Test Strips Market Size Share Competitive Landscape And Trend Analysis Report Report

RA00508

Test Strips Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, Application, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

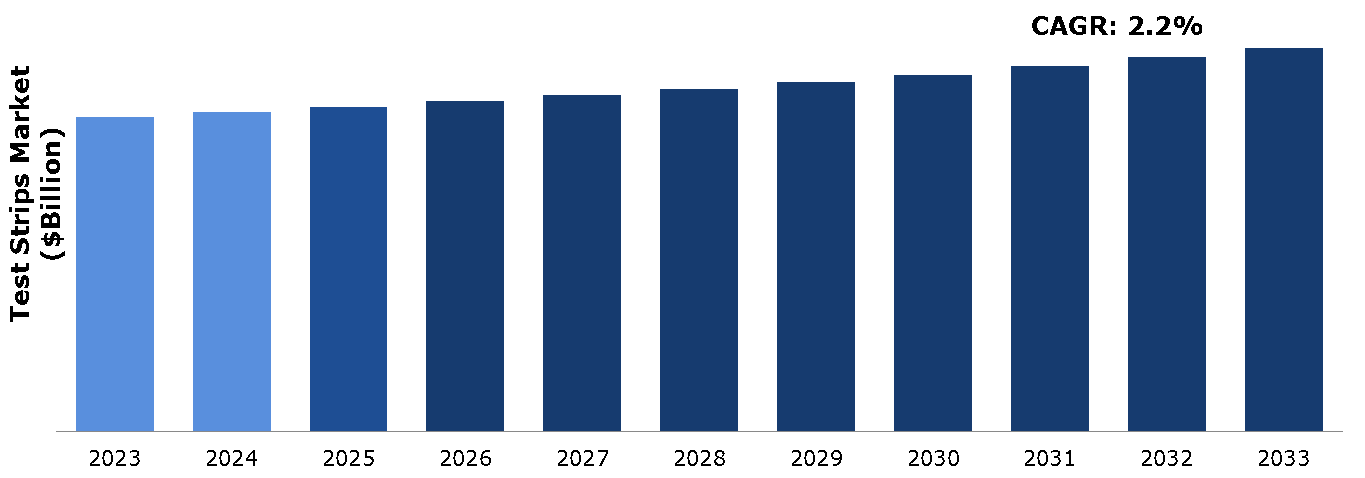

The test strips market was valued at $11.74 billion in 2023 and is estimated to reach $14.31 billion by 2033, exhibiting a CAGR of 2.2% from 2024 to 2033.

Market Introduction and Definition

The test strips market includes a range of diagnostic tools used for various medical purposes, with a primary focus on monitoring specific biomarkers or analytes in bodily fluids like blood, urine, or saliva. Test strips typically consist of a small strip made of paper, plastic, or other materials coated with reagents that react with the target substance, producing a visible change indicative of the analyte's presence or concentration. These strips are widely utilized in healthcare settings, laboratories, and at-home testing scenarios for diagnosing and managing various conditions such as diabetes, urinary tract infections, kidney disorders, and pregnancy. Their compact size, ease of use, and rapid results make them valuable for quick and convenient testing, facilitating timely interventions and treatment decisions. As technological advancements continue to enhance the accuracy, sensitivity, and connectivity of test strips, their role in healthcare diagnostics is poised to expand further.

Key Takeaways

- The test strips market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major test strips industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In May 2023, Roche Diabetes Care India (RDC India) announced the local production of the 'Accu-Chek Active' blood glucose monitoring device and test strips in India. This strategic move aligns with the company's goal of improving diabetes care accessibility and meeting the growing demands of the Indian market. Manufacturing is facilitated through partnerships with Sanmina-SCI India Pvt. Ltd. for production and Parekh Integrated Services Pvt. Ltd. (PISPL) for assembly and distribution.

