Homeopathy Market Report

RA02596

Homeopathy Market, by End Use (Homeopathic clinics, Hospitals, Retailers, E-Retailers, Research Laboratories, Others), Type (Dilutions, Tincture, Biochemics, Ointments, Tablets, Others), Application (Analgesic and Antipyretic, Respiratory, Neurology, Immunology, Gastroenterology, Dermatology, Others), Source (Plants, Animals, Minerals): Global Opportunity Analysis and Industry Forecast, 2020-2027

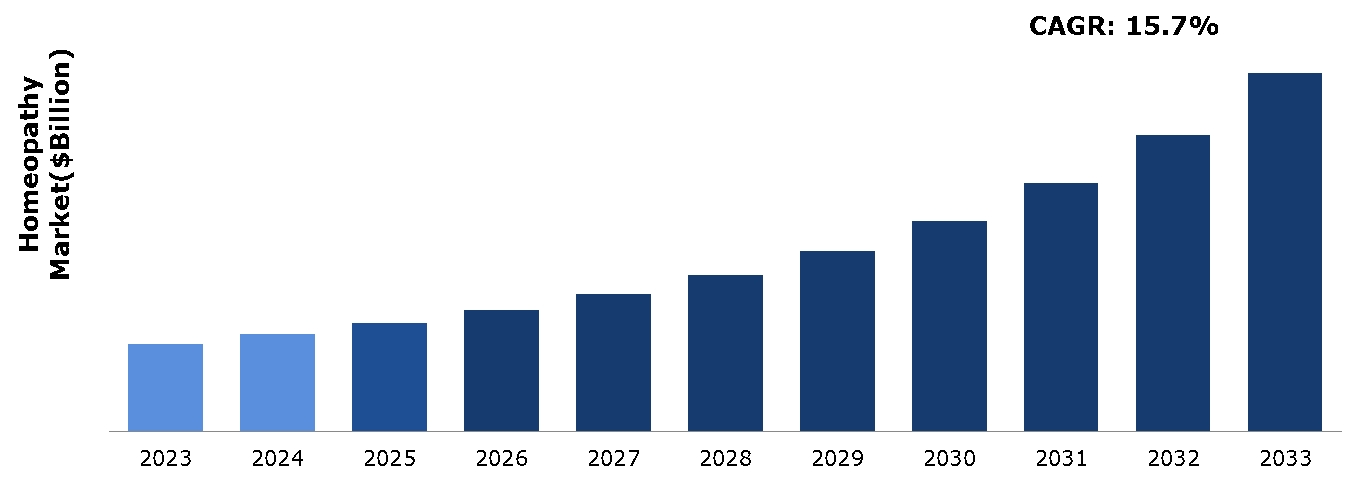

The homeopathy market was valued at $5.10 billion in 2023 and is estimated to reach $20.87 billion by 2033, exhibiting a CAGR of 15.7% from 2024 to 2033.

Market Definition and Overview

Homeopathy, a holistic healing system developed in the late 18th century by Samuel Hahnemann, operates on the principle of ‘like cures like’ (similia similibus curentur). It uses highly diluted substances to stimulate the body's self-healing mechanisms. Practitioners select remedies based on a patient's comprehensive symptom profile, including physical, emotional, and mental states. The remedies, prepared through serial dilution and succussion (vigorous shaking), are believed to retain the energetic essence of the original substance, despite the lack of chemical presence. Homeopathy aims to treat the individual as a whole rather than targeting specific diseases, promoting overall wellness and balance.

Key Takeaways

- The homeopathy market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major homeopathy industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In March 2024, the European Commission published a report on the safety and efficacy of homeopathic medicines, recognizing the lack of scientific backing for their effectiveness while acknowledging their widespread use across the EU. The report promotes for stricter regulations governing the labeling and marketing of homeopathic products, aiming to ensure clearer information for consumers and promote informed decision-making regarding their use.

- In September 2022, Dubai hosted the inaugural Homeopathy International Health Summit, organized by Burnett Homeopathy Pvt Limited. The summit aimed to educate and promote homeopathic medicine, featuring discussions on homeopathic dilutions, mother tinctures, lower trituration tablets, and other remedies.

Market Dynamics

The homeopathy market is experiencing a significant growth due to rising global awareness and acceptance of homeopathy. As more people seek natural and holistic approaches to health, homeopathy's principles of individualized treatment and minimal side effects are gaining traction. Increased awareness, boosted by positive patient experiences and endorsements from practitioners, is expanding its appeal beyond traditional strongholds. Moreover, the rising preference for personalized healthcare solutions and the known effectiveness in managing chronic conditions are further driving this trend. With a broader acceptance across diverse demographics and geographies, the homeopathy market is anticipated to continue its upward trajectory in the healthcare industry.

