Audiology Devices Market Report

RA00521

Audiology Devices Market by Technology (Digital and Analog), Product (Cochlear Implants, Hearing Aids, and Others), Sales Channel (Retail Sales, Government Purchases, and E-commerce), Age Group (Pediatric and Adult), End User (Hospitals, Ambulatory Surgical Centers (ASCs), and Research Institutes), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Audiology Devices Market Analysis

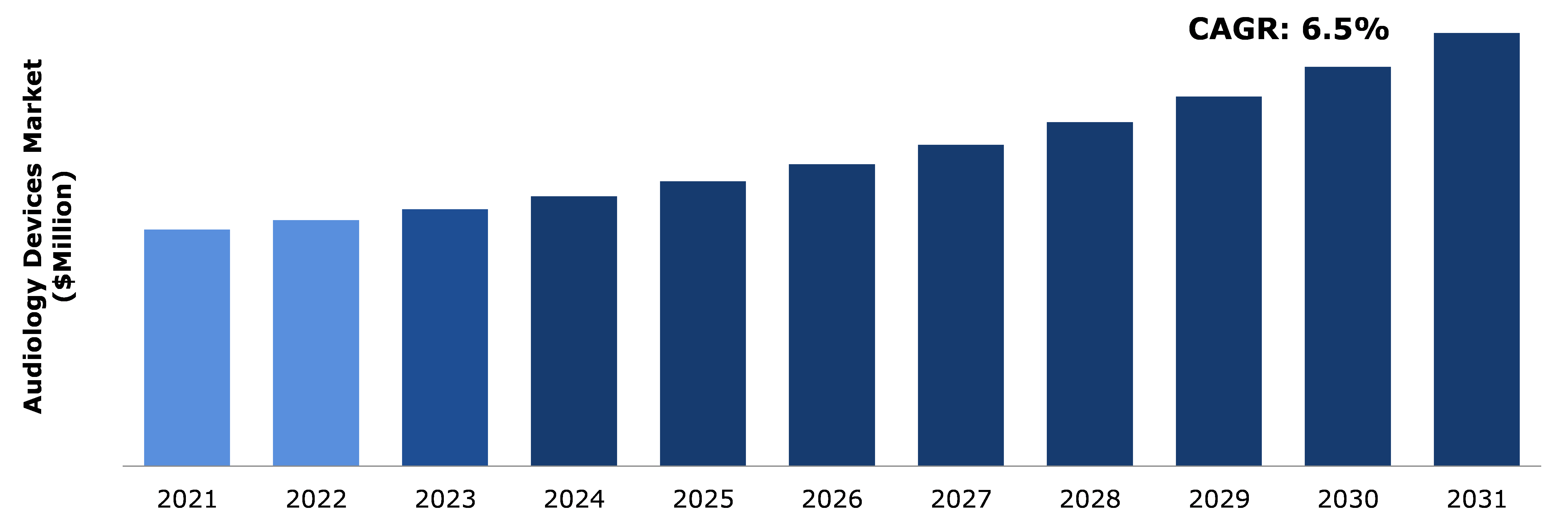

The Global Audiology Devices Market Size was $7,147.9 million in 2021 and is predicted to grow with a CAGR of 6.5%, by generating revenue of $13,093.8 million by 2031.

Global Audiology Devices Market Synopsis

Audiology devices are electronic equipment that identify and manage hearing loss or impairments. In addition, hearing is monitored and studied using hearing aids. Age-related hearing loss or impairment is majorly a concern on a global scale. Also, growing technical advancements, and the adoption of cutting-edge equipment among the elderly population is further expected to drive audiology devices market in the forecast time period. Hearing gadgets now come with sensor devices that make them easier to use. Furthermore, a lot of companies are making wireless hearing aids, which are gaining popularity in the market for audiology devices. The incidence of hearing loss and impairment among populations, particularly among the elderly, has increased, and this is the main factor projected to drive the market expansion. The number of persons with hearing disabilities rises along with the global population, which is expected to drive the market growth.

Market expansion is anticipated to be hampered by the negative stigma with deafness. Throughout the forecast period, high costs for hearing impairment treatments, particularly those based on surgery, are expected to be a challenge for the market for audiology devices.

Improvements in diagnostic ability and treatment choices, such as advancements in PC-based and hybrid audiometers, offer lucrative opportunities to market participants. In addition, a supportive regulatory framework for providing healthcare aids by government in developing regions and rural areas is anticipated to accelerate the market for audiology devices future growth.

According to regional analysis, the North America audiology devices market dominated the global audiology devices in 2021. The regional market share growth can be linked to technical improvements in audiology systems, a rise in the number of audiologists, growing number of patients with hearing impairment and the adoption of cutting-edge digital platforms by the manufacturers for manufacturing highest quality hearing aids.

Audiology Devices Overview

The audiology devices are used to help audiologists diagnose hearing impairment in patients and assist those who have hearing difficulties. These devices work on the principle of sound amplification. They can be used for aural monitoring or analysis as well. In prehistoric times, sensorineural hearing loss or sporadic hearing loss was widespread, and it is still widespread today. The increased frequency of hearing impairments has been attributed to expanding populations as well as an increase in the prevalence of impairment and hearing issues among younger generations.

COVID-19 Impact on Global Audiology Devices Market

The audiology devices manufacturing business suffered owing to the delay in cochlear surgeries caused by the COVID-19 pandemic. The total demand for hearing devices was impacted by a reduction in cochlear procedures. For instance, Cochlear Ltd. reported a 42% decrease in net profits in 2020. During the prevalence of COVID-19 pandemic, the global medical care was severely impacted as the healthcare professionals, worldwide, had to shift their preference from other diseases to the coronavirus-infected patients. Several hospitals and departments were re-profiled for treating patients with COVID-19 due to the rise in demand brought on by the increase in the rate of hospitalization of COVID-19 patients. Many elective treatments were canceled or delayed globally in order to reserve and redirect the limited capacity and resources, including hospital beds and care professionals, toward COVID-19 patient care. The provision of ENT-related procedures and services was adversely affected by the shift of intensive care resources. According to The Centers for Disease Control and Prevention, ENT clinics or audiology centers were a major source of medium-to-high risk for COVID-19 infection, and thus, the healthcare authorities were bound to restrict the treatment of any patient visiting, other than emergency, ENT department. Such factors have negatively impacted the audiology devices market size growth in the pandemic period.

