Peptide Synthesis Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01838

Peptide Synthesis Market Size, Share, Competitive Landscape, and Trend Analysis Report by Product, Technology, Application, End Use, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

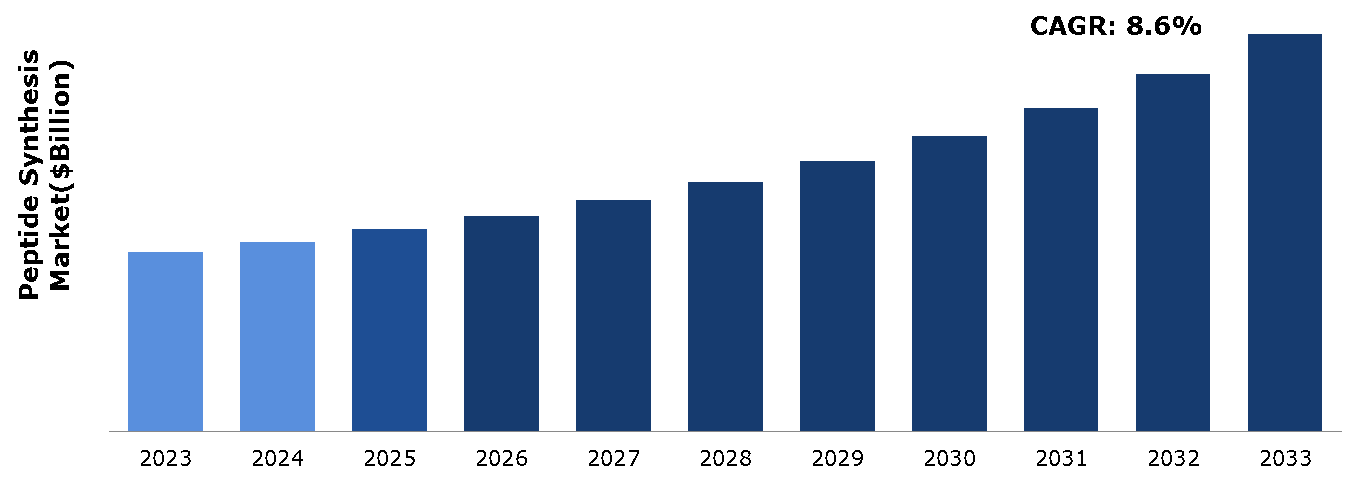

The peptide synthesis market was valued at $5.01 billion in 2023 and is estimated to reach $11.12 billion by 2033, exhibiting a CAGR of 8.6% from 2024 to 2033.

Market Definition and Overview

Peptide synthesis is the process of forming peptides, which are short chains of amino acids linked by peptide bonds. This can be achieved through biological or chemical methods. Biological synthesis occurs naturally within cells, while chemical synthesis involves sequential addition of amino acids using techniques like solid-phase peptide synthesis (SPPS). In SPPS, the peptide chain is assembled on a solid resin support, allowing for efficient automation and purification. Peptide synthesis is crucial for creating peptides for research, drug development, and diagnostics, enabling the study of protein functions, interactions, and therapeutic potential. Key advancements in peptide synthesis have improved yield, purity, and the ability to produce complex and modified peptides.

Key Takeaways

- The peptide synthesis market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major healthcare reimbursement industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In August 2023, data from the British Heart Foundation revealed an increase in UK coronary heart disease deaths to 65,579 in 2021, up from 64,170 in 2020. This rise in chronic diseases fuels the expansion of the peptide synthesis market, as the need for advanced therapeutic peptides in addressing these health challenges grows.

- In December 2022, Bachem Group signed a long-term follow-on contract for peptides with a minimum order volume of CHF 1 billion over five years (2025-2029). To support this, Bachem is investing in capacity expansion across all sites, including doubling the peptide and oligonucleotide manufacturing capacity at their modern large-scale Bubendorf facility.

Market Dynamics

The driving factor behind the peptide synthesis market is the growing demand for peptides in various industries, including pharmaceuticals, biotechnology, and cosmetics. Peptides play a crucial role in drug discovery and development, as they are increasingly utilized in the production of therapeutics for treating various diseases such as cancer, metabolic disorders, and autoimmune diseases. Additionally, advancements in peptide synthesis technologies, such as solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS), are enhancing the efficiency and scalability of peptide production, further driving market growth. Moreover, the rising investments in research and development activities to explore novel peptide-based therapeutics are fueling market expansion.

