Doxorubicin Market Size Share Competitive Landscape And Trend Analysis Report Report

RA02208

Doxorubicin Market Size, Share, Competitive Landscape, and Trend Analysis Report by Drug Formulation, Application, Distribution Channel, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

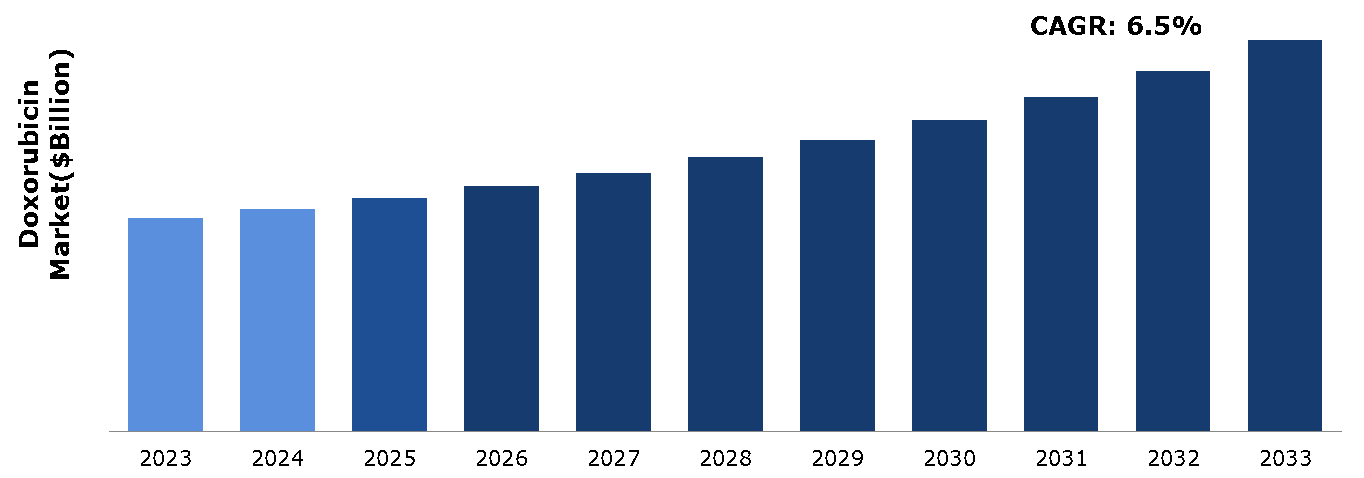

The doxorubicin market was valued at $1.49 billion in 2023 and is estimated to reach $2.74 billion by 2033, exhibiting a CAGR of 6.5% from 2024 to 2033.

Market Definition and Overview

Doxorubicin is an anthracycline antibiotic used primarily as a chemotherapy agent. It works by intercalating DNA, disrupting the function of topoisomerase II, and generating free radicals, which collectively lead to the inhibition of DNA replication and RNA transcription. This results in the death of rapidly dividing cancer cells. Doxorubicin is administered intravenously and is effective against a variety of cancers, including breast cancer, leukemia, lymphoma, and sarcomas. It is often included in combination chemotherapy regimens to enhance therapeutic efficacy. Despite its effectiveness, doxorubicin is associated with significant side effects, particularly cardiotoxicity, which can limit its use. Therefore, careful monitoring and dose adjustments are crucial in its clinical application to balance efficacy and safety.

Key Takeaways

- The doxorubicin market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major healthcare reimbursement industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In June 2023, GenoBioPharma, a biopharma startup, unveiled a novel combination therapy using doxorubicin and a targeted immunotherapy agent. Preclinical studies indicate this approach boosts immune response and enhances doxorubicin's cytotoxic effects against cancer. GenoBioPharma plans to begin clinical trials to assess the safety and efficacy of this new treatment in cancer patients.

- A WHO article published in April 2021 stated that 2.3 million women were diagnosed with breast cancer in 2020, with 685,000 global deaths. By the end of 2020, 7.8 million women had been diagnosed with breast cancer in the past five years, making it the most prevalent cancer worldwide. The American Cancer Institute notes that doxorubicin is used in advanced breast cancer treatment.

Market Dynamics

Expanding oncology research is a significant driver of the doxorubicin market. Heightened investments in cancer research and development are fostering the discovery of novel applications and innovative combination therapies that enhance doxorubicin’s effectiveness. Advanced research is leading to better understanding of doxorubicin’s mechanisms and its potential synergistic effects when used with other therapeutic agents, such as targeted immunotherapies. This progress enables the development of personalized treatment strategies, which can improve patient outcomes and expand doxorubicin's therapeutic applications. Additionally, ongoing clinical trials and preclinical studies are crucial in demonstrating the safety and efficacy of these new therapeutic approaches, further boosting market growth.

