Cold Plasma Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01491

Cold Plasma Market Size, Share, Competitive Landscape, and Trend Analysis Report by Regime, Application, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

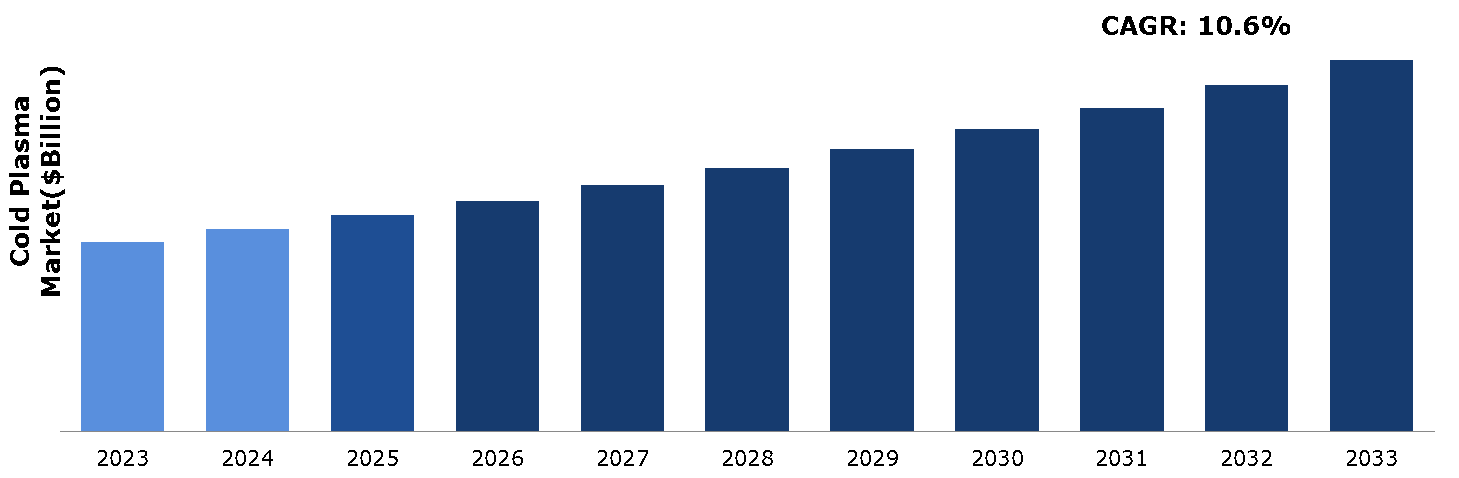

The cold plasma market was valued at $2.39 billion in 2023 and is estimated to reach $6.40 billion by 2033, exhibiting a CAGR of 10.6% from 2024 to 2033.

Overview of Cold Plasma

Cold plasma is an innovative technology used for microbial destruction and surface modification, addressing the limitations of conventional preservation methods that can compromise nutritional quality. It offers high efficacy and preservation without the use of toxic substances. The selection of gases with inherent germicidal properties enhances the efficiency of plasma sterilization. Cold plasma techniques operate at ambient temperatures, minimizing thermal effects on nutritional and sensory quality and leaving no chemical residues. This technology is versatile, applicable for starch modification, and as an additive or filler in packaging materials.

Key Takeaways

- The cold plasma treatment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major cold plasma treatment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In October 2023, Viromed Medical GmbH, the distributor of terraplasma medical GmbH's cold atmospheric plasma (CAP) therapy, partnered with Wundex Group GmbH and its subsidiary MasterCare Medical GmbH to revolutionize home care and wound treatment. This collaboration aims to expand the use of innovative CAP therapy in outpatient wound care. By integrating terraplasma medical's advanced wound healing technology, MasterCare would enhance its services and appeal to doctors across Germany. Consequently, a significantly larger number of home care patients would benefit from this advanced treatment.

