Collagen Peptides Market Report

RA00389

Collagen Peptides Market by Source (Bovine, Porcine, Marine, and Poultry), Application (Nutritional Products, Food & Beverage, Cosmetics & Personal Care, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030.

Global Collagen Peptides Market Analysis

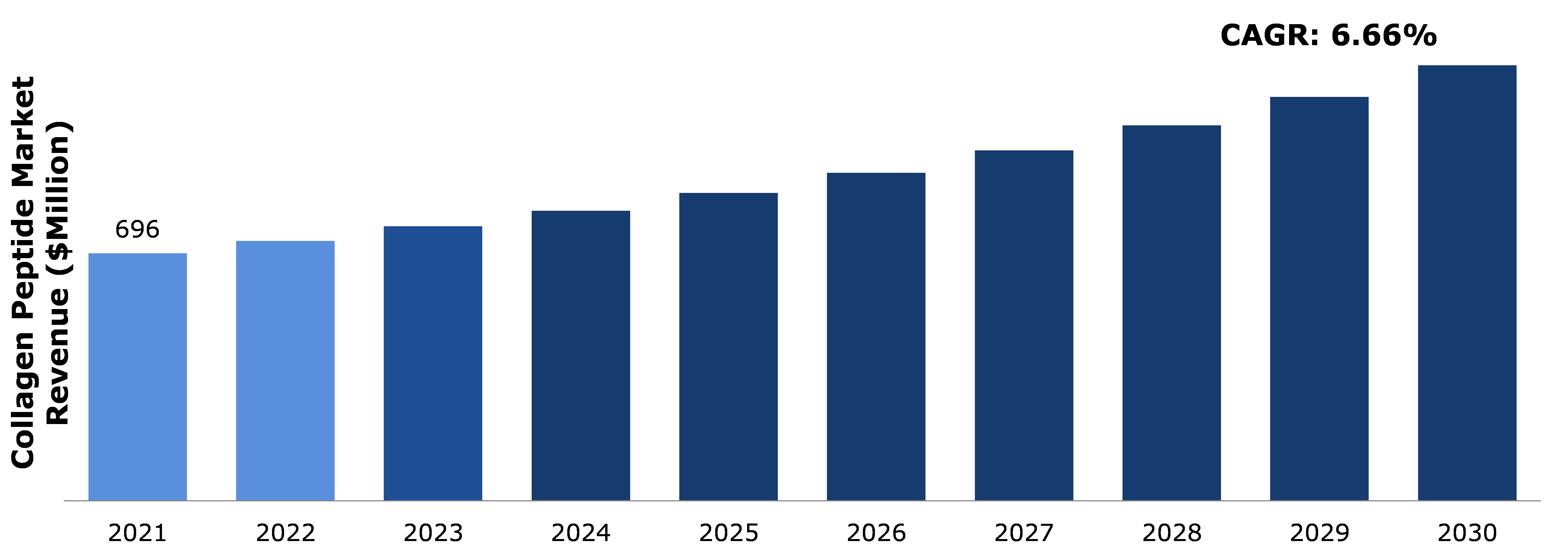

The global collagen peptides market size was $696 million in 2021 and is predicted to grow with a CAGR of 6.66%, by generating a revenue of $1,224.4 million by 2030.

Global Collagen Peptides Synopsis

People's desire for active substances for skin health protection and therapeutic efficacy is increasing as the social aging problem becomes more prevalent. Bioactive peptides are the best anti-aging ingredients because of their wide range of biological activity and excellent safety, including anti-oxidation, anti-aging, anti-diabetes, anti-hypertension, and antibacterial properties. Anti-aging peptides, both natural and synthetic, have been intensively researched in vitro, vivo, and clinically in recent years. When administered locally and consumed, anti-aging peptides, such as collagen peptides, can alter many physiological pathways of the skin and have a considerable skin protection effect. Bioactive peptides can promote skin health by performing certain physiological tasks, as evidenced by these properties. The beauty sector is another booster for the collagen peptides market. Products with fruit juices, beer, and wine use collagen peptides as thickeners or clarifying agents. Collagen peptides are used in lots of meals as useful meal ingredients.

However, the presence of substitutes of collagen peptides like soy products, black beans, kidney beans, nuts, and seeds of pumpkin limits the intake of collagen peptides. This is one of the most important restraints of the market. Another most important restraint is that the extraction of the collagen peptides is generally from bovine animals. Products containing animal content are denied by spiritual and vegetarian people.

