Medication Management Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01381

Medication Management Market Size, Share, Competitive Landscape, and Trend Analysis Report by Software, Services, Mode of Delivery, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

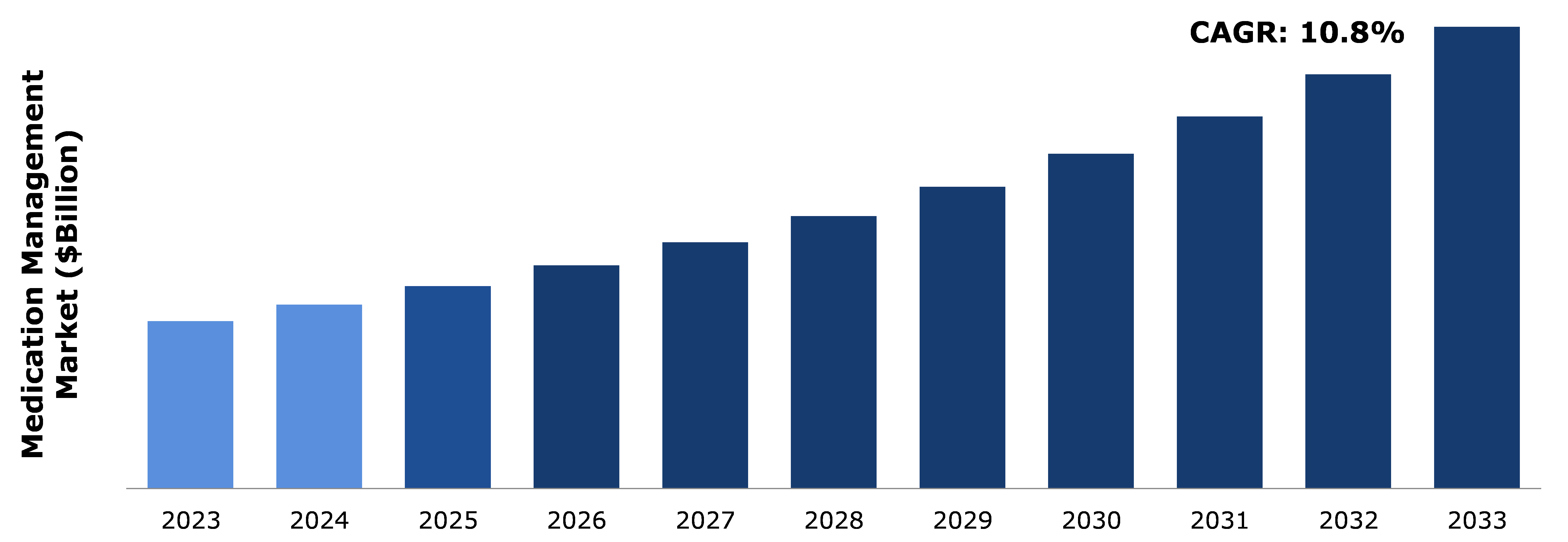

The medication management market was valued at $3.1 billion in 2023 and is estimated to reach $8.6 billion by 2033, exhibiting a CAGR of 10.8% from 2024 to 2033.

Market Introduction

Medication management is a multifaceted approach to optimizing the safe and effective use of medications among patients, particularly those with mental health issues. It encompasses various strategies aimed at ensuring patients receive the right medications, in correct doses, at appropriate times, and with adequate monitoring to achieve desired therapeutic outcomes. For instance, medication management in mental health care entails a continuum of care, starting from the initial evaluation of the patient's medication needs and extending to ongoing monitoring and adjustment of treatment regimens. This process involves collaboration between healthcare providers, patients, and caregivers to ensure the safe and effective use of psychotropic medications.