Increase in Incidences of Hearing Loss to Drive the Demand for Audiology Devices

The increasing need for diagnosis and treatment is expected to rise with an increase in prevalence of hearing issues among people, which is anticipated to boost the global market for audiology devices. For instance, according to a report published by the World Health Organization, in 2021, approximately 1.5 billion of patients were suffering from hearing loss issue, globally. The organization states that people with hearing loss typically communicate verbally and the use of cochlear implants, and other assistive technologies may be helpful. Cochlear implants may help those who have more serious hearing loss. For instance, according to the National Institute of Deafness and Other Communication Disorders, in 2019, approximately 15% of American adults or nearly 37.5 million adult population suffered from some trouble hearing. Also, in 2019, approximately 736,900 cochlear implants were implanted worldwide. In the U.S., nearly 118,100 devices were implanted in adults and 65,000 in children. Such factors are expected to drive the audiology devices market share growth in the forecast time period. Also, the market is expected to boost as a result of technological developments in audiological equipment brought on by intensive R&D efforts by leading players.

To know more about global audiology devices market drivers, get in touch with our analysts here.

High Prices for Audiology Devices and Limited Access to Treatments for Hearing Loss to Restrain the Market Growth

The high cost of audiology devices is a significant factor projected to restrict the market growth. High-end features, including AI and deep neural networks, are enabled in some hearing aids, which unnecessarily increase the cost of making the final product. Some lower and middle-class customers may not be able to pay the high prices for audiology equipment. The market for audiology devices is dominated by a small number of multinational corporations, which also increases the price of related products. Patients with hearing loss can either undergo surgery or receive an implant to permanently cure them but the entire surgical procedure is highly expensive. In addition, the success rate of clinical trials for new audiology devices is increasing, but many upcoming audiology devices are still in the early stages of R&D and will take time to enter the market and benefit the patients. These factors are anticipated to hamper the audiology devices market growth during the forecast period.

New Products Launched by Manufacturers to Provide Growth Opportunity for Audiology Devices Market

As the prevalence of hearing impairment cases among people has increased, the need for new and technically advanced hearing aids has also grown among the patients. Also, there are tremendous advancements in research and development activities by the manufacturers in developed and industrialized nations. The launch of innovative, high-quality, affordable goods as well as technological advancements are important additional elements supporting the expansion and growth of the worldwide audiology industry. For instance, according to a news published on Yahoo Sports, January 04, 2023, The Eargo 7, a seventh-generation hearing aid, has been launched by Eargo, Inc., a medical device firm with a goal to enhance the quality of life for people with hearing loss. The Eargo 7 is the company's first product to be sold as an over the counter (OTC) self-fitting hearing aid. It features Sound Adjust+ with Clarity Mode, which aims to help address consumers' fundamental need to hear more clearly in noisy environments and give those with hearing loss the most natural Eargo hearing experience yet. Such factors are likely to boost the market growth in the anticipated time period.

To know more about global audiology devices market opportunities, get in touch with our analysts here.

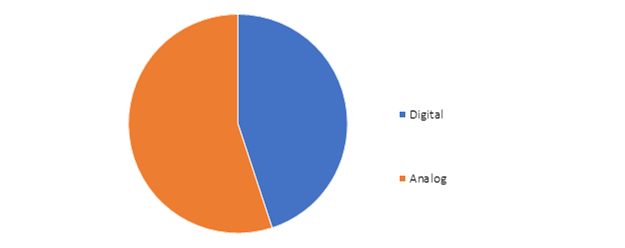

Global Audiology Devices Market, by Technology

By technology, the market has been divided into digital and analog. Among these, the analog sub-segment accounted for the highest market share in 2021 and is expected to have the fastest growth during the forecast period.

Global Audiology Devices Market Size, by Technology, 2021

Source: Research Dive Analysis

The analog segment had a dominating market share in 2021. Sound waves are converted into electrical impulses by analogue hearing aids to function. Following that, the electrical signals are amplified. Analog hearing aids are made for patients depending on the type and severity of a person's hearing loss. These devices are cheaper compared to digital audiology devices, which is expected to drive the market growth in the forecast time period.

