Gram Staining Market Size Share Competitive Landscape And Trend Analysis Report Report

RA02056

Gram Staining Market Size, Share, Competitive Landscape, and Trend Analysis Report by Type, Application, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

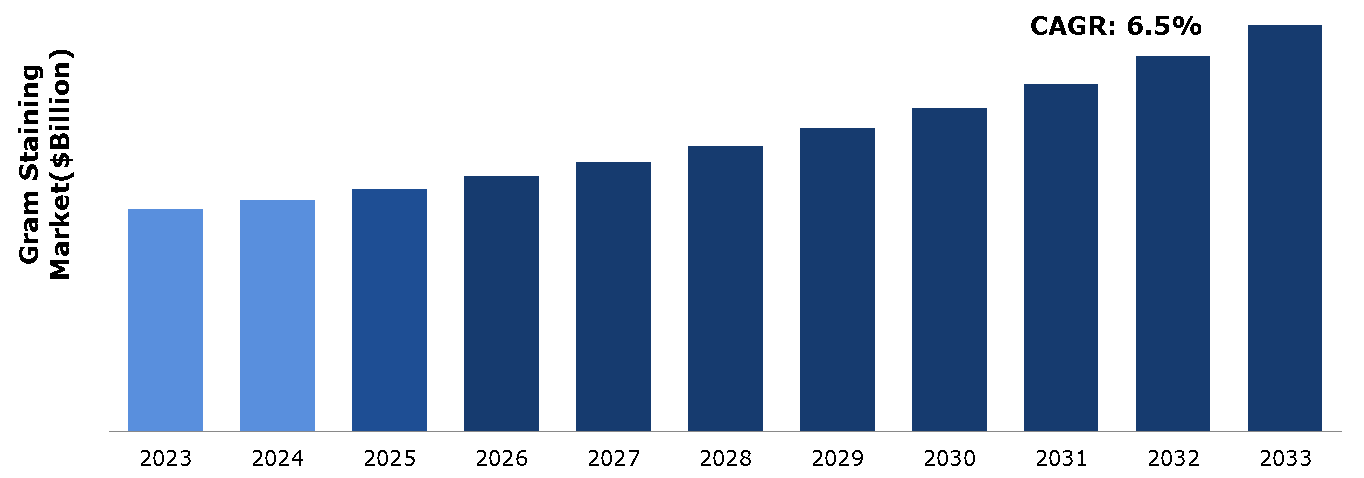

The Gram staining market was valued at $2.33 billion in 2023 and is estimated to reach $4.27 billion by 2033, exhibiting a CAGR of 6.5% from 2024 to 2033.

Market Definition and Overview

Gram staining is a pivotal microbiological technique developed by Hans Christian Gram in 1884 to categorize bacteria into Gram-positive or Gram-negative. This differentiation hinges on the structural variations in bacterial cell walls. The process involves staining bacteria with crystal violet, fixing it with iodine, decolorizing with alcohol or acetone, and counterstaining with safranin. Gram-positive bacteria, with thicker peptidoglycan layers, retain the crystal violet stain and appear purple, while Gram-negative bacteria, with thinner walls and an outer membrane, lose the initial stain and take up the counterstain, appearing red or pink. Gram staining is foundational for bacterial identification, influencing diagnosis and treatment decisions in clinical microbiology.

Key Takeaways

- The Gram staining market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major healthcare reimbursement industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In October 2022, LordsMed, the global healthcare arm of Lord's Mark Industries, opened a 20,000-sqft in-vitro diagnostics (IVD) manufacturing facility in Vasai, near Mumbai, India. The plant produces IVD and point-of-care diagnostic solutions, including analyzers, reagents for various medical tests, rapid antigen kits (ICMR-approved), and lab consumables.

- In June 2022, Agilent introduced IVDR-compliant instruments, kits, and reagents for the EU market. This launch ensures that labs using Agilent’s diagnostic products can continue their operations seamlessly. The availability of these IVDR-compliant reagents, crucial for detecting bacterial infections, is expected to drive growth in the Gram staining market over the coming years.

