Laboratory Mixer Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01986

Laboratory Mixer Market Size, Share, Competitive Landscape and Trend Analysis Report by Product, Platform, Mode of Operation, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

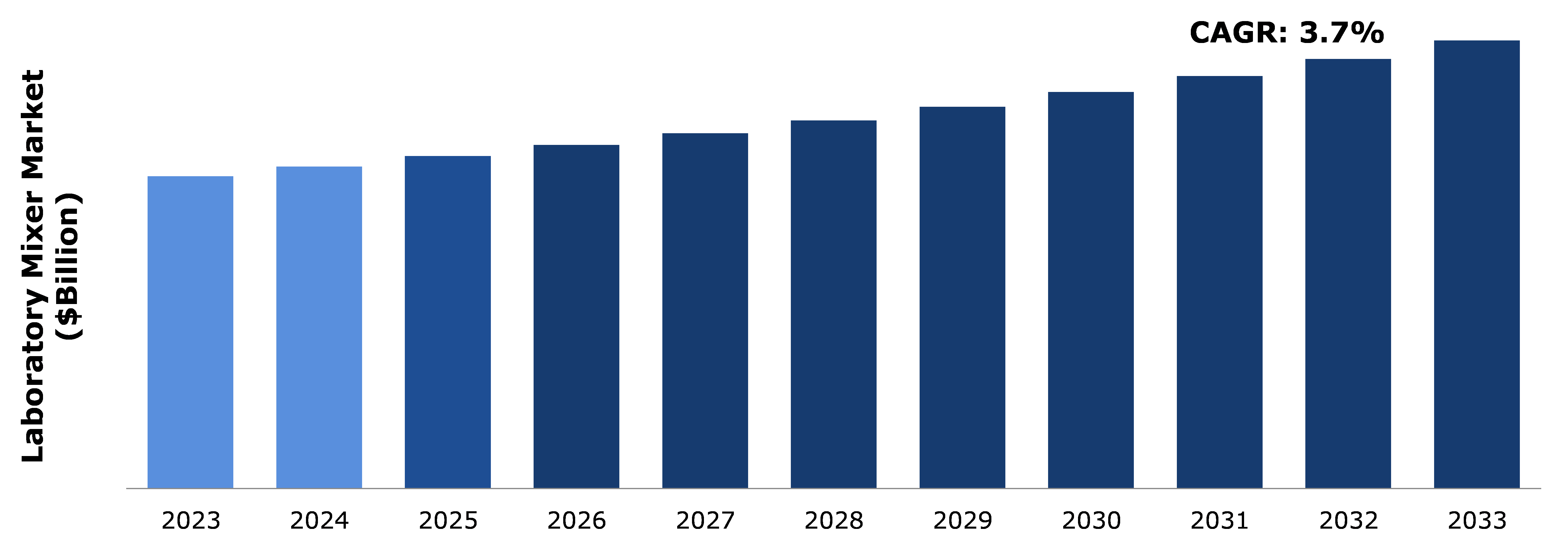

The laboratory mixer market was valued at $2.3 billion in 2023 and is estimated to reach $3.2 billion by 2033, exhibiting a CAGR of 3.7% from 2024 to 2033.

Market Introduction

Laboratory mixers are essential devices equipped with powerful motors, designed for thorough mixing, dispersion, and emulsification tasks in various industries. They come in diverse configurations, such as electric or pneumatic motors with direct drive or gear reduced speed options, allowing for precise control over mixing processes. These mixers typically feature removable mixing shafts with interchangeable impellers, enhancing versatility to suit different applications. They are available in capacities ranging from 1 to 20 liters, accommodating stainless steel, heat-resistant glass, or PC beakers to handle a variety of substances. Advanced models like BITUMIX automate and optimize the mixing of bituminous materials, ensuring consistency in asphalt mix batches.

Key Takeaways

- The laboratory mixer market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major laboratory mixer industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In September 2022, Admix Inc. launched the Benchmix 10, a compact high shear lab mixer catering to diverse industries including food & beverage, chemical, cosmetic, and pharmaceutical sectors. Featuring the patented Rotosolver high-shear mix head, it efficiently disperses powders, eliminates agglomerates, and creates homogeneous mixtures and emulsions. With a capacity of up to 1 gal (4 L) and speeds reaching 9,300 RPM, the Benchmix 10 ensures rapid mixing in as little as 10 minutes. Equipped with a touchscreen interface and electronic lift, it aims to streamline operation for enhanced productivity and scalability.