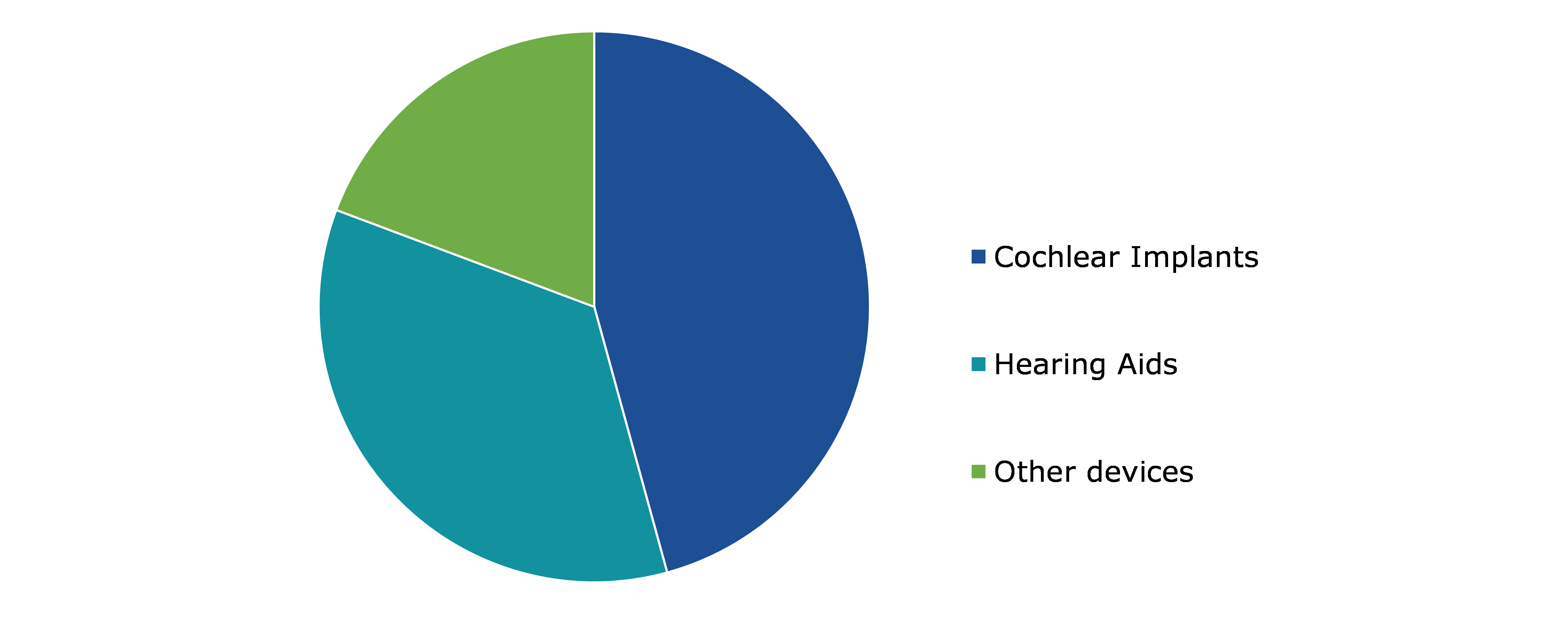

Global Audiology Devices Market, by Product

By product, the market has been divided into cochlear implants, hearing aids, and other devices. Among these, the cochlear implants sub-segment accounted for the highest market share in 2021 and is expected to have the fastest growth during the forecast period.

Global Audiology Devices Market Share, by Product, 2021

Source: Research Dive Analysis

The cochlear implants sub-segment had a dominant market share in 2021. People with severe hearing loss who are no longer helped by using hearing aids may benefit from cochlear implants to improve their hearing. Their communication and quality of life may be enhanced by cochlear implants. The market growth for cochlear implants can be linked to the increased public awareness of cochlear implants as minimally invasive treatments.

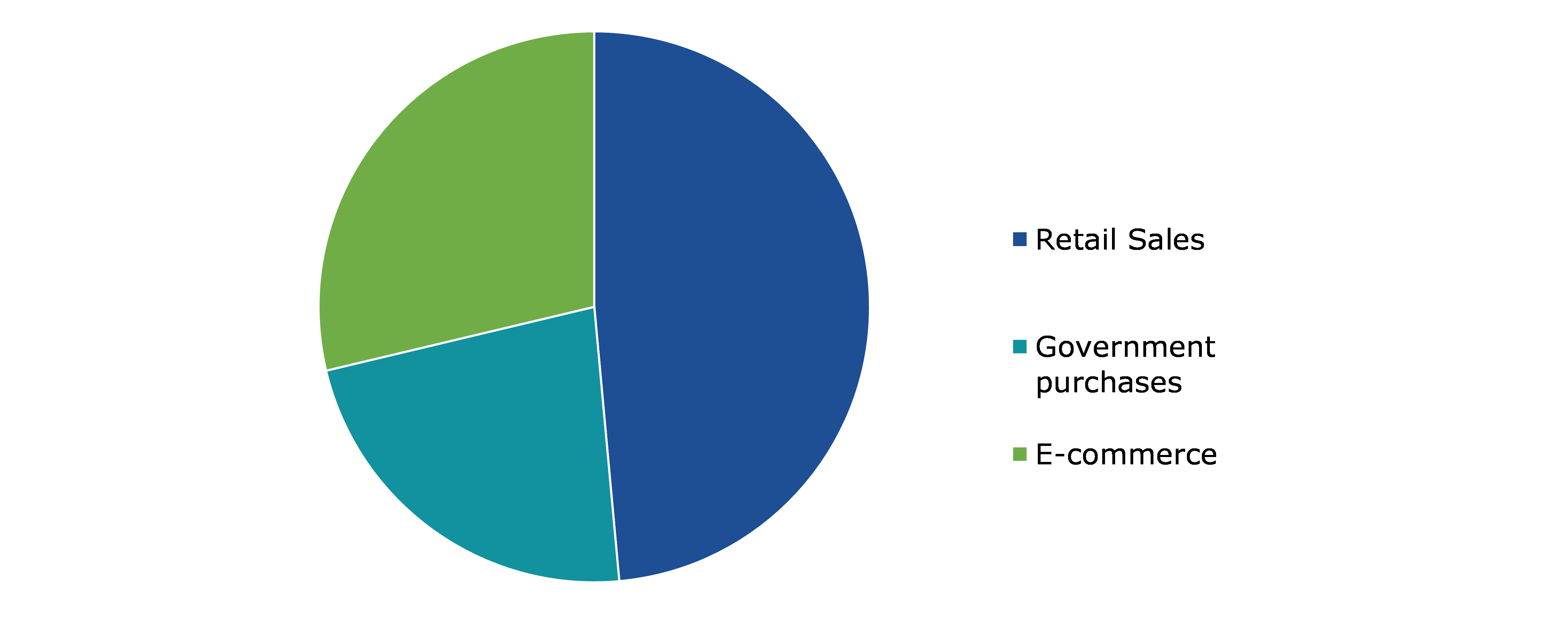

Global Audiology Devices Market, by Sales Channel

By sales channel, the market has been divided into retail sales, government purchases, and e-commerce. Among these, the retail sales sub-segment accounted for the highest revenue share in 2021.

Global Audiology Devices Market Growth, by Sales Channel, 2021

Source: Research Dive Analysis

The retail sales sub-segment had a dominant market share in 2021. The growth of the retail channel is majorly because large retail chains like CVS, Walgreens, Walmart, and Amazon present in many nations. They are approaching the retail market for healthcare. Additionally, it is anticipated that during the projected period, the government's growing initiative for remote care and audiology care goods will promote the retail outlets segment. With a possible impending recession, retailers could profit from the extra sales that over-the-counter hearing aids could bring.