Doxorubicin can result in severe side effects like cardiotoxicity, which can limit its use and dosage. Additionally, the emergence of drug resistance in cancer cells reduces its effectiveness over time. High treatment costs and stringent regulatory requirements further hinder market growth. Moreover, the availability of alternative therapies and advancements in personalized medicine impact doxorubicin’s market share, as newer treatments may offer more targeted and less toxic options for cancer patients.

The doxorubicin market presents a significant opportunity driven by its established efficacy in treating various cancers, including breast cancer, lymphomas, and sarcomas. Despite its known side effects such as cardiotoxicity and myelosuppression, doxorubicin remains a cornerstone of chemotherapy regimens due to its potent cytotoxic properties. The market's growth is bolstered by increasing cancer incidence rates globally, especially in emerging economies where access to advanced treatments is expanding. Moreover, ongoing research into novel formulations and delivery methods aims to mitigate doxorubicin's adverse effects while enhancing therapeutic outcomes. As healthcare systems strive to improve cancer care and patient outcomes, the demand for Doxorubicin continues to be robust, supported by its role in both first-line and salvage therapies across a range of malignancies.

Parent Market Overview of the Global Doxorubicin Market

The global doxorubicin market is a segment of the broader oncology drugs market, which encompasses a variety of treatments for cancer. Advances in biotechnology and pharmaceutical research have led to the development of targeted therapies and personalized medicine, pushing the demand for effective chemotherapeutic agents like doxorubicin. The oncology market is characterized by substantial R&D investments, fostering innovations in drug formulations and delivery mechanisms. The growing elderly population and increasing awareness of early cancer detection further fuel this market. Regulatory policies and healthcare reimbursement structures significantly impact the availability and affordability of cancer treatments, shaping the dynamics of the doxorubicin segment. Emerging economies with expanding healthcare infrastructure and improved access to oncology care represent a critical growth area within this market.

Market Segmentation

The market is segmented into drug formulation, application, distribution channel, and region. On the basis of drug formulation, the market is divided into lyophilized powder, and doxorubicin injection. As per application, the market is segmented into bladder cancer, kaposi sarcoma, leukemia, lymphoma, breast cancer, and others. On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America has a significant burden of cancer, particularly breast, lung, and prostate cancers, driving the demand for doxorubicin as a key chemotherapeutic agent. The region benefits from cutting-edge healthcare facilities and technologies, supporting the effective use of doxorubicin in cancer treatment. Additionally, strong investments in pharmaceutical research and development foster innovations in doxorubicin formulations and delivery systems, enhancing its efficacy and reducing side effects.

- In September 2018, Hikma Pharmaceuticals USA Inc., a subsidiary of Hikma Pharmaceuticals PLC, introduced Adriamycin (doxorubicin HCl) for injection. This doxorubicin-based therapy is part of a multi-agent adjuvant chemotherapy regimen for treating women with axillary lymph node involvement post-primary breast cancer resection, expanding the application of doxorubicin in breast cancer treatment.

Competitive Landscape

The major players operating in the doxorubicin market include Synbias Pharma AG, Reddy’s Laboratories Ltd., Changzhou Kinyond Pharmaceutical Co. Ltd., Janssen-Cilag Pty Limited, Pfizer Inc., Meiji Seika Pharma Co. Ltd., Cipla Limited, Hikma Thymoorgan Pharmazie GmbH, Changzhou Kinyond Pharmaceutical Co. Ltd., Novartis International AG, and Teva Pharmaceutical Industries Ltd.

