Health Insurance Exchange Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01383

Health Insurance Exchange Market Size, Share, Competitive Landscape and Trend Analysis Report by Type of Insurance, Distribution Channel, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

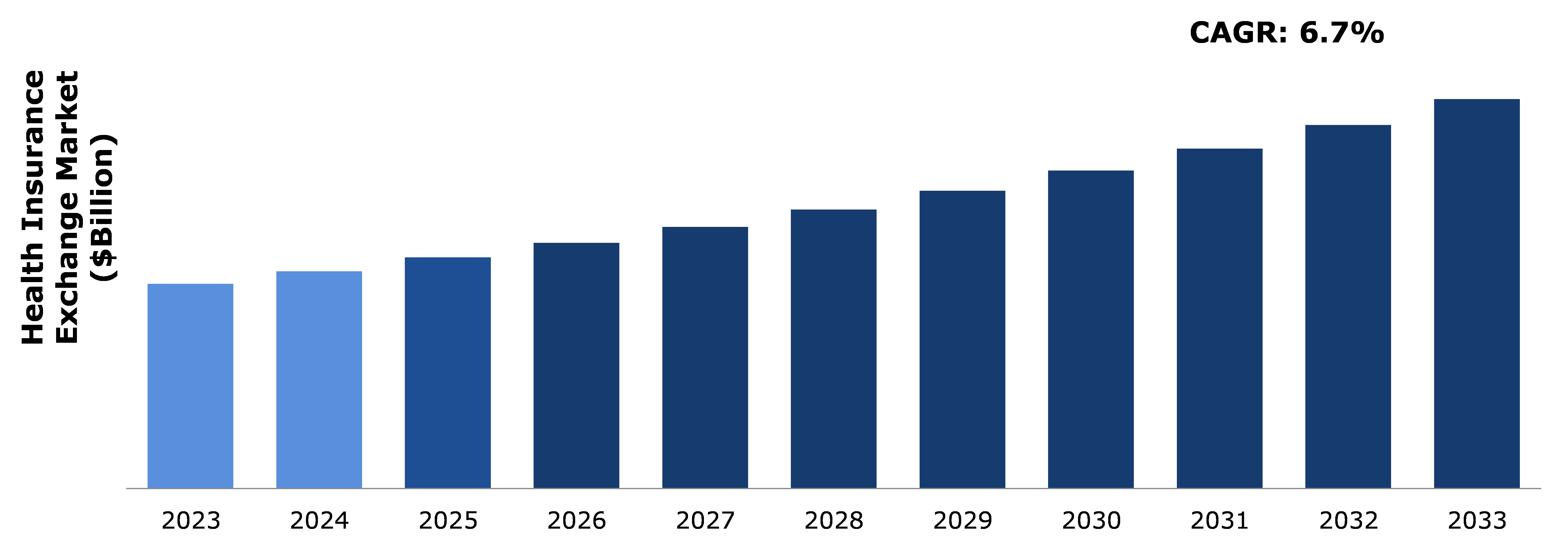

The health insurance exchange market was valued at $2,528.0 billion in 2023 and is estimated to reach $4,808.4 billion by 2033, exhibiting a CAGR of 6.7% from 2024 to 2033.

Market Introduction

A health insurance marketplace, also known as an exchange, functions as a centralized platform established under the Affordable Care Act (ACA) to facilitate the purchase of health insurance plans. Operated by either state or federal entities, these marketplaces provide individuals, families, and small businesses with essential services such as plan comparison, enrollment, and information regarding available subsidies.

Designed to enhance accessibility and affordability, health insurance exchange offers a range of insurance options tailored to varying needs and budgets. Through this system, individuals and families lacking employer-sponsored coverage can explore and select suitable plans, while small businesses can provide insurance options for their employees via the Small Business Health Options Program (SHOP). The health insurance exchange serves as a crucial component of the ACA, aiming to extend insurance coverage to the uninsured and promote competition among insurers to offer diverse plans based on cost and coverage levels.

Key Takeaways

- The health insurance exchange market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major health insurance exchange industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- The number of enrollments for health insurance exchanges are increasing in the U.S. For instance, Ohio witnessed a surge in affordable care act (ACA) marketplace enrollment, with a record 477,793 residents signing up as of February 2024, for various health insurance exchange plans. This increase reflects a national trend, with 21.3 million Americans selecting health insurance exchange plans. The ACA, enacted in 2010, aims to make healthcare more affordable, with subsidies and Medicaid expansion. Medicaid is a government-sponsored insurance program for individuals and families whose income is insufficient to cover health-related services.

- In January 2024, a record-breaking 3.5 million Texans enrolled in health insurance plans through the ACA marketplace for 2024, part of a nationwide surge totaling 21 million enrollees. Despite progress, Texas retains the highest uninsured rate in the U.S., prompting calls for Medicaid expansion.

