted to generate a revenue of $24,161.1 million by 2027 with a CAGR of 28.2% in the forecast period. North America market accounted for $993.5 million in 2019 and is predicted to rise with a CAGR of 27.2% in the forecast period.

Mobile device management software is used by IT department of most of the organizations for securing, monitoring and managing organizations’ mobile devices. Mobile device management software are usually handled by third party products for particular vendors of mobile devices.

The pandemic has impacted the mobile device management market in a positive way. The pandemic has forced organizations to adopt the work-from-home option for all employees for safety reasons. Most organizations have adopted the mobile device management software as work is being managed through cloud services. There are high chances of data to be hacked, due to which companies have adopted the mobile device management software to protect the data of the organization, which is predicted to be the major driving factor for the mobile device management market in the estimated period.

Increase in the manufacturing of new mobile phones is predicted to be the major driving factor for the global mobile device management market

Mobile device management increases device supportability, security, and corporate functionality while maintaining some user flexibility. The implementation of mobile device management can be done through cloud services by distribution of applications, data and configuration settings for all types of mobile devices. Due to these factors, the mobile phone manufacturers focus on mobile device management software to secure the organization data which is predicted to boost the global market in the estimated period. Moreover, increase in the security concern to protect corporate data is predicted to be the major driving for the global market in the estimated period.

Stringent government rules and regulation is predicted to hinder the market growth

Mobile device management is used in managing mobile devices used in organizations to access sensitive data inaccessible to outsiders. These software restrict unauthorized personnel from accessing data. Even the government cannot access any data of the organization. Thus, the government’s initiatives of rules and regulation in terms of restricting the securing of data is predicted to hinder the market growth in the estimated period.

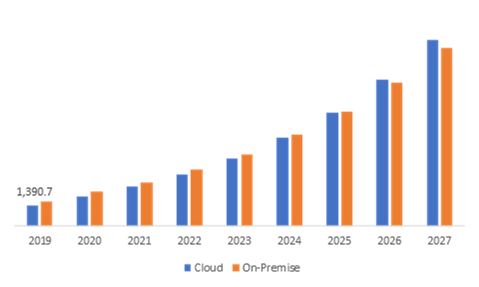

Mobile Device Management Market, by Deployment Type:

Cloud sub-segment is predicted have the highest growth rate

Source; Research Dive Analysis

Cloud segment is predicted to have the maximum growth rate in the estimated period. Cloud segment accounted for $1,390.7 million in 2019 and is predicted to rise with a CAGR of 29.9% in the estimated time frame. Using cloud in mobile device management enhances the efficiency of the employee as the company allows them to work remotely and have access to use them anytime and anywhere without even compromising the security of the organization, which is predicted to drive the sub-segment market in the forecast period.

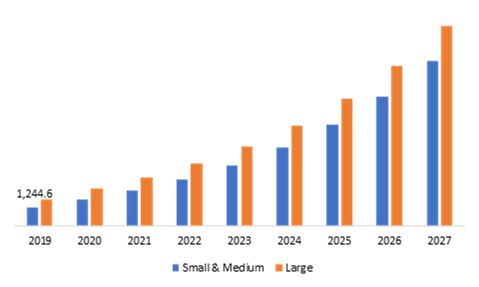

Mobile Device Management Market, by Organization Size:

Small & Medium sub-segment is predicted to be the most lucrative segment

Source; Research Dive Analysis

Small and medium sub segment is predicted to have the maximum growth rate in the forecast period. Small and medium sub segment accounted for $1,244.6 million in 2019 and is predicted to rise with a CAGR of 29.7% in the estimated timeframe. The small and medium enterprises uses various mobile devices to get the operational work done which are done by the employee. The remote devices gives them access to work across the globe whenever it is required. Due to multiple benefits of mobile devices, the adoption of mobile device management software has increased as it helps in securing mobile devices which is predicted to be the major driving factor for the small and medium enterprise size in the estimated period.

