Cardiac Ablation Market Report

RA00453

Cardiac Ablation Market, by Product (Radiofrequency (RF) Ablators, Electrical Ablators, Cryoablation Devices, Ultrasound Ablators, Others), End Use (Hospitals, Ambulatory Surgical Centers, Cardiac Centers, Others), Application (Cardiac Rhythm Management, Open Surgery, Others): Global Opportunity Analysis and Industry Forecast, 2020-2027

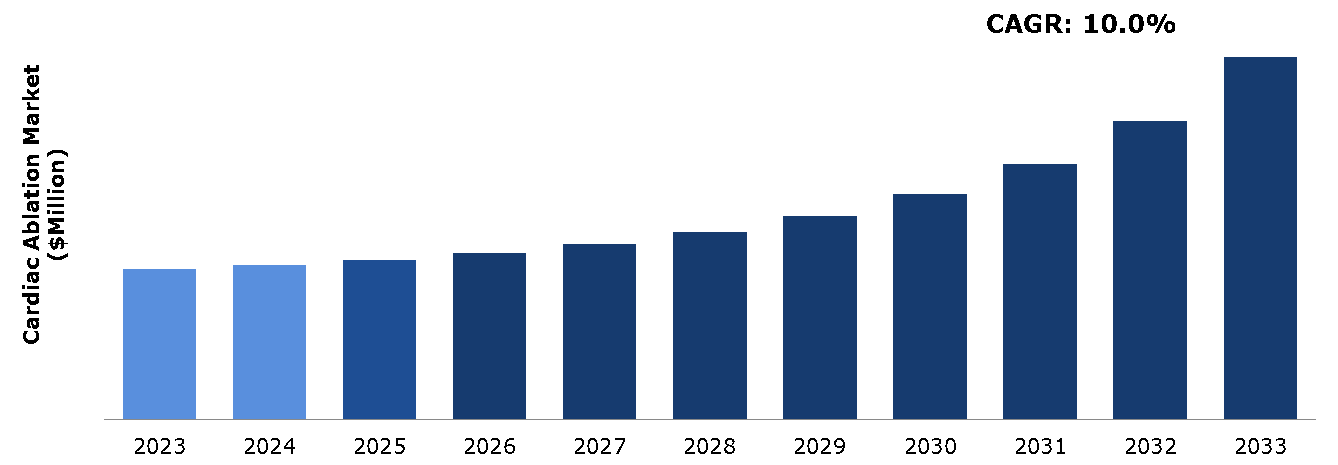

The cardiac ablation market was valued at $3,600.64 million in 2023 and is estimated to reach $8,697.44 million by 2033, exhibiting a CAGR of 10% from 2024 to 2033.

Market Introduction and Definition

Cardiac ablation is a treatment for irregular heartbeats, known as arrhythmias. It utilizes heat or cold energy to create tiny scars in the heart. The scars block faulty heart signals and restore a normal heartbeat. Cardiac ablation is most commonly performed using thin, flexible tubes that are inserted through a blood vessel. In rare cases, ablation is done during heart surgery. Cardiac ablation is commonly used to treat conditions like atrial fibrillation, atrial flutter, supraventricular tachycardia, and some forms of ventricular tachycardia. It can be an effective alternative or complement to medication or other treatments, depending on the specific arrhythmia and the patient's overall health.

Key Takeaways

- The cardiac ablation market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major cardiac ablation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- On April 8, 2024, a significant international consensus statement on treating atrial fibrillation (AF) with catheter or surgical ablation was published in the journal EP Europace. Atrial fibrillation, the most common cardiac arrhythmia, affects approximately 2% of individuals worldwide. This consensus statement offers best practice standards and practical advice on key aspects such as patient selection, procedure performance, and post-procedure management, aiming to improve outcomes for individuals undergoing atrial fibrillation ablation.

- On May 20, 2023, the Heart Rhythm Society announced findings from three new studies demonstrating the safety and efficacy of pulsed field ablation (PFA) for patients with atrial fibrillation. PFA is a non-thermal ablation treatment.

