Animal Genetics Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01822

Animal Genetics Market Size, Share, Competitive Landscape, and Trend Analysis Report by Product & Service, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

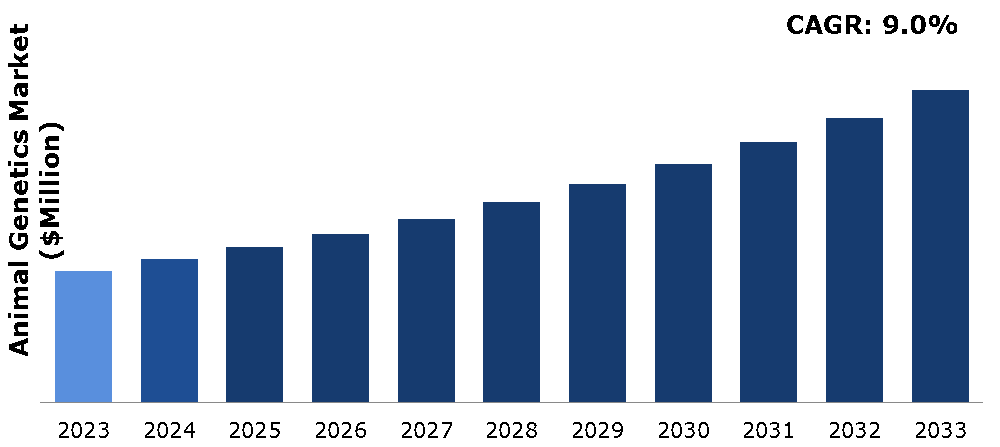

The animal genetics market was valued at $8,236.20 million in 2023 and is estimated to reach $19,482.52 million by 2033 exhibiting a CAGR of 9.0% from 2024 to 2033

Market Introduction and Definition

Animal genetics is a branch of genetics that focuses on the inheritance of traits and genetic variation in animals. This scientific discipline encompasses the study of the genetic makeup of animals, including domesticated species like cattle, horses, dogs, cats, and agricultural livestock, as well as wild species. This involves identifying the specific locations of genes on chromosomes and determining the DNA sequences that make up these genes. Techniques such as whole-genome sequencing have revolutionized the understanding of genetic diversity and evolution in animals. This examines the inheritance of traits that are determined by multiple genes, such as milk production in dairy cows or growth rates in meat-producing animals. It uses statistical methods to predict how these traits will be passed on to future generations. This area focuses on the molecular structure and function of genes. It includes the study of mutations, gene expression, and genetic interactions. This investigates the genetic composition of animal populations and how it changes over time due to factors such as natural selection, genetic drift, and migration.

Key Takeaways

- The animal genetics market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- According to the National Institute of Food and Agriculture (NIFA), over 60% of dairy cows in the U.S. are bred using artificial insemination, while beef producers use this method for less than 5% of their cattle.

- In March 2022, the U.S. Food and Drug Administration cleared the way for gene-edited beef to enter the U.S. market by stating that two gene-edited beef cattle developed by Acceligen pose no safety concerns.

- In May 2022, Neogen Corporation and Gencove introduced InfiniSEEK, an affordable solution for genome sequencing and targeted Single Nucleotide Polymorphism (SNP) analysis. InfiniSEEK is capable of handling over 400 bovine genetic traits and conditions.

- According to a July 2020 report from the Federation of Veterinarians of Europe (FVE), a survey conducted across 28 European countries revealed that approximately 78.5% of veterinarians in rural and remote areas are currently facing shortages, while the remaining 21.5% report no significant shortage of veterinarians.

Key Market Dynamics

As incomes rise globally, dietary preferences shift towards healthy food intake with higher protein, particularly from meat and dairy products. This surge in demand necessitates livestock that can produce more efficiently and yield higher-quality products. Efficient animal genetics play a crucial role in enhancing the productivity of livestock. Genetic improvements can lead to animals that grow faster, produce more milk or eggs, and have better feed conversion rates. This efficiency is essential to meet the growing demand for protein while optimizing resources. The world population is projected to reach 9.7 billion by 2050, according to the United Nations' Department of Economic and Social Affairs. This growth directly correlates with increased demand for protein-rich diets. Moreover, to meet the growing demand for animal products, there is a need for livestock that can produce more efficiently in terms of growth rate, feed conversion efficiency, and disease resistance. This is where advancements in animal genetics play a crucial role.

