Scleral Lens Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01394

Scleral Lens Market Size, Share, Competitive Landscape, and Trend Analysis Report by Type, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

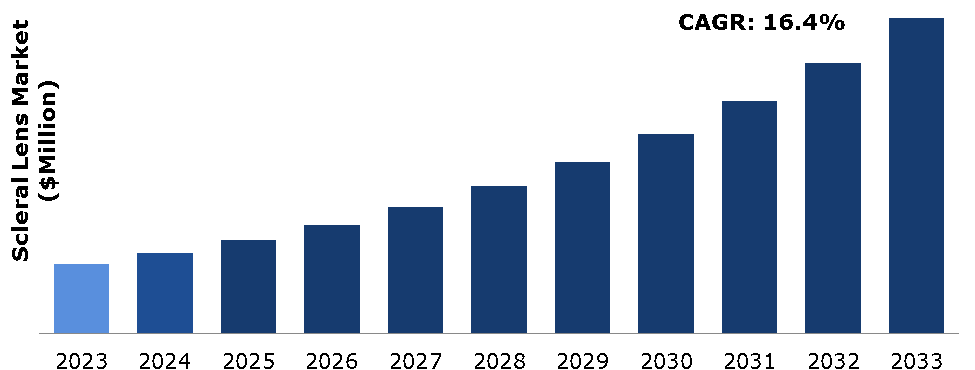

The scleral lens market was valued at $334.22 million in 2023 and is estimated to reach $1,519.47 million by 2033 exhibiting a CAGR of 16.4% from 2024 to 2033

Market Introduction and Definition

A scleral lens is a type of rigid gas permeable (RGP) contact lens that is larger in diameter compared to traditional contact lenses, designed to rest on the sclera, the white part of the eye. Unlike standard lenses that sit on the cornea, scleral lenses vault over the cornea, creating a tear-filled reservoir between the lens and the eye's surface. This unique design provides several benefits: it ensures a stable fit, enhances comfort, and offers improved vision correction, particularly for individuals with irregular corneas, severe dry eye, keratoconus, or other corneal abnormalities. The tear reservoir keeps the eye hydrated and protects the cornea from irritation and damage. Scleral lenses are customized to the wearer’s eye shape, providing a tailored fit that can improve visual acuity and comfort significantly for those who cannot achieve optimal results with conventional contact lenses.

Key Takeaways

- The scleral lens market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- According to a July 2023 article by Healio, scleral lenses are favored by providers for treating corneal irregularity. In a survey of 631 participants, 42% indicated that scleral lenses were their preferred choice.

- According to data from the Dry Eye Directory, approximately 16.4 million Americans, or about 6.8% of the population, experienced dry eye in 2020. Likewise, a study published by Cornea.org found that the prevalence of Keratoconus in the U.S. was 54.5 per 100,000 people.

- In February 2023, Visionary Optics introduced a scleral lens that simplifies the fitting process. This groundbreaking product allows healthcare professionals to customize zone parameters for each individual.

Key Market Dynamics

The rising incidence of eye conditions such as keratoconus, dry eye syndrome, and corneal irregularities is indeed a significant driver of the scleral lens market. According to government sources like the National Eye Institute (NEI) in the United States and similar agencies worldwide, the prevalence of these conditions has been steadily increasing in recent years. For instance, in the United States alone, the NEI reports that approximately 1 in 2,000 people are affected by keratoconus, a condition where the cornea thins and bulges into a cone shape, leading to distorted vision. Dry eye syndrome, characterized by a lack of sufficient moisture on the eye's surface, affects millions of people globally, with prevalence rates varying across different regions. Moreover, corneal irregularities resulting from conditions like trauma, surgeries, or diseases also contribute to the growing demand for specialized vision correction solutions.

Scleral lenses are custom designed to fit each individual's eye shape and size. This customization requires specialized equipment and expertise from eye care professionals, leading to higher costs compared to mass-produced traditional contact lenses. Scleral lenses are typically made from high-quality materials such as rigid gas permeable (RGP) or silicone hydrogel. These materials offer benefits such as durability, oxygen permeability, and comfort, but they also come at a higher price point compared to the materials used in conventional soft contact lenses. In regions where healthcare coverage does not fully cover the cost of scleral lenses, patients may have to bear a significant portion of the expenses out of pocket. This financial burden can deter some individuals from opting for scleral lenses, especially if they have more affordable alternatives available. These factors are anticipated to restrain the scleral lens market growth during the forecast period.