Collagen peptides products are available in pills, capsule, liquid, and powder forms. One way to consume collagen peptides is by adding a scoop of powdered form of collagen peptides in omelet, which will help in building muscle, losing fat, and recovering muscles. Since humans are changing their life-styles and are being extra health-conscious by consuming wholesome food, keeping a balanced diet, and using nutraceutical dietary supplements to reinforce their immunity, the marketplace for collagen peptides is expected to grow. Technology has superior exponentially and is in addition growing at a speedy rate, which may be used to perceive distinct markets and forecast the growth.

Collagen Peptides Overview

Collagen peptides are small fragments of collagen which helps to makeup the skin and cartilage and improve joint conditions. They are used for taking care of aging skin and osteoarthritis. Collagen peptides can be consumed by adding them to oats, milk, and eggs.

COVID-19 Impact on Collagen Peptides Market

The COVID-19 epidemic impacted food & beverage industry due to restrictions and isolation measures imposed by governments all over the world, disrupting supply chain procedures both within and outside the country, resulting in food shortage, which lead to decreased consumption of collagen peptides as they are mostly consumed through food. This had an influence on local markets, and there was a shortage of supply of products like nutraceuticals due to a reduction in the number of ingredients manufactured for the food & beverage industry. Increasing Covid cases led shortage of food as people started panic buying food in order to maintain future stock, which affected the collagen peptides market trends.

However, since COVID cases and mortality rates have decreased, the situation has stabilized, and the global collagen peptides market is expected to grow as people become more conscious of what they eat and how it impacts their bodies. People have started consuming collagen peptides for muscle building. During the crisis, many major players continuously strategized new tactics such as launching new products and joint ventures to capture the market. According to the article on www.researchdive.com, GELITA AG, a company that provides collagen peptides, launched "VERISOL", a new bioactive collagen peptide which enhances hair growth. The company found that in the study conducted on 44 women for 26 weeks, there was a 31% increase in hair growth due to administration of bioactive collagen peptides (BPC).

Rising Collagen Peptides Demand as a Healthy Supplement for Skin Betterment and Muscle Recovery is the Major Driver for Collagen Peptides Market

There has been an increase in health awareness among people which is leading them to consume nutritious and healthy supplements which boost immunity as well as prevent diseases. This, followed by their concern about how they look and how healthy their skin & joints are may drive the collagen peptides market growth. The hype in the cosmetic industry is another booster for the collagen peptides market. Products such as fruit juices, beer, and wine use collagen peptides as thickeners or clarifying agents. Collagen peptides are used in many food items as functional food ingredients. The major increase in demand for collagen peptides is due to the high source of protein, which plays a very important role in body nutrition. The growth in the food & beverage market is boosting the growth of the collagen peptides market.

Availability of Alternatives of Collagen Peptides like Kidney Beans and Regulatory Mandate on Animal Origin Food Restrict the Collagen Peptides Market

The presence of substitutes for collagen peptides such as soy products, black beans, kidney beans, nuts, and seeds of pumpkin limits the consumption of collagen peptides. This is one of the major restraints of the market. Another major restraint is that the extraction of the collagen peptides is mostly from bovine animals. Products containing animal content are denied by religious and vegetarian people. There are some areas where the use or consumption of animals is less such as Haryana and Rajasthan, which might restrict the market growth. Animal welfare and care organizations such as PETA and People for Animals protest against activities that involve animal cruelty or animal harm. Their presence globally has a huge impact on people, and they also organize online campaigns which enable them to reach the maximum number of people and restrict the companies that use animal content in their products.

Increase in Collagen Peptides Product Demand by Health Conscious People in Developing Economies is Expected to Provide Collagen Peptides Market Opportunity for Investment leading to the Growth of Collagen Peptides Market

Insufficient intake of essential nutrients like proteins and vitamins increases the chances of many chronic diseases such as hypertension, cancer, diabetes and obesity. Since people are changing their lifestyles and are being more health-conscious by consuming healthy food, maintaining a balanced diet, and using nutraceutical supplements to boost their immunity, the market for collagen peptides is projected to grow as they have benefits like muscle recovery. Technology has advanced exponentially and is further developing at a rapid rate, which can be used to identify different markets and forecast the growth. Additionally, the rise in the usage of cosmetic products will fuel the growth of the collagen peptides market in the future.