- In January 2024, Alabama experienced a significant increase in ACA enrollment, with over 386,000 residents selecting health insurance plans through the federally-run health insurance exchange. This marked a nearly 50% rise from the previous year, driven by enhanced subsidies introduced under the American Rescue Plan Act of 2021. These subsidies made ACA plans more affordable, leading to broader accessibility and increased enrollment in various insurance plans.

Key Market Dynamics

The health insurance exchange, established under the Affordable Care Act (ACA), serves as a pivotal platform for individuals seeking accessible and comprehensive health insurance options. Health insurance exchanges enable individuals to compare and select policies tailored to their specific needs, whether it is comprehensive hospitalization coverage, pre- and post-hospitalization expenses, or additional benefits like alternative treatments and health check-ups, thereby making the insurance process efficient and transparent. Moreover, the availability of tax benefits, no claim bonuses, and the flexibility to choose coverage across various life stages make health insurance exchanges popular.

One significant restraint for health insurance exchanges is the lack of flexibility and control compared to traditional group health insurance. In addition, the inability to tailor plans to individual needs may necessitate supplemental insurance to fill gaps in coverage, thereby affecting the growth of health insurance exchange market.

The integration of telehealth services into health insurance exchange provides numerous opportunities for the market players. For instance, telehealth services integrated into exchanges offer convenient access to medical consultations, reducing costs and enhancing accessibility. Blockchain technology can streamline administrative tasks and enhance data security, ensuring efficient claim processing. Moreover, leveraging AI and data analytics tools can enable exchanges to personalize insurance products, identify emerging health risks, and improve overall customer service through efficient chatbot services.

Health Insurance Exchange Market Ecosystem Analysis

Health insurance exchanges in the U.S., mandated by the Affordable Care Act (ACA), serve as vital platforms for individuals, families, and small businesses to access and purchase private health insurance plans. These exchanges come in two main types: individual exchanges and small business health options program (SHOP) exchanges. Individual exchanges cater to eligible consumers seeking nongroup insurance coverage, offering options for premium tax credits and cost-sharing reductions. On the other hand, SHOP exchanges provide opportunities for small businesses to compare and purchase small-group insurance plans, with employees also enrolling in these plans.

Exchange administration varies based on whether they are state-based or federally facilitated. States have the option to establish their own exchanges, with variations like state-based exchanges using a federal platform (SBE-FP).

| Location | Number of Individuals Who Selected a Marketplace Plan, 2024 |

| United States | 21,446,150 |

| Alabama | 386,195 |

| Alaska | 27,464 |

| Arizona | 348,055 |

| Arkansas | 156,607 |

| California | 1,784,653 |

| Colorado | 237,106 |

| Connecticut | 129,000 |

| Delaware | 44,842 |

| District of Columbia | 14,799 |

| Florida | 4,211,902 |

| Georgia | 1,305,114 |

| Hawaii | 22,170 |

| Idaho | 103,783 |

| Illinois | 398,814 |

| Indiana | 295,772 |

| Iowa | 111,423 |

| Kansas | 171,376 |

| Kentucky | 75,317 |

| Louisiana | 212,493 |

| Maine | 62,586 |

| Maryland | 213,895 |

| Massachusetts | 311,199 |

| Michigan | 418,100 |

| Minnesota | 135,001 |

| Mississippi | 286,410 |

| Missouri | 359,369 |

| Montana | 66,336 |

| Nebraska | 117,882 |

| Nevada | 99,312 |

| New Hampshire | 65,117 |

| New Jersey | 397,942 |

| New Mexico | 56,472 |

| New York | 288,681 |

| North Carolina | 1,027,930 |

| North Dakota | 38,535 |

| Ohio | 477,793 |

| Oklahoma | 277,436 |

| Oregon | 145,509 |

| Pennsylvania | 434,571 |

| Rhode Island | 36,121 |

| South Carolina | 571,175 |

| South Dakota | 52,974 |

| Tennessee | 555,103 |

| Texas | 3,484,632 |

| Utah | 366,939 |

| Vermont | 30,027 |

| Virginia | 400,058 |

| Washington | 272,494 |

| West Virginia | 51,046 |

| Wisconsin | 266,327 |

| Wyoming | 42,293 |

Market Segmentation

The health insurance exchange market is segmented into type of insurance, distribution channel, end user, and region. On the basis of type of insurance, the market is divided into individual health insurance, family health insurance, and group health insurance. On the basis of distribution channel, the market is classified into online and offline. On the basis of end user, the market is divided into children, adults, and senior citizens. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In India, the landscape of health insurance is undergoing significant growth and transformation, driven by rising awareness regarding the importance of healthcare coverage and increasing burden of medical expenses. Despite the decentralized approach to health insurance penetration across the country, health insurance exchanges play a crucial role in facilitating access to coverage for millions of individuals and families.