The advancements in materials and manufacturing techniques are leading to the development of more comfortable, breathable, and customizable scleral lenses. This allows for better fitting and improved vision correction, catering to a wider range of patients with various corneal conditions. Newer materials such as silicone hydrogel allow for greater oxygen permeability, enhancing comfort for the wearer. High oxygen permeability is crucial in reducing the risk of hypoxia-related complications. Computer Numerical Control (CNC) machining technology enables the production of scleral lenses with high precision. This allows for customization tailored to the unique contours of an individual's eye. The FDA has approved several new materials and manufacturing techniques for scleral lenses, emphasizing their safety and effectiveness in treating various corneal conditions. These factors are anticipated to create opportunities in the scleral lens market during the forecast years.

Public Policies in the Global Scleral Lens Market

Regulatory Approvals and Standards: Scleral lenses, like other medical devices, must comply with regulatory standards set by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These standards ensure that the lenses are safe for use and meet quality requirements. The FDA, for example, classifies contact lenses as Class II medical devices, which require premarket notification and adherence to specific manufacturing practices.

Healthcare Policies and Insurance Coverage: Public health policies and insurance coverage play a significant role in the accessibility of scleral lenses. In many regions, insurance plans and national health services cover the cost of scleral lenses for specific medical conditions, such as keratoconus, severe dry eye syndrome, and other corneal irregularities. This coverage can significantly influence patient access to these specialized lenses.

Market Segmentation

The scleral lens market is segmented into type, end user, and region. On the basis of type, the market is divided into mini-scleral lenses and large-scleral lenses. On the basis of end user, the market is divided into hospital, eye clinic, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America scleral lens market is poised for growth due to the increasing prevalence of eye diseases, advancements in technology, greater awareness, supportive government policies, and an aging population. According to the National Eye Institute (NEI), approximately 16 million Americans have dry eye disease, and around 1 in 2,000 Americans is affected by keratoconus. The prevalence of eye conditions such as keratoconus, severe dry eye, and other corneal irregularities is rising. According to the Centers for Disease Control and Prevention (CDC), millions of Americans suffer from these conditions, driving the demand for specialized contact lenses like scleral lenses. The CDC reports that about 7.2% of the U.S. population aged 40 and older has corneal conditions that could benefit from scleral lenses.

In October 2023, Alcon introduced TOTAL30 Multifocal lenses worldwide. These lenses feature Alcon's premium Water Gradient technology and are offered at a more affordable price than other monthly lenses. They are now available in the United States and select international markets.

Competitive Landscape

The major players operating in the scleral lens market include Bausch Health Companies Inc. (Canada), Essilor (France), ABB Optical Group (U.S.), Blanchard Lab (U.S.), Art Optical Contact Lens, Inc. (U.S.), Visionary Optics (U.S.), BostonSight (U.S.), TruForm Optics Inc. (U.S.), SynergEyes (U.S.), and AccuLens (U.S.).

Recent Key Strategies and Developments

- On November 16, 2021, BostonSight®, a nonprofit healthcare organization that advances the treatment of diseased or damaged corneas and dry eye, announced their new free form lens design feature, Smart360™, for the BostonSight SCLERAL product.

- On November 3, 2021, CooperVision Specialty EyeCare announced the launch of Optimized Pupil Optics (OPO) for its Onefit™ MED and Onefit™ MED+ scleral contact lenses to eye care providers (ECPs) in the United States and Canada. The new high precision design option—which is supported by a user-friendly online fitting tool—enables ECPs to reposition the multifocal optics to align with the visual axis, which is key to achieving superior results and subjective vision.

Key Sources Referred

- Centers for Disease Control and Prevention (CDC)

- National Institutes of Health (NIH)

- National Institute of Child Health and Human Development (NICHD)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the scleral lens market segments, current trends, estimations, and dynamics of the scleral lens market analysis from 2023 to 2033 to identify the prevailing scleral lens market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the scleral lens market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global scleral lens market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global point of care testing trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Scleral Lens Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Scleral Lens Market Analysis, by Type

5.1. Overview

5.2. Mini-Scleral Lenses

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Large-Scleral Lenses

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Scleral Lens Market Analysis, by End User

6.1. Overview

6.2. Hospitals

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Eye Clinic

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Others

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Scleral Lens Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by End User, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by End User, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by End User, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by End User, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by End User, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by End User, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by End User, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by End User, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by End User, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by End User, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by End User, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by End User, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by End User, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by End User, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by End User, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by End User, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by End User, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by End User, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by End User, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by End User, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Bausch Health Companies Inc.

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Essilor

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. ABB Optical Group

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Blanchard Lab

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Art Optical Contact Lens, Inc.

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Visionary Optics

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. BostonSight

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. TruForm Optics Inc.

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. SynergEyes

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. AccuLens

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com