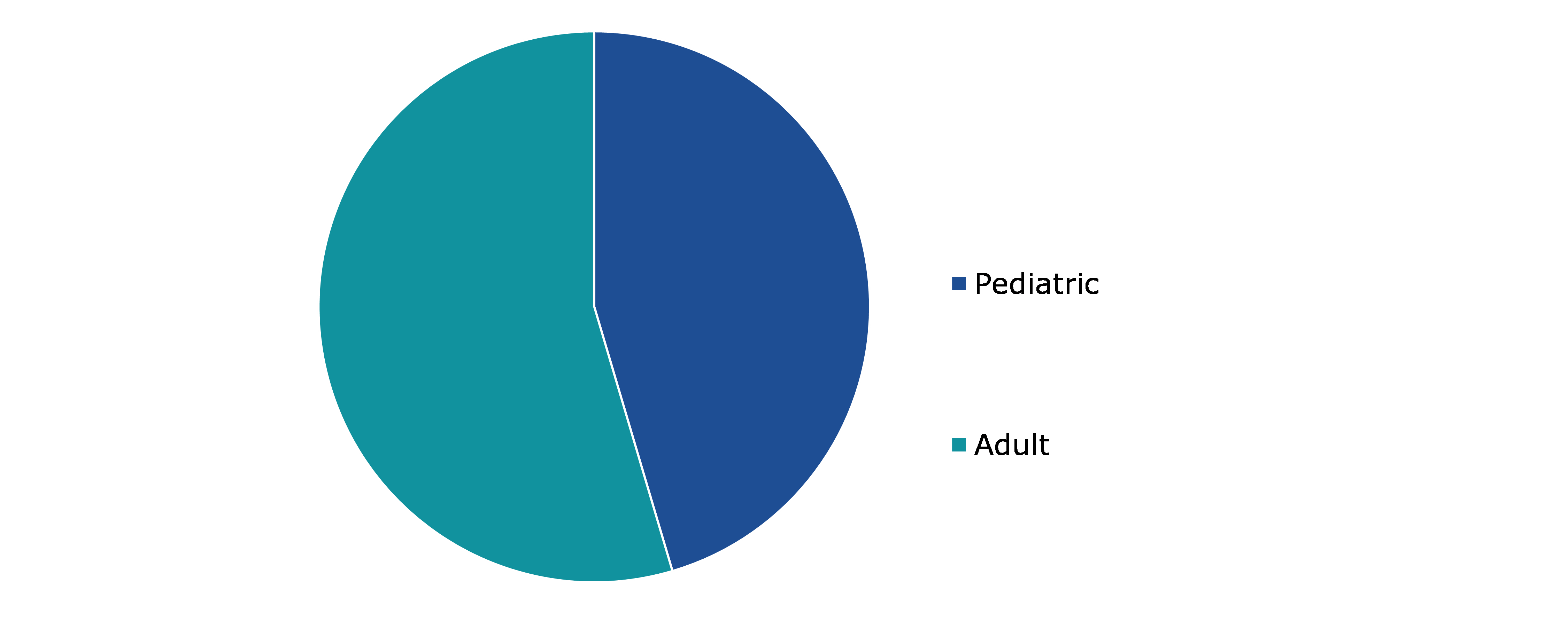

Global Audiology Devices Market, by Age Group

By age group, the market has been divided into pediatric and adult. Among these, the pediatric sub-segment accounted for the highest revenue share in 2021.

Global Audiology Devices Market Forecast, by Age Group, 2021

Source: Research Dive Analysis

The adult sub-segment had a dominant market share in 2021. The market is anticipated to grow significantly over the forecast period owing to growing cases of hearing loss issues among geriatric population, globally. Also, growing affordability and availability of reimbursement policies along with rising awareness of the various hearing implants and gadgets is expected to drive the market growth in the forecast time period.

