Dental Sealants Market Size Share Competitive Landscape And Trend Analysis Report Report

RA02428

Dental Sealants Market Size, Share, Competitive Landscape, and Trend Analysis Report by Raw Material, Type, Curing, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

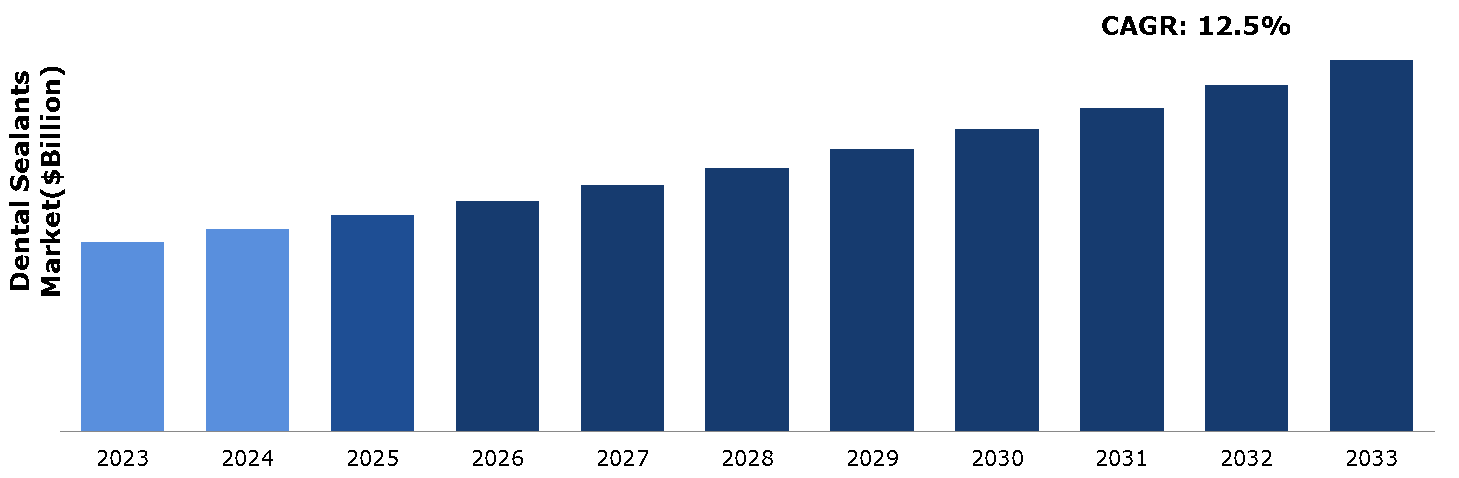

The dental sealants market was valued at $1.01 billion in 2023 and is estimated to reach $3.23 billion by 2033, exhibiting a CAGR of 12.5% from 2024 to 2033.

Overview of Dental Sealants

Dental sealants are liquid, thin coatings applied to the chewing surfaces of back teeth (premolars and molars). Once a dentist applies the sealant, it is cured and hardened to create a protective barrier against cavity-causing bacteria. Sealants are typically made from medical-grade materials such as resins or glass ionomers. These materials effectively protect teeth by covering the deep grooves and fissures on the chewing surfaces, where food and bacteria often get trapped. This entrapment can lead to tooth decay over time. By coating these vulnerable areas, sealants prevent bacteria from accessing and damaging the teeth, thus significantly reducing the risk of cavities. The application of dental sealants is a preventive measure aimed at maintaining oral health and protecting teeth from disease-causing bacteria.

Key Takeaways

- The dental sealants market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major dental sealants industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In May 2024, Pulpdent generously donated 600 applications of Embrace Varnish and 400 applications of Embrace Pit & Fissure Sealant to Deserving Dental, a non-profit founded by Jennifer Geiselhofer, RDH, based in Denver. Deserving Dental offers free preventative dental care and education in settings such as homeless shelters, battered women shelters, human trafficking rescue centers, runaway youth shelters, correctional facilities, residential substance abuse treatment facilities, and homes for seniors and people with disabilities. This donation will significantly support the organization’s mission to provide essential dental services to underserved and vulnerable populations.

- In February 2023, in recognition of National Children’s Dental Health Month, the Hawai‘i Keiki––Hawai‘i Dental Service (HDS) Dental Sealant Program highlighted the importance of oral health, urging parents to take their children to the dentist. Offering no-cost dental screenings to keiki in HIDOE public schools on Oʻahu, Maui, and Kauaʻi, the program has screened nearly 2,000 students since 2019. Over half of these students (61%) required and received dental sealants, highlighting the need for school-based oral health services. Dental sealants are a simple, effective way to prevent cavities, yet over 60% of children in Hawaiʻi still lack them.

