Dental Implants Market Report

RA00501

Dental Implants Market, by Product (Tapered Implants, Parallel-walled Implants), End Use (Hospitals, Dental Clinics, Others), Material (Titanium Implants, Zirconium Implants): Global Opportunity Analysis and Industry Forecast, 2024 to 2033

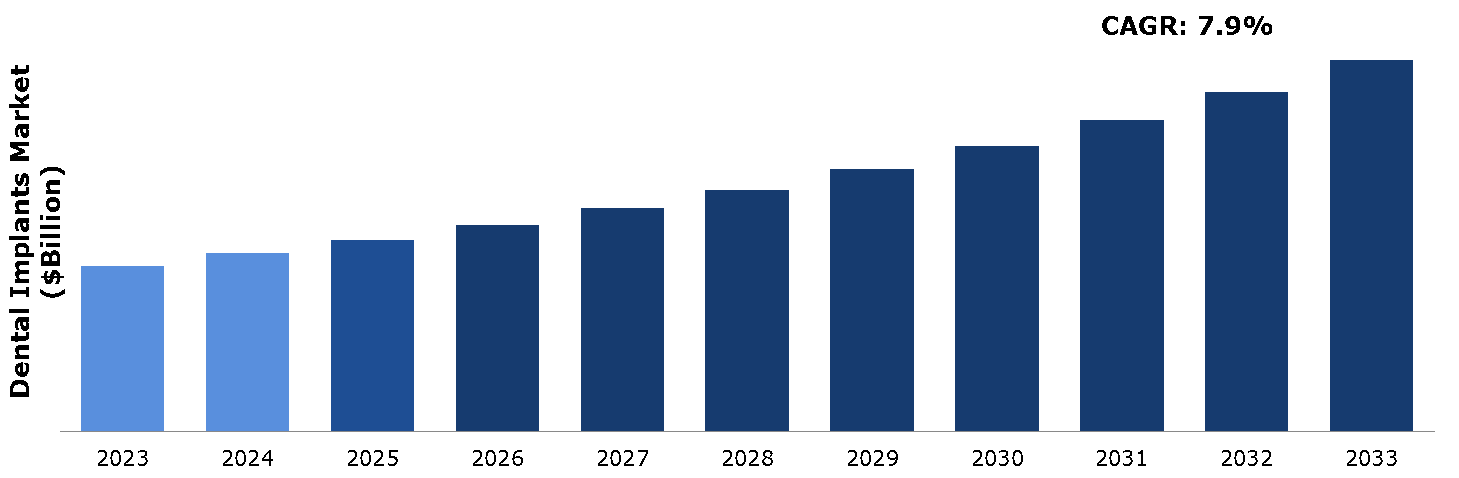

The dental implants market was valued at $4.74 billion in 2023 and is estimated to reach $10.10 billion by 2033, exhibiting a CAGR of 7.9% from 2024 to 2033.

Market Introduction and Definition

Dental implants are innovative solutions for replacing damaged or infected teeth, enhancing both function and aesthetics. These artificial teeth, inserted into the gumline, offer patients a long-term remedy for restoring their dental health and quality of life. By improving bite strength and facilitating a better eating experience, successful implantation significantly enhances the overall well-being of individuals. Key materials utilized in commercial dental implants include metallic alloys like titanium, renowned for their biocompatibility and durability, as well as ceramic options such as zirconia, offering aesthetic appeal and strength. In addition, materials like glassy carbon contribute to the versatility and effectiveness of these implants. Through the combination of advanced materials and precise surgical techniques, dental implants represent a reliable and enduring solution for individuals seeking to regain optimal dental function and appearance.

Key Takeaways

- The dental implants market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major dental implants industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In February 2023, Rapid Shape and BEGO collaborated, providing users with Rapid Shape's RS D20+, D30+, and D50+ 3D printers to utilize BEGO's Varseo dental materials. This partnership grants access to VarseoSmile and VarseoWax materials, including VarseoSmile Crown and Temp, and VarseoWax Model and WAX CAD/Cast. With this collaboration, Rapid Shape users can now create definitive crowns, inlays, tabletops, onlays, and veneers.

- In January 2023, Nobel Biocare, in collaboration with Mimetis Biomaterials S.L., introduced creos syntogain, a biomimetic bone graft substitute. With a composition comprising 80% Calcium Deficient Hydroxyapatite (CDHA) and 20% B-TCP (beta-tricalcium phosphate), this innovative material closely replicates human bone structure. Its resemblance to CDHA, the primary component of natural bone, enhances bone formation efficacy. By replicating the natural composition of human bone, creos syntogain offers a promising solution for bone regeneration, promising better integration and long-term stability in medical applications.