The peptide synthesis market faces limitations due to challenges in achieving high yields and purity, especially with longer peptide sequences. Additionally, complexities in purification processes and the high cost associated with equipment and reagents hinder market growth. Regulatory hurdles and ethical concerns regarding the use of certain peptides also impede the market's expansion. These factors collectively restrain the full potential of the peptide synthesis market.

The peptide synthesis market presents a promising opportunity to address rare genetic disorders and orphan diseases. With peptides offering potential therapeutic solutions for these conditions, there’s a significant opening for developing peptide-based treatments. Companies can leverage this market growth by focusing on designing and synthesizing peptides that target specific molecular pathways associated with rare diseases, meeting critical unmet medical needs. The increasing ability to produce high-purity peptides efficiently enhances the development of tailored therapies, positioning firms to cater to niche markets with significant clinical impact. As the demand for innovative treatments for rare conditions rises, peptide synthesis stands out as a pivotal field, providing a pathway to novel and effective therapeutic options.

Diabetes Market Analysis

The diabetes market continues to witness a rise in the number of patients worldwide. As of recent estimates, the International Diabetes Federation reported approximately 537 million adults between the ages of 20 and 79 were living with diabetes in 2021. This prevalence highlights the ongoing global challenge posed by diabetes and underscores the need for effective management and treatment options, including peptide-based therapeutics, to address the growing demand for diabetes care. Peptide synthesis plays a crucial role in the development of peptide-based drugs used in the management and treatment of diabetes. Peptide-based drugs can help regulate blood sugar levels by mimicking the action of natural peptides like insulin or by targeting specific pathways involved in glucose metabolism.

Peptide-based therapeutics offer personalized treatment solutions, catering to individual patient needs more effectively than generic alternatives. This trend underscores the importance of leveraging advanced peptide synthesis methodologies to create tailored peptides for each patient, thereby driving demand for related products and services. In 2021, the International Diabetes Federation estimated that approximately 537 million adults aged 20-79 globally had diabetes, with an additional 541 million individuals exhibiting impaired glucose tolerance (IGT), heightening the demand for peptide drugs and facilitating market growth. For instance, according to the International Diabetic Federation 2021 report, an estimated 51 million adults aged 20-29 years were living with diabetes in the North America Caribbean (NAC) region in 2021, representing a regional prevalence of 14.6%. This region has the second highest number of children and adolescents with type 1 diabetes (193,000). The high prevalence of diabetes is expected to continue resulting in higher demand for peptide therapeutics driving the market in the region.

Market Segmentation

The market is segmented into product, technology, application, end use, and region. On the basis of product, the market is divided into equipment, reagents & consumables, and other. As per technology, the market is solid phase peptide synthesis (SPPS), liquid phase peptide synthesis (LPPS), and hybrid technology. On the basis of application, therapeutics, diagnosis, and research. On the basis of end use pharmaceutical & biotechnology companies, contract development & manufacturing organization/contract research organization, and academic & research institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America's peptide synthesis market is driven by several factors. Firstly, the region's robust pharmaceutical and biotechnology industries demand peptides for drug development and research, fostering market growth. Secondly, advancements in peptide synthesis technologies and techniques, coupled with strong research infrastructure, fuel innovation and expansion. Additionally, favorable government initiatives and increased investment in healthcare R&D further stimulate market growth, making North America a prominent player in the global peptide synthesis market.

In March 2022, Gyros Protein Technologies, a US-based company specializing in peptide synthesis and bioanalytical technology services, launched the PurePep Sonata+ peptide synthesizer. The PurePep Sonata+ enhances the features of its predecessor, the Sonata XT, by integrating real-time flow technology. This innovation allows for continuous monitoring of fluid flow rates, ensuring accurate and precise fluid transfers across various viscosities without invasive methods.

Competitive Landscape

The major players operating in the peptide synthesis market include Genscript Biotech, Merck KGaA, Thermo Fisher, Bachem Holdings, CEM Corporation, Creative Diagnostics, Polypeptide Group, Syngene, PuroSynth, and Lonza.