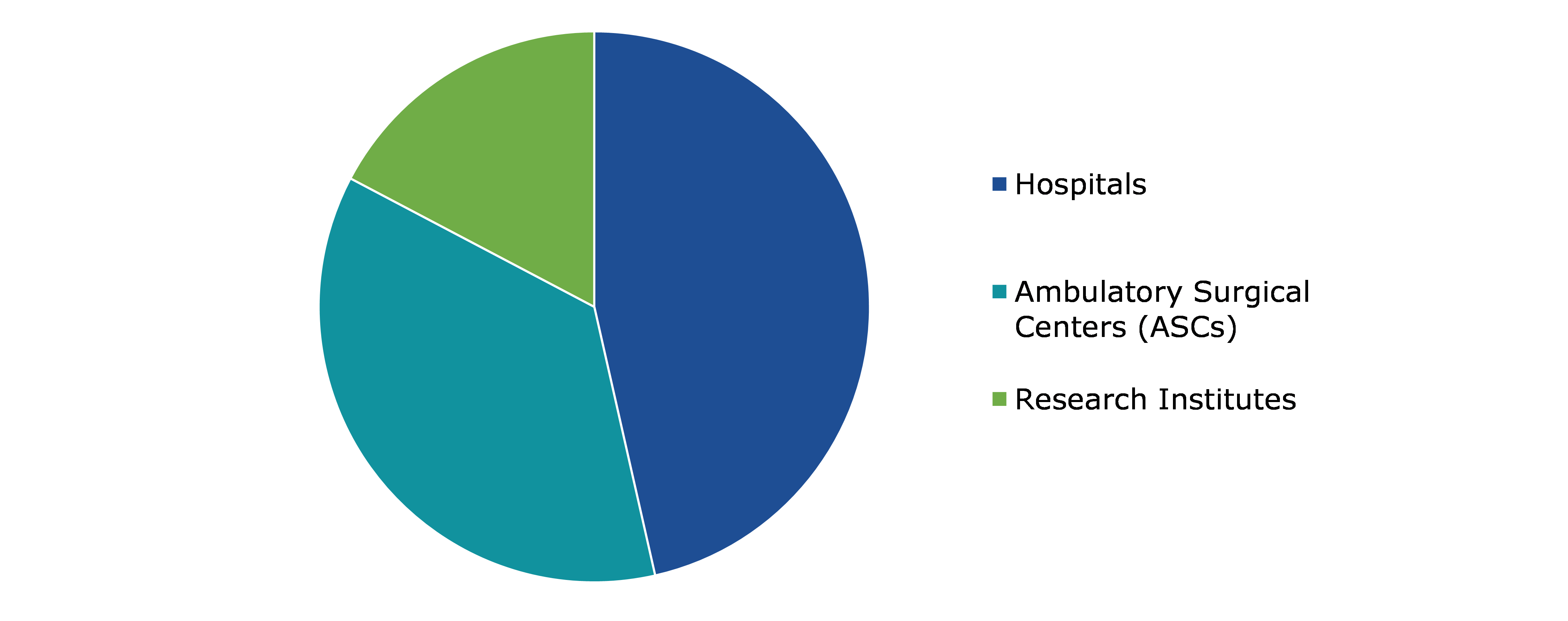

Global Audiology Devices Market, by End User

Based on end user, the market has been divided into hospitals, ambulatory surgical centers (ASCs), and research institutes. Among these, the ambulatory surgical centers (ASCs) sub-segment accounted for the highest revenue share in 2021.

Global Audiology Devices Market Analysis, by End User, 2021

Source: Research Dive Analysis

The ambulatory surgical centers (ASCs) sub-segment had a dominant market share in 2021. ASCs are medical facilities that provide patients the convenience of having procedures and surgeries safely conducted outside of a hospital setting. Patients at ASCs often receive a 24-hour window for release, saving both time and money. Patients get surgical care at an ASC in a closely supervised, highly specialized setting. These factors are predicted to drive the segment growth during the forecast period.

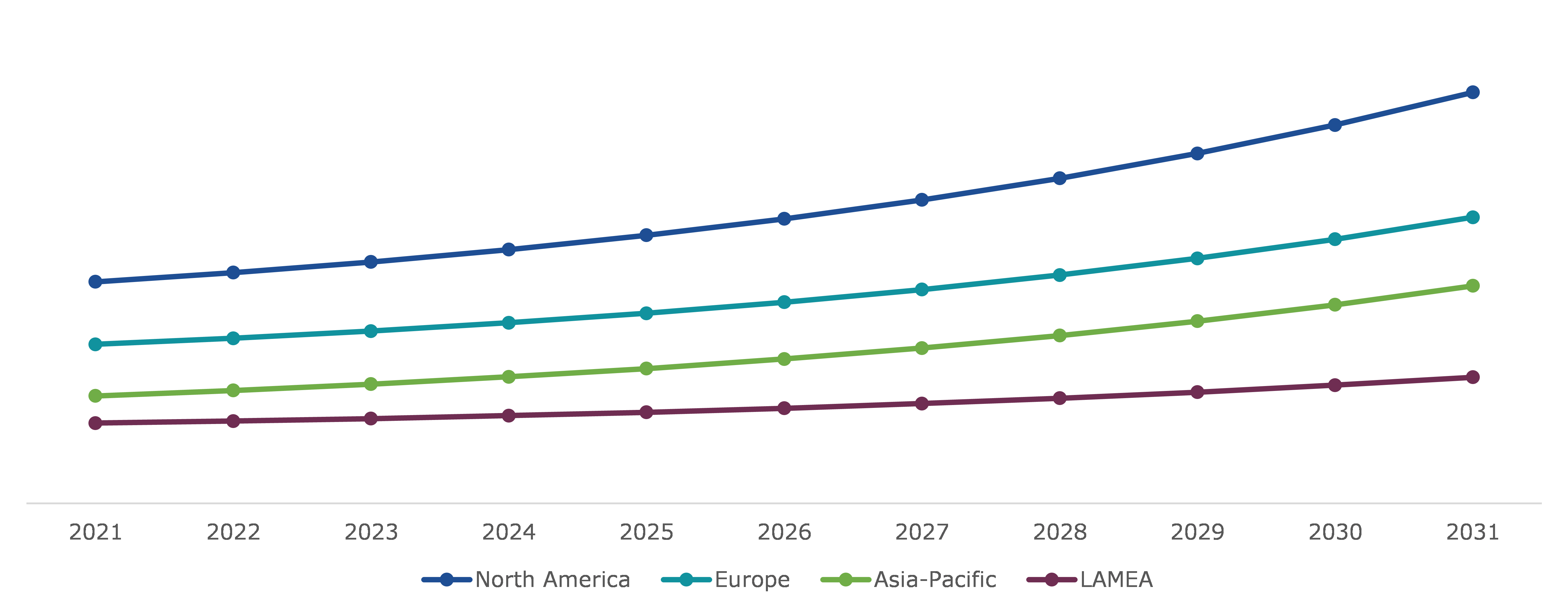

Global Audiology Devices Market, Regional Insights

The audiology devices market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Audiology Devices Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Audiology Devices in North America to be the Most Dominant

The North America audiology devices market had a dominant market share in 2021. More than 10% of people in North America have hearing loss, and this number is growing, especially among young people. Meanwhile, research indicates that a sizable majority of these hearing-impaired individuals do not wear hearing aids. In addition, the regional market share is projected to increase significantly during the forecast period. The higher prevalence of hearing loss in the region is responsible for the market expansion. According to the government statistics in the U.S, every year, over 10 million Americans suffer from hearing loss, one million are functionally deaf, and one in 20 Americans is currently deaf or has partial hearing loss. The growing prevalence of hearing issues among elderly people and tinnitus as well as the widespread use of audiology devices for better hearing are propelling this region's market revenue growth.