The homeopathy market faces regulatory challenges due to varying regulations and a lack of standardization across different countries. Regulatory frameworks for homeopathic products differ significantly worldwide, impacting market entry and product consistency. In some regions, stringent requirements hinder market expansion, while others may have more lenient supervision. Standardizing regulations and establishing global standards for quality and efficacy could facilitate smoother market operations and enhance consumer confidence in homeopathic remedies across international borders.

The homeopathy market continues to evolve with increasing integration into conventional medicine, positioning itself as a complementary treatment along with mainstream therapy. This integration presents a significant opportunity for collaborative healthcare approaches, where homeopathic remedies can complement conventional treatments to enhance patient outcomes. As more healthcare providers recognize the potential synergies between homeopathy and conventional medicine, there is an increase in acceptance and adoption of these complementary practices. This trend not only expands treatment options for patients but also encourages a more holistic approach to healthcare, focusing on personalized and comprehensive management of conditions. With continued research and integration efforts, the homeopathy market stands to contribute significantly to the broader healthcare landscape, catering to diverse patient needs and preferences.

Parent Market Overview of the Global Homeopathy Market

The global homeopathy market is a subsection of the broader complementary and alternative medicine (CAM) market, which encompasses diverse therapies beyond conventional medicine. CAM includes homeopathy, Ayurveda, naturopathy, traditional Chinese medicine, and other holistic approaches. The complementary and alternative medicine market growth is driven by increasing consumer interest in natural, non-invasive treatments, and a rising preference for personalized healthcare. Homeopathy stands out within CAM for its focus on individualized treatment using highly diluted substances to trigger the body’s self-healing mechanisms. Rising awareness regarding the benefits of holistic health, along with dissatisfaction with conventional pharmaceuticals' side effects, boosts demand in this market. In addition, regulatory support and integration with modern healthcare systems contribute to the expanding footprint of CAM, including homeopathy.

Market Segmentation

The market is segmented into type, application, source, and region. On the basis of type, the market is divided into tablets, ointments, biochemicals, tincture, and dilutions. As per application, the market is classified into dermatology, gastroenterology, immunology, neurology, respiratory, analgesic, and antipyretic. On the basis of source, the market is divided into minerals, animals, and plants. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific homeopathy market growth is driven by increasing consumer preference for natural and holistic healthcare solutions, rising awareness about the benefits of homeopathic treatments, and increasing acceptance of alternative medicine practices. Factors such as expanding urbanization and improving healthcare infrastructure also contribute to market growth. Moreover, regulatory support for homeopathic products and advancements in technology for production and distribution are further driving the market growth in Asia-Pacific.

- In May 2024, the Indian Ministry of AYUSH unveiled plans for a national telemedicine portal, facilitating remote consultations with certified homeopathic practitioners. This initiative aims to enhance accessibility to homeopathic healthcare services, particularly benefiting patients residing in rural and remote regions across the country.

- In March 2021, Schwabe India, a homeopathic products manufacturer based in India, acquired Sanat Products Ltd, strengthening its presence in the over-the-counter (OTC) segment. The acquisition aims to enhance distribution channels and product offerings, further solidifying Schwabe India's position in the market for homeopathic remedies and health supplements.

Competitive Landscape

The major players operating in the homeopathy market include Boiron Group, Hahnemann Laboratories, Inc., Washington Homeopathic Products, Inc., Homeocan Inc., Mediral International Inc., Ainsworths Ltd., Biologische Heilmittel Heel GmbH, A Nelson & Co Ltd, GMP Laboratories of America, Inc., Standard Homeopathic Company (Hyland's, Inc.), and others.

Recent Key Strategies and Developments

- In April 2022, Kaps3 Lifesciences Pvt. Ltd., an Indian pharmaceutical company, inaugurated its Kaps3 Homeopathy Division to cater to rising consumer demand for homeopathic products. This initiative strategically positions Kaps3 Lifesciences to leverage the growing market for homeopathy and address increased interest in natural remedies and holistic healthcare solutions.

- In January 2022, Boiron Group launched Storinyl, a new homeopathic syrup in France designed to alleviate cold symptoms such as nasal congestion, runny nose, sneezing, and coughing. Tailored for both dry and wet coughs, Storinyl aims to promote respiratory health through its specialized homeopathic formula, targeting common cold ailments effectively.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Government websites

- Industry Publications and Journals

- Medical Journals and Publications

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the homeopathy market segments, current trends, estimations, and dynamics of the homeopathy market analysis from 2023 to 2033 to identify the prevailing homeopathy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the homeopathy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global homeopathy market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global homeopathy market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Segmentation by Source |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on homeopathy market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Homeopathy Market Analysis, by Type