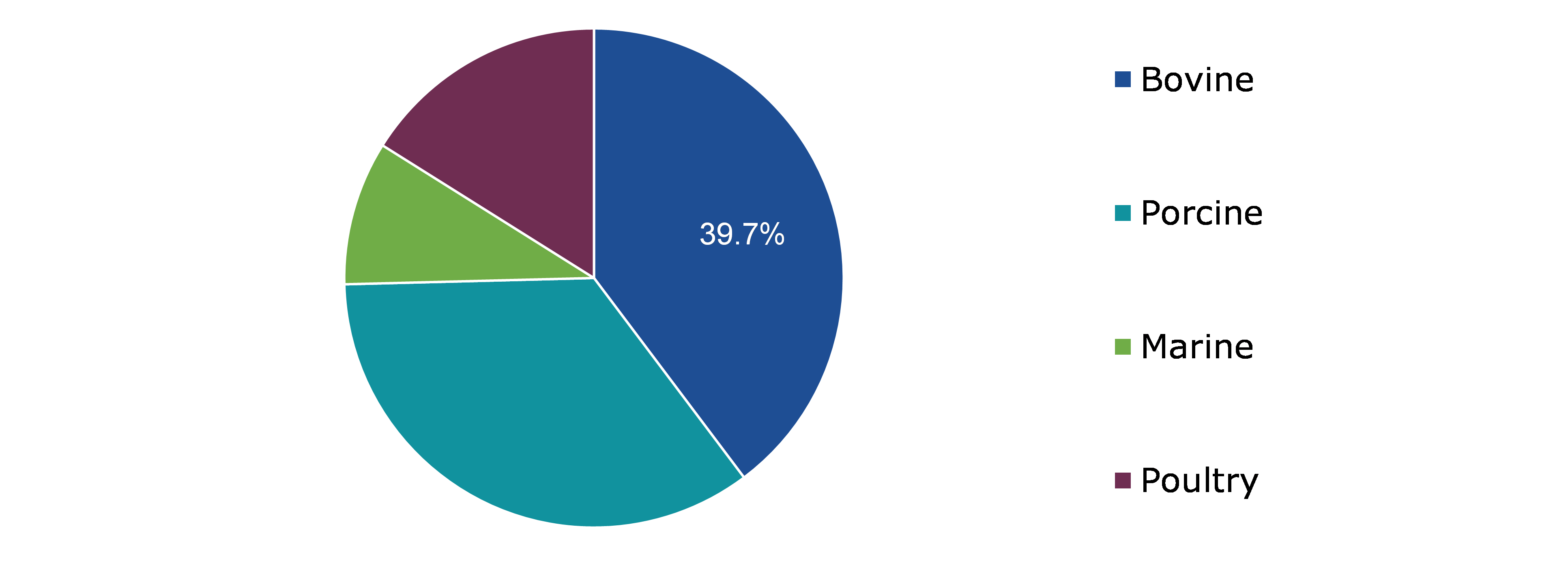

Global Collagen Peptides Market, by Source

Based on source, the market has been divided into bovine, porcine, marine, and poultry. Among these, the bovine sub-segment accounted for the highest market share in 2021 whereas the marine source will witness fastest market growth in projected timeframe.

Global Collagen Peptides Market Share, by Source, 2021

Source: Research Dive Analysis

Bovine source sub-type is anticipated to have a dominant market share and generate a revenue of $476.4 million by 2030, growing from $276.6 million in 2021. According to the collagen peptides market article on www.researchdive.com, the bovine source of collagen peptides has a 40.4% market share, which is the majority of the market share. Cattles are one of the most consumed meats globally and due to their easy availability, there is a wide utilization of bovine animals' organs such as bones, ligaments, and other body parts for extraction of collagen peptides. Due to these factors, bovine sources are estimated to accelerate their growth in the forecasted years.

Marine sub-segment- is the fastest growing sub-segment and generate a revenue of $124.3 million by 2030, growing from $64.9 million in 2021. An excess amount of waste is generated by fish processing, such as fins and scales, which is utilized in the production of collagen peptides. This rapid growth of the aquaculture industry boosts and supports the growth of the collagen peptides market as the raw material for collagen peptides is derived from the waste of the marine industry.

