Cell Signaling Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01875

Cell Signaling Market Size, Share, Competitive Landscape, and Trend Analysis Report by Type, Product, Technology, Pathway, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

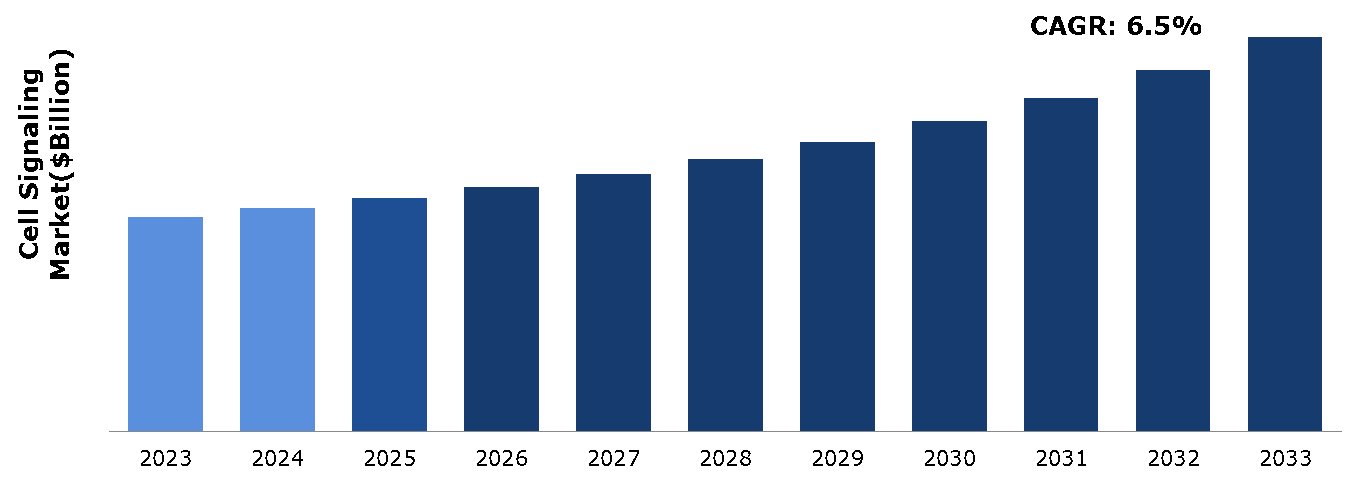

The cell signaling market was valued at $4.5 billion in 2023 and is estimated to reach $8.3 billion by 2033, exhibiting a CAGR of 6.5% from 2024 to 2033.

Market Definition and Overview

Cell signaling refers to the intricate process by which cells communicate with each other and respond to their environment. This communication occurs via biochemical signals like hormones, neurotransmitters, and cytokines that bind to specific receptors on target cells. These interactions initiate a series of molecular events, often involving secondary messengers, leading to a cell response. This can include changes in gene expression, enzyme activity, or cell behavior. Cell signaling ensures proper cellular function, coordination, and response to external stimuli. It plays a crucial role in processes such as development, immune responses, and homeostasis, making it essential for the organism's health and survival.

Key Takeaways

- The cell signaling market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major healthcare reimbursement industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In May 2023, Pfizer and Thermo Fisher Scientific partnered to expand next-generation sequencing (NGS)-based screening for lung and breast cancer in over 30 countries across Latin America, the Middle East, Africa, and Asia. This initiative aims to enhance local access to advanced genomic testing, previously limited or unavailable in these regions.

- In June 2021, Thermo Fisher Scientific and the University of Sheffield collaborated to improve the characterization and monitoring of complex oligonucleotide and mRNA products. Combining Thermo Fisher's advanced sample preparation, liquid chromatography, HRAM mass spectrometry, and data software with the university's research expertise, they aimed to develop efficient analytical workflows and robust, purpose-built processes.

Market Dynamics

The cell signaling market is experiencing robust growth due to increased funding for cell-based research. Governments and private sectors are investing heavily in innovative cell biology studies, driven by the need for advancement in cancer research, regenerative medicine, and personalized therapies. This influx of capital boosts the development of sophisticated cell signaling technologies and platforms, accelerating breakthroughs in drug discovery and therapeutic applications. Increased financial support not only expands research capacities but also drives the market forward, ensuring rapid technological advancements and the conversion of scientific insights into clinical solutions. All these factors are projected to drive the market growth during the forecast period.