- On March 6, 2023, at the American College of Cardiology's Annual Scientific Session, researchers presented a study showcasing the success of a new ablation technology called pulsed field ablation. This technology demonstrated its effectiveness in eliminating abnormal heart rhythms for up to 12 months in two-thirds of patients with atrial fibrillation. The promising results suggest that pulsed field ablation could be a valuable addition to the treatment options for atrial fibrillation, offering a potential new approach to managing this common cardiac arrhythmia.

Key Market Dynamics

Cardiac ablation offers a minimally invasive alternative to open-heart surgery, leading to shorter recovery times, reduced risk of complications, and increased patient preference. This trend is driving the demand for cardiac ablation procedures. The expansion of healthcare infrastructure, particularly in emerging markets, is increasing access to specialized cardiac care, including ablation procedures. This broader access is contributing to the growth of the cardiac ablation market. Advancements in diagnostic tools, such as electrocardiography (ECG), cardiac MRI, and electrophysiological mapping, have enhanced the detection and diagnosis of cardiac arrhythmias. This improved diagnostic capability has led to earlier detection and increase in the number of patients being recommended for ablation procedures.

Cardiac ablation involves sophisticated technology and precise technique. The complexity of the procedure can lead to variability in outcomes, affecting the overall success rate and potentially limiting market acceptance. While cardiac ablation has shown success in treating arrhythmias, there is still a need for more long-term data on its efficacy and safety. This lack of extensive long-term evidence might limit broader adoption among healthcare providers.

The integration of advanced imaging techniques, such as MRI and 3D mapping, with ablation procedures can improve accuracy and outcomes. This opportunity allows for better planning, execution, and follow-up, potentially increasing the success rates of cardiac ablation. As the prevalence of atrial fibrillation (AF) increases due to aging population and lifestyle factors, there is a growing demand for ablation procedures. This trend creates an opportunity for market expansion as more patients seek treatment for AF. In addition, the use of artificial intelligence (AI) and data analytics in cardiac ablation can optimize procedure planning and patient follow-up. AI can help identify patterns and predict outcomes, while data analytics can provide insights into improving ablation techniques.

Patent Analysis of Global Cardiac Ablation Market

Medtronic's recent entry into the pulsed field ablation (PFA) market, with FDA approval for its PulseSelect system in December 2023, marks a significant expansion in its product offerings. Medtronic's wide distribution network, extensive research and development resources, and collaborations with healthcare professionals give it a strong market presence. Boston Scientific made a notable impact in the pulsed field ablation space with its Farapulse system, which received Conformité Européenne (CE) approval in 2021, allowing it to gain market share in Europe. In 2021, Boston Scientific received Conformité Européenne (CE) approval for its Farapulse system, enabling it to enter the European cardiac ablation market with its pulsed field ablation technology. This strategic entry into the European market has positioned Boston Scientific as a major player in the evolving PFA space.

