Medical Coding Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01462

Medical Coding Market Size, Share, Competitive Landscape and Trend Analysis Report by Classification System, Component, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

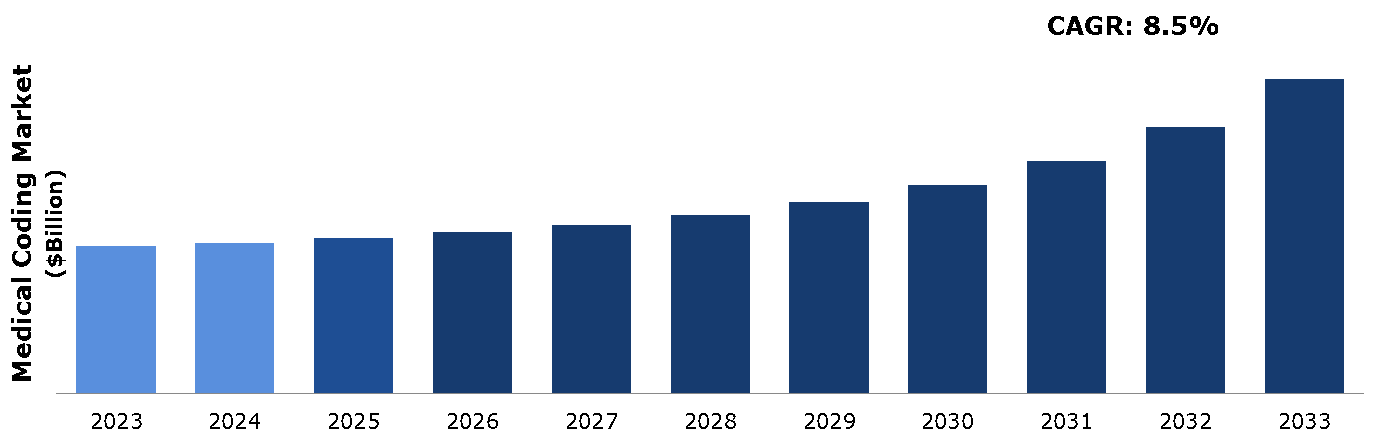

The medical coding market was valued at $22.65 billion in 2023 and is estimated to reach $48.26 billion by 2033, exhibiting a CAGR of 8.5% from 2024 to 2033.

Market Definition and Overview

Medical coding is the process of translating healthcare diagnoses, procedures, medical services, and equipment into universal alphanumeric codes. These codes are used for various purposes, including medical billing, insurance claims processing, statistical analysis, and reimbursement purposes. Medical coding ensures that healthcare services and procedures are accurately documented and classified according to standardized code sets, such as the International Classification of Diseases (ICD) and the Current Procedural Terminology (CPT). Proper medical coding is essential for healthcare providers to receive reimbursement for services rendered, maintain accurate patient records, and comply with regulatory requirements.

Key Takeaways

- The medical coding market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major medical coding industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- According to an update from the World Health Organization (WHO), as of February 2022, the latest iteration of the International Classification of Diseases (ICD), known as ICD-11, had transitioned to a fully digital format. This new version boasted a user-friendly interface and multilingual capabilities aimed at minimizing errors. Compiled and updated with contributions from over 90 countries, ICD-11 saw unprecedented involvement from healthcare providers. This shift marked a departure from a system imposed on clinicians to a more supportive clinical classification and terminology database, serving diverse purposes such as health statistics recording and reporting.

- In October 2021, Blue Shield of California (U.S.) partnered with Google Cloud to revolutionize medical billing. This collaboration leverages AI technology to provide real-time reimbursement information, thereby reducing the administrative burden for both providers and patients.

Key Market Dynamics

The medical coding market has experienced significant growth in recent years, due to a variety of factors that highlight the increasing complexity and expansion of healthcare services globally. One of the primary driving forces is the rising demand for efficient healthcare administration. As the healthcare industry continues to grow, the need for systematic documentation of patient care and medical procedures has become paramount. This requirement is not only crucial for maintaining accurate patient records but also essential for insurance claims processing, regulatory compliance, and data management. Consequently, the adoption of medical coding systems such as International Classification of Diseases (ICD) and Current Procedural Terminology (CPT) has become indispensable, driving market growth.