- In June 2022, Gericke unveiled the Multiflux GMS laboratory mixer, featuring a proprietary double rotor design for high-speed, gentle, and hygienic mixing in a compact tabletop model. This new addition to their lineup accommodates volumes from 1 to 20 liters, ideal for fast and precise mixing in R&D tasks such as new product development and formulation testing. Operating in cycle times of 30 seconds or less, it ensures homogeneous mixtures even with small quantities below 0.01%. The mixer boasts stainless steel construction, a full-size access door for easy cleaning, and optional sanitary and Atmosphères Explosibles (ATEX)-certified designs for safety and versatility.

Key Market Dynamics

Laboratory mixers cater to diverse needs across scientific applications, from pharmaceutical research to biochemical analysis, where the uniformity achieved through mixing is essential for accurate measurements and consistent outcomes. In addition, the versatility of mixers offering options such as programmable settings and timer functionalities further boosts their utility in modern laboratories. As R&D continue to expand globally, the demand for reliable, efficient, and technologically advanced laboratory mixing equipment is expected to rise.

However, inadequate maintenance of laboratory mixers leads to seal failures and particle leakage, presenting significant limitations in scientific research. Seal failures compromise the containment of samples, risking cross-contamination and experimental errors. Particle leakage not only creates cleanup challenges but also compromises the integrity of experimental results by introducing foreign materials. These factors are anticipated to restrain the market growth in the upcoming years.

The versatility of lab mixers spans various industries from pharmaceuticals to biotechnology and beyond, which is anticipated to generate excellent growth opportunities in the market. These mixers are adaptable across diverse scientific applications such as dispersion, emulsification, and dissolution studies. Precision control offered by modern lab mixer technologies ensures reproducibility of experiments, essential for rigorous scientific inquiry and comparison of results. As laboratories continue to drive innovation, lab mixers will remain indispensable tools, facilitating advancements in knowledge and breakthrough discoveries across multiple scientific disciplines. Their role in optimizing research processes highlights their importance as foundational instruments in modern laboratory settings.

Global Laboratory Mixer Market Ecosystem Analysis

Laboratory mixers are used in diverse applications such as mixing, emulsifying, homogenizing, disintegrating, and dissolving. Its unique duplex mixing assembly employs two opposing heads for efficient material manipulation and processing. Ideal for tasks ranging from blending polymers into oils to dissolving solid resins, these mixers offer unparalleled efficiency and flexibility in laboratory settings.

| Company | Product Name | Key Features | Applications |

| Thermo Fisher Scientific | MaxQ Series Orbital Shakers |

|

|

| IKA Works | Vortex Genie |

|

|

| Cole-Parmer | Stuart Range Hotplate Stirrers |

|

|

| Benchmark Scientific | Microplate Magnetic Stirrers |

|

|

| Scilogex | MX-S Tube Roller Mixer |

|

|

Market Segmentation

The laboratory mixer market is segmented into product, platform, mode of operation, end user, and region. On the basis of product, the market is divided into shakers, magnetic stirrers, vortex mixer, conical mixer, overhead stirrers, and accessories. On the basis of platform, the market is classified into digital devices and analog devices. On the basis of mode of operation, the market is divided into gyratory movement, linear movement, rocking/tilting movement, and orbital movement. On the basis of end user, the market is classified into research laboratories & institutes, pharmaceutical & biotechnology companies, clinical research organizations, environmental testing laboratories, food testing laboratories, diagnostic & pathology laboratories, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The demand for laboratory mixers in Asia-Pacific is driven by the advancements in clinical diagnostics, pharmaceutical development, and scientific research. In Asia-Pacific, clinical laboratories play a critical role in healthcare delivery, diagnostics, and disease monitoring. With a rising population and increasing healthcare awareness, there is a rising demand for efficient diagnostic tools and technologies.

In addition, pharmaceutical laboratories in countries like China, India, and Japan are expanding their capabilities in drug development, production, and quality control, which is driving the demand for laboratory mixers. Leading pharmaceutical companies such as Takeda Pharmaceutical (Japan), Sun Pharmaceutical (India), and Beijing Double-Crane Pharmaceutical (China) utilize advanced mixer technologies to enhance productivity, ensure product consistency, and comply with stringent regulatory standards. Also, the leading research institutions such as the National University of Singapore, Tsinghua University (China), and Kyoto University (Japan) utilize state-of-the-art laboratory mixers to support cutting-edge research projects and collaborations.

Competitive Landscape

The major players operating in the laboratory mixer market include Remi Group, Corning, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Heidolph Instrument Gmbh & Co. KG, IKA Works, ColeParmer, Avantor, Inc., Eppendorf AG, Scientific Industries, Inc., and others.