The cell signaling market faces a significant challenge due to the high cost of cell signaling systems, restraining its widespread adoption. These systems often require substantial investment in both equipment and expertise, limiting accessibility for many research institutions and biotech companies. The prohibitive costs hinder innovation and impede the progress of understanding complex cellular processes. Consequently, affordability barriers hinder the potential advancements and applications of cell signaling research, constraining the market growth and development.

The cell signaling market presents a robust opportunity driven by advancements in biotechnology, pharmaceuticals, and healthcare. With increasing demand for targeted therapies, diagnostics, and personalized medicine, the market is poised for substantial expansion. Factors such as rising prevalence of chronic diseases, expanding research in cellular biology, and technological innovations in signal transduction pathways are anticipated to create several growth opportunities for the key players operating in the market. Key players are also investing in novel technologies and strategic collaborations to capitalize on this expanding landscape, making the cell signaling market a promising field for innovation and investment.

Parent Market Overview

The cell signaling market is a critical segment of the broader life sciences and biotechnology industry. This parent market encompasses various sectors including pharmaceuticals, diagnostics, genomics, and molecular biology. It is driven by the increasing need for innovative solutions in drug discovery, personalized medicine, and advanced diagnostic tools. Technological advancements, such as high-throughput screening, next-generation sequencing, and bioinformatics, have revolutionized research capabilities. In addition, increasing investments in R&D, along with rising incidence of chronic and infectious diseases, are driving the demand for sophisticated analytical techniques. The integration of artificial intelligence and machine learning in life sciences further boosts market growth, offering enhanced data analysis and predictive capabilities. This dynamic landscape creates a productive environment for the cell signaling market, supporting its expansion and diversification within the life sciences domain.

Market Segmentation

The market is segmented into type, product, technology, pathway, and region. On the basis of type, the market is divided into endocrine signaling, paracrine signaling, autocrine signaling, and others. As per product, the market is classified into consumables and instruments. On the basis of technology, the market is divided into flow cytometry, microscopy, western blotting, ELISA, and others. On the basis of pathway, the market is classified into AKT signaling pathway, AMPK signaling pathway, ErbB/HER signaling pathway, and other signaling pathways. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In North America, the cell signaling market is driven by significant investments in biotechnology and pharmaceuticals, robust research infrastructure, and a high prevalence of chronic diseases. The region's advanced healthcare system, along with government support for biomedical research and innovation, fosters market growth. In addition, the presence of leading biotech firms and research institutions accelerates developments in cell signaling technologies, enhancing therapeutic and diagnostic capabilities.

- The National Library of Medicine projected 1,898,160 new cancer cases and 608,570 cancer deaths in the U.S. for 2021. This alarming trend highlights the rising need for advanced research. Consequently, global funding for cell-based research is increasing, aiming to develop innovative therapies and diagnostic tools to combat the rising cancer burden.

- In March 2020, the Canadian government invested approximately $7 million to regenerative medicine and stem cell research. This funding supports nine transnational projects and four clinical trials, aiming to boost advancements in the regenerative medicine sector within Canada. These initiatives highlight the country's commitment toward pioneering therapies and medical innovations in this expanding field.

Competitive Landscape

The major players operating in the cell signaling market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Merck KGaA, Perkinelmer Inc, Qiagen N.V., Becton, Promega Corporation., F. Hoffmann-La Roche Ltd, Johnson & Johnso, Abbott Laboratories, and others.

Recent Key Strategies and Developments

- In September 2023, Cell Signaling Technology (CST) launched the SignalStar Multiplex IHC technology. This advanced tool supports spatial biology research with mid-plex and high-throughput immunohistochemistry (IHC) assays, enabling more detailed and efficient analysis of biological samples. SignalStar enhances the capabilities of IHC in investigating cellular processes, offering significant advancements for research and diagnostics.