Key Market Dynamics

The rising prevalence of dental caries is significantly driving the growth of the dental sealants market. According to a March 2023 WHO publication, approximately 2 billion people worldwide are affected by caries in their permanent teeth, while 514 million children suffer from caries in their primary teeth. This rising rate of dental decay highlights the urgent need for effective dental sealants solutions, propelling advancements, and investments in the industry to address this widespread health issue. As the global population continues to affect with dental caries, the demand for comprehensive oral hygiene products is expected to increase.

However, limited access to dental services in rural and low-income communities significantly hampers the growth of the dental sealants market. These regions often lack sufficient dental professionals and facilities, impeding residents from receiving proper dental sealants. For instance, rural areas in many developing countries face severe shortages of dentists, leading to untreated dental issues and a reliance on inadequate home remedies.

Innovations in dental sealants are expected to drive market expansion in the upcoming years. Advances such as longer-lasting formulations, enhanced biocompatibility, and easier application methods are expected to significantly improve dental care. For instance, the development of resin-based sealants with antibacterial properties would offer better protection against cavities. Major industry players and associations, like the American Dental Association (ADA), are spearheading research and promoting the adoption of these advanced sealants. These efforts are likely to result in increased acceptance and usage, driving market expansion and improving oral health outcomes globally.

Public Policy Analysis

Since its inaugural oral health policy in 2003, the American Academy of Pediatrics (AAP) has continued to address oral health matters through subsequent policies. By 2023, the AAP's professionals developed a total of eight policies, demonstrating a sustained commitment toward promoting oral health among children and adolescents, they are given below:

- 2023 - Maintaining and Improving the Oral Health of Young Children.

- 2021 - Early Childhood Caries in Indigenous Communities.

- 2021 - Management of Dental Trauma in a Primary Care Setting.

- 2020 - Fluoride Use in Caries Prevention in the Primary Care Setting.

- 2019 (w/AAPD) - Guidelines for Monitoring and Management of Pediatric Patients Before, During, and After Sedation for Diagnostic and Therapeutic Procedures.

- 2017 - Oral and Dental Aspects of Child Abuse and Neglect.

- 2017 - The Primary Care Pediatrician and the Care of Children with Cleft Lip and/or Cleft Palate.

- 2013 - Oral Health Care for Children with Developmental Disabilities.

The ‘maintaining and improving the oral health of young children’ 2023 policy talks about early childhood dental caries, one of the prevalent chronic disease among children, often impacted with limited access to oral health care. Addressing this, pediatricians and dental professionals can play major roles by supporting children's oral health across various levels - within their practices, communities, and in governmental fields. The Campaign for Dental Health (CDH) emerged with a mission to guarantee universal access to the most efficient, cost-effective, and fair method for safeguarding teeth against decay: community water fluoridation. By supporting this cause, CDH aims to bridge gaps in oral health care accessibility for people of all ages.

Market Segmentation

The dental sealants market is segmented into raw material, type, curing, and region. On the basis of raw material, the market is divided into synthetic adhesive and natural adhesive. As per type, the market is classified into water-based and solvent-based. By curing, the market is divided into self cured, light cured, and dual cured. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In the U.S., the adoption of dental sealants is expected to witness significant growth in the upcoming years. As awareness regarding oral health benefits increases, there is a notable trend towards preventive dental care, particularly among children and adolescents. Dental sealants, which protect teeth from decay by forming a protective barrier over the enamel, have gained traction due to their effectiveness in reducing cavities. This shift is supported by major developments in dental associations promoting broader sealant application guidelines. For instance, the American Dental Association has revised its recommendations to encourage the use of sealants as a standard preventive measure in dental practices nationwide. This proactive approach not only promotes better oral health outcomes but also highlights a strategic focus on reducing long-term healthcare costs associated with dental treatments. Therefore, the U.S. anticipates progressive advancements in oral health care through increased utilization of dental sealants in the upcoming years.

- In December 2022, Septodont announced the new product launch BioRoot Flow, a bioceramic root canal sealer offering significant clinical advantages. Its proprietary hydraulic technology creates an alkaline environment that inhibits bacterial growth and releases calcium for bioactivity and mineral tag formation. With over 60 minutes of working time, it is suitable for multi-rooted molars. The pure mineral formulation, free from eugenol and resin, prevents shrinkage, microleakage, and staining. Compatible with warm and cold obturation techniques, it is also easy to remove during retreatment. The cost-effective 2g syringe, item #01E0510, comes with 20 bendable tips, providing clinicians with a versatile and successful solution for various cases.

Competitive Landscape

The major players operating in the dental sealants market include Den-Mat Holdings, LLC, 3M, Dux Industries, Inc., Henkel AG & Co. KGaA, Johnson Services, Inc., Dentsply Sirona, PULPDENT Corporation, Tricol Biomedical, Septodont Holding, and Dentsply Sirona Inc.

Other players in the dental sealants market include KaVo Dental and Procter & Gamble.