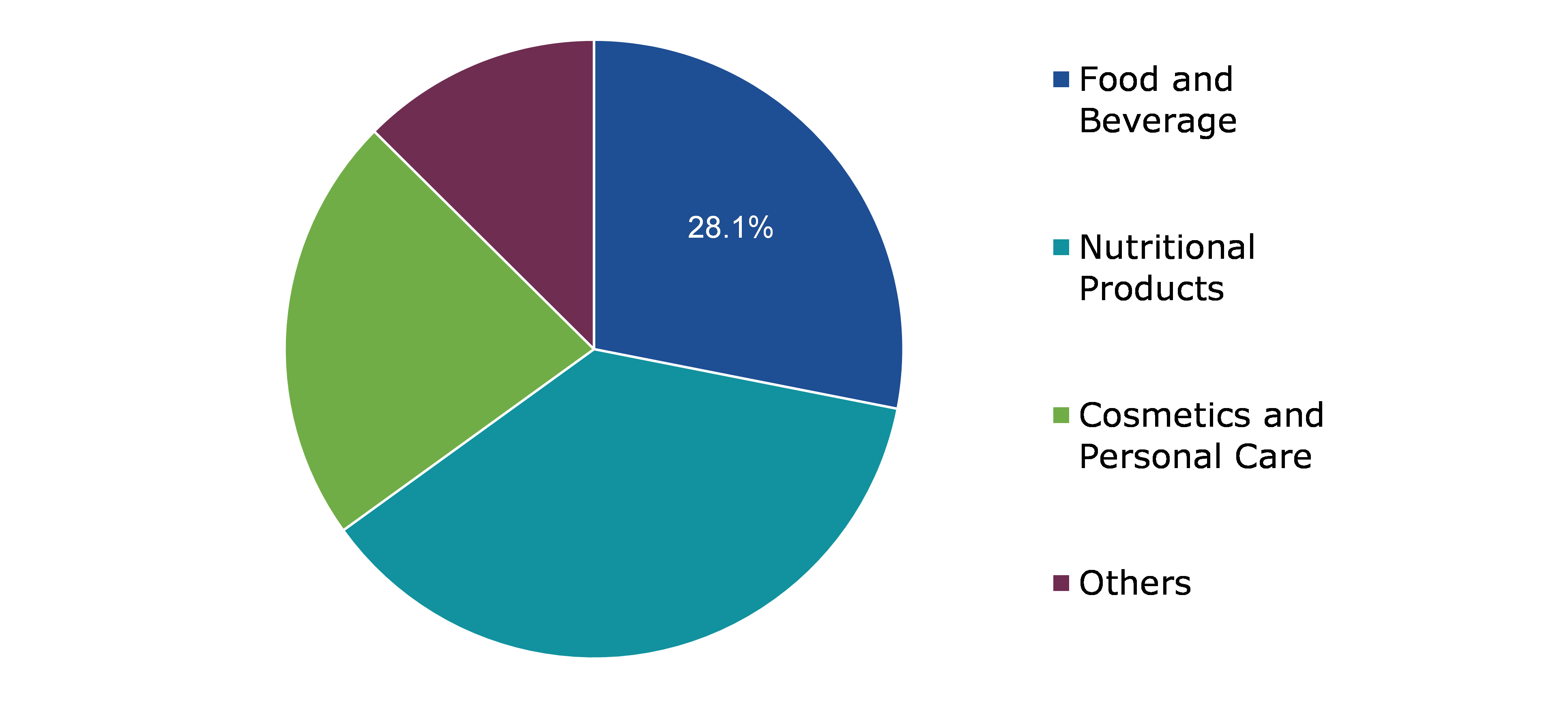

Global Collagen Peptides Market, by Application

Based on application the global collagen peptides market has been divided into nutritional products, food & beverage, cosmetics & personal care, and others. Food & beverage sub-segment is expected to be the dominating application in the global collagen peptides market.