Market Dynamics

The Gram staining market is experiencing growth due to increasing investments in healthcare infrastructure. Expanding healthcare facilities and diagnostic laboratories, particularly in developing regions, are driving demand for effective diagnostic tools such as gram staining. These investments are aimed at enhancing diagnostic capabilities and improving healthcare access, thereby fueling the adoption of advanced staining techniques. As healthcare infrastructure continues to expand, the market for gram staining is expected to expand further, supported by the need for accurate and timely detection of bacterial infections, crucial for effective patient management and public health outcomes.

Gram staining has limited diagnostic utility for bacteria with atypical cell wall structures, such as Mycobacterium or intracellular bacteria, due to its inability to effectively differentiate them. This limitation reduces the overall sensitivity of Gram staining for identifying a wide range of pathogens. Consequently, the method's reliance on cell wall characteristics restricts its effectiveness, necessitating supplementary or alternative diagnostic techniques for comprehensive microbial analysis and impacting its clinical reliability in certain cases.

Advancements in diagnostic technology, such as innovations in staining techniques and automated systems, are significantly enhancing the accuracy and efficiency of diagnostic processes. These innovations are poised to drive substantial adoption within the Gram staining market. By offering improved precision and faster turnaround times, automated systems reduce human mistake and increase throughput in laboratories. Additionally, advancements in staining techniques contribute to clearer and more reliable results, thereby bolstering confidence among healthcare professionals and researchers. As the demand for reliable and efficient diagnostic tools continues to grow, particularly in the detection of bacterial infections, the Gram staining market is expected to expand steadily. Companies investing in these technological advancements are likely to capture a larger share of this evolving market, contributing to its overall growth and development.

Patent Analysis of Global Gram Staining Market

The global Gram staining market is experiencing significant growth, driven by innovative solutions and increased demand for effective therapies. Patent analysis in this market reveals key trends and insights:

- In January 2022, In China, Autobio Diagnostics Co., Ltd introduced Gram staining kit for automatic drop staining and staining method. This invention pertains to in-vitro diagnostic reagents, specifically a gram staining kit for automated drop staining and its method. The kit includes a rinsing solution (sodium chloride or alcohol aqueous) to facilitate even spread of the staining solution, ensuring efficient sample coverage and conservation of staining solution during the process.

- In July 2021, in China, hainan younike'er biotech co., ltd. introduced a novel Gram staining device. The device is designed to enhance diagnostic efficiency in microbiology laboratories. This device integrates automated staining processes with precise control over reagent application, ensuring uniform and reliable results. With its user-friendly interface and advanced technology, the device aims to streamline gram staining procedures, offering healthcare professionals a valuable tool for accurate bacterial identification in clinical settings.

Market Segmentation

The market is segmented into type, application, and region. As per application, the market is divided into hospitals, diagnostic laboratories, contract research organizations, and academic institutes. On the basis of type, the market is divided into automated gram staining system and kit and regents. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In North America, the Gram staining market is driven by increasing healthcare expenditure, robust research and development activities, and the rising prevalence of infectious diseases. The region's advanced healthcare infrastructure supports the adoption of sophisticated diagnostic technologies, including automated staining systems. Moreover, stringent regulatory standards and a strong emphasis on healthcare quality control further propel market growth. As laboratories strive for enhanced efficiency and accuracy in diagnostic processes, the demand for gram staining solutions continues to expand across clinical and research settings in North America.

- In April 2023, BioMérieux submitted a 510(k) premarket notification to the FDA for VITEK REVEAL, formerly known as SPECIFIC REVEAL Rapid AST System. This innovative platform offers rapid antimicrobial-susceptibility testing for gram-negative bacteria directly from positive blood cultures. Providing results in just over five hours, it empowers clinicians to promptly decide on same-day treatments for patients with bacteremia sepsis.