Key Market Dynamics

The global dental implants market is growing due to several factors such as increasing awareness regarding oral health and aesthetics, which encourages individuals to opt for dental implants as a permanent solution. Furthermore, the rising prevalence of dental conditions like periodontal disease further boosts the need for implant treatments, contributing to the steady growth of the dental implants market.

Moreover, the growth of dental implants faces significant challenges in low-income economies due to limited awareness. This obstacle is owing to inadequate resources for education and healthcare infrastructure, hindering the awareness about the benefits and availability of dental implants.

The increasing integration of AI in oral care is anticipated to boost the demand for dental implants in the future. As AI technologies advance, they enhance diagnostic accuracy and treatment planning, providing confidence in implant procedures. This trend is anticipated to drive significant expansion of the dental implant market.

Patent Analysis of Dental Implant Market

The patent analysis of the dental implants market offers innovative products for enhancing patient care, related to dental prosthesis, fixture coupling, and other dental implant solutions. Companies are regularly investing in intellectual property to provide advancements in technology, ensuring competitive advantage, facilitating unique product development, and driving demand for dental implants products.

- In July 2021, Osstemimplant Co., Ltd. filed patent in South Korea for dental implants abutment. The disclosure provides a dental implant abutment encompassing a prosthesis coupling part that comprises a body coupled to a prosthesis, and has a protrusion provided on the outer surface of the body and protruding in an outer peripheral surface direction, a flat surface formed so as to contact the protrusion, and a rotation-preventing protrusion formed on the opposite side of the body from the protrusion. This development would progress the growth and adoption of the product in the country.

- In June 2021, DeguDent GmbH, and Dentsply Sirona Inc. filed a patent for dental implant and dental restoration system comprising. The development is related to a dental implant comprising the lower part and an upper part. Wherein the lower part of the dental implant, which would be connected to the jawbone of a patient. While the upper part of the dental implant is made of a ceramic material, and ceramic material comprises zirconium dioxide comprising at least one coloring additive. The invention is further related to a dental restoration system comprising at least such an inventive dental implant and at least one abutment.

Market Segmentation

The dental implants market is segmented into product, material, end use, and region. On the basis of product, the market is divided into tapered implants and parallel-walled implants. As per material, the market is segregated into titanium and zirconia. By end use, the market is classified into hospitals, dental clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Asia-Pacific is experiencing a notable increase in demand for dental implants due to several factors. Increasing healthcare expenditure in countries like China, India, and Japan are facilitating greater affordability of dental procedures, including implants. For instance, according to WHO, China health expenditure in 2021, increased to $956,082.4 million in comparison to $831,350 in 2020. In addition, increasing awareness regarding dental health and aesthetics, driven by urbanization and media campaigns by numerous brands, is prompting more individuals to seek advanced dental solutions such as implants.

- In March 2024, UnionTech showcased its advanced EvoDent D300 3D printer at Dental South China, featuring advanced digital light processing (DLP) technology. Specifically designed for large and medium-sized denture processing facilities, the fully automated machine targets restoration and implant model applications, signaling a significant growth in stereolithography innovation within the dental industry.

- In August 2023, RevBio, Inc. announced that the company obtained the U.S. FDA approval for a 20-patient clinical trial to assess the safety and efficacy of their Tetranite bone adhesive biomaterial, designed to stabilize dental implants post-tooth extraction.

Competitive Landscape

The major players operating in the dental implants market include BioHorizons IPH, Inc., Nobel Biocare Services AG, ZimVie Inc., OSSTEM IMPLANT, Institut Straumann AG, Bicon, LLC, T-Plus Implant Tech. Co., Anthogyr SAS, DENTSPLY Sirona, and KYOCERA Medical Corp.

Other players in dental implants market include DENTIUM Co., Ltd., and RevBio, Inc.

Recent Key Strategies and Developments

- In March 2023, Envista Holdings Corporation, through its subsidiary Implant Direct, unveiled the Simply Iconic implant system, a conical hex design aimed at enhancing primary stability and aesthetics in dental treatments. This innovation will provide simplified procedures, marking a significant advancement in implant technology for improved patient outcomes and practitioner convenience.