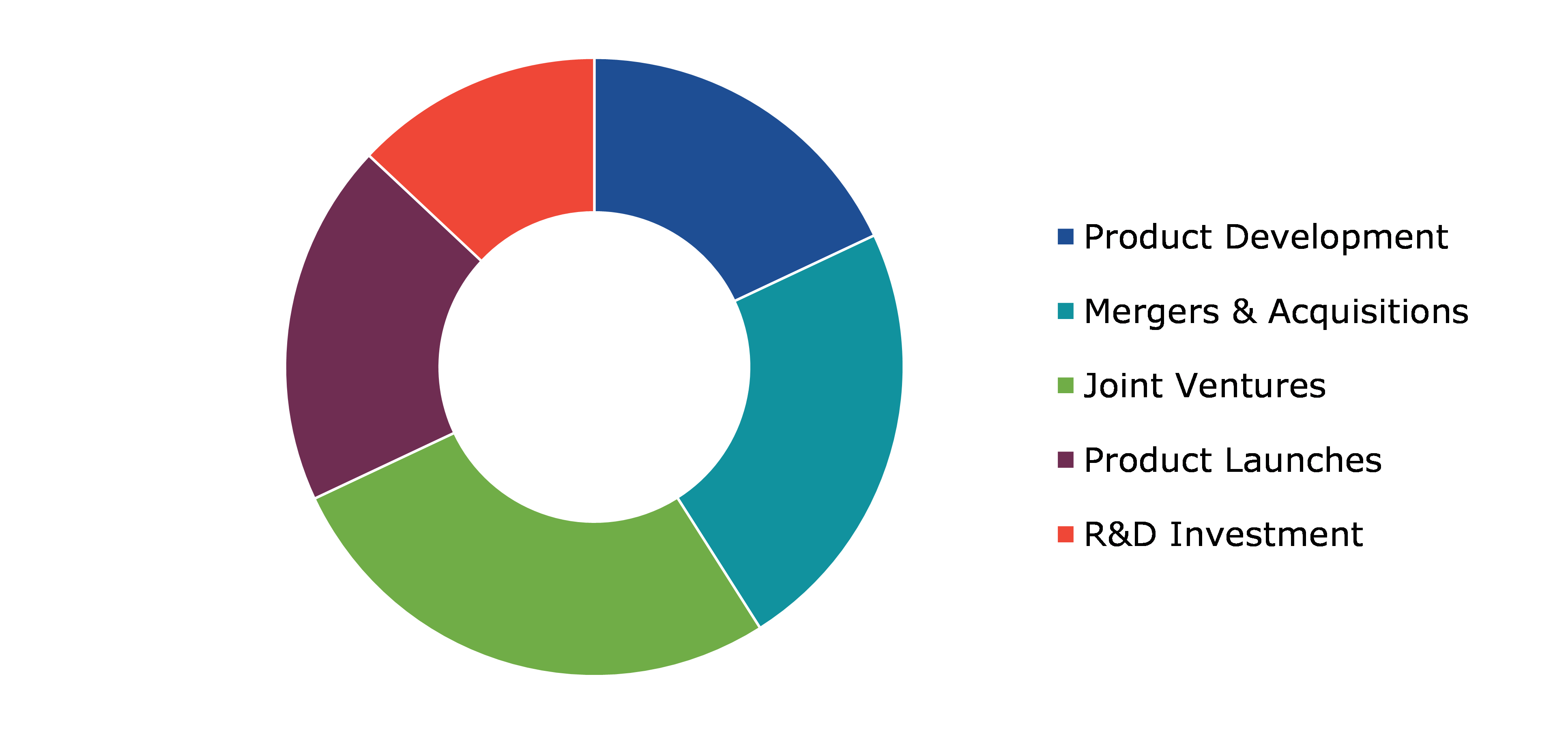

Competitive Scenario in the Global Audiology Devices Market

Investment and agreement are common strategies followed by the major market players. For instance, on March 22, 2022, Signia Company launched its latest paradigm-shifting hearing aid, Signia Active X for general use. The product aims at ‘’enhancing human performance by delivering breakthrough signal processing technology for optimized hearing in noise”.

Source: Research Dive Analysis

Some of the leading audiology devices market players are Demant A/S, GN Store Nord A/S, Sonova, Starkey Laboratories, Inc., MED-EL Medical Electronics, Cochlear Ltd., WS Audiology A/S, MAICO Diagnostics GmbH, Ltd., Oticon Medical, and INVENTIS srl.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Sales channel |

|

| Segmentation by Age Group |

|

| Segmentation by End User |

|

| Segmentation by Technology |

|

| Key Companies Profiled |

|

Q1. What is the size of the global audiology devices market?

A. The size of the global audiology devices market was over $7,147.9 million in 2021 and is projected to reach $13,093.8 million by 2031.

Q2. Which are the major companies in the audiology devices market?

A. Demant A/S, GN Store Nord A/S, and Sonova are some of the key players in the global audiology devices market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. North America possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific audiology devices market?

A. Asia-Pacific audiology devices market is anticipated to grow at 7.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Agreement and investment are the two key strategies opted by the operating companies in the market.

Q6. Which companies are investing more on R&D practices?

A. Starkey Laboratories, Inc., MED-EL Medical Electronics, and Cochlear Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global audiology devices market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Audiology devices market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Audiology Devices Market Analysis, by Technology

5.1.Overview

5.2.Digital

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Analog

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Audiology Devices Market Analysis, by Product

6.1.Cochlear Implants

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Hearing Aids

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Others

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Audiology Devices Market Analysis, by Sales channel

7.1.Retail Sales

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Government purchases

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.E-commerce

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Audiology Devices Market Analysis, by Age Group

8.1.Pediatric

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region

8.1.3.Market share analysis, by country

8.2.Adult

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region

8.2.3.Market share analysis, by country

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

9.Audiology Devices Market Analysis, by End User

9.1.Hospitals

9.1.1.Definition, key trends, growth factors, and opportunities

9.1.2.Market size analysis, by region

9.1.3.Market share analysis, by country

9.2.Ambulatory Surgical Centers (ASCs)

9.2.1.Definition, key trends, growth factors, and opportunities

9.2.2.Market size analysis, by region

9.2.3.Market share analysis, by country

9.3.Research Institutes

9.3.1.Definition, key trends, growth factors, and opportunities

9.3.2.Market size analysis, by region

9.3.3.Market share analysis, by country

9.4.Research Dive Exclusive Insights

9.4.1.Market attractiveness

9.4.2.Competition heatmap

10.Audiology Devices Market, by Region

10.1.North America

10.1.1.U.S.