Implementing advanced medical coding systems and EHRs can be expensive, requiring significant initial investments and ongoing maintenance costs. Small and medium-sized healthcare facilities might struggle with these financial burdens. The medical coding system is complex and constantly evolving, with updates and changes to coding standards such as ICD-10, CPT, and HCPCS. Keeping up with these changes can be challenging for healthcare providers and coding professionals.

AI and ML can automate and enhance the accuracy of medical coding, reduce errors, and increase efficiency. These technologies can also help in predictive analytics and personalized medicine. NLP can improve the extraction of relevant information from unstructured data in clinical notes, aiding in more accurate and efficient coding. The expansion of telehealth services due to the COVID-19 pandemic has led to an increase in demand for accurate coding of virtual visits and remote patient monitoring. This trend is expected to continue, providing a significant opportunity for medical coders.

Parent Market of Global Medical Coding Market

The healthcare information technology (IT) market encompasses a wide range of technologies designed to manage, process, and exchange health information, ultimately improving the delivery of healthcare services. This market includes electronic health records (EHRs), practice management systems, clinical decision support systems (CDSS), telemedicine platforms, health information exchanges (HIE), and medical billing & coding software. The integration of these technologies into healthcare systems aims to enhance the quality of patient care, streamline operations, and ensure compliance with regulatory standards.

Healthcare IT solutions offer significant potential to improve efficiency, reduce administrative burdens, and minimize errors, which collectively contribute to cost savings. For instance, EHRs provide a comprehensive and real-time view of patient records, facilitating better diagnosis and treatment decisions. Similarly, practice management systems automate routine administrative tasks, allowing healthcare providers to focus more on patient care.

Market Segmentation

The medical coding market is segmented into classification system, component end user, and region. On the basis of classification system, the market is divided into international classification of diseases (ICD) and healthcare common procedure code system (HCPCS). On the basis of component, the market is classified into in-house and outsourced. On the basis of end user, the market is divided into hospitals, diagnostic centers, and other end users. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Many countries in Asia-Pacific are undergoing rapid digital transformation in their healthcare systems, leading to increased adoption of electronic health records (EHRs) and health information systems. This drives the demand for medical coding solutions to digitize and standardize healthcare data. Governments of various countries across the region are implementing healthcare reforms and regulations aimed at improving healthcare quality, accessibility, and efficiency. Compliance with these regulations, such as mandatory use of standardized coding systems, stimulates the growth of the medical coding market.

In March 2024, FinThrive, a leading provider of revenue cycle management solutions, announced its acquisition of Admit One Healthcare Solutions, a healthcare technology company based in Australia. This acquisition expands FinThrive's presence in Asia-Pacific and strengthens its capabilities in medical coding, revenue integrity, and healthcare analytics.

Competitive Landscape

The major players operating in the medical coding market include 3M, Aviacode Inc., Dolbey, Maxim Healthcare Services, MRA Health Information Services, Oracle, PAREXEL International Corporation, Startek, Verisk Analytics, Inc, Nuance Communications, Inc., and others.

Recent Key Strategies and Developments

- On February 29, 2024, KAID Health, a leader in clinical analytics and patient chart summarization, unveiled its latest innovation, the Patient Risk Identification & Data Extraction (PRIDE) application. Simultaneously, KAID Health announced the establishment of its new Coding Services Group. This technological advancement, along with the introduction of medical coding services, empowers healthcare providers to achieve higher levels of accuracy and comprehensiveness in coding practices while advancing patient care.

- In December 2023, the Professional Medical Billers Association, a prominent provider of professional development and certification initiatives, unveiled its newest offering: the Certified AI Medical Coder (CAIMC) program. This program is tailored to empower medical coders with the essential skills and knowledge required to excel in the continually evolving healthcare landscape, where the integration of AI technology is steadily on the rise.