5.1. Overview

5.2. Tablets

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Ointments

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Biochemicals

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2024-2033

5.4.3. Market share analysis, by country, 2024-2033

5.5. Tincture

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2024-2033

5.5.3. Market share analysis, by country, 2024-2033

5.6. Dilutions

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2024-2033

5.6.3. Market share analysis, by country, 2024-2033

5.7. Research Dive Exclusive Insights

5.7.1. Market attractiveness

5.7.2. Competition heatmap

6. Homeopathy Market Analysis, by Application

6.1. Overview

6.2. Dermatology

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Gastroenterology

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Immunology

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Neurology

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2024-2033

6.5.3. Market share analysis, by country, 2024-2033

6.6. Respiratory

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2024-2033

6.6.3. Market share analysis, by country, 2024-2033

6.7. Analgesic

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2024-2033

6.7.3. Market share analysis, by country, 2024-2033

6.8. Antipyretic

6.8.1. Definition, key trends, growth factors, and opportunities

6.8.2. Market size analysis, by region, 2024-2033

6.8.3. Market share analysis, by country, 2024-2033

6.9. Research Dive Exclusive Insights

6.9.1. Market attractiveness

6.9.2. Competition heatmap

7. Homeopathy Market Analysis, by Source

7.1. Overview

7.2. Minerals

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2024-2033

7.2.3. Market share analysis, by country, 2024-2033

7.3. Animals

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2024-2033

7.3.3. Market share analysis, by country, 2024-2033

7.4. Plants

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2024-2033

7.4.3. Market share analysis, by country, 2024-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Homeopathy Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type, 2024-2033

8.1.1.2. Market size analysis, by Application, 2024-2033

8.1.1.3. Market size analysis, by Source, 2024-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Type, 2024-2033

8.1.2.2. Market size analysis, by Application, 2024-2033

8.1.2.3. Market size analysis, by Source, 2024-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type, 2024-2033

8.1.3.2. Market size analysis, by Application, 2024-2033

8.1.3.3. Market size analysis, by Source, 2024-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type, 2024-2033

8.2.1.2. Market size analysis, by Application, 2024-2033

8.2.1.3. Market size analysis, by Source, 2024-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Type, 2024-2033

8.2.2.2. Market size analysis, by Application, 2024-2033

8.2.2.3. Market size analysis, by Source, 2024-2033

8.2.3. France

8.2.3.1. Market size analysis, by Type, 2024-2033

8.2.3.2. Market size analysis, by Application, 2024-2033

8.2.3.3. Market size analysis, by Source, 2024-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Type, 2024-2033

8.2.4.2. Market size analysis, by Application, 2024-2033

8.2.4.3. Market size analysis, by Source, 2024-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Type, 2024-2033

8.2.5.2. Market size analysis, by Application, 2024-2033

8.2.5.3. Market size analysis, by Source, 2024-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type, 2024-2033

8.2.6.2. Market size analysis, by Application, 2024-2033

8.2.6.3. Market size analysis, by Source, 2024-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type, 2024-2033

8.3.1.2. Market size analysis, by Application, 2024-2033

8.3.1.3. Market size analysis, by Source, 2024-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Type, 2024-2033

8.3.2.2. Market size analysis, by Application, 2024-2033

8.3.2.3. Market size analysis, by Source, 2024-2033

8.3.3. India

8.3.3.1. Market size analysis, by Type, 2024-2033

8.3.3.2. Market size analysis, by Application, 2024-2033

8.3.3.3. Market size analysis, by Source, 2024-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Type, 2024-2033

8.3.4.2. Market size analysis, by Application, 2024-2033

8.3.4.3. Market size analysis, by Source, 2024-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type, 2024-2033

8.3.5.2. Market size analysis, by Application, 2024-2033

8.3.5.3. Market size analysis, by Source, 2024-2033

8.3.6. Rest of Asia Pacific

8.3.6.1. Market size analysis, by Type, 2024-2033

8.3.6.2. Market size analysis, by Application, 2024-2033

8.3.6.3. Market size analysis, by Source, 2024-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type, 2024-2033

8.4.1.2. Market size analysis, by Application, 2024-2033

8.4.1.3. Market size analysis, by Source, 2024-2033

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Type, 2024-2033

8.4.2.2. Market size analysis, by Application, 2024-2033

8.4.2.3. Market size analysis, by Source, 2024-2033

8.4.3. UAE

8.4.3.1. Market size analysis, by Type, 2024-2033

8.4.3.2. Market size analysis, by Application, 2024-2033

8.4.3.3. Market size analysis, by Source, 2024-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type, 2024-2033

8.4.4.2. Market size analysis, by Application, 2024-2033

8.4.4.3. Market size analysis, by Source, 2024-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type, 2024-2033

8.4.5.2. Market size analysis, by Application, 2024-2033

8.4.5.3. Market size analysis, by Source, 2024-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2023

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2023

10. Company Profiles

10.1. Boiron Group

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Hahnemann Laboratories, Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Washington Homeopathic Products, Inc.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Homeocan Inc.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Mediral International Inc.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Ainsworths Ltd.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Biologische Heilmittel Heel GmbH

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. A Nelson & Co Ltd

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. GMP Laboratories of America, Inc.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Standard Homeopathic Company (Hyland's, Inc.)

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com