10.1.1.1.Market size analysis, by Technology

10.1.1.2.Market size analysis, by Product

10.1.1.3.Market size analysis, by Sales channel

10.1.1.4.Market size analysis, by Age Group

10.1.1.5.Market size analysis, by End User

10.1.2.Canada

10.1.2.1.Market size analysis, by Technology

10.1.2.2.Market size analysis, by Product

10.1.2.3.Market size analysis, by Sales channel

10.1.2.4.Market size analysis, by Age Group

10.1.2.5.Market size analysis, by End User

10.1.3.Mexico

10.1.3.1.Market size analysis, by Technology

10.1.3.2.Market size analysis, by Product

10.1.3.3.Market size analysis, by Sales channel

10.1.3.4.Market size analysis, by Age Group

10.1.3.5.Market size analysis, by End User

10.1.4.Research Dive Exclusive Insights

10.1.4.1.Market attractiveness

10.1.4.2.Competition heatmap

10.2.Europe

10.2.1.Germany

10.2.1.1.Market size analysis, by Technology

10.2.1.2.Market size analysis, by Product

10.2.1.3.Market size analysis, by Sales channel

10.2.1.4.Market size analysis, by Age Group

10.2.1.5.Market size analysis, by End User

10.2.2.UK

10.2.2.1.Market size analysis, by Technology

10.2.2.2.Market size analysis, by Product

10.2.2.3.Market size analysis, by Sales channel

10.2.2.4.Market size analysis, by Age Group

10.2.2.5.Market size analysis, by End User

10.2.3.France

10.2.3.1.Market size analysis, by Technology

10.2.3.2.Market size analysis, by Product

10.2.3.3.Market size analysis, by Sales channel

10.2.3.4.Market size analysis, by Age Group

10.2.3.5.Market size analysis, by End User

10.2.4.Spain

10.2.4.1.Market size analysis, by Technology

10.2.4.2.Market size analysis, by Product

10.2.4.3.Market size analysis, by Sales channel

10.2.4.4.Market size analysis, by Age Group

10.2.4.5.Market size analysis, by End User

10.2.5.Italy

10.2.5.1.Market size analysis, by Technology

10.2.5.2.Market size analysis, by Product

10.2.5.3.Market size analysis, by Sales channel

10.2.5.4.Market size analysis, by Age Group

10.2.5.5.Market size analysis, by End User

10.2.6.Rest of Europe

10.2.6.1.Market size analysis, by Technology

10.2.6.2.Market size analysis, by Product

10.2.6.3.Market size analysis, by Sales channel

10.2.6.4.Market size analysis, by Age Group

10.2.6.5.Market size analysis, by End User

10.2.7.Research Dive Exclusive Insights

10.2.7.1.Market attractiveness

10.2.7.2.Competition heatmap

10.3.Asia Pacific

10.3.1.China

10.3.1.1.Market size analysis, by Technology

10.3.1.2.Market size analysis, by Product

10.3.1.3.Market size analysis, by Sales channel

10.3.1.4.Market size analysis, by Age Group

10.3.1.5.Market size analysis, by End User

10.3.2.Japan

10.3.2.1.Market size analysis, by Technology

10.3.2.2.Market size analysis, by Product

10.3.2.3.Market size analysis, by Sales channel

10.3.2.4.Market size analysis, by Age Group

10.3.2.5.Market size analysis, by End User

10.3.3.India

10.3.3.1.Market size analysis, by Technology

10.3.3.2.Market size analysis, by Product

10.3.3.3.Market size analysis, by Sales channel

10.3.3.4.Market size analysis, by Age Group

10.3.3.5.Market size analysis, by End User

10.3.4.Australia

10.3.4.1.Market size analysis, by Technology

10.3.4.2.Market size analysis, by Product

10.3.4.3.Market size analysis, by Sales channel

10.3.4.4.Market size analysis, by Age Group

10.3.4.5.Market size analysis, by End User

10.3.5.South Korea

10.3.5.1.Market size analysis, by Technology

10.3.5.2.Market size analysis, by Product

10.3.5.3.Market size analysis, by Sales channel

10.3.5.4.Market size analysis, by Age Group

10.3.5.5.Market size analysis, by End User

10.3.6.Rest of Asia Pacific

10.3.6.1.Market size analysis, by Technology

10.3.6.2.Market size analysis, by Product

10.3.6.3.Market size analysis, by Sales channel

10.3.6.4.Market size analysis, by Age Group

10.3.6.5.Market size analysis, by End User

10.3.7.Research Dive Exclusive Insights

10.3.7.1.Market attractiveness

10.3.7.2.Competition heatmap

10.4.LAMEA

10.4.1.Brazil

10.4.1.1.Market size analysis, by Technology

10.4.1.2.Market size analysis, by Product

10.4.1.3.Market size analysis, by Sales channel

10.4.1.4.Market size analysis, by Age Group

10.4.1.5.Market size analysis, by End User

10.4.2.Saudi Arabia

10.4.2.1.Market size analysis, by Technology

10.4.2.2.Market size analysis, by Product

10.4.2.3.Market size analysis, by Sales channel

10.4.2.4.Market size analysis, by Age Group

10.4.2.5.Market size analysis, by End User

10.4.3.UAE

10.4.3.1.Market size analysis, by Technology

10.4.3.2.Market size analysis, by Product

10.4.3.3.Market size analysis, by Sales channel

10.4.3.4.Market size analysis, by Age Group

10.4.3.5.Market size analysis, by End User

10.4.4.South Africa

10.4.4.1.Market size analysis, by Technology

10.4.4.2.Market size analysis, by Product

10.4.4.3.Market size analysis, by Sales channel

10.4.4.4.Market size analysis, by Age Group

10.4.4.5.Market size analysis, by End User

10.4.5.Rest of LAMEA

10.4.5.1.Market size analysis, by Technology

10.4.5.2.Market size analysis, by Product

10.4.5.3.Market size analysis, by Sales channel

10.4.5.4.Market size analysis, by Age Group

10.4.5.5.Market size analysis, by End User

10.4.6.Research Dive Exclusive Insights

10.4.6.1.Market attractiveness

10.4.6.2.Competition heatmap

11.Competitive Landscape

11.1.Top winning strategies, 2021

11.1.1.By strategy

11.1.2.By year

11.2.Strategic overview

11.3.Market share analysis, 2021

12.Company Profiles

12.1.Demant A/S

12.1.1.Overview

12.1.2.Business segments

12.1.3.Product portfolio

12.1.4.Financial performance

12.1.5.Recent developments

12.1.6.SWOT analysis

12.2.GN Store Nord A/S

12.2.1.Overview

12.2.2.Business segments

12.2.3.Product portfolio

12.2.4.Financial performance

12.2.5.Recent developments

12.2.6.SWOT analysis

12.3. Starkey Laboratories, Inc.

12.3.1.Overview