- In June 2021, Thermo Fisher Scientific launched the Invitrogen Attune CytPix Flow Cytometer. This innovative device combines acoustic focusing flow cytometry with a high-speed camera, enabling users to capture high-resolution bright-field images along with high-performance fluorescent flow cytometry data. This integration allows for enhanced analysis of cell morphology and quality, providing a deeper understanding of cellular characteristics.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Government websites

- Industry publications Reports

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the cell signaling market segments, current trends, estimations, and dynamics of the cell signaling market analysis from 2023 to 2033 to identify the prevailing cell signaling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peptide synthesis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cell signaling market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global cell signaling market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Product |

|

| Segmentation by Technology |

|

| Segmentation by Pathway |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Cell Signaling market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Cell Signaling Market Analysis, by Type

5.1. Overview

5.2. Endocrine Signaling

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Paracrine Signaling

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Autocrine Signaling

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2024-2033

5.4.3. Market share analysis, by country, 2024-2033

5.5. Others

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2024-2033

5.5.3. Market share analysis, by country, 2024-2033

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Cell Signaling Market Analysis, by Product

6.1. Overview

6.2. Consumables

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Instruments

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Cell Signaling Market Analysis, by Technology

7.1. Overview

7.2. Flow Cytometry

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2024-2033

7.2.3. Market share analysis, by country, 2024-2033

7.3. Microscopy

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2024-2033

7.3.3. Market share analysis, by country, 2024-2033

7.4. Western Blotting

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2024-2033

7.4.3. Market share analysis, by country, 2024-2033

7.5. ELISA

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2024-2033

7.5.3. Market share analysis, by country, 2024-2033

7.6. Others

7.6.1. Definition, key trends, growth factors, and opportunities

7.6.2. Market size analysis, by region, 2024-2033

7.6.3. Market share analysis, by country, 2024-2033

7.7. Research Dive Exclusive Insights

7.7.1. Market attractiveness

7.7.2. Competition heatmap

8. Cell Signaling Market Analysis, by Pathway

8.1. Overview

8.2. AKT Signaling Pathway

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2024-2033

8.2.3. Market share analysis, by country, 2024-2033

8.3. AMPK Signaling Pathway

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2024-2033

8.3.3. Market share analysis, by country, 2024-2033

8.4. ErbB/HER Signaling Pathway

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2024-2033

8.4.3. Market share analysis, by country, 2024-2033

8.5. Other Signaling Pathways

8.5.1. Definition, key trends, growth factors, and opportunities

8.5.2. Market size analysis, by region, 2024-2033

8.5.3. Market share analysis, by country, 2024-2033

8.5.4. Others

8.5.5. Definition, key trends, growth factors,

8.6. Research Dive Exclusive Insights

8.6.1. Market attractiveness

8.6.2. Competition heatmap

9. Cell Signaling Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Type, 2024-2033

9.1.1.2. Market size analysis, by Product, 2024-2033

9.1.1.3. Market size analysis, by Technology, 2024-2033

9.1.1.4. Market size analysis, by Pathway, 2024-2033

9.1.2. Canada

9.1.2.1. Market size analysis, by Type, 2024-2033

9.1.2.2. Market size analysis, by Product, 2024-2033

9.1.2.3. Market size analysis, by Technology, 2024-2033

9.1.2.4. Market size analysis, by Pathway, 2024-2033

9.1.3. Mexico

9.1.3.1. Market size analysis, by Type, 2024-2033

9.1.3.2. Market size analysis, by Product, 2024-2033

9.1.3.3. Market size analysis, by Technology, 2024-2033

9.1.3.4. Market size analysis, by Pathway, 2024-2033

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Type, 2024-2033

9.2.1.2. Market size analysis, by Product, 2024-2033

9.2.1.3. Market size analysis, by Technology, 2024-2033

9.2.1.4. Market size analysis, by Pathway, 2024-2033