Global Collagen Peptides Market Share, by Application, 2021

Source: Research Dive Analysis

Food & beverage sub-type is expected to be the dominating market share and generate a revenue of $332.9 million by 2030, growing from $195.5 million in 2021. Collagen peptides are abundantly used in food and beverages due to their ability to easily get absorbed in the digestive track, thickening food, and texturing properties. The food & beverage industry in North America and Europe have high demand for dietary supplements and functional foods & beverages. These factors will propel the growth of collagen peptides in the nutritional market in the forecasted years

Global Collagen Peptides Market, Regional Insights

The collagen peptides market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Collagen Market Size & Forecast, by Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Collagen Peptides Market in North America to be the Most Dominant

North America collagen peptides market is expected to be the fastest growing accounted $228.3 million in 2021 and is projected to grow with a CAGR of 6.18%. Collagen as a source of energy and nutrition is taking over North America and is very popular among the population of North America. The healthcare industry is using collagen peptides to manufacture drugs for the regeneration of bones in arthritis patients. These factors contribute to the development of the collagen peptides market in the North America region. The presence of collagen peptides in the cosmetic industry coupled with health consciousness of people accelerates the growth of the collagen peptides market demand in North America.

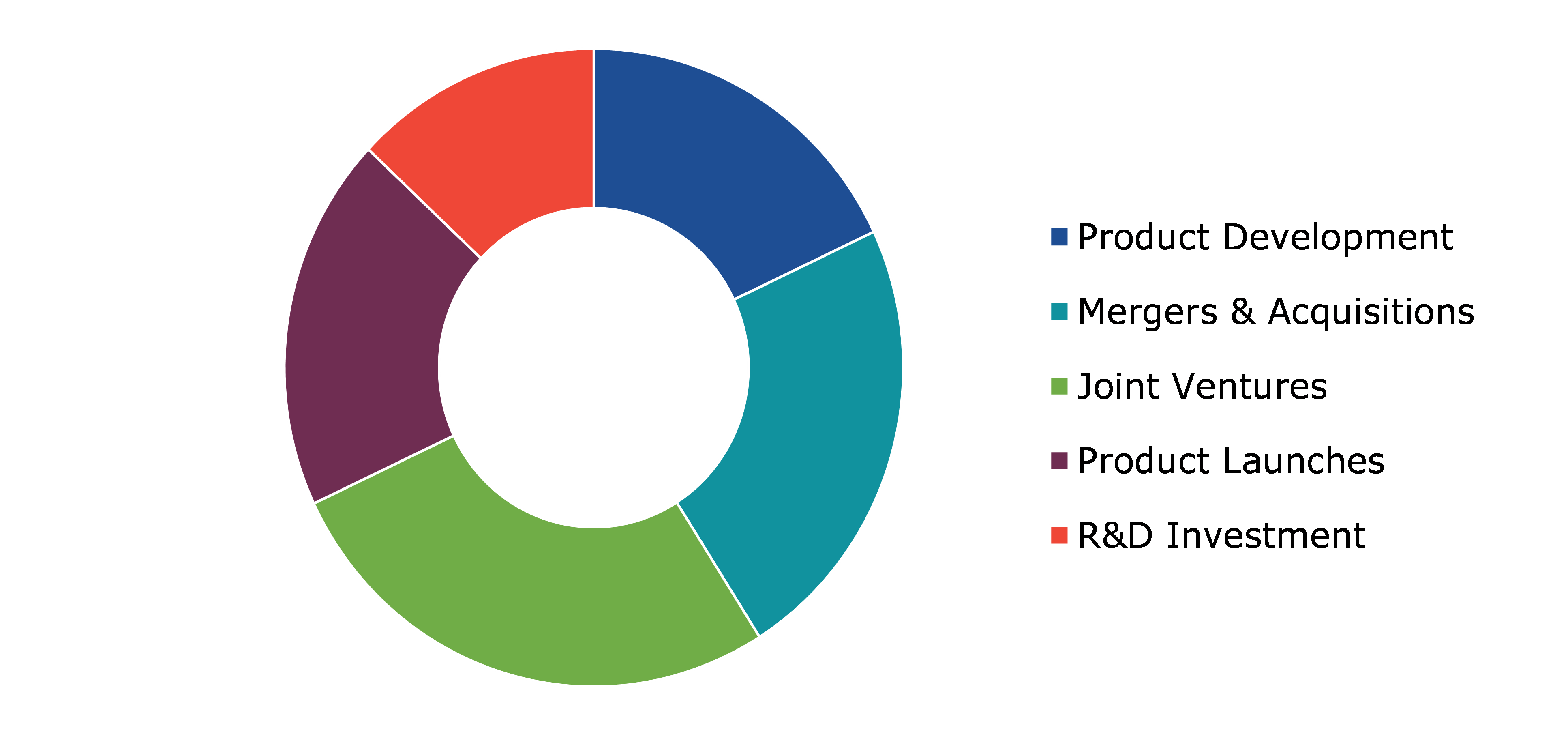

Competitive Scenario in the Collagen Peptides Market

Investment and agreement are common strategies used by major market players. For example, In December 2020, Gelita AG, acquired 65% of the shares in the Turkish gelatin producer, SelJel (Turkey). The acquisition is part of the company’s growth strategy, enabling it to meet the increasing demand for halal beef gelatin.