The strict regulations regarding genetic modification and breeding practices can limit the scope of genetic research and development in animals. These factors are anticipated to restrain the animal genetics market growth during the forecast period. Compliance with regulatory requirements can be costly and time-consuming. Companies may need to invest substantial resources in obtaining approvals, conducting safety assessments, and ensuring compliance with legal standards. Regulations often aim to address ethical concerns related to animal welfare and environmental impact. While necessary, these considerations may impose additional constraints on genetic research and development. Regulations vary significantly across countries and regions, adding complexity for companies operating in multiple markets. This variation can create challenges in navigating regulatory landscapes and complying with diverse requirements.

Rising precision breeding technologies enable more precise and efficient selection of desirable traits in animals. Genetic sequencing allows for a comprehensive understanding of an animal's genetic makeup, facilitating targeted breeding programs. Genomic selection enhances the accuracy of breeding value predictions, enabling breeders to select animals with the highest potential for desired traits like disease resistance, productivity, or quality of products (e.g., meat, milk). Gene editing technologies such as CRISPR-Cas9 provide unprecedented precision in modifying specific genes. This can accelerate genetic improvement by introducing beneficial traits or removing undesirable ones within a shorter timeframe compared to traditional breeding methods. For example, livestock can be made more resistant to diseases, reducing the need for antibiotics and improving overall health. Precision breeding technologies are applicable across various animal species, including livestock (cattle, pigs, poultry), aquaculture species (fish, shrimp), and even companion animals. Each species can benefit from tailored genetic improvements suited to their specific breeding goals and environmental conditions. These factors are anticipated to create opportunities in the animal genetics market during the forecast years.

Macro and Micro Economic Analysis of Animal Genetics Market

Analyzing the animal genetics market involves both macroeconomic and microeconomic perspectives.

- Regulatory Frameworks: Governments establish regulatory agencies (e.g., FDA in the U.S., EMA in the EU) to ensure the safety, efficacy, and quality of biologic products. These agencies set guidelines for the approval and post-market surveillance of biologics.

- Intellectual Property Protection: Governments grant patents to incentivize innovation in biologics. However, there is often a delicate balance between providing adequate protection for innovators and ensuring access to affordable biosimilars once patents expire. Policies like patent cliffs or compulsory licensing may be used to encourage competition and lower prices.

- Health Technology Assessment (HTA): Many countries conduct HTA to assess the value of biologics compared to existing treatments. HTA informs reimbursement decisions by considering factors like clinical efficacy, safety, cost-effectiveness, and societal impact.

- Patient Safety and Monitoring: Post-market surveillance systems are established to monitor the safety and efficacy of biologic products once they are in the market. Adverse event reporting and pharmacovigilance programs are essential components of these systems.

Market Segmentation

The animal genetics market is segmented into product & service, end user, and region. On the basis of product & service, the market is divided into animal type (canine, poultry, porcine, bovine, and others), genetic material (semen, and embryo), and service type (DNA typing, genetic trait testing, genetic disease tests). On the basis of end user, the market is divided into veterinary hospitals & clinics, research centers & institutes, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The increasing global population and rising demand for protein-rich diets are significant drivers of the market. According to the USDA, the consumption of meat and dairy in North America has been steadily increasing over the years. Advances in genetic engineering and biotechnology have led to improved breeding techniques and genetic selection processes, enhancing the quality and productivity of livestock. The USDA's National Institute of Food and Agriculture (NIFA) often publishes reports on advancements in agricultural biotechnology. Government policies that support animal welfare and sustainable agriculture drive investments in genetic research and development. Regulatory bodies such as the FDA and USDA provide guidelines and support for genetic research in animals.

- In November 2022, Zoetis expanded its portfolio in genetic screening and data analytics crucial for advancing pet care through the acquisition of Basepaws, an animal genetics company.

- In August 2022, URUS Group LP acquired Trans Ova Genetics, a leading provider of bovine reproductive technologies, with the goal of enhancing the profitability, productivity, and sustainability of cattle herds.

Competitive Landscape

The major players operating in the animal genetics market include Neogen Corporation, Genetics Australia, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., and Generatio GmbH.

Recent Key Strategies and Developments

- In October 2023, Basepaws launched an extensive DNA test for dogs focused on enhancing health and identifying disease risks early. This test allows pet owners to shift from reacting to health issues to actively managing them, with easy swabbing and convenient mobile access to results for a smoother user experience.

- In June 2022, Zoetis purchased Basepaws, a genetics company focused on petcare, thereby bolstering its range of genetic testing and data analytics to advance animal care.

- In October 2020, the Veterinary Genetics Laboratory introduced a DNA test for coat color dilution in Charolais, Highland, Simmental, Galloway, and Hereford cattle breeds.

- In May 2020, Zoetis introduced INHERIT Select, a new genomic test providing Genomic Expected Progeny Differences (GEPDs).