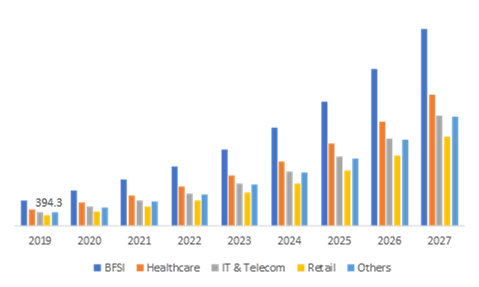

Mobile Device Management Market, by Industry Vertical:

Retail sub-segment is predicted generate a huge amount of profit

Source; Research Dive Analysis

Retail sub-segment is predicted to grow enormously with the highest growth rate in the estimated period. Retail sub-segment accounted for $394.3 million in 2019 and is predicted to rise with a CAGR of 29.4% in the forecast period. Retailers are using mobile devices for various operational use for securing the data. In retail industry, the retailer sells smaller units of goods. Keeping a track of these small goods is very difficult and the retailer requires the mobile device management for securing and tracking the data on a daily basis in a minute manner, which is predicted to be the major driving factor for the sub segment market in the estimated period.

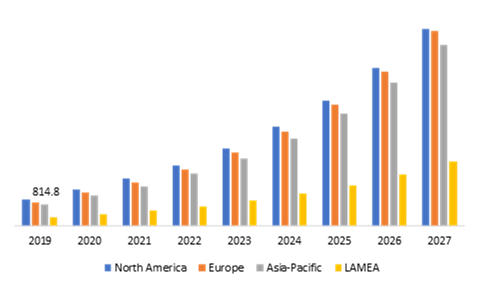

Mobile Device Management Market, by Region:

Asia-Pacific region market is predicted to create more investment opportunities in the estimated time frame

Source; Research Dive Analysis

Asia-Pacific region market is predicted to create more growth opportunity for the regional market in the estimated period. Asia-Pacific region market accounted for $814.8 million in 2019 and is predicted to rise with a CAGR of 29.1% in the forecast period. Shifting of large number of companies across the region is predicted to be the major driving factor for the regional market in the estimated timeframe. For instance, in Aug 2020, 22 Domestic and international firms, including Apple's contract manufacturers & Samsung, Lava, Dixon etc. have lined up with proposals for mobile phones production Rs 11 lakh crore over next 5 years in India. Majority of companies are shifting in the region due availability of the skilled labor and lower investment cost in setting up of business in the region is predicted to be the major driving factor for the market in the estimated period.

Key Participants in the Mobile Device Management Market

Source: Research Dive Analysis

The major key player in the global mobile device management market are IBM, SAP , Google, Cisco System Inc., Microsoft, Samsung, Blackberry, Citrix Systems Inc., VMware Inc., Quest Software among others. For instance, in Aug 2020, Beachhead Solutions, provider of cloud-managed PC & mobile device encryption, security, and data access control for managed service providers announced an expansion of its channel reseller program into Asia that makes SimplySecure for MSPs™ available to new partners across the continent.

Porter’s Five Forces Analysis for Mobile device management Market:

- Bargaining Power of Suppliers: The market have limited numerous number of suppliers who can offer the software at a reasonable price to the customer.. The bargaining power of suppliers is moderate.

- Bargaining Power of Consumers: In this market the buyer have very limited number of trusted security software to protect the mobile devices.

The bargaining power of consumers is moderate.

- The threat of New Entrants: Huge initial investments are essential to start a new mobile device management software firm.

The threat of new entrants is Low.

- The threat of Substitutes: This market has limited number of alternatives products; moreover, the supplier offer the software with higher technology which offers high switching costs for clients.

The threat of substitutes is high.

- Competitive Rivalry in the Market: The mobile device management market has only major players to sell their products and it becomes difficult for small and medium enterprises and local manufacturer to get into the market. The competitive rivalry in the industry is Moderate.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2019-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Organization Size |

|

| Segmentation by Deployment type |

|

| Segmentation by Vertical |

|

| Key Countries Covered | U.S., Canada, Mexico Germany, France, UK, Italy, Japan, China, India, South Korea, Australia, Latin America, Middle East, Africa |

| Key Companies Profiled |

|

Q1. What is the size of mobile device management market?

A. The global mobile device management market size was over $3,019.9 million in 2019 and is predicted to grow with a CAGR of 28.2% over the forecast period.

Q2. Which are the leading companies in the mobile device management market?

A. IBM and SAP SE are the key players in the mobile device management market.

Q3. Which region possesses greater investment opportunities in the coming future for the Mobile Device Management Market?

A. Asia-Pacific possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the North America Mobile Device Management Market?

A. Asia-Pacific mobile device management market is projected to grow at 29.1% CAGR during the forecast period.

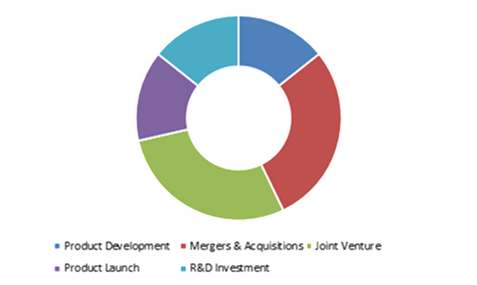

Q5. What are the strategies opted by the leading players in the Mobile Device Management Market?