- In March 2023, the National Institute of Health (NIH) announced a projected USD 609 million funding boost for pneumonia research in the United States, highlighting a heightened emphasis on infectious disease diagnostics. This anticipated increase in funding is poised to stimulate demand for Gram staining techniques, thereby driving market expansion in the foreseeable future.

Competitive Landscape

The major players operating in the Gram staining market include Thermo Fisher Scientific, BD Biosciences, Roche, BioMérieux SA, Millipore Sigma (Merck), ELITechGroup, Hardy Diagnostics, Lorne Laboratories Limited, Axon Lab AG, and Agilent.

Recent Key Strategies and Developments

- In April 2023, Sohag University initiated a clinical trial funded to assess phenotypic and genotypic variations of Enterococcus species, gram-positive, facultative anaerobic cocci arranged in short and medium chains. The study utilized diverse staining methods to enhance the effective identification of these bacteria, contributing valuable insights into their characteristics and behavior for clinical and research purposes.

- In December 2022, Elsevier published research showcasing promising outcomes from an automated algorithm adept at categorizing microscopic Gram stain images. Furthermore, the projected rise in clinical studies utilizing diverse Gram-staining methods is anticipated to propel market growth in the coming years.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Government websites

- Research Papers

- D&B Hoovers

- Industry Publications and Journals

- Regulatory Agencies

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the Gram staining market segments, current trends, estimations, and dynamics of the Gram staining market analysis from 2024 to 2033 to identify the prevailing Gram staining market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peptide synthesis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Gram staining market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Gram staining market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on gram staining market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Gram Staining Market Analysis, by Type

5.1. Overview

5.2. Automated Gram Staining System

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Kit and Regents

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Gram Staining Market Analysis, by Application

6.1. Overview

6.2. Hospitals

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Diagnostic Laboratories

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Contract Research Organizations

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Academic Institutes

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2024-2033

6.5.3. Market share analysis, by country, 2024-2033

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Gram Staining Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2024-2033

7.1.1.2. Market size analysis, by Application, 2024-2033

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2024-2033

7.1.2.2. Market size analysis, by Application, 2024-2033

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2024-2033

7.1.3.2. Market size analysis, by Application, 2024-2033

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2024-2033

7.2.1.2. Market size analysis, by Application, 2024-2033

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2024-2033

7.2.2.2. Market size analysis, by Application, 2024-2033

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2024-2033

7.2.3.2. Market size analysis, by Application, 2024-2033

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2024-2033

7.2.4.2. Market size analysis, by Application, 2024-2033

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2024-2033

7.2.5.2. Market size analysis, by Application, 2024-2033

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2024-2033

7.2.6.2. Market size analysis, by Application, 2024-2033

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2024-2033

7.3.1.2. Market size analysis, by Application, 2024-2033

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2024-2033

7.3.2.2. Market size analysis, by Application, 2024-2033

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2024-2033

7.3.3.2. Market size analysis, by Application, 2024-2033

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2024-2033

7.3.4.2. Market size analysis, by Application, 2024-2033

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2024-2033

7.3.5.2. Market size analysis, by Application, 2024-2033

7.3.6. Rest of Asia Pacific

7.3.6.1. Market size analysis, by Type, 2024-2033

7.3.6.2. Market size analysis, by Application, 2024-2033

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2024-2033

7.4.1.2. Market size analysis, by Application, 2024-2033

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Type, 2024-2033

7.4.2.2. Market size analysis, by Application, 2024-2033

7.4.3. UAE

7.4.3.1. Market size analysis, by Type, 2024-2033

7.4.3.2. Market size analysis, by Application, 2024-2033

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2024-2033

7.4.4.2. Market size analysis, by Application, 2024-20333

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2024-2033

7.4.5.2. Market size analysis, by Application, 2024-2033

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2023

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2023

9. Company Profiles

9.1. BD Biosciences

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. BioMérieux SA

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Agilent

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Millipore Sigma (Merck)

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Hardy Diagnostics

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Thermo Fisher Scientific

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Roche

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Lorne Laboratories Limited

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Axon Lab AG

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. ELITechGroup

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com