- A January 2022 research study published in NCBI revealed that 12-16% of adult hospital inpatients in the U.S. had indwelling urinary catheters (IUCs) during their stay, with each additional day increasing the risk of catheter-associated urinary tract infections (CAUTIs) by 3-7%. Forecasted increases in complicated urinary tract infections (UTIs) are anticipated due to bacterial resistance and recurrence rates, leading to an increase in demand for test strips in North America.

- In 2021, the American Diabetes Association estimated that 38.4 million Americans had diabetes, with 29.7 million diagnosed and 8.7 million undiagnosed. This growing diabetic population is expected to drive demand for blood glucose test strips. Consequently, the region anticipates market growth as the prevalence of the disease continues to rise.

Key Market Dynamics

The market growth of test strips is significantly driven due to the rising population across the globe, as there is a consistent increase in health conditions like diabetes in the elderly population. Factors such as decreased physical activity, metabolic changes, and hormonal imbalances make senior adults more prone to diabetes. Consequently, there is an increase in demand for blood glucose testing strips as this demographic requires diligent diabetes management. With the elderly population experiencing higher rates of chronic diseases, including diabetes, the necessity for regular blood glucose monitoring increases. Thus, there is an increase in demand for test strips to ensure senior adults undergo routine testing and effectively manage their diabetes.

However, stringent regulatory requirements pose a significant obstacle to market development, as manufacturers need to go through complex approval processes to ensure product safety and efficacy, potentially slowing innovation and market.

The increasing demand for point-of-care testing presents significant growth opportunities for the key players operating in the test strips market. This factor allows for rapid on-site blood level analyses without the need for laboratory processing, delivering timely results. With benefits such as convenience, quicker response times, and immediate adjustments in diabetes management strategies, point-of-care testing is gaining popularity. Patients can obtain blood glucose measurements within minutes, enabling prompt adjustments to diet, exercise, or medication, thereby empowering individuals to make timely health decisions.

Patent Analysis of Global Test Strips Market

A patent analysis of the global test strips market reveals innovative developments in glucose monitoring technology. Key patents focus on enhancing accuracy, ease of use, and integration with digital platforms for real-time data management. Such advancements drive competitiveness and shape the future landscape of blood glucose testing.

- In November 2023, in China, TIANJIN OUERKE MEDICAL TECHNOLOGY CO., LTD. launched the device for automatically screening test strips which comprises a box body with a box cover that buckles at the top. A rectangular groove is positioned at the bottom end of one side of the box body. A bearing seat, which is connected to the rectangular groove, is fixed at the bottom end of this side. An infrared sensor is installed at the top of one side of the box body, facing the bearing seat. This sensor is connected to the rectangular groove, enhancing the functionality and precision of the device in screening test strips.

Market Segmentation

The market is segmented into type, application, and region. On the basis of type, the market is divided into urine test strip, diabetic strips, and fluorescein. As per application, the market is segregated into disease diagnosis and pregnancy test. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America test strips market growth is driven by robust healthcare reimbursements, rapid adoption of new medical technologies, and rising government initiatives to combat diabetes. According to the 2022 National Diabetes Statistics Report by the Centers for Disease Control and Prevention (CDC), over 130 million adults in the U.S. are fighting with diabetes or prediabetes.

- As per the CDC's January 2022 update, 37.3 million individuals, comprising 11.3% of the U.S. population, were reported to have diabetes, with 28.7 million diagnosed cases in the previous year alone. This increasing diabetic population is anticipated to boost demand for diabetes test strips, consequently stimulating market growth in the region.

-

As per the American Diabetes Association's estimates for 2021, approximately 38.4 million Americans were affected by diabetes. Among them, 29.7 million were diagnosed, while 8.7 million remained undiagnosed. The expanding diabetic populace is poised to boost the need for blood glucose test strips, consequently driving market growth across the region.