- In November 2022, Plasma Water Solutions LLC launched its wholly owned Indian subsidiary to provide safe drinking water and chemical-free agricultural solutions. Their patented technology employs low-energy cold plasma in a continuous flow system to eliminate harmful bacteria and viruses from water, enabling real-time water quality monitoring. This technology produces Plasma Activated Water (PAW) for agriculture, which enhances seed germination, disease management, growth rates, yields, and shelf life. This results in higher farmer income and environmentally safe agricultural run-off, protecting surface and underground water sources for future generations.

Key Market Dynamics

The rising demand for biologically derived products is set to drive significant growth of the cold plasma market. Cold plasma, known for its effectiveness in sterilization, surface modification, and medical applications, is becoming increasingly essential due to its compatibility with biological materials. As industries seek sustainable and efficient methods to process biologically derived products, the adoption of cold plasma technology is increasing. This trend is expected to boost advancements and expansion in the cold plasma sector, catering to the rising needs of biotechnology and healthcare industries.

However, the demand for cold plasma systems faces restraints due to the necessity for specialized knowledge and training in their operation and maintenance. This requirement delays widespread adoption and hampers the growth potential of cold plasma technology. The complex nature of these systems creates barriers for industries and businesses seeking to adapt these systems, constraining the expansion of cold plasma applications across various sectors.

Researchers are advancing cold plasma systems, enhancing efficacy, processing speed, and affordability. Innovations in plasma sources would provide higher efficiency, durability, and stability, driving market expansion. These developments indicate a new trend, driving the industry forward with advanced technology.

Semiconductor Market Analysis

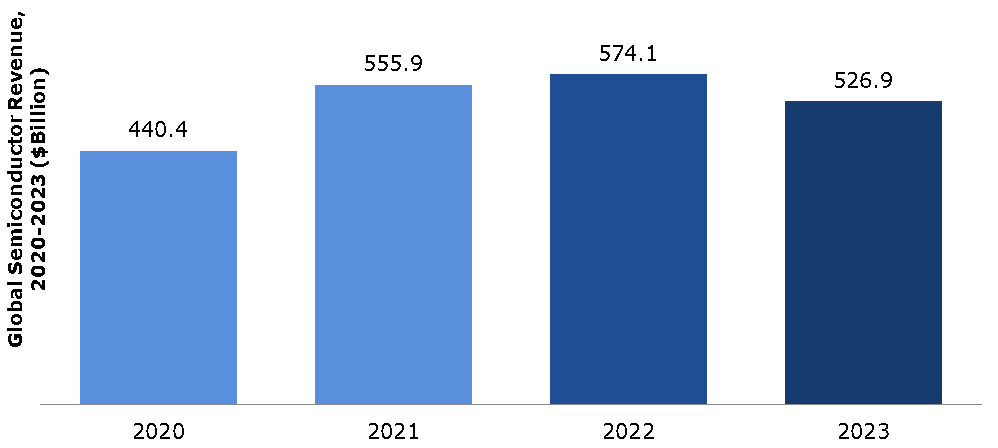

The booming semiconductor industry is expected to drive a progressive rise in demand for cold plasma technology. As semiconductor manufacturing processes become increasingly intricate and delicate, the need for precise and efficient cleaning and etching techniques increases. Cold plasma, with its ability to gently yet effectively remove contaminants and modify surfaces without causing damage, emerges as a critical solution. Its non-thermal nature allows for intricate control over the treatment process, ensuring the integrity of sensitive semiconductor components. With the semiconductor market projected to continue its rapid expansion driven by emerging technologies like AI, IoT, and 5G, the demand for cold plasma technology is expected to increase. This rising demand highlights the vital role that cold plasma is expected to play in facilitating the continued advancement and innovation within the semiconductor industry.

Source: World Semiconductor Trade Statistics, Research Dive Analysis, Secondary Research

In April 2024, the Semiconductor Industry Association (SIA) reported global semiconductor industry sales of $46.4 billion, marking a 15.8% rise from April 2023's $40.1 billion and a 1.1% increase from March 2024's $45.9 billion. The industry has consistently seen double-digit sales growth on a year-to-year basis, with April being the first month in 2024 to show a month-to-month increase. This increase indicates a promising market trend as the year progresses, suggesting significant positive momentum within the global semiconductor industry.