Key Sources Referred

- National Association of Animal Breeders (NAAB)

- International Embryo Technology Society (IETS)

- American Society of Animal Science (ASAS)

- Government and Regulatory Agencies

- Annual Reports

- Investor Presentations

- Press Releases

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the animal genetics market segments, current trends, estimations, and dynamics of the animal genetics market analysis from 2023 to 2033.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the animal genetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global animal genetics market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global animal genetics market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product & Service | animal type

genetic material

service type

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Animal Genetics Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Animal Genetics Market Analysis, by Product & Service

5.1. Overview

5.2. Animal Type

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.2.3.1. Canine

5.2.4. Definition, key trends, growth factors, and opportunities

5.2.5. Market size analysis, by region, 2022-2032

5.2.6. Market share analysis, by country, 2022-2032

5.2.6.1. Poultry

5.2.7. Definition, key trends, growth factors, and opportunities

5.2.8. Market size analysis, by region, 2022-2032

5.2.9. Market share analysis, by country, 2022-2032

5.2.9.1. Porcine

5.2.10. Definition, key trends, growth factors, and opportunities

5.2.11. Market size analysis, by region, 2022-2032

5.2.12. Market share analysis, by country, 2022-2032

5.2.12.1. Bovine

5.2.13. Definition, key trends, growth factors, and opportunities

5.2.14. Market size analysis, by region, 2022-2032

5.2.15. Market share analysis, by country, 2022-2032

5.2.15.1. Others

5.2.16. Definition, key trends, growth factors, and opportunities

5.2.17. Market size analysis, by region, 2022-2032

5.2.18. Market share analysis, by country, 2022-2032

5.3. Genetic Material

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.3.3.1. Semen

5.3.4. Definition, key trends, growth factors, and opportunities

5.3.5. Market size analysis, by region, 2022-2032

5.3.6. Market share analysis, by country, 2022-2032

5.3.6.1. Embryo

5.3.7. Definition, key trends, growth factors, and opportunities

5.3.8. Market size analysis, by region, 2022-2032

5.3.9. Market share analysis, by country, 2022-2032

5.4. Service Type

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.4.3.1. DNA Typing

5.4.4. Definition, key trends, growth factors, and opportunities

5.4.5. Market size analysis, by region, 2022-2032

5.4.6. Market share analysis, by country, 2022-2032

5.4.6.1. Genetic Trait Testing

5.4.7. Definition, key trends, growth factors, and opportunities

5.4.8. Market size analysis, by region, 2022-2032

5.4.9. Market share analysis, by country, 2022-2032

5.4.9.1. Genetic Disease Tests

5.4.10. Definition, key trends, growth factors, and opportunities

5.4.11. Market size analysis, by region, 2022-2032

5.4.12. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Animal Genetics Market Analysis, by End User

6.1. Overview

6.2. Veterinary Hospitals & Clinics

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Research Centers & Institutes

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Others

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Animal Genetics Market , by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Product & Service, 2022-2032

7.1.1.2. Market size analysis, by End User, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Product & Service, 2022-2032

7.1.2.2. Market size analysis, by End User, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Product & Service, 2022-2032

7.1.3.2. Market size analysis, by End User, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Product & Service, 2022-2032

7.2.1.2. Market size analysis, by End User, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Product & Service, 2022-2032

7.2.2.2. Market size analysis, by End User, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Product & Service, 2022-2032

7.2.3.2. Market size analysis, by End User, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Product & Service, 2022-2032

7.2.4.2. Market size analysis, by End User, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Product & Service, 2022-2032

7.2.5.2. Market size analysis, by End User, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Product & Service, 2022-2032

7.2.6.2. Market size analysis, by End User, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Product & Service, 2022-2032

7.3.1.2. Market size analysis, by End User, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Product & Service, 2022-2032

7.3.2.2. Market size analysis, by End User, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Product & Service, 2022-2032

7.3.3.2. Market size analysis, by End User, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Product & Service, 2022-2032

7.3.4.2. Market size analysis, by End User, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Product & Service, 2022-2032

7.3.5.2. Market size analysis, by End User, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Product & Service, 2022-2032

7.3.6.2. Market size analysis, by End User, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Product & Service, 2022-2032

7.4.1.2. Market size analysis, by End User, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Product & Service, 2022-2032

7.4.2.2. Market size analysis, by End User, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Product & Service, 2022-2032

7.4.3.2. Market size analysis, by End User, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Product & Service, 2022-2032

7.4.4.2. Market size analysis, by End User, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Product & Service, 2022-2032

7.4.5.2. Market size analysis, by End User, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Neogen Corporation

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Genetics Australia

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Hendrix Genetics BV

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. URUS Group LP

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. CRV

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Semex

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Swine Genetics International

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. STgenetics

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Animal Genetics Inc.

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Generatio GmbH

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com