Key Sources Referred

- Company Annual Reports

- Investor Presentations

- Press Release

- Research Paper

- D&B Hoovers

- ZoomInfo Technologies LLC

- National Institutes of Health (NIH) (.gov)

- WHO

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the medical coding market segments, current trends, estimations, and dynamics of the medical coding market analysis from 2023 to 2033 to identify the medical coding market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical coding market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global medical coding market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as medical coding market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Classification System |

|

| Segmentation by Component |

|

|

Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global Medical Coding Market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Medical Coding Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Medical Coding Market Analysis, by Classification System

5.1. Overview

5.2. International Classification of Diseases (ICD)

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Healthcare Common Procedure Code System (HCPCS)

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Medical Coding Market Analysis, by Component

6.1. Overview

6.2. In-house

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Outsourced Source

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Medical Coding Market Analysis, by End User

7.1. Overview

7.2. Hospitals

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Diagnostic Centers

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Others

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Medical Coding Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Classification System, 2023-2033

8.1.1.2. Market size analysis, by Component, 2023-2033

8.1.1.3. Market size analysis, by End User, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Classification System, 2023-2033

8.1.2.2. Market size analysis, by Component, 2023-2033

8.1.2.3. Market size analysis, by End User, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Classification System, 2023-2033

8.1.3.2. Market size analysis, by Component, 2023-2033

8.1.3.3. Market size analysis, by End User, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Classification System, 2023-2033

8.2.1.2. Market size analysis, by Component, 2023-2033

8.2.1.3. Market size analysis, by End User, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Classification System, 2023-2033

8.2.2.2. Market size analysis, by Component, 2023-2033

8.2.2.3. Market size analysis, by End User, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Classification System, 2023-2033

8.2.3.2. Market size analysis, by Component, 2023-2033

8.2.3.3. Market size analysis, by End User, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Classification System, 2023-2033

8.2.4.2. Market size analysis, by Component, 2023-2033

8.2.4.3. Market size analysis, by End User, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Classification System, 2023-2033

8.2.5.2. Market size analysis, by Component, 2023-2033

8.2.5.3. Market size analysis, by End User, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Classification System, 2023-2033

8.2.6.2. Market size analysis, by Component, 2023-2033

8.2.6.3. Market size analysis, by End User, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Classification System, 2023-2033

8.3.1.2. Market size analysis, by Component, 2023-2033

8.3.1.3. Market size analysis, by End User, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Classification System, 2023-2033

8.3.2.2. Market size analysis, by Component, 2023-2033

8.3.2.3. Market size analysis, by End User, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Classification System, 2023-2033

8.3.3.2. Market size analysis, by Component, 2023-2033

8.3.3.3. Market size analysis, by End User, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Classification System, 2023-2033

8.3.4.2. Market size analysis, by Component, 2023-2033

8.3.4.3. Market size analysis, by End User, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Classification System, 2023-2033

8.3.5.2. Market size analysis, by Component, 2023-2033

8.3.5.3. Market size analysis, by End User, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Classification System, 2023-2033

8.3.6.2. Market size analysis, by Component, 2023-2033

8.3.6.3. Market size analysis, by End User, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Classification System, 2023-2033

8.4.1.2. Market size analysis, by Component, 2023-2033

8.4.1.3. Market size analysis, by End User, 2023-2033

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Classification System, 2023-2033

8.4.2.2. Market size analysis, by Component, 2023-2033

8.4.2.3. Market size analysis, by End User, 2023-2033

8.4.3. UAE

8.4.3.1. Market size analysis, by Classification System, 2023-2033

8.4.3.2. Market size analysis, by Component, 2023-2033

8.4.3.3. Market size analysis, by End User, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Classification System, 2023-2033

8.4.4.2. Market size analysis, by Component, 2023-2033

8.4.4.3. Market size analysis, by End User, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Classification System, 2023-2033

8.4.5.2. Market size analysis, by Component, 2023-2033

8.4.5.3. Market size analysis, by End User, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2023

10. Company Profiles

10.1. 3M.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Aviacode Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Dolbey

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Maxim Healthcare Services.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. MRA Health Information Services

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Oracle

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Startek

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Verisk Analytics, Inc

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Nuance Communications, Inc.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. PAREXEL International Corporation

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com