Market Segmentation

The cold plasma market is segmented into regime, application, end user, and region. On the basis of regime, the market is divided into atmospheric pressure and low pressure. As per application, the market is classified into surface treatment, sterilization & disinfection, coating & finishing, adhesion, wound healing, and others. Based on end user, the market is divided into automotive, electronics & semiconductors, food processing & packaging, healthcare, aerospace, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

Germany is experiencing a surge in demand for cold plasma technology due to its wide-ranging applications across various industries. This growth is driven by the technology's effectiveness in medical treatments, especially in wound healing and sterilization. In addition, the manufacturing sector is leveraging cold plasma for surface modifications and improving material properties. Environmental applications, such as water purification and pollution control, also contribute to its increasing demand. The country's emphasis on technological innovation and sustainable solutions is accelerating cold plasma adoption. This growth is further driven by increased innovation from major industry players in the country, enhancing its application and development.

- In July 2022, NGK SPARK PLUG announced the beginning of a strategic partnership with neoplas med GmbH, a German medical company that specializes in innovative cold plasma jet technology. The collaboration will involve the world’s leading ignition and vehicle electronics specialist investing growth capital from its Venture Capital Fund CVC (jointly operated with Pegasus Tech Ventures) into this future-oriented medical company. The move further demonstrates NGK SPARK PLUG’s commitment toward promoting the creation of new businesses.

Competitive Landscape

The major players operating in the cold plasma market include Apyx Medical, AcXys Plasma Technologies, Enercon Industries Corporation, Adtec Plasma Technology Co., Ltd., Henniker Plasma, Coating Plasma Innovation, Nordson Corporation, Europlasma N.V., P2i Limited, and Plasmatreat GmbH.

Other players in the cold plasma market include Neoplas GmbH and Surfx Technologies, LLC.

Recent Key Strategies and Developments

- In June 2022, Intertronics introduced the Relyon Plasma Piezobrush PZ3-i, the world’s smallest active plasma unit for industrial integration, targeting the life sciences and medical sectors. This innovative device facilitates the automation of plasma surface treatment, enhancing adhesion, wetting, and cleanliness on challenging cold surfaces by providing surface treatment and activation prior to bonding, printing, or laminating. The Piezobrush PZ3-i is adept at treating materials like glass, plastics, and metals, making it invaluable for processes in microbiology, medicine, microfluidics, and food engineering. It supports semi-automated and automated production lines, ideal for applications such as filters, test tubes, cell walls, syringes, catheters, needle hubs, petri-dishes, and lenses. By utilizing cold plasma technology, the Piezobrush PZ3-i significantly improves manufacturing processes in the medical and life sciences industries.

Key Sources Referred

- European Physical Society (EPS) - Plasma Physics Division

- International Society for Plasma Medicine (ISPM)

- Neoplas med GmbH

- Perricone MD

- Mirari Doctor

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the cold plasma treatment market segments, current trends, estimations, and dynamics of the cold plasma treatment market analysis from 2023 to 2033 to identify the prevailing cold plasma treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cold plasma treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cold plasma treatment market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cold plasma treatment market trends, key players, market segments, application areas, and market growth strategies.

The market study comprises of all latest technological advancements, including the latest market development by major players operating in the market.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Regime |

|

| Segmentation by Application |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of service provider

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Cold Plasma Market Analysis, by Regime

5.1. Overview

5.2. Atmospheric Pressure

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Low Pressure

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Cold Plasma Market Analysis, by Application

6.1. Overview

6.2. Surface Treatment

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Sterilization & Disinfection

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Coating & Finishing

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2023-2033

6.4.3. Market share analysis, by country, 2023-2033

6.5. Adhesion

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2023-2033

6.5.3. Market share analysis, by country, 2023-2033

6.6. Wound Healing

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2023-2033

6.6.3. Market share analysis, by country, 2023-2033

6.7. Others

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2023-2033

6.7.3. Market share analysis, by country, 2023-2033

6.8. Research Dive Exclusive Insights

6.8.1. Market attractiveness

6.8.2. Competition heatmap

7. Cold Plasma Market Analysis, by End User

7.1. Overview

7.2. Automotive

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Electronics & Semiconductors