Source: Research Dive Analysis

Some of the major players in the collagen peptides market are Tessenderlo Group, Darling Ingredients, GELITA AG, Holista Colltech, Collagen Solutions Plc, Nitta Gelatin India Limited, Amicogen, GELNEX, FOODMATE CO. LTD., and Ewald-Gelatine GmbH.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

|

Segmentation by Source

|

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the collagen peptides market?

A. The size of the global Collagen Peptide market was over $696 million in 2021 and is projected to reach $1,224.4 million by 2030.

Q2. Which are the major companies in the collagen peptides market?

A. CGelita AG, Tessenderlo Group, Darling Ingredients, GELITA AG, Holista Colltech, Collagen Solutions Plc, and Nitta Gelatin India Limited are some of the key players in the global Collagen Peptide.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The North America region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific collagen peptides market?

A. Asia-Pacific collagen peptides market is anticipated to grow at 7.79% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Tessenderlo Group, Darling Ingredients, and GELITA AG are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Collagen Peptides Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Collagen Peptides Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Collagen Peptides Market Analysis, by Source

5.1.Overview

5.2.Connectivity system

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Driver Assistance System

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness, 2021-2030

5.4.2.Competition heatmap, 2021-2030

6.Collagen Peptides Market Analysis, by Application

6.1.Original Equipment Manufacturer

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Aftermarket

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness, 2021-2030

6.3.2.Competition heatmap, 2021-2030

7.Collagen Peptides Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Source, 2021-2030