Recent Key Strategies and Developments

- In November 2023, ROSS Mixers introduced a Trial Rental Program for R&D, offering access to their extensive inventory of mixing equipment. Highlighting the ROSS Model PDM-1/2 PowerMix, the program enables process managers to optimize projects without upfront capital investment. Featuring dual agitators for versatile mixing of powders, slurries, and viscous pastes, the bench-mounted unit includes vacuum operation capabilities and hydraulic lift for ease of use. This initiative caters to diverse industry needs with both new and pre-owned equipment available for trial rental.

- In September 2021, Hauschild Engineering introduced the SpeedMixer SMART DAC Series, marking a new era in laboratory mixing technology. Featuring real-time temperature control, vacuum-robotic options, and variable counter rotation, these mixers enhance efficiency and precision. With capacities ranging from 250 g to 2 kg and volumes from 310 ml to 2.8 liters, they cater to diverse applications. Designed for durability and performance, the SMART DAC Series supports up to 30 minutes of mixing and includes innovative features like automatic cooling.

Key Sources Referred

- Food and Drug Administration

- EKATO HOLDING GmbH

- Silverson

- Matest

- INDCO

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the laboratory mixer market segments, current trends, estimations, and dynamics of the laboratory mixer market analysis from 2023 to 2033 to identify the prevailing laboratory mixer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the laboratory mixer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global laboratory mixer market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global laboratory mixer market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Platform |

|

| Segmentation by Mode of Operation |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market Definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on the Laboratory Mixer Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Laboratory Mixer Market Analysis, by Product

5.1. Overview

5.2. Shakers

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Magnetic Stirrers

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Vortex Mixer

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Conical Mixer

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Overhead Stirrers

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2023-2033

5.6.3. Market share analysis, by country, 2023-2033

5.7. Accessories

5.7.1. Definition, key trends, growth factors, and opportunities

5.7.2. Market size analysis, by region, 2023-2033

5.7.3. Market share analysis, by country, 2023-2033

5.8. Research Dive Exclusive Insights

5.8.1. Market attractiveness

5.8.2. Competition heatmap

6. Laboratory Mixer Market Analysis, by Platform

6.1. Overview

6.2. Digital Devices

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Analog Devices

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Laboratory Mixer Market Analysis, by Mode of Operation

7.1. Overview

7.2. Gyratory Movement

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Linear Movement

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Rocking/Tilting Movement

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Orbital Movement

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2023-2033

7.5.3. Market share analysis, by country, 2023-2033

7.6. Research Dive Exclusive Insights

7.6.1. Market attractiveness

7.6.2. Competition heatmap

8. Laboratory Mixer Market Analysis, by End User

8.1. Overview

8.2. Research Laboratories & Institutes

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2023-2033

8.2.3. Market share analysis, by country, 2023-2033

8.3. Pharmaceutical & Biotechnology Companies

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2023-2033

8.3.3. Market share analysis, by country, 2023-2033

8.4. Clinical Research Organizations

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2023-2033

8.4.3. Market share analysis, by country, 2023-2033

8.5. Environmental Testing Laboratories

8.5.1. Definition, key trends, growth factors, and opportunities

8.5.2. Market size analysis, by region, 2023-2033

8.5.3. Market share analysis, by country, 2023-2033

8.6. Food Testing Laboratories

8.6.1. Definition, key trends, growth factors, and opportunities

8.6.2. Market size analysis, by region, 2023-2033

8.6.3. Market share analysis, by country, 2023-2033

8.7. Diagnostic & Pathology Laboratories

8.7.1. Definition, key trends, growth factors, and opportunities

8.7.2. Market size analysis, by region, 2023-2033

8.7.3. Market share analysis, by country, 2023-2033

8.8. Others

8.8.1. Definition, key trends, growth factors, and opportunities

8.8.2. Market size analysis, by region, 2023-2033

8.8.3. Market share analysis, by country, 2023-2033

8.9. Research Dive Exclusive Insights

8.9.1. Market attractiveness

8.9.2. Competition heatmap

9. Laboratory Mixer Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Product, 2023-2033

9.1.1.2. Market size analysis, by Platform, 2023-2033

9.1.1.3. Market size analysis, by Mode of Operation, 2023-2033

9.1.1.4. Market size analysis, by End User, 2023-2033

9.1.2. Canada

9.1.2.1. Market size analysis, by Product, 2023-2033

9.1.2.2. Market size analysis, by Platform, 2023-2033

9.1.2.3. Market size analysis, by Mode of Operation, 2023-2033

9.1.2.4. Market size analysis, by End User, 2023-2033

9.1.3. Mexico

9.1.3.1. Market size analysis, by Product, 2023-2033

9.1.3.2. Market size analysis, by Platform, 2023-2033

9.1.3.3. Market size analysis, by Mode of Operation, 2023-2033

9.1.3.4. Market size analysis, by End User, 2023-2033

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Product, 2023-2033

9.2.1.2. Market size analysis, by Platform, 2023-2033

9.2.1.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.1.4. Market size analysis, by End User, 2023-2033