As per the statistics, approximately 514 million people were covered under health insurance schemes in 2021, representing only 37% of the population. Moreover, nearly 400 million individuals still lack access to health insurance, highlighting the significant gap in coverage.

The Maharashtra state leads in health insurance premiums, capturing a principal share of over $2.1 billion (INR 183 billion). This disparity in coverage and premium distribution highlights the need for more inclusive and equitable access to health insurance, particularly in underserved regions and among vulnerable populations.

Despite the challenges, employer-sponsored health insurance has witnessed significant growth in 2022. This trend reflects a positive trajectory in extending coverage to a large number of workers, enhancing their safety and security during medical emergencies. However, with lifestyle diseases on the rise and healthcare costs increasing, there is a pressing need for better health insurance coverage across the country.

Competitive Landscape

The major players operating in the health insurance exchange market include Prudential Financial, Allianz, AXA, Ping An Insurance, AIA Group, Aviva, MetLife, China Life Insurance Company, Zurich Insurance Group, and others.

Recent Key Strategies and Developments

- In March 2024, Insurance Regulatory and Development Authority of India (IRDAI), an autonomous and statutory body under the jurisdiction of Ministry of Finance (MoF), granted Galaxy Health and Allied Insurance Company Limited approval to commence health insurance operations in India, marking its sixth registration in the past year across life, non-life, and health insurance segments.

- In January 2024, Trinity Health, Anthem Blue Cross and Blue Shield have announced a new multi-year provider network agreement aimed at ensuring continued access to affordable healthcare for Trinity Health patients covered by Anthem. The agreement emphasizes enhanced data connectivity through the epic payer platform to streamline patient data exchange, improve operational efficiency, and support value-based care models.

Key Sources Referred

- Healthcare.gov

- Oregon Health Plan (OHP)

- Affordable Care Act (ACA)

- KFF

- USAGov

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the health insurance exchange market segments, current trends, estimations, and dynamics of the health insurance exchange market analysis from 2023 to 2033 to identify the prevailing health insurance exchange market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the health insurance exchange market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global health insurance exchange market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global health insurance exchange market trends, key players, market segments, application areas, and market growth strategies.

In addition to providing a detailed analysis of key players in the global market, the report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type of Insurance |

|

| Segmentation by Distribution Channel |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market Definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on the Health Insurance Exchange Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Health Insurance Exchange Market Analysis, by Type of Insurance

5.1. Overview

5.2. Individual Health Insurance

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Family Health Insurance

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Group Health Insurance

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Health Insurance Exchange Market Analysis, by Distribution Channel

6.1. Overview

6.2. Online

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Offline

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Health Insurance Exchange Market Analysis, by End User

7.1. Overview

7.2. Children

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Adults

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Senior Citizens

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Health Insurance Exchange Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type of Insurance, 2023-2033

8.1.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.1.3. Market size analysis, by End User, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Type of Insurance, 2023-2033

8.1.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.2.3. Market size analysis, by End User, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type of Insurance, 2023-2033

8.1.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.1.3.3. Market size analysis, by End User, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.1.3. Market size analysis, by End User, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.2.3. Market size analysis, by End User, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.3.3. Market size analysis, by End User, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.4.3. Market size analysis, by End User, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.5.3. Market size analysis, by End User, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type of Insurance, 2023-2033

8.2.6.2. Market size analysis, by Distribution Channel, 2023-2033

8.2.6.3. Market size analysis, by End User, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.1.3. Market size analysis, by End User, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.2.3. Market size analysis, by End User, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.3.3. Market size analysis, by End User, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.4.3. Market size analysis, by End User, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.5.3. Market size analysis, by End User, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Type of Insurance, 2023-2033

8.3.6.2. Market size analysis, by Distribution Channel, 2023-2033

8.3.6.3. Market size analysis, by End User, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type of Insurance, 2023-2033

8.4.1.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.1.3. Market size analysis, by End User, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Type of Insurance, 2023-2033

8.4.2.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.2.3. Market size analysis, by End User, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Type of Insurance, 2023-2033

8.4.3.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.3.3. Market size analysis, by End User, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type of Insurance, 2023-2033

8.4.4.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.4.3. Market size analysis, by End User, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type of Insurance, 2023-2033

8.4.5.2. Market size analysis, by Distribution Channel, 2023-2033

8.4.5.3. Market size analysis, by End User, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2023

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2023

10. Company Profiles

10.1. Prudential Financial

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Allianz

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. AXA

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Ping An Insurance

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. AIA Group

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Aviva

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. MetLife

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. China Life Insurance Company

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Zurich Insurance Group

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

Research Methodology

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com