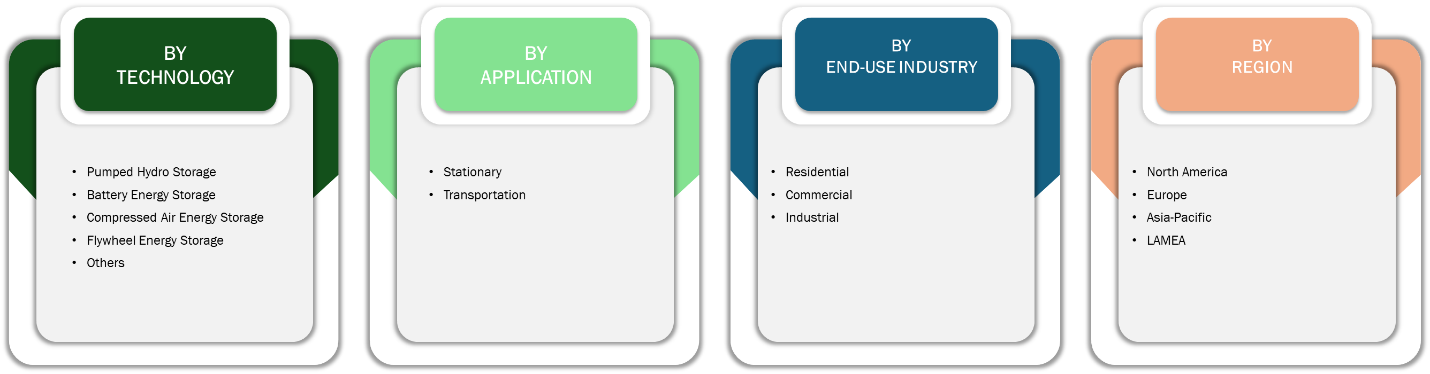

Market Segmentation

The cardiac ablation market is segmented into product, approach, application, end use, and region. On the basis of product, the market is divided into radiofrequency (RF), ablators, electrical ablators, cryoablation devices, ultrasound ablators, and others. On the basis of approach, the market is divided into catheter-based and open/surgical. On the basis of application, the market is bifurcated into atrial fibrillation & flutter, tachycardia, and others. As per end use, the market is segregated into hospitals, ambulatory surgical centers, cardiac centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The continuous expansion of healthcare infrastructure in North America, particularly with the growing adoption of specialized cardiac care facilities, is supporting the cardiac ablation market growth. Hospitals and cardiac centers are investing in advanced ablation technologies to meet the increasing demand for minimally invasive procedures. The rising prevalence of atrial fibrillation (AF) and other cardiac arrhythmias in North America is a major growth factor. According to the American Heart Association, approximately 12.1 million people in the U.S. could be living with AF by 2030, highlighting the rising demand for cardiac ablation treatments.

- In December 2023, Medtronic received approval from the U.S. Food and Drug Administration (FDA) for its PulseSelect system, making it the first commercially available pulsed field ablation (PFA) catheter in the U.S. Though Medtronic is the first to market in the U.S., Boston Scientific had previously entered the European market after receiving Conformité Européenne (CE) approval for its Farapulse system in 2021.

- Currently, the U.S. holds the largest share in the electrophysiology (EP) ablation market, accounting for nearly 50% of the total market. In comparison, Europe holds a market share of approximately 39% in this $2.8 billion market.

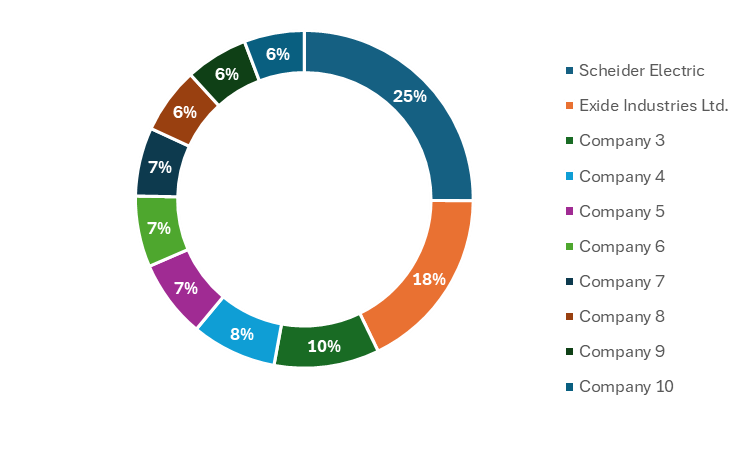

Competitive Landscape

The major players operating in the cardiac ablation market include Abbott Laboratories, Medtronic, Biosense Webster (Johnson & Johnson), Angiodynamics, Boston Scientific Corporation, and Atricure, Japan Lifeline.

Other players in cardiac ablation market include Teleflex Incorporated, St. Jude Medical Inc, Lepu Medical Technology (Beijing) Co., Ltd, and MicroPort Scientific Corporation.

Recent Key Strategies and Developments

- On February 14, 2024, Adagio Medical, Inc. announced a business combination with ARYA Sciences Acquisition Corp IV, a special purpose acquisition company sponsored by an affiliate of Perceptive Advisors, LLC. This business combination allows Adagio Medical to further expand its reach in the cardiac ablation market.

- Following the transaction, Adagio Medical will become a subsidiary of Aja Holdco, Inc. and is expected to list on the Nasdaq Capital Market under the ticker symbol ‘ADGM.’

