Breathalyzer Market Size Share Competitive Landscape And Trend Analysis Report Report

RA02577

Breathalyzer Market Size, Share, Competitive Landscape and Trend Analysis Report by Technology, Application, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

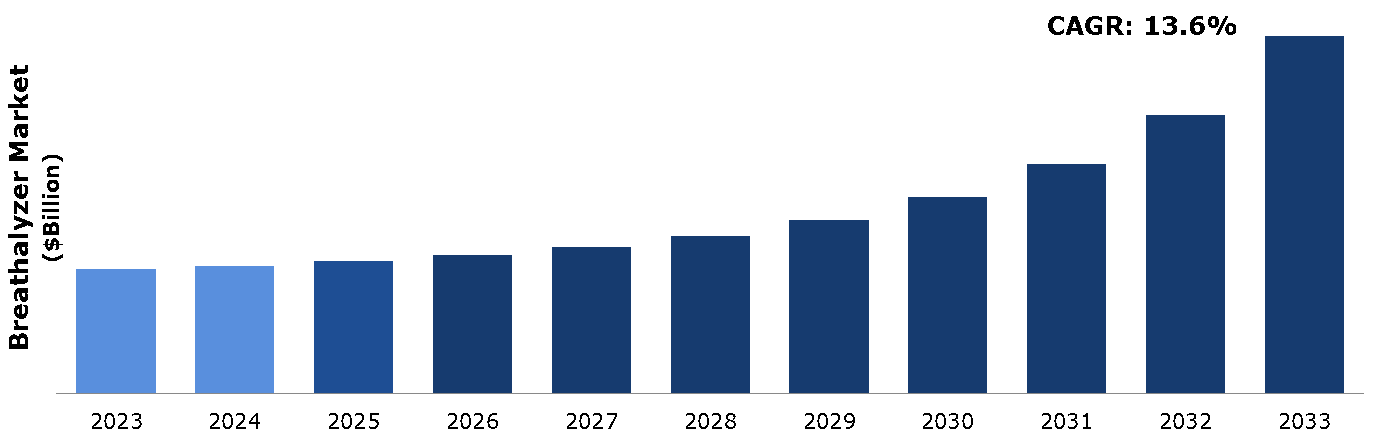

The breathalyzer market was valued at $2.94 billion in 2023 and is estimated to reach $9.61 billion by 2033, exhibiting a CAGR of 13.6% from 2024 to 2033.

Market Definition and Overview

A breathalyzer is a device used to estimate blood alcohol concentration (BAC) from a breath sample. It works by measuring the amount of alcohol in the breath, which is directly related to the amount of alcohol in the bloodstream. The device typically consists of a mouthpiece, a sample chamber, and a system for measuring the alcohol level, often using infrared spectroscopy or a chemical reaction that produces a color change. Breathalyzers are commonly used by law enforcement to test drivers suspected of driving under the influence (DUI) of alcohol. When a person exhales into the breathalyzer, the device calculates the BAC based on the alcohol content in the breath. This provides a quick, non-invasive method to assess intoxication levels. Portable breathalyzers are also available for personal use, allowing individuals to monitor their own alcohol levels.

Key Takeaways

- The breathalyzer market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major breathalyzer industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- According to a September 2022 article by Breathalysers Australia, fuel cell breathalyzer sensors offer consistent and accurate Blood Alcohol Content (BAC) readings ranging from 0.00% to 0.400%, including the detection of trace alcohol amounts. These sensors are widely used in breathalyzers to measure BAC. In most countries, the legal limit is set at 0.08 grams of alcohol per 100 milliliters of blood, which is the threshold at which a driver is legally considered intoxicated.

- In May 2022, Breathonix Pte Ltd.'s BreFence Go breath test obtained provisional approval from Singapore authorities for COVID-19 testing. Similarly, InspectIR Systems, LLC's InspectIR COVID-19 Breathalyzer received Emergency Use Authorization (EUA) from the U.S. FDA in April 2022.

- According to the National Institute on Alcohol Abuse and Alcoholism, as of February 2022, over 14 million adults suffered from alcohol use disorder. Individuals with this condition face increased risks of accidents while driving, swimming, operating machinery, or navigating hazardous areas. Therefore, the deployment of breathalyzers by law enforcement and safety personnel in such environments aids in reducing accidents, thereby driving market growth.