12.3.2.Business segments

12.3.3.Product portfolio

12.3.4.Financial performance

12.3.5.Recent developments

12.3.6.SWOT analysis

12.4.MED-EL Medical Electronics

12.4.1.Overview

12.4.2.Business segments

12.4.3.Product portfolio

12.4.4.Financial performance

12.4.5.Recent developments

12.4.6.SWOT analysis

12.5.Cochlear Ltd.

12.5.1.Overview

12.5.2.Business segments

12.5.3.Product portfolio

12.5.4.Financial performance

12.5.5.Recent developments

12.5.6.SWOT analysis

12.6.WS Audiology A/S

12.6.1.Overview

12.6.2.Business segments

12.6.3.Product portfolio

12.6.4.Financial performance

12.6.5.Recent developments

12.6.6.SWOT analysis

12.7.MAICO Diagnostics GmbH, Ltd.

12.7.1.Overview

12.7.2.Business segments

12.7.3.Product portfolio

12.7.4.Financial performance

12.7.5.Recent developments

12.7.6.SWOT analysis

12.8.Sonova

12.8.1.Overview

12.8.2.Business segments

12.8.3.Product portfolio

12.8.4.Financial performance

12.8.5.Recent developments

12.8.6.SWOT analysis

12.9.Oticon Medical

12.9.1.Overview

12.9.2.Business segments

12.9.3.Product portfolio

12.9.4.Financial performance

12.9.5.Recent developments

12.9.6.SWOT analysis

12.10.INVENTIS SRL

12.10.1.Overview

12.10.2.Business segments

12.10.3.Product portfolio

12.10.4.Financial performance

12.10.5.Recent developments

12.10.6.SWOT analysis

Audiology devices are used by audiologists to diagnose hearing loss in patients and help people who experience hearing problems. These devices operate on the principle of sound amplification. They can also be used for aural monitoring and analysis. Sensorineural hearing loss, also known as occasional hearing loss, was common in prehistoric times and remains so today.

The increasing prevalence of hearing problems among people is expected to increase the need for diagnosis and treatment, which is likely to boost the global audiology devices market. Moreover, increasing technological advancements and use of advanced healthcare devices among the ageing population are anticipated to drive the market growth. Additionally, a supportive regulatory framework for offering healthcare facilities by government bodies in emerging and rural areas is anticipated to accelerate the growth of the global market in the future.

Newest Insights in the Audiology Devices Market

The prevalence of hearing loss and impairment has become more common among populations, particularly among the elderly, and this is the main factor expected to drive the market expansion. As per a report by Research Dive, the global audiology devices market is anticipated to surpass a revenue of $13,093.8 million in the 2022–2031 timeframe. The North America audiology devices market is predicted to experience dominant growth in the years to come. This is because the region has a huge demand for audiology devices due to an increase in audiologists, a rise in individuals with hearing impairment, and the use of cutting-edge digital platforms by manufacturers to provide the highest quality hearing aids in the region.

How are Market Players Responding to the Rising Demand for Audiology Devices?

Market players are expanding their product offerings, improving product quality, increasing production capacity, and collaborating with other market players to cater to the increasing need for new, technologically improved hearing devices. Some of the foremost players in the audiology devices market are GN Store Nord A/S, Demant A/S, Sonova, MED-EL Medical Electronics, Cochlear Ltd., Starkey Laboratories, Inc., WS Audiology A/S, Oticon Medical, INVENTIS SRL, MAICO Diagnostics GmbH, Ltd., and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market. For instance:

- In August 2022, GN Hearing, the leader in hearing aid technology, launched ReSound OMNIA, a new hearing aid platform that will advance hearing technology and enhance how people communicate with their environment. ReSound OMNIA provides much improved hearing in noisy conditions than any prior ReSound hearing aid.

- In September 2022, Widex, the world's sixth-largest producer of hearing aids, launched the new Widex Moment Sheer hearing aid solution to assist hearing healthcare professionals in helping patients' hearing and overall wellness.

- In January 2023, Eargo, Inc., a medical device firm dedicated to improving the quality of life of people suffering from hearing loss, introduced the Eargo 7, its 7th generation device, at CES. The Eargo 7 provides Sound Adjust+ with Clarity Mode, the company's first product to be sold as an OTC (over-the-counter) self-fitting hearing aid. This feature seeks to help fulfill consumers' basic need to hear more clearly in noisy surroundings and give those with hearing loss the most natural Eargo hearing experience yet.

COVID-19 Impact on the Global Audiology Devices Market

The unpredicted rise of the coronavirus pandemic in 2020 significantly impacted the global audiology devices market. A decrease in cochlear surgeries had an impact on the overall demand for hearing aids. The COVID-19 pandemic had a significant influence on global health care as doctors and nurses had to switch their preferences from treating patients with other illnesses to coronavirus infections. In addition, numerous hospitals and departments were re-profiled to treat COVID-19 patients due to an increase in demand caused by an increase in the rate of hospitalization of COVID-19 patients. In order to reserve and redirect the restricted capacity and resources, including hospital beds and care personnel, towards COVID-19 patient care, many elective treatments were postponed or cancelled globally. The relocation of intensive care resources has an adverse impact on the delivery of ENT-related surgeries & services. Such factors have had a negative effect on the expansion of the audiology devices market during the pandemic.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com