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Food Processing & Packaging

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Healthcare

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2023-2033

7.5.3. Market share analysis, by country, 2023-2033

7.6. Aerospace

7.6.1. Definition, key trends, growth factors, and opportunities

7.6.2. Market size analysis, by region, 2023-2033

7.6.3. Market share analysis, by country, 2023-2033

7.7. Others

7.7.1. Definition, key trends, growth factors, and opportunities

7.7.2. Market size analysis, by region, 2023-2033

7.7.3. Market share analysis, by country, 2023-2033

7.8. Research Dive Exclusive Insights

7.8.1. Market attractiveness

7.8.2. Competition heatmap

8. Cold Plasma Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Regime, 2023-2033

8.1.1.2. Market size analysis, by Application, 2023-2033

8.1.1.3. Market size analysis, by End User, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Regime, 2023-2033

8.1.2.2. Market size analysis, by Application, 2023-2033

8.1.2.3. Market size analysis, by End User, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Regime, 2023-2033

8.1.3.2. Market size analysis, by Application, 2023-2033

8.1.3.3. Market size analysis, by End User, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Regime, 2023-2033

8.2.1.2. Market size analysis, by Application, 2023-2033

8.2.1.3. Market size analysis, by End User, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Regime, 2023-2033

8.2.2.2. Market size analysis, by Application, 2023-2033

8.2.2.3. Market size analysis, by End User, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Regime, 2023-2033

8.2.3.2. Market size analysis, by Application, 2023-2033

8.2.3.3. Market size analysis, by End User, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Regime, 2023-2033

8.2.4.2. Market size analysis, by Application, 2023-2033

8.2.4.3. Market size analysis, by End User, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Regime, 2023-2033

8.2.5.2. Market size analysis, by Application, 2023-2033

8.2.5.3. Market size analysis, by End User, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Regime, 2023-2033

8.2.6.2. Market size analysis, by Application, 2023-2033

8.2.6.3. Market size analysis, by End User, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Regime, 2023-2033

8.3.1.2. Market size analysis, by Application, 2023-2033

8.3.1.3. Market size analysis, by End User, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Regime, 2023-2033

8.3.2.2. Market size analysis, by Application, 2023-2033

8.3.2.3. Market size analysis, by End User, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Regime, 2023-2033

8.3.3.2. Market size analysis, by Application, 2023-2033

8.3.3.3. Market size analysis, by End User, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Regime, 2023-2033

8.3.4.2. Market size analysis, by Application, 2023-2033

8.3.4.3. Market size analysis, by End User, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Regime, 2023-2033

8.3.5.2. Market size analysis, by Application, 2023-2033

8.3.5.3. Market size analysis, by End User, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Regime, 2023-2033

8.3.6.2. Market size analysis, by Application, 2023-2033

8.3.6.3. Market size analysis, by End User, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Regime, 2023-2033

8.4.1.2. Market size analysis, by Application, 2023-2033

8.4.1.3. Market size analysis, by End User, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Regime, 2023-2033

8.4.2.2. Market size analysis, by Application, 2023-2033

8.4.2.3. Market size analysis, by End User, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Regime, 2023-2033

8.4.3.2. Market size analysis, by Application, 2023-2033

8.4.3.3. Market size analysis, by End User, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Regime, 2023-2033

8.4.4.2. Market size analysis, by Application, 2023-2033

8.4.4.3. Market size analysis, by End User, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Regime, 2023-2033

8.4.5.2. Market size analysis, by Application, 2023-2033

8.4.5.3. Market size analysis, by End User, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Apyx Medical

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. AcXys Plasma Technologies

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Enercon Industries Corporation

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Adtec Plasma Technology Co., Ltd.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Henniker Plasma

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Coating Plasma Innovation

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Nordson Corporation

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Europlasma N.V.

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. P2i Limited

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Plasmatreat GmbH

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com