A. Agreement and business expansion is the key strategies opted by the operating companies in this mobile device management market.

Q6. Which companies are investing more on R&D practices for Mobile Device Management Market?

A. IBM is the company investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Organization size trends

2.3. Deployment Mode trends

2.4. Vertical trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By organization size

3.8.2. By Deployment Mode

3.8.3. By vertical

3.8.4. By region

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Mobile Device Management Market, by Organization Size

4.1. SME

4.1.1. Market size and forecast, by region, 2019-2027

4.1.2. Comparative market share analysis, 2019-2027

4.2. Large

4.2.1. Market size and forecast, by region, 2019-2027

4.2.2. Comparative market share analysis, 2019-2027

5. Mobile Device Management Market, by Deployment Mode

5.1. Cloud

5.1.1. Market size and forecast, by region, 2019-2027

5.1.2. Comparative market share analysis, 2019-2027

5.2. On-Premises

5.2.1. Market size and forecast, by region, 2019-2027

5.2.2. Comparative market share analysis, 2019-2027

6. Mobile Device Management Market, by Vertical

6.1. BFSI

6.1.1. Market size and forecast, by region, 2019-2027

6.1.2. Comparative market share analysis, 2019-2027

6.2. Health care

6.2.1. Market size and forecast, by region, 2019-2027

6.2.2. Comparative market share analysis, 2019-2027

6.3. IT & Telecom

6.3.1. Market size and forecast, by region, 2019-2027

6.3.2. Comparative market share analysis, 2019-2027

6.4. Retail

6.4.1. Market size and forecast, by region, 2019-2027

6.4.2. Comparative market share analysis, 2019-2027

6.5. Others

6.5.1. Market size and forecast, by region, 2019-2027

6.5.2. Comparative market share analysis, 2019-2027

7. Mobile Device Management Market, by Region

7.1. North Region

7.1.1. Market size and forecast, by Organization Size, 2019-2027

7.1.2. Market size and forecast, by Deployment Mode, 2019-2027

7.1.3. Market size and forecast, by Vertical, 2019-2027

7.1.4. Market size and forecast, by country, 2019-2027

7.1.5. Comparative market share analysis, 2019-2027

7.1.6. U.S

7.1.7. Market size and forecast, by Organization Size, 2019-2027

7.1.8. Market size and forecast, by Deployment Mode, 2019-2027

7.1.9. Market size and forecast, by Vertical, 2019-2027

7.1.10. Canada

7.1.11. Market size and forecast, by Organization Size, 2019-2027

7.1.12. Market size and forecast, by Deployment Mode, 2019-2027

7.1.13.

7.1.14. Market size and forecast, by Vertical, 2019-2027

7.2. Europe

7.2.1. Market size and forecast, by Organization Size, 2019-2027

7.2.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.3. Market size and forecast, by Vertical, 2019-2027

7.2.4. Market size and forecast, by country, 2019-2027

7.2.5. Comparative market share analysis, 2019-2027

7.2.6. UK

7.2.6.1. Market size and forecast, by Organization Size, 2019-2027

7.2.6.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.6.3. Market size and forecast, by Vertical, 2019-2027

7.2.6.4. Comparative market share analysis, 2019-2027

7.2.7. Germany

7.2.7.1. Market size and forecast, by Organization Size, 2019-2027

7.2.7.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.7.3. Market size and forecast, by Vertical, 2019-2027

7.2.7.4. Comparative market share analysis, 2019-2027

7.2.8. France

7.2.8.1. Market size and forecast, by Organization Size, 2019-2027

7.2.8.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.8.3. Market size and forecast, by Vertical, 2019-2027

7.2.8.4. Comparative market share analysis, 2019-2027

7.2.9. Italy

7.2.9.1. Market size and forecast, by Organization Size, 2019-2027

7.2.9.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.9.3. Market size and forecast, by Vertical, 2019-2027

7.2.9.4. Comparative market share analysis, 2019-2027

7.2.10. Rest of Europe

7.2.10.1. Market size and forecast, by Organization Size, 2019-2027

7.2.10.2. Market size and forecast, by Deployment Mode, 2019-2027

7.2.10.3. Market size and forecast, by Vertical, 2019-2027

7.2.10.4. Comparative market share analysis, 2019-2027

7.3. Asia-Pacific

7.3.1. Market size and forecast, by Organization Size, 2019-2027

7.3.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.3. Market size and forecast, by Vertical, 2019-2027