Key Market Dynamics

Increased alcohol consumption globally, particularly in urban areas, necessitates effective monitoring and control measures, thereby boosting demand for breathalyzers in both personal and professional settings. Advances in breathalyzer technology, including improved accuracy, compact designs, and integration with smartphones and apps, are enhancing user convenience. Innovations such as fuel cell sensors and infrared spectroscopy have made breathalyzers more reliable and user-friendly. Many industries, particularly those involving heavy machinery and transportation, are adopting breathalyzer testing to ensure employee safety and compliance with occupational safety regulations. This trend is anticipated to significantly contribute to market growth during the forecast period.

The use of breathalyzers is subject to legal and regulatory scrutiny. Inconsistent regulations across different regions can complicate market expansion and create compliance challenges for manufacturers. Breathalyzers require regular calibration and maintenance to ensure accuracy. This ongoing need can be a barrier, particularly for smaller entities or personal users who may find it inconvenient or costly.

Integration of breathalyzers with health & fitness apps is expected to create new opportunities for the key market players. This allows users to track their alcohol consumption as part of their overall health monitoring regime, appealing to a tech-savvy audience. Government policies mandating the use of breathalyzers for law enforcement, as well as in commercial transportation and other sectors, can significantly drive market expansion. For instance, laws requiring ignition interlock devices for convicted DUI offenders create a steady demand for breathalyzer technology. Businesses, especially those in hospitality and construction, are increasingly adopting breathalyzers to ensure workplace safety and compliance with regulations.

Parent Market of Global Breathalyzer Market

The breathalyzer market is a segment within the broader parent market of alcohol detection devices and related safety technologies. Alcohol detection devices encompass various technologies designed to detect the presence and concentration of alcohol in biological samples, primarily breath, but also saliva and blood. These devices serve critical roles in enforcing laws related to alcohol consumption, ensuring workplace safety, and promoting personal health. Alcohol detection devices include breathalyzers (using semiconductor sensors, fuel cell sensors, or infrared spectroscopy), saliva alcohol tests, and blood alcohol tests. Each type offers varying levels of accuracy and suitability for different applications.

The market is heavily influenced by regulations governing alcohol consumption, driving limits, workplace safety standards, and healthcare practices. Compliance with these regulations drives the adoption and development of alcohol detection technologies.

Market Segmentation

The breathalyzer market is segmented into technology, application, and region. On the basis of technology, the market is divided into fuel cell technology, semiconductor oxide sensor technology, and infrared spectroscopy. On the basis of application, the market is classified into drug abuse detection, alcohol detection, and other applications. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The breathalyzer market in Asia-Pacific is projected to show the fastest growth during the forecast period. Many countries in Asia-Pacific are implementing and enforcing stricter drunk driving laws. Governments of various countries across the region are increasing penalties for DUI offenses and mandating the use of breathalyzers, which boosts market growth. Rapid economic growth and urbanization in countries like China, India, and Southeast Asian nations are leading to more vehicles on the road. This increases the need for effective measures to control and monitor drunk driving, thereby driving the breathalyzer market expansion.

The Indian government has been actively enforcing stricter DUI laws. In 2021, the Ministry of Road Transport and Highways increased fines and penalties for drunk driving under the amended Motor Vehicles Act. In 2022, various state governments launched campaigns to raise awareness about the dangers of drunk driving, including the ‘Don't Drink and Drive’ campaign in Maharashtra.

Competitive Landscape

The major players operating in the breathalyzer market include AK GlobalTech Corp., Intoximeters, Lion Laboratories, Tanita, Quest Products, Inc., Bedfont Scientific Ltd., Lifeloc Technologies, Inc., Alcohol Countermeasure Systems Corp., Shenzhen Ztsense Hi-Tech Co., Ltd, Drägerwerk AG & Co. KGaA, and others.

Recent Key Strategies and Developments

- In June 2023, Drägerwerk announced the launch of their new Alcotest 7000, an advanced breathalyzer with improved accuracy and faster response times, aimed at both law enforcement and personal use markets. The device features connectivity options for data management and compliance reporting.

- In March 2023, Lifeloc Technologies released their latest breathalyzer model, the LT7, which incorporates advanced fuel cell sensor technology for enhanced precision. This new device is targeted at workplace safety programs and law enforcement agencies.