- In November 2022, ZimVie Inc. introduced the TSX Implant in the U.S., enhancing their range of dental solutions. Engineered for immediate extraction and loading, it would facilitate predictability and stability in various bone densities. This innovation reflects the company’s commitment toward advancing surgical, restorative, and digital dentistry practices, benefiting patients and practitioners.

Key Sources Referred

- World Dental Federation (FDI)

- World Bank

- American Dental Association (ADA)

- International Association for Dental Research (IADR)

- ZimVie Inc.

- Envista Holdings Corporation

- RevBio, Inc.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the dental implants market segments, current trends, estimations, and dynamics of the dental implants market analysis from 2023 to 2033 to identify the prevailing dental implants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global dental implants market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental implants market trends, key players, market segments, application areas, and market growth strategies.

The market study comprises of all latest technological advancements, including the latest market development by major players operating in the market. Furthermore, the study also comprises detailed patent analysis.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Material |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of manufacturers

4.3.2. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Dental Implants Market Analysis, by Product

5.1. Overview

5.2. Tapered Implants

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Parallel-Walled Implants

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Dental Implants Market Analysis, by Material

6.1. Overview

6.2. Titanium

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Zirconia

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Dental Implants Market Analysis, by End-use

7.1. Overview

7.2. Hospitals

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Dental Clinics

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Others

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Dental Implants Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product, 2023-2033

8.1.1.2. Market size analysis, by Material, 2023-2033

8.1.1.3. Market size analysis, by End-use, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Product, 2023-2033

8.1.2.2. Market size analysis, by Material, 2023-2033

8.1.2.3. Market size analysis, by End-use, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product, 2023-2033

8.1.3.2. Market size analysis, by Material, 2023-2033

8.1.3.3. Market size analysis, by End-use, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product, 2023-2033

8.2.1.2. Market size analysis, by Material, 2023-2033

8.2.1.3. Market size analysis, by End-use, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Product, 2023-2033

8.2.2.2. Market size analysis, by Material, 2023-2033

8.2.2.3. Market size analysis, by End-use, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Product, 2023-2033

8.2.3.2. Market size analysis, by Material, 2023-2033

8.2.3.3. Market size analysis, by End-use, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Product, 2023-2033

8.2.4.2. Market size analysis, by Material, 2023-2033

8.2.4.3. Market size analysis, by End-use, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Product, 2023-2033

8.2.5.2. Market size analysis, by Material, 2023-2033

8.2.5.3. Market size analysis, by End-use, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product, 2023-2033

8.2.6.2. Market size analysis, by Material, 2023-2033

8.2.6.3. Market size analysis, by End-use, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product, 2023-2033

8.3.1.2. Market size analysis, by Material, 2023-2033

8.3.1.3. Market size analysis, by End-use, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Product, 2023-2033

8.3.2.2. Market size analysis, by Material, 2023-2033

8.3.2.3. Market size analysis, by End-use, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Product, 2023-2033

8.3.3.2. Market size analysis, by Material, 2023-2033

8.3.3.3. Market size analysis, by End-use, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Product, 2023-2033

8.3.4.2. Market size analysis, by Material, 2023-2033

8.3.4.3. Market size analysis, by End-use, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Product, 2023-2033

8.3.5.2. Market size analysis, by Material, 2023-2033

8.3.5.3. Market size analysis, by End-use, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Product, 2023-2033

8.3.6.2. Market size analysis, by Material, 2023-2033

8.3.6.3. Market size analysis, by End-use, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product, 2023-2033

8.4.1.2. Market size analysis, by Material, 2023-2033

8.4.1.3. Market size analysis, by End-use, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Product, 2023-2033

8.4.2.2. Market size analysis, by Material, 2023-2033

8.4.2.3. Market size analysis, by End-use, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Product, 2023-2033

8.4.3.2. Market size analysis, by Material, 2023-2033

8.4.3.3. Market size analysis, by End-use, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Product, 2023-2033

8.4.4.2. Market size analysis, by Material, 2023-2033

8.4.4.3. Market size analysis, by End-use, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product, 2023-2033

8.4.5.2. Market size analysis, by Material, 2023-2033

8.4.5.3. Market size analysis, by End-use, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. BioHorizons IPH, Inc.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Nobel Biocare Services AG

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. ZimVie Inc.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. OSSTEM IMPLANT

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Institut Straumann AG

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Bicon, LLC

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. T-Plus Implant Tech. Co.

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Anthogyr SAS

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. DENTSPLY Sirona

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. KYOCERA Medical Corp

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com