9.2.2. UK

9.2.2.1. Market size analysis, by Type, 2024-2033

9.2.2.2. Market size analysis, by Product, 2024-2033

9.2.2.3. Market size analysis, by Technology, 2024-2033

9.2.2.4. Market size analysis, by Pathway, 2024-2033

9.2.3. France

9.2.3.1. Market size analysis, by Type, 2024-2033

9.2.3.2. Market size analysis, by Product, 2024-2033

9.2.3.3. Market size analysis, by Technology, 2024-2033

9.2.3.4. Market size analysis, by Pathway, 2024-2033

9.2.4. Spain

9.2.4.1. Market size analysis, by Type, 2024-2033

9.2.4.2. Market size analysis, by Product, 2024-2033

9.2.4.3. Market size analysis, by Technology, 2024-2033

9.2.4.4. Market size analysis, by Pathway, 2024-2033

9.2.5. Italy

9.2.5.1. Market size analysis, by Type, 2024-2033

9.2.5.2. Market size analysis, by Product, 2024-2033

9.2.5.3. Market size analysis, by Technology, 2024-2033

9.2.5.4. Market size analysis, by Pathway, 2024-2033

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Type, 2024-2033

9.2.6.2. Market size analysis, by Product, 2024-2033

9.2.6.3. Market size analysis, by Technology, 2024-2033

9.2.6.4. Market size analysis, by Pathway, 2024-2033

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Type, 2024-2033

9.3.1.2. Market size analysis, by Product, 2024-2033

9.3.1.3. Market size analysis, by Technology, 2024-2033

9.3.2. Market size analysis, by Pathway, 2024-2033

9.3.3. Japan

9.3.3.1. Market size analysis, by Type, 2024-2033

9.3.3.2. Market size analysis, by Product, 2024-2033

9.3.3.3. Market size analysis, by Technology, 2024-2033

9.3.3.4. Market size analysis, by Pathway, 2024-2033

9.3.4. India

9.3.4.1. Market size analysis, by Type, 2024-2033

9.3.4.2. Market size analysis, by Product, 2024-2033

9.3.4.3. Market size analysis, by Technology, 2024-2033

9.3.4.4. Market size analysis, by Pathway, 2024-2033

9.3.5. Australia

9.3.5.1. Market size analysis, by Type, 2024-2033

9.3.5.2. Market size analysis, by Product, 2024-2033

9.3.5.3. Market size analysis, by Technology, 2024-2033

9.3.5.4. Market size analysis, by Pathway, 2024-2033

9.3.6. South Korea

9.3.6.1. Market size analysis, by Type, 2024-2033

9.3.6.2. Market size analysis, by Product, 2024-2033

9.3.6.3. Market size analysis, by Technology, 2024-2033

9.3.6.4. Market size analysis, by Pathway, 2024-2033

9.3.7. Rest of Asia Pacific

9.3.7.1. Market size analysis, by Type, 2024-2033

9.3.7.2. Market size analysis, by Product, 2024-2033

9.3.7.3. Market size analysis, by Technology, 2024-2033

9.3.7.4. Market size analysis, by Pathway, 2024-2033

9.3.8. Research Dive Exclusive Insights

9.3.8.1. Market attractiveness

9.3.8.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Type, 2024-2033

9.4.1.2. Market size analysis, by Product, 2024-2033

9.4.1.3. Market size analysis, by Technology, 2024-2033

9.4.1.4. Market size analysis, by Pathway, 2024-2033

9.4.2. Saudi Arabia

9.4.2.1. Market size analysis, by Type, 2024-2033

9.4.2.2. Market size analysis, by Product, 2024-2033

9.4.2.3. Market size analysis, by Technology, 2024-2033

9.4.2.4. Market size analysis, by Pathway, 2024-2033

9.4.3. UAE

9.4.3.1. Market size analysis, by Type, 2024-2033

9.4.3.2. Market size analysis, by Product, 2024-2033

9.4.3.3. Market size analysis, by Technology, 2024-2033

9.4.3.4. Market size analysis, by Pathway, 2024-2033

9.4.4. South Africa

9.4.4.1. Market size analysis, by Type, 2024-2033

9.4.4.2. Market size analysis, by Product, 2024-2033

9.4.4.3. Market size analysis, by Technology, 2024-2033

9.4.4.4. Market size analysis, by Pathway, 2024-2033

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Type, 2024-2033

9.4.5.2. Market size analysis, by Product, 2024-2033

9.4.5.3. Market size analysis, by Technology, 2024-2033

9.4.5.4. Market size analysis, by Pathway, 2024-2033

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2023

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2023

11. Company Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Bio-Rad Laboratories Inc.

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Merck KGaA

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Perkinelmer Inc

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. Qiagen N.V.

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Becton

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. Promega Corporation

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. F. Hoffmann-La Roche Ltd

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. Johnson & Johnso

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Abbott Laboratories

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com