Competitive Landscape

The major players operating in the test strips market include Chiltern Medicare Ltd, Lifeassay Diagnostics (Pty), Braun Melsungen AG, Arkray Inc, Teco Diagnostics, Henry Schein, global, Roche Diagnostics, Taidoc Technology Corporation, Siemens Healthcare, and Abbott Laboratories,

Recent Key Strategies and Developments

- In May 2022, OmegaQuant introduced an at-home testing kit for HbA1c blood sugar, enabling users to measure their hemoglobin A1c levels, crucial for glucose metabolism. Traditionally necessitating a blood draw and lab analysis, OmegaQuant's HbA1c test simplifies the process with a convenient finger stick, empowering users to conduct the test at their convenience and in the comfort of their homes.

- In September 2020, Lifescan inaugurated its OneTouch Amazon storefront, catering to patients dealing with Type 1 and Type 2 diabetes. Among the new features is the debut of a value-pack comprising 30-count test strips for the OneTouch Verio. This move is anticipated to bolster their service portfolio and drive revenue expansion.

Key Sources Referred

- Annual Reports

- Press Release

- Research Papers

- Investor Presentations

- D&B Hoovers

- Company Analysis

- Test Strips Investment & Trade

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the test strips market segments, current trends, estimations, and dynamics of the test strips market analysis from 2024 to 2033 to identify the prevailing test strips market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the test strips market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global test strips market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

This report includes the analysis of the regional as well as global test strips market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on test strips market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Test Strips Market Analysis, by Type

5.1. Overview

5.2. Urine Test Strip

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Diabetic Strip

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Fluorescein

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2024-2033

5.4.3. Market share analysis, by country, 2024-2033

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Test Strips Market Analysis, by Application

6.1. Overview

6.2. Disease Diagnosis

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Pregnancy Test

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Test Strips Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2024-2033

7.1.1.2. Market size analysis, by Application, 2024-2033

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2024-2033

7.1.2.2. Market size analysis, by Application, 2024-2033

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2024-2033

7.1.3.2. Market size analysis, by Application, 2024-2033

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2024-2033

7.2.1.2. Market size analysis, by Application, 2024-2033

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2024-2033

7.2.2.2. Market size analysis, by Application, 2024-2033

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2024-2033

7.2.3.2. Market size analysis, by Application, 2024-2033

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2024-2033

7.2.4.2. Market size analysis, by Application, 2024-2033

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2024-2033

7.2.5.2. Market size analysis, by Application, 2024-2033

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2024-2033

7.2.6.2. Market size analysis, by Application, 2024-2033

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2024-2033

7.3.1.2. Market size analysis, by Application, 2024-2033

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2024-2033

7.3.2.2. Market size analysis, by Application, 2024-2033

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2024-2033

7.3.3.2. Market size analysis, by Application, 2024-2033

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2024-2033

7.3.4.2. Market size analysis, by Application, 2024-2033

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2024-2033

7.3.5.2. Market size analysis, by Application, 2024-2033

7.3.6. Rest of Asia Pacific

7.3.6.1. Market size analysis, by Type, 2024-2033

7.3.6.2. Market size analysis, by Application, 2024-2033

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2024-2033

7.4.1.2. Market size analysis, by Application, 2024-2033

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Type, 2024-2033

7.4.2.2. Market size analysis, by Application, 2024-2033

7.4.3. UAE

7.4.3.1. Market size analysis, by Type, 2024-2033

7.4.3.2. Market size analysis, by Application, 2024-2033

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2024-2033

7.4.4.2. Market size analysis, by Application, 2024-2033

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2024-2033

7.4.5.2. Market size analysis, by Application, 2024-2033

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2023

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2023

9. Company Profiles

9.1. Chiltern Medicare Ltd

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Lifeassay Diagnostics (Pty)

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Braun Melsungen AG

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Arkray Inc

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Teco Diagnostics

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Henry Schein

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Roche Diagnostics

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Taidoc Technology Corporation

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Siemens Healthcare

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Abbott Laboratories

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com