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Release

- Research Paper

- D&B Hoovers

- ZoomInfo Technologies LLC

- National Library of Medicine

- The American Society of Microbiology

- Science Direct Journal

- American Heart Association

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the cardiac ablation market segments, current trends, estimations, and dynamics of the cardiac ablation market analysis from 2023 to 2033 to identify the prevailing cardiac ablation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cardiac ablation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cardiac ablation market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global cardiac ablation market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Approach |

|

|

Segmentation by Application |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global Cardiac Ablation Market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Cardiac Ablation Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Cardiac Ablation Market Analysis, by Product

5.1. Overview

5.2. Radiofrequency (RF) Ablators

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Electrical Ablators

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Cryoablation Devices

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Ultrasound Ablators

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Others

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2023-2033

5.6.3. Market share analysis, by country, 2023-2033

5.7. Research Dive Exclusive Insights

5.7.1. Market attractiveness

5.7.2. Competition heatmap

6. Cardiac Ablation Market Analysis, by Approach

6.1. Catheter-based

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2023-2033

6.1.3. Market share analysis, by country, 2023-2033

6.2. Open/Surgical

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Research Dive Exclusive Insights

6.3.1. Market attractiveness

6.3.2. Competition heatmap

7. Cardiac Ablation Market Analysis, by Application

7.1. Atrial Fibrillation & Flutter

7.1.1. Definition, key trends, growth factors, and opportunities

7.1.2. Market size analysis, by region, 2023-2033

7.1.3. Market share analysis, by country, 2023-2033

7.2. Tachycardia

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Others

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Cardiac Ablation Market Analysis, by End use

8.1. Hospitals

8.1.1. Definition, key trends, growth factors, and opportunities

8.1.2. Market size analysis, by region, 2023-2033

8.1.3. Market share analysis, by country, 2023-2033

8.2. Ambulatory Surgical Centers

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2023-2033

8.2.3. Market share analysis, by country, 2023-2033

8.3. Cardiac Centers

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2023-2033

8.3.3. Market share analysis, by country, 2023-2033

8.4. Others

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2023-2033

8.4.3. Market share analysis, by country, 2023-2033

8.5. Research Dive Exclusive Insights

8.5.1. Market attractiveness

8.5.2. Competition heatmap

9. Cardiac Ablation Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Product, 2023-2033

9.1.1.2. Market size analysis, by Approach, 2023-2033

9.1.1.3. Market size analysis, by Application, 2023-2033

9.1.1.4. Market size analysis, by End-use, 2023-2033

9.1.2. Canada

9.1.2.1. Market size analysis, by Product, 2023-2033

9.1.2.2. Market size analysis, by Approach, 2023-2033

9.1.2.3. Market size analysis, by Application, 2023-2033

9.1.2.4. Market size analysis, by End-use, 2023-2033

9.1.3. Mexico

9.1.3.1. Market size analysis, by Product, 2023-2033

9.1.3.2. Market size analysis, by Approach, 2023-2033

9.1.3.3. Market size analysis, by Application, 2023-2033

9.1.3.4. Market size analysis, by End-use, 2023-2033

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Product, 2023-2033

9.2.1.2. Market size analysis, by Approach, 2023-2033

9.2.1.3. Market size analysis, by Application, 2023-2033

9.2.1.4. Market size analysis, by End-use, 2023-2033

9.2.2. UK

9.2.2.1. Market size analysis, by Product, 2023-2033

9.2.2.2. Market size analysis, by Approach, 2023-2033

9.2.2.3. Market size analysis, by Application, 2023-2033

9.2.2.4. Market size analysis, by End-use, 2023-2033

9.2.3. France

9.2.3.1. Market size analysis, by Product, 2023-2033

9.2.3.2. Market size analysis, by Approach, 2023-2033

9.2.3.3. Market size analysis, by Application, 2023-2033

9.2.3.4. Market size analysis, by End-use, 2023-2033

9.2.4. Spain

9.2.4.1. Market size analysis, by Product, 2023-2033

9.2.4.2. Market size analysis, by Approach, 2023-2033

9.2.4.3. Market size analysis, by Application, 2023-2033

9.2.4.4. Market size analysis, by End-use, 2023-2033

9.2.5. Italy

9.2.5.1. Market size analysis, by Product, 2023-2033

9.2.5.2. Market size analysis, by Approach, 2023-2033

9.2.5.3. Market size analysis, by Application, 2023-2033

9.2.5.4. Market size analysis, by End-use, 2023-2033

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Product, 2023-2033

9.2.6.2. Market size analysis, by Approach, 2023-2033

9.2.6.3. Market size analysis, by Application, 2023-2033

9.2.6.4. Market size analysis, by End-use, 2023-2033

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia-Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Product, 2023-2033