7.1.1.2.Market size analysis, by Application, 2021-2030

7.1.2.Canada

7.1.2.1.Market size analysis, by Source, 2021-2030

7.1.2.2.Market size analysis, by Application, 2021-2030

7.1.3.Mexico

7.1.3.1.Market size analysis, by Source, 2021-2030

7.1.3.2.Market size analysis, by Application, 2021-2030

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness, 2021-2030

7.1.4.2.Competition heatmap, 2021-2030

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Source, 2021-2030

7.2.1.2.Market size analysis, by Application, 2021-20300

7.2.2.UK

7.2.2.1.Market size analysis, by Source, 2021-2030

7.2.2.2.Market size analysis, by Application, 2021-2030

7.2.3.France

7.2.3.1.Market size analysis, by Source, 2021-2030

7.2.3.2.Market size analysis, by Application, 2021-2030

7.2.4.Spain

7.2.4.1.Market size analysis, by Source, 2021-2030

7.2.4.2.Market size analysis, by Application, 2021-2030

7.2.5.Italy

7.2.5.1.Market size analysis, by Source, 2021-2030

7.2.5.2.Market size analysis, by Application, 2021-2030

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Source, 2021-2030

7.2.6.2.Market size analysis, by Application, 2021-2030

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness, 2021-2030

7.2.7.2.Competition heatmap, 2021-2030

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Source, 2021-2030

7.3.1.2.Market size analysis, by Application, 2021-2030

7.3.2.Japan

7.3.2.1.Market size analysis, by Source, 2021-2030

7.3.2.2.Market size analysis, by Application, 2021-2030

7.3.3.India

7.3.3.1.Market size analysis, by Source, 2021-2030

7.3.3.2.Market size analysis, by Application, 2021-2030

7.3.4.Australia

7.3.4.1.Market size analysis, by Source, 2021-2030

7.3.4.2.Market size analysis, by Application, 2021-2030

7.3.5.South Korea

7.3.5.1.Market size analysis, by Source, 2021-2030

7.3.5.2.Market size analysis, by Application, 2021-2030

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Source, 2021-2030

7.3.6.2.Market size analysis, by Application, 2021-2030

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness, 2021-2030

7.3.7.2.Competition heatmap, 2021-2030

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Source, 2021-2030

7.4.1.2.Market size analysis, by Application, 2021-2030

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Source, 2021-2030

7.4.2.2.Market size analysis, by Application, 2021-2030

7.4.3.UAE

7.4.3.1.Market size analysis, by Source, 2021-2030

7.4.3.2.Market size analysis, by Application, 2021-2030

7.4.4.South Africa

7.4.4.1.Market size analysis, by Source, 2021-2030

7.4.4.2.Market size analysis, by Application, 2021-2030

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Source, 2021-2030

7.4.5.2.Market size analysis, by Application, 2021-2030

7.4.5.3.Market size analysis, by End-user, 2021-2030

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness, 2021-2030

7.4.6.2.Competition heatmap, 2021-2030

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1. GELITA AG

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2. Tessenderlo Group

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3. Darling Ingredients

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4. Holista Colltech

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5. Collagen Solutions Plc

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6. Nitta Gelatin India Limited

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7. Amicogen

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8. GELNEX

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9. FOODMATE CO. LTD

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10. Ewald-Gelatine GmbH

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Collagen is a key component in the skin of a human body. It plays a major part in firming skin, as well as in elasticity and hydration of the skin. As humans get older, their body forms less collagen, resulting into dry skin and the initiation of wrinkles. However, numerous researches state that collagen peptides or supplements comprising collagen might aid in slowing the skin’s aging process by plummeting wrinkles and dehydration. Peptides, also termed as polypeptides, naturally develop in the skin and are also comprised in numerous skincare products.

Peptides are nothing but amino acids that form some kind of proteins required by the skin. To be precise, collagen is made of 3 polypeptide chains, so by providing peptides to skin, it can produce collagen. The development of abundant collagen can result in firmer, younger-looking skin. Currently, there are a number of skincare products available in the market containing peptides. The surging demand for collagen peptides as a healthy supplement for the health and betterment of the skin and for the recovery of muscles is the key factor propelling the growth of the global collagen peptides market.

Newest Insights in the Collagen peptides Market

As per a report by Research Dive, the global collagen peptides market is expected to grow with 6.66% CAGR, surpassing $1,224.4 million in the 2022–2030 timeframe. The North America collagen peptides market is expected to perceive leading and speedy growth in the years to come. This is because, the region has an enormous demand for collagen peptides supplements owing to the rising health consciousness and awareness about the benefits of collagen peptides for skin in the people in this region. The healthcare industry is making use of collagen peptides to produce drugs for the restoration of bones in arthritis patients. Hence, the collagen peptides market is experiencing massive growth in this region.

How are Market Players Responding to the Rising Demand for Collagen peptides?

Market players are greatly investing in innovative product launches to cater the rising demand for collagen peptides. Some of the leading players of the collagen peptides market are Tessenderlo Group, GELITA AG, Darling Ingredients, Holista Colltech, Nitta Gelatin India Limited, Collagen Solutions Plc., FOODMATE CO. LTD., GELNEX, Amicogen, Ewald-Gelatine GmbH, and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a foremost position in the global market.

For instance,

- In October 2021, Ancient Nutrition, a leading regenerative agriculture company focused on saving the world with superfoods, launched an advanced line of Collagen Peptides - a first ever formula that gives outcomes in minimum one day.

- In March 2022, Pura Collagen, a start-up firm in the nutrition and supplement arena, launched a novel supplement which targets to offer immune support for consumers.

- In June 2022, Vital Proteins®, a manufacturer of an ever-growing line of collagen supplements, launched Vital Proteins® Lemon Collagen Peptides, a product comprising the same grass-fed, pasture-raised collagen with an additional boost of lemon flavour for its customers.

COVID-19 Impact on the Global Collagen Peptides Market

The abrupt rise of the coronavirus pandemic in 2020 has partially impacted the global collagen peptides market. During the pandemic period, many skincare product industries and supply chains faced disruptions, owing to which the market growth was greatly impacted. On the other hand, people became extra conscious about their diets. As a result, many people began consuming collagen peptides for muscle building and good health. In the course of the pandemic, numerous key market players came up with novel strategies such as launch of new products and partnerships to offer enhanced products and obtain a leading-edge in the market. All these factors propelled the collagen peptides market growth in the pandemic period. In addition, with the relaxation of the pandemic since the end of 2021, many industries using collagen peptides in their products have resumed their normal functioning, which is anticipated to thrust the growth of the global market in the future years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com