Recent Key Strategies and Developments

- In October 2021, Padagis, collaborating with Ayana Pharma Ltd, obtained US FDA approval to release their AB-rated generic version of Doxil (doxorubicin liposome injection). This milestone enables the introduction of a cost-effective alternative to the branded chemotherapy drug, enhancing the availability and affordability of doxorubicin treatment options for cancer patients.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- Industry Publications and Journals

- D&B Hoovers

- Government websites

- FDA and Regulatory Agencies

- Medical Journals and Publications

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the doxorubicin market segments, current trends, estimations, and dynamics of the doxorubicin market analysis from 2024 to 2033 to identify the prevailing doxorubicin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the doxorubicin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global doxorubicin market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global doxorubicin market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Drug Formulation |

|

| Segmentation by Application |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on doxorubicin market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Doxorubicin Market Analysis, by Drug Formulation

5.1. Overview

5.2. Lyophilized Powder

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Doxorubicin Injection

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Doxorubicin Market Analysis, by Application

6.1. Overview

6.2. Bladder Cancer

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Kaposi Sarcoma

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Leukemia

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Lymphoma

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2024-2033

6.5.3. Market share analysis, by country, 2024-2033

6.6. Breast Cancer

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2024-2033

6.6.3. Market share analysis, by country, 2024-2033

6.7. Others

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2024-2033

6.7.3. Market share analysis, by country, 2024-2033

6.8. Research Dive Exclusive Insights

6.8.1. Market attractiveness

6.8.2. Competition heatmap

7. Doxorubicin Market Analysis, by Distribution Channel

7.1. Overview

7.2. Hospital Pharmacy

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2024-2033

7.2.3. Market share analysis, by country, 2024-2033

7.3. Retail Pharmacy

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2024-2033

7.3.3. Market share analysis, by country, 2024-2033

7.4. Online Pharmacy

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2024-2033

7.4.3. Market share analysis, by country, 2024-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Doxorubicin Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Drug Formulation, 2024-2033

8.1.1.2. Market size analysis, by Application, 2024-2033

8.1.1.3. Market size analysis, by Distribution Channel, 2024-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Drug Formulation, 2024-2033

8.1.2.2. Market size analysis, by Application, 2024-2033

8.1.2.3. Market size analysis, by Distribution Channel, 2024-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Drug Formulation, 2024-2033

8.1.3.2. Market size analysis, by Application, 2024-2033

8.1.3.3. Market size analysis, by Distribution Channel, 2024-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.1.2. Market size analysis, by Application, 2024-2033

8.2.1.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.2.2. Market size analysis, by Application, 2024-2033

8.2.2.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.3. France

8.2.3.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.3.2. Market size analysis, by Application, 2024-2033

8.2.3.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.4.2. Market size analysis, by Application, 2024-2033

8.2.4.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.5.2. Market size analysis, by Application, 2024-2033

8.2.5.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Drug Formulation, 2024-2033

8.2.6.2. Market size analysis, by Application, 2024-2033

8.2.6.3. Market size analysis, by Distribution Channel, 2024-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.1.2. Market size analysis, by Application, 2024-2033

8.3.1.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.2.2. Market size analysis, by Application, 2024-2033

8.3.2.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.3. India

8.3.3.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.3.2. Market size analysis, by Application, 2024-2033

8.3.3.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.4.2. Market size analysis, by Application, 2024-2033

8.3.4.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.5.2. Market size analysis, by Application, 2024-2033

8.3.5.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.6. Rest of Asia Pacific

8.3.6.1. Market size analysis, by Drug Formulation, 2024-2033

8.3.6.2. Market size analysis, by Application, 2024-2033

8.3.6.3. Market size analysis, by Distribution Channel, 2024-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Drug Formulation, 2024-2033

8.4.1.2. Market size analysis, by Application, 2024-2033

8.4.1.3. Market size analysis, by Distribution Channel, 2024-2033

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Drug Formulation, 2024-2033

8.4.2.2. Market size analysis, by Application, 2024-2033

8.4.2.3. Market size analysis, by Distribution Channel, 2024-2033

8.4.3. UAE

8.4.3.1. Market size analysis, by Drug Formulation, 2024-2033

8.4.3.2. Market size analysis, by Application, 2024-2033

8.4.3.3. Market size analysis, by Distribution Channel, 2024-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Drug Formulation, 2024-2033

8.4.4.2. Market size analysis, by Application, 2024-2033

8.4.4.3. Market size analysis, by Distribution Channel, 2024-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Drug Formulation, 2024-2033

8.4.5.2. Market size analysis, by Application, 2024-2033

8.4.5.3. Market size analysis, by Distribution Channel, 2024-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2023

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2023

10. Company Profiles

10.1. Meiji Seika Pharma Co. Ltd.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Novartis International AG

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Teva Pharmaceutical Industries Ltd.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Pfizer Inc.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Cipla Limited

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Hikma Thymoorgan Pharmazie GmbH

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Synbias Pharma AG

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Reddy’s Laboratories Ltd.

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Changzhou Kinyond Pharmaceutical Co. Ltd.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Janssen-Cilag Pty Limited

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com