- In November 2022, Intoximeters introduced the Alco-Sensor FST, a portable breathalyzer designed for roadside testing by police forces. This device offers a quick, easy-to-use interface and improved durability, catering to the rigorous demands of field use.

Key Sources Referred

- Company Annual Reports

- Investor Presentations

- Press Release

- Research Paper

- D&B Hoovers

- ZoomInfo Technologies LLC

- Connecticut Association of Boards of Education

- breathalyzer.org

- National Institutes of Health (NIH) (.gov)

- ScienceDirect.com

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the breathalyzer market segments, current trends, estimations, and dynamics of the breathalyzer market analysis from 2023 to 2033 to identify the breathalyzer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the breathalyzer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global breathalyzer market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global breathalyzer market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global Breathalyzer Market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Breathalyzer Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Breathalyzer Market Analysis, by Technology

5.1. Overview

5.2. Fuel Cell Technology

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Semiconductor Sensor

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Infrared (IR) Spectroscopy

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Others

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Breathalyzer Market Analysis, by Application

6.1. Drug Abuse Detection

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2023-2033

6.1.3. Market share analysis, by country, 2023-2033

6.2. Alcohol Detection

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Medical Applications

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Breathalyzer Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Technology, 2023-2033

7.1.1.2. Market size analysis, by Application, 2023-2033

7.1.2. Canada

7.1.2.1. Market size analysis, by Technology, 2023-2033

7.1.2.2. Market size analysis, by Application, 2023-2033

7.1.3. Mexico

7.1.3.1. Market size analysis, by Technology, 2023-2033

7.1.3.2. Market size analysis, by Application, 2023-2033

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Technology, 2023-2033

7.2.1.2. Market size analysis, by Application, 2023-2033

7.2.2. UK

7.2.2.1. Market size analysis, by Technology, 2023-2033

7.2.2.2. Market size analysis, by Application, 2023-2033

7.2.3. France

7.2.3.1. Market size analysis, by Technology, 2023-2033

7.2.3.2. Market size analysis, by Application, 2023-2033

7.2.4. Spain

7.2.4.1. Market size analysis, by Technology, 2023-2033

7.2.4.2. Market size analysis, by Application, 2023-2033

7.2.5. Italy

7.2.5.1. Market size analysis, by Technology, 2023-2033

7.2.5.2. Market size analysis, by Application, 2023-2033

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Technology, 2023-2033

7.2.6.2. Market size analysis, by Application, 2023-2033

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Technology, 2023-2033

7.3.1.2. Market size analysis, by Application, 2023-2033

7.3.2. Japan

7.3.2.1. Market size analysis, by Technology, 2023-2033

7.3.2.2. Market size analysis, by Application, 2023-2033

7.3.3. India

7.3.3.1. Market size analysis, by Technology, 2023-2033

7.3.3.2. Market size analysis, by Application, 2023-2033

7.3.4. Australia

7.3.4.1. Market size analysis, by Technology, 2023-2033

7.3.4.2. Market size analysis, by Application, 2023-2033

7.3.5. South Korea

7.3.5.1. Market size analysis, by Technology, 2023-2033

7.3.5.2. Market size analysis, by Application, 2023-2033

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Technology, 2023-2033

7.3.6.2. Market size analysis, by Application, 2023-2033

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Technology, 2023-2033

7.4.1.2. Market size analysis, by Application, 2023-2033

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Technology, 2023-2033

7.4.2.2. Market size analysis, by Application, 2023-2033

7.4.3. UAE

7.4.3.1. Market size analysis, by Technology, 2023-2033

7.4.3.2. Market size analysis, by Application, 2023-2033

7.4.4. South Africa

7.4.4.1. Market size analysis, by Technology, 2023-2033

7.4.4.2. Market size analysis, by Application, 2023-2033

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Technology, 2023-2033

7.4.5.2. Market size analysis, by Application, 2023-2033

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2023

9. Company Profiles

9.1. Lion Laboratories

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Intoximeters

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Lifeloc Technologies, Inc.

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Alcohol Countermeasure Systems Corp

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Bedfont Scientific Ltd.

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Shenzhen Ztsense Hi-Tech Co., Ltd.

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Tanita.

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. AK GlobalTech Corp.

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Drägerwerk AG & Co. KGaA

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Quest Products, Inc.

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com