7.3.4. Market size and forecast, by country, 2019-2027

7.3.5. Comparative market share analysis, 2019-2027

7.3.6. China

7.3.7. Market size and forecast, by Organization Size, 2019-2027

7.3.8. Market size and forecast, by Deployment Mode, 2019-2027

7.3.9. Market size and forecast, by Vertical, 2019-2027

7.3.10. Comparative market share analysis, 2019-2027

7.3.11. India

7.3.11.1. Market size and forecast, by Organization Size, 2019-2027

7.3.11.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.11.3. Market size and forecast, by Vertical, 2019-2027

7.3.11.4. Comparative market share analysis, 2019-2027

7.3.12. Japan

7.3.12.1. Market size and forecast, by Organization Size, 2019-2027

7.3.12.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.12.3. Market size and forecast, by Vertical, 2019-2027

7.3.12.4. Comparative market share analysis, 2019-2027

7.3.13. South Kore

7.3.13.1. Market size and forecast, by Organization Size, 2019-2027

7.3.13.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.13.3. Market size and forecast, by Vertical, 2019-2027

7.3.13.4. Comparative market share analysis, 2019-2027

7.3.14. Australia

7.3.14.1. Market size and forecast, by Organization Size, 2019-2027

7.3.14.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.14.3. Market size and forecast, by Vertical, 2019-2027