9.2.2. UK

9.2.2.1. Market size analysis, by Product, 2023-2033

9.2.2.2. Market size analysis, by Platform, 2023-2033

9.2.2.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.2.4. Market size analysis, by End User, 2023-2033

9.2.3. France

9.2.3.1. Market size analysis, by Product, 2023-2033

9.2.3.2. Market size analysis, by Platform, 2023-2033

9.2.3.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.3.4. Market size analysis, by End User, 2023-2033

9.2.4. Spain

9.2.4.1. Market size analysis, by Product, 2023-2033

9.2.4.2. Market size analysis, by Platform, 2023-2033

9.2.4.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.4.4. Market size analysis, by End User, 2023-2033

9.2.5. Italy

9.2.5.1. Market size analysis, by Product, 2023-2033

9.2.5.2. Market size analysis, by Platform, 2023-2033

9.2.5.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.5.4. Market size analysis, by End User, 2023-2033

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Product, 2023-2033

9.2.6.2. Market size analysis, by Platform, 2023-2033

9.2.6.3. Market size analysis, by Mode of Operation, 2023-2033

9.2.6.4. Market size analysis, by End User, 2023-2033

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia-Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Product, 2023-2033

9.3.1.2. Market size analysis, by Platform, 2023-2033

9.3.1.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.1.4. Market size analysis, by End User, 2023-2033

9.3.2. Japan

9.3.2.1. Market size analysis, by Product, 2023-2033

9.3.2.2. Market size analysis, by Platform, 2023-2033

9.3.2.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.2.4. Market size analysis, by End User, 2023-2033

9.3.3. India

9.3.3.1. Market size analysis, by Product, 2023-2033

9.3.3.2. Market size analysis, by Platform, 2023-2033

9.3.3.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.3.4. Market size analysis, by End User, 2023-2033

9.3.4. Australia

9.3.4.1. Market size analysis, by Product, 2023-2033

9.3.4.2. Market size analysis, by Platform, 2023-2033

9.3.4.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.4.4. Market size analysis, by End User, 2023-2033

9.3.5. South Korea

9.3.5.1. Market size analysis, by Product, 2023-2033

9.3.5.2. Market size analysis, by Platform, 2023-2033

9.3.5.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.5.4. Market size analysis, by End User, 2023-2033

9.3.6. Rest of Asia-Pacific

9.3.6.1. Market size analysis, by Product, 2023-2033

9.3.6.2. Market size analysis, by Platform, 2023-2033

9.3.6.3. Market size analysis, by Mode of Operation, 2023-2033

9.3.6.4. Market size analysis, by End User, 2023-2033

9.3.7. Research Dive Exclusive Insights

9.3.7.1. Market attractiveness

9.3.7.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Product, 2023-2033

9.4.1.2. Market size analysis, by Platform, 2023-2033

9.4.1.3. Market size analysis, by Mode of Operation, 2023-2033

9.4.1.4. Market size analysis, by End User, 2023-2033

9.4.2. UAE

9.4.2.1. Market size analysis, by Product, 2023-2033

9.4.2.2. Market size analysis, by Platform, 2023-2033

9.4.2.3. Market size analysis, by Mode of Operation, 2023-2033

9.4.2.4. Market size analysis, by End User, 2023-2033

9.4.3. Saudi Arabia

9.4.3.1. Market size analysis, by Product, 2023-2033

9.4.3.2. Market size analysis, by Platform, 2023-2033

9.4.3.3. Market size analysis, by Mode of Operation, 2023-2033

9.4.3.4. Market size analysis, by End User, 2023-2033

9.4.4. South Africa

9.4.4.1. Market size analysis, by Product, 2023-2033

9.4.4.2. Market size analysis, by Platform, 2023-2033

9.4.4.3. Market size analysis, by Mode of Operation, 2023-2033

9.4.4.4. Market size analysis, by End User, 2023-2033

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Product, 2023-2033

9.4.5.2. Market size analysis, by Platform, 2023-2033

9.4.5.3. Market size analysis, by Mode of Operation, 2023-2033

9.4.5.4. Market size analysis, by End User, 2023-2033

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2023

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2023

11. Company Profiles

11.1. Remi Group

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Corning, Inc.

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Bio-Rad Laboratories, Inc.

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Thermo Fisher Scientific, Inc.

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. Heidolph Instrument Gmbh & Co. KG

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. IKA Works

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. ColeParmer

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. Avantor, Inc.

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. Eppendorf AG

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Scientific Industries, Inc.

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com