9.3.1.2. Market size analysis, by Approach, 2023-2033

9.3.1.3. Market size analysis, by Application, 2023-2033

9.3.1.4. Market size analysis, by End-use, 2023-2033

9.3.2. Japan

9.3.2.1. Market size analysis, by Product, 2023-2033

9.3.2.2. Market size analysis, by Approach, 2023-2033

9.3.2.3. Market size analysis, by Application, 2023-2033

9.3.2.4. Market size analysis, by End-use, 2023-2033

9.3.3. India

9.3.3.1. Market size analysis, by Product, 2023-2033

9.3.3.2. Market size analysis, by Approach, 2023-2033

9.3.3.3. Market size analysis, by Application, 2023-2033

9.3.3.4. Market size analysis, by End-use, 2023-2033

9.3.4. Australia

9.3.4.1. Market size analysis, by Product, 2023-2033

9.3.4.2. Market size analysis, by Approach, 2023-2033

9.3.4.3. Market size analysis, by Application, 2023-2033

9.3.4.4. Market size analysis, by End-use, 2023-2033

9.3.5. South Korea

9.3.5.1. Market size analysis, by Product, 2023-2033

9.3.5.2. Market size analysis, by Approach, 2023-2033

9.3.5.3. Market size analysis, by Application, 2023-2033

9.3.5.4. Market size analysis, by End-use, 2023-2033

9.3.6. Rest of Asia-Pacific

9.3.6.1. Market size analysis, by Product, 2023-2033

9.3.6.2. Market size analysis, by Approach, 2023-2033

9.3.6.3. Market size analysis, by Application, 2023-2033

9.3.6.4. Market size analysis, by End-use, 2023-2033

9.3.7. Research Dive Exclusive Insights

9.3.7.1. Market attractiveness

9.3.7.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Product, 2023-2033

9.4.1.2. Market size analysis, by Approach, 2023-2033

9.4.1.3. Market size analysis, by Application, 2023-2033

9.4.1.4. Market size analysis, by End-use, 2023-2033

9.4.2. Saudi Arabia

9.4.2.1. Market size analysis, by Product, 2023-2033

9.4.2.2. Market size analysis, by Approach, 2023-2033

9.4.2.3. Market size analysis, by Application, 2023-2033

9.4.2.4. Market size analysis, by End-use, 2023-2033

9.4.3. UAE

9.4.3.1. Market size analysis, by Product, 2023-2033

9.4.3.2. Market size analysis, by Approach, 2023-2033

9.4.3.3. Market size analysis, by Application, 2023-2033

9.4.3.4. Market size analysis, by End-use, 2023-2033

9.4.4. South Africa

9.4.4.1. Market size analysis, by Product, 2023-2033

9.4.4.2. Market size analysis, by Approach, 2023-2033

9.4.4.3. Market size analysis, by Application, 2023-2033

9.4.4.4. Market size analysis, by End-use, 2023-2033

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Product, 2023-2033

9.4.5.2. Market size analysis, by Approach, 2023-2033

9.4.5.3. Market size analysis, by Application, 2023-2033

9.4.5.4. Market size analysis, by End-use, 2023-2033

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2022

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2023

11. Company Profiles

11.1. Abbott Laboratories

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Medtronic

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Biosense Webster (Johnson & Johnson)

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Angiodynamics

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. Boston Scientific Corporation

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Atricure

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. Japan Lifeline

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. Teleflex Incorporated

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. St. Jude Medical Inc

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Lepu Medical Technology (Beijing)Co., Ltd

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com