Recent Key Strategies and Developments

- In March 2024, a study by NYU College of Dentistry, published in JAMA Pediatrics, revealed that silver diamine fluoride (SDF), an affordable liquid for combating cavities, matches dental sealants in preventing tooth decay. Tracking 4,000+ elementary students for four years, the research highlights SDF's potential to widen dental care access and cut costs. Dental cavities, a prevalent issue among children, contribute to pain, school absenteeism, and academic setbacks. While the CDC supports sealant programs in schools, SDF, initially FDA-approved for tooth sensitivity, offers a promising alternative. It functions by eliminating decay-causing bacteria and promoting tooth remineralization, marking a significant advancement in pediatric oral health care.

Key Sources Referred

- World Bank

- World Dental Federation (FDI)

- FDA

- American Dental Association (ADA)

- Septodont

- PULPDENT Corporation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the dental sealants market segments, current trends, estimations, and dynamics of the dental sealants market analysis from 2023 to 2033 to identify the prevailing dental sealants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental sealants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global dental sealants market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental sealants market trends, key players, market segments, application areas, and market growth strategies.

The market study comprises of all latest technological advancements, including the latest market development by major players operating in the market. Furthermore, the study also comprises detailed public policy analysis.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Raw Material |

|

| Segmentation by Type |

|

| Segmentation by Curing |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of manufacturers

4.3.2. List of customers

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Dental Sealants Market Analysis, by Raw Material

5.1. Overview

5.2. Synthetic Adhesive

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Natural Adhesive

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Dental Sealants Market Analysis, by Type

6.1. Overview

6.2. Water-based

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Solvent-based

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Dental Sealants Market Analysis, by Curing

7.1. Overview

7.2. Self-cured

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Light Cured

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Dual Cured

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Dental Sealants Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Raw Material, 2023-2033

8.1.1.2. Market size analysis, by Type, 2023-2033

8.1.1.3. Market size analysis, by Curing, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Raw Material, 2023-2033

8.1.2.2. Market size analysis, by Type, 2023-2033

8.1.2.3. Market size analysis, by Curing, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Raw Material, 2023-2033

8.1.3.2. Market size analysis, by Type, 2023-2033

8.1.3.3. Market size analysis, by Curing, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Raw Material, 2023-2033

8.2.1.2. Market size analysis, by Type, 2023-2033

8.2.1.3. Market size analysis, by Curing, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Raw Material, 2023-2033

8.2.2.2. Market size analysis, by Type, 2023-2033

8.2.2.3. Market size analysis, by Curing, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Raw Material, 2023-2033

8.2.3.2. Market size analysis, by Type, 2023-2033

8.2.3.3. Market size analysis, by Curing, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Raw Material, 2023-2033

8.2.4.2. Market size analysis, by Type, 2023-2033

8.2.4.3. Market size analysis, by Curing, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Raw Material, 2023-2033

8.2.5.2. Market size analysis, by Type, 2023-2033

8.2.5.3. Market size analysis, by Curing, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Raw Material, 2023-2033

8.2.6.2. Market size analysis, by Type, 2023-2033

8.2.6.3. Market size analysis, by Curing, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Raw Material, 2023-2033

8.3.1.2. Market size analysis, by Type, 2023-2033

8.3.1.3. Market size analysis, by Curing, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Raw Material, 2023-2033

8.3.2.2. Market size analysis, by Type, 2023-2033

8.3.2.3. Market size analysis, by Curing, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Raw Material, 2023-2033

8.3.3.2. Market size analysis, by Type, 2023-2033

8.3.3.3. Market size analysis, by Curing, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Raw Material, 2023-2033

8.3.4.2. Market size analysis, by Type, 2023-2033

8.3.4.3. Market size analysis, by Curing, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Raw Material, 2023-2033

8.3.5.2. Market size analysis, by Type, 2023-2033

8.3.5.3. Market size analysis, by Curing, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Raw Material, 2023-2033

8.3.6.2. Market size analysis, by Type, 2023-2033

8.3.6.3. Market size analysis, by Curing, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Raw Material, 2023-2033

8.4.1.2. Market size analysis, by Type, 2023-2033

8.4.1.3. Market size analysis, by Curing, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Raw Material, 2023-2033

8.4.2.2. Market size analysis, by Type, 2023-2033

8.4.2.3. Market size analysis, by Curing, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Raw Material, 2023-2033

8.4.3.2. Market size analysis, by Type, 2023-2033

8.4.3.3. Market size analysis, by Curing, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Raw Material, 2023-2033

8.4.4.2. Market size analysis, by Type, 2023-2033

8.4.4.3. Market size analysis, by Curing, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Raw Material, 2023-2033

8.4.5.2. Market size analysis, by Type, 2023-2033

8.4.5.3. Market size analysis, by Curing, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Den-Mat Holdings, LLC

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. 3M

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Dux Industries, Inc.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Henkel AG & Co. KGaA

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Johnson Services, Inc.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Dentsply Sirona

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. PULPDENT Corporation

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Tricol Biomedical

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Septodont Holding

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Dentsply Sirona Inc.

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com