Recent Key Strategies and Developments

- In May 2022, Biohaven Pharmaceuticals and Pfizer Inc. agreed to collaborate on producing an innovative dual-acting migraine therapy aimed at treating and preventing episodic migraine. This partnership underscores the significant role of peptide synthesis in developing advanced therapeutic solutions, reflecting its crucial application in creating effective treatments for neurological conditions like migraines.

- On January 2022, CordenPharma announced a collaboration with PeptiSystems, a Swedish company specializing in peptide and oligonucleotide therapeutic process research using flow-through column technology. The partnership aims to enhance the CordenPharma Peptide Centre of Excellence in Frankfurt, reducing the environmental footprint and improving Process Mass Intensity (PMI) in peptide manufacturing, which typically generates significant waste in large-scale production.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Industry publications such as Genetic Engineering & Biotechnology News (GEN) and FierceBiotech

- Government websites

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the peptide synthesis market segments, current trends, estimations, and dynamics of the healthcare reimbursement market analysis from 2024 to 2033 to identify the prevailing peptide synthesis market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peptide synthesis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global peptide synthesis market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global peptide synthesis market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Segmentation by End-Use |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on peptide synthesis market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Peptide Synthesis Market Analysis, by Product

5.1. Overview

5.2. Equipment

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Reagents & Consumables

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Others

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2024-2033

5.4.3. Market share analysis, by country, 2024-2033

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Peptide Synthesis Market Analysis, by Technology

6.1. Overview

6.2. Solid Phase Peptide Synthesis (SPPS)

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Liquid Phase Peptide Synthesis (LPPS)

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Hybrid Technology

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Peptide Synthesis Market Analysis, by Application

7.1. Overview

7.2. Therapeutics, Diagnosis

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2024-2033

7.2.3. Market share analysis, by country, 2024-2033

7.3. Research

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2024-2033

7.3.3. Market share analysis, by country, 2024-2033

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Peptide Synthesis Market Analysis, by End-Use