7.3.14.4. Comparative market share analysis, 2019-2027

7.3.15. Rest of Asia Pacific

7.3.15.1. Market size and forecast, by Organization Size, 2019-2027

7.3.15.2. Market size and forecast, by Deployment Mode, 2019-2027

7.3.15.3. Market size and forecast, by Vertical, 2019-2027

7.3.15.4. Comparative market share analysis, 2019-2027

7.4. LAMEA

7.4.1. Market size and forecast, by Organization Size, 2019-2027

7.4.2. Market size and forecast, by Deployment Mode, 2019-2027

7.4.3. Market size and forecast, by Vertical, 2019-2027

7.4.4. Market size and forecast, by country, 2019-2027

7.4.5. Comparative market share analysis, 2019-2027

7.4.6. Latin America

7.4.6.1. Market size and forecast, by Organization Size, 2019-2027

7.4.6.2. Market size and forecast, by Deployment Mode, 2019-2027

7.4.6.3. Market size and forecast, by Vertical, 2019-2027

7.4.6.4. Comparative market share analysis, 2019-2027

7.4.7. Middle East

7.4.7.1. Market size and forecast, by Organization Size, 2019-2027

7.4.7.2. Market size and forecast, by Deployment Mode, 2019-2027

7.4.7.3. Market size and forecast, by Vertical, 2019-2027

7.4.7.4. Comparative market share analysis, 2019-2027

7.4.8. Africa

7.4.8.1. Market size and forecast, by Organization Size, 2019-2027

7.4.8.2. Market size and forecast, by Deployment Mode, 2019-2027

7.4.8.3. Market size and forecast, by Vertical, 2019-2027

7.4.8.4. Comparative market share analysis, 2019-2027

8. Company Profiles

8.1. IBM Corporation

8.1.1. Business overview

8.1.2. Financial performance

8.1.3. Product portfolio

8.1.4. Recent strategic moves & developments

8.1.5. SWOT analysis

8.2. Cisco Systems Inc.,

8.2.1. Business overview

8.2.2. Financial performance

8.2.3. Product portfolio

8.2.4. Recent strategic moves & developments

8.2.5. SWOT analysis

8.3. SAP

8.3.1. Business overview

8.3.2. Financial performance

8.3.3. Product portfolio

8.3.4. Recent strategic moves & developments

8.3.5. SWOT analysis

8.4. Google

8.4.1. Business overview

8.4.2. Financial performance

8.4.3. Product portfolio

8.4.4. Recent strategic moves & developments

8.4.5. SWOT analysis

8.5. Microsoft

8.5.1. Business overview

8.5.2. Financial performance

8.5.3. Product portfolio

8.5.4. Recent strategic moves & developments

8.5.5. SWOT analysis

8.6. Samsung

8.6.1. Business overview

8.6.2. Financial performance

8.6.3. Product portfolio

8.6.4. Recent strategic moves & developments

8.6.5. SWOT analysis

8.7. Blackberry

8.7.1. Business overview

8.7.2. Financial performance

8.7.3. Product portfolio

8.7.4. Recent strategic moves & developments

8.7.5. SWOT analysis

8.8. Citrix

8.8.1. Business overview

8.8.2. Financial performance

8.8.3. Product portfolio

8.8.4. Recent strategic moves & developments

8.8.5. SWOT analysis

8.9. VMare Inc.,

8.9.1. Business overview

8.9.2. Financial performance

8.9.3. Product portfolio

8.9.4. Recent strategic moves & developments

8.9.5. SWOT analysis

8.10. Quest Software

8.10.1. Business overview

8.10.2. Financial performance

8.10.3. Product portfolio

8.10.4. Recent strategic moves & developments

8.10.5. SWOT analysis

In the recent years, various innovative tools, techniques, and software have been developed to streamline various operations performed in different types of businesses. One such ground-breaking technological invention is the mobile device management (MDM) software, which is used by organizations to monitor, manage, and secure employees' mobile devices such as smart phones, tablets, laptops, etc. These devices are deployed across numerous mobile service providers and across numerous mobile operating systems used in the organization.

What has Triggered the Demand for Mobile Device Management Software?

MDM software is meant to improve the functionality and security of the mobile devices used for business operations and safeguard the corporate network. By implementing custom programmes to mobile devices through MDM software, an IT administrator can manage both corporate-owned as well as personally owned devices to the company’s policies. MDM software can prevent the threat of data loss, avert unapproved installation of software, and deny unofficial access to the mobile devices accessing business data and networks.

The number of mobile phone users have drastically increased since last few years. This has surged the development and manufacturing of advanced mobile devices. Many organizations have shifted from fitted devices to mobile devices in the last decade. As per Small Business Trends, the average employee now uses 2.3 mobile devices. Moreover, as per a research by Vodafone, before the outburst of COVID-19, nearly 75% of organizations had some sort of flexible working arrangements in place. Moreover, IBM have predicted that the global workforce will include 1.87 billion mobile workers by 2022. All these factors have surged the demand for effective mobile device management software for corporate use.

As organizations grow in size, it becomes difficult for IT professionals to manage the growing number of corporate mobile devices that perform work-related tasks. Hence, the need for effective mobile management software becomes a necessity of every organization for protecting their valuable data. MDM is a great way to configure devices to protect personal as well as the organization’s data. Moreover, it offers you the power to lock the stolen devices remotely. Also, the growing data security risks and cyber-attacks on sensitive data of the company have made it very important to implement a decent MDM software. A MDM software also enhances the workflow of the company as well as lets the employees work from remote locations. All these factors have greatly triggered the demand for MDM software, thus leading to the growth of the global MDM market.

Impact of COVID-19 on the Mobile Device Management Market

As per a report by Research Dive, the outbreak of COVID-19 pandemic has made an optimistic impact on the global mobile device management market. As per the report, the global market for mobile device management is expected to grow with a striking growth rate of 28.2% from 2020 to 2027. This is mainly because various companies have adopted work-from-home model for avoiding health related risks all through the pandemic.

During the pandemic, various organizations have implemented mobile device management software for smoother functioning of their business, while following work-from-home working model based on cloud services. The pandemic has greatly increased the adoption of MDM software, thus boosting the revenue of the global mobile device management market.

Recent Developments in the Mobile Device Management Industry

Various players in the MDM sector are coming up with ground-breaking innovations to attain a competitive edge in the market. For instance, in January 2020, Sophos, a leading provider of next-generation cyber security solutions, have developed “Sophos Intercept X for Mobile” with novel security features for Chrome OS devices and enhanced mobile threat protection for iOS and Android devices.

Later in September 2020, the company was named as a front-runner in the “IDC MarketScape: Worldwide Mobile Threat Management Software 2020 Vendor Assessment”, which estimates the product inventions and business policies of 10 mobile threat management (MTM) providers.

Moreover, in August 2020, Beachhead Solutions, a supplier of cloud-managed PC & mobile device security, encryption, and data access control for managed service providers, has declared to expand its channel reseller program, which makes SimplySecure for MSPs™ obtainable to new partners, over the Asian region.

The Way Ahead for Mobile Device Management Industry

As a MDM software helps in maintaining an organization’s sensitive content and guarantees safety of the critical data, it is greatly being used in various organizations across the world. The growing popularity and demand of MDM software, due to their growing functionalities and addition of new features, are sure to take the MDM market growth to a next-level in the near future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com