8.1. Overview

8.2. Pharmaceutical & Biotechnology Companies

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2024-2033

8.2.3. Market share analysis, by country, 2024-2033

8.3. Contract Development & Manufacturing Organization/Contract Research Organization

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2024-2033

8.3.3. Market share analysis, by country, 2024-2033

8.4. Academic & Research Institutes (CRO & CDMO)

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2024-2033

8.4.3. Market share analysis, by country, 2024-2033

8.5. Research Dive Exclusive Insights

8.5.1. Market attractiveness

8.5.2. Competition heatmap

9. Peptide Synthesis Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Product, 2024-2033

9.1.1.2. Market size analysis, by Technology, 2024-2033

9.1.1.3. Market size analysis, by Application, 2024-2033

9.1.1.4. Market size analysis, by End-Use, 2024-2033

9.1.2. Canada

9.1.2.1. Market size analysis, by Product, 2024-2033

9.1.2.2. Market size analysis, by Technology, 2024-2033

9.1.2.3. Market size analysis, by Application, 2024-2033

9.1.2.4. Market size analysis, by End-Use, 2024-2033

9.1.3. Mexico

9.1.3.1. Market size analysis, by Product, 2024-2033

9.1.3.2. Market size analysis, by Technology, 2024-2033

9.1.3.3. Market size analysis, by Application, 2024-2033

9.1.3.4. Market size analysis, by End-Use, 2024-2033

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Product, 2024-2033

9.2.1.2. Market size analysis, by Technology, 2024-2033

9.2.1.3. Market size analysis, by Application, 2024-2033

9.2.1.4. Market size analysis, by End-Use, 2024-2033

9.2.2. UK

9.2.2.1. Market size analysis, by Product, 2024-2033

9.2.2.2. Market size analysis, by Technology, 2024-2033

9.2.2.3. Market size analysis, by Application, 2024-2033

9.2.2.4. Market size analysis, by End-Use, 2024-2033

9.2.3. France

9.2.3.1. Market size analysis, by Product, 2024-2033

9.2.3.2. Market size analysis, by Technology, 2024-2033

9.2.3.3. Market size analysis, by Application, 2024-2033

9.2.3.4. Market size analysis, by End-Use, 2024-2033

9.2.4. Spain

9.2.4.1. Market size analysis, by Product, 2024-2033

9.2.4.2. Market size analysis, by Technology, 2024-2033

9.2.4.3. Market size analysis, by Application, 2024-2033

9.2.4.4. Market size analysis, by End-Use, 2024-2033

9.2.5. Italy

9.2.5.1. Market size analysis, by Product, 2024-2033

9.2.5.2. Market size analysis, by Technology, 2024-2033

9.2.5.3. Market size analysis, by Application, 2024-2033

9.2.5.4. Market size analysis, by End-Use, 2024-2033

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Product, 2024-2033

9.2.6.2. Market size analysis, by Technology, 2024-2033

9.2.6.3. Market size analysis, by Application, 2024-2033

9.2.6.4. Market size analysis, by End-Use, 2024-2033

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Prod, 2024-2033

9.3.2. Market size analysis, by Technology, 2024-2033

9.3.3. Market size analysis, by Application, 2024-2033

9.3.4. Market size analysis, by End-Use, 2024-2033

9.3.5. Japan

9.3.5.1. Market size analysis, by Product, 2024-2033

9.3.5.2. Market size analysis, by Technology, 2024-2033

9.3.5.3. Market size analysis, by Application, 2024-2033

9.3.5.4. Market size analysis, by End-Use, 2024-2033

9.3.6. India

9.3.6.1. Market size analysis, by Product, 2024-2033

9.3.6.2. Market size analysis, by Technology, 2024-2033

9.3.6.3. Market size analysis, by Application, 2024-2033

9.3.6.4. Market size analysis, by End-Use, 2024-2033

9.3.7. Australia

9.3.7.1. Market size analysis, by Product, 2024-2033

9.3.7.2. Market size analysis, by Technology, 2024-2033

9.3.7.3. Market size analysis, by Application, 2024-2033

9.3.7.4. Market size analysis, by End-Use, 2024-2033

9.3.8. South Korea

9.3.8.1. Market size analysis, by Product, 2024-2033

9.3.8.2. Market size analysis, by Technology, 2024-2033

9.3.8.3. Market size analysis, by Application, 2024-2033

9.3.8.4. Market size analysis, by End-Use, 2024-2033

9.3.9. Rest of Asia Pacific

9.3.9.1. Market size analysis, by Product, 2024-2033

9.3.9.2. Market size analysis, by Technology, 2024-2033

9.3.9.3. Market size analysis, by Application, 2024-2033

9.3.9.4. Market size analysis, by End-Use, 2024-2033

9.3.10. Research Dive Exclusive Insights

9.3.10.1. Market attractiveness

9.3.10.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Product, 2024-2033

9.4.1.2. Market size analysis, by Technology, 2024-2033

9.4.1.3. Market size analysis, by Application, 2024-2033

9.4.1.4. Market size analysis, by End-Use, 2024-2033

9.4.2. Saudi Arabia

9.4.2.1. Market size analysis, by Product, 2024-2033

9.4.2.2. Market size analysis, by Technology, 2024-2033

9.4.2.3. Market size analysis, by Application, 2024-2033

9.4.2.4. Market size analysis, by End-Use, 2024-2033

9.4.3. UAE

9.4.3.1. Market size analysis, by Product, 2024-2033

9.4.3.2. Market size analysis, by Technology, 2024-2033

9.4.3.3. Market size analysis, by Application, 2024-2033

9.4.3.4. Market size analysis, by End-Use, 2024-2033

9.4.4. South Africa

9.4.4.1. Market size analysis, by Product, 2024-2033

9.4.4.2. Market size analysis, by Technology, 2024-2033

9.4.4.3. Market size analysis, by Application, 2024-2033

9.4.4.4. Market size analysis, by End-Use, 2024-2033

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Product, 2024-2033

9.4.5.2. Market size analysis, by Technology, 2024-2033

9.4.5.3. Market size analysis, by Application, 2024-2033

9.4.5.4. Market size analysis, by End-Use, 2024-2033

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2023

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2023

11. Company Profiles

11.1. Creative Diagnostics

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Merck KGaA

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Bachem Holdings

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Thermo Fisher

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. Polypeptide Group

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Syngene

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. PuroSynth

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. Lonza

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. CEM Corporation

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Genscript Biotech

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com