Medications play a pivotal role in treating mental health disorders, offering the potential to alleviate symptoms and enhance patients' quality of life. However, the efficacy of psychiatric medications can vary significantly among individuals due to factors such as medical history, genetic predispositions, and adherence to treatment regimens. To address these complexities, mental health professionals employ medication management strategies to tailor treatment plans to each patient's unique needs and circumstances.

Key Takeaways

- The medication management market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major medication management industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In May 2024, Omnicell revolutionized point-of-care medication management in the Middle East with the launch of MedXpert and AMiS-Pro Smart Cart. MedXpert offers real-time data traceability, enhancing clinical practices, operational workflows, and financial performance. With over 120 reports and click-and-collect functionality, it optimizes healthcare institutions' workflows and nursing tasks. The AMiS-Pro Smart Cart ensures safer medication administration with individual patient bins and streamlined medication ordering.

- In May 2024, VirtualHealth partnered with MDI Health Technologies to integrate AI-powered medication management solutions into its HELIOS platform. This collaboration aims to improve medication treatment, reduce costs, and enhance clinical outcomes for payors and value-based care providers. MDI's HIPAA-compliant solution offers comprehensive analysis and AI automation to identify at-risk populations and drive personalized clinical interventions.

Key Market Dynamics

Medication management is driven by a myriad of factors aimed at ensuring optimal health outcomes and patient well-being. With a significant portion of the global population relying on multiple medications, the need for effective management strategies is paramount.

One key driver is the growing recognition of the complexities associated with medication usage, including potential drug interactions, dosage adjustments, and adherence challenges. As evidenced by the Centers for Disease Control and Prevention (CDC) report indicating that 24% of individuals worldwide take three or more prescription drugs monthly, the complexity of medication regimens underscores the necessity for robust management practices. Furthermore, the increasing emphasis on patient engagement and collaborative healthcare approaches fuels the demand for medication management.

Despite the growing need for effective medication management among older adults facing multiple chronic conditions, numerous restraints hinder optimal outcomes. The lack of standardized evaluations in clinical settings and the limited efficacy of existing assessment tools pose significant barriers to accurately gauging medication management capacity. Moreover, the complexity of medication regimens and the absence of comprehensive approaches to address diverse barriers further impede efforts to enhance medication management among older populations.

Medication management presents an opportunity to promote interdisciplinary collaboration within healthcare teams. By involving pharmacists, nurses, physicians, and other healthcare professionals in medication management processes, healthcare organizations can leverage the expertise of each team member to optimize medication regimens and improve patient outcomes. Additionally, there is an opportunity to integrate medication management into broader initiatives aimed at improving healthcare quality and patient safety. By prioritizing medication reconciliation, regular medication reviews, and patient education, healthcare organizations can enhance patient safety, reduce the risk of adverse drug events, and improve overall healthcare quality.

Global Medication Management Market Ecosystem Analysis

Medication management is a crucial aspect of healthcare, especially for individuals taking multiple medications daily. Research indicates that nearly 25% of people in the U.S. take three or more medications a day, with over 10% taking five or more. However, almost 50% of individuals struggle to adhere to their medication regimens as prescribed, highlighting the need for effective tools to aid in medication management.

One popular solution is medication reminder apps, which leverage smartphone technology to provide customizable reminders for medication intake. These apps allow users to input their medications, dosage, and schedule, receiving timely reminders for each dose. Additionally, some apps offer features such as medication interaction warnings, refill alerts, and tracking of health data.

Here's a summary of some popular medication reminder apps:

| Medication Reminder App | Platform | Features |

| Medisafe | iOS, Android | Medication input, refill alerts, medication interaction warnings |

| Dosecast | iOS, Android | Basic reminder features, premium features include data syncing and refill alerts |

| Mango Health | iOS, Android | Medication reminders, healthy habit reminders, medication interaction warnings |

| EveryDose | iOS, Android | Customizable reminders, virtual assistant for medication-related questions |

| MyTherapy Pill Reminder | iOS, Android | Customizable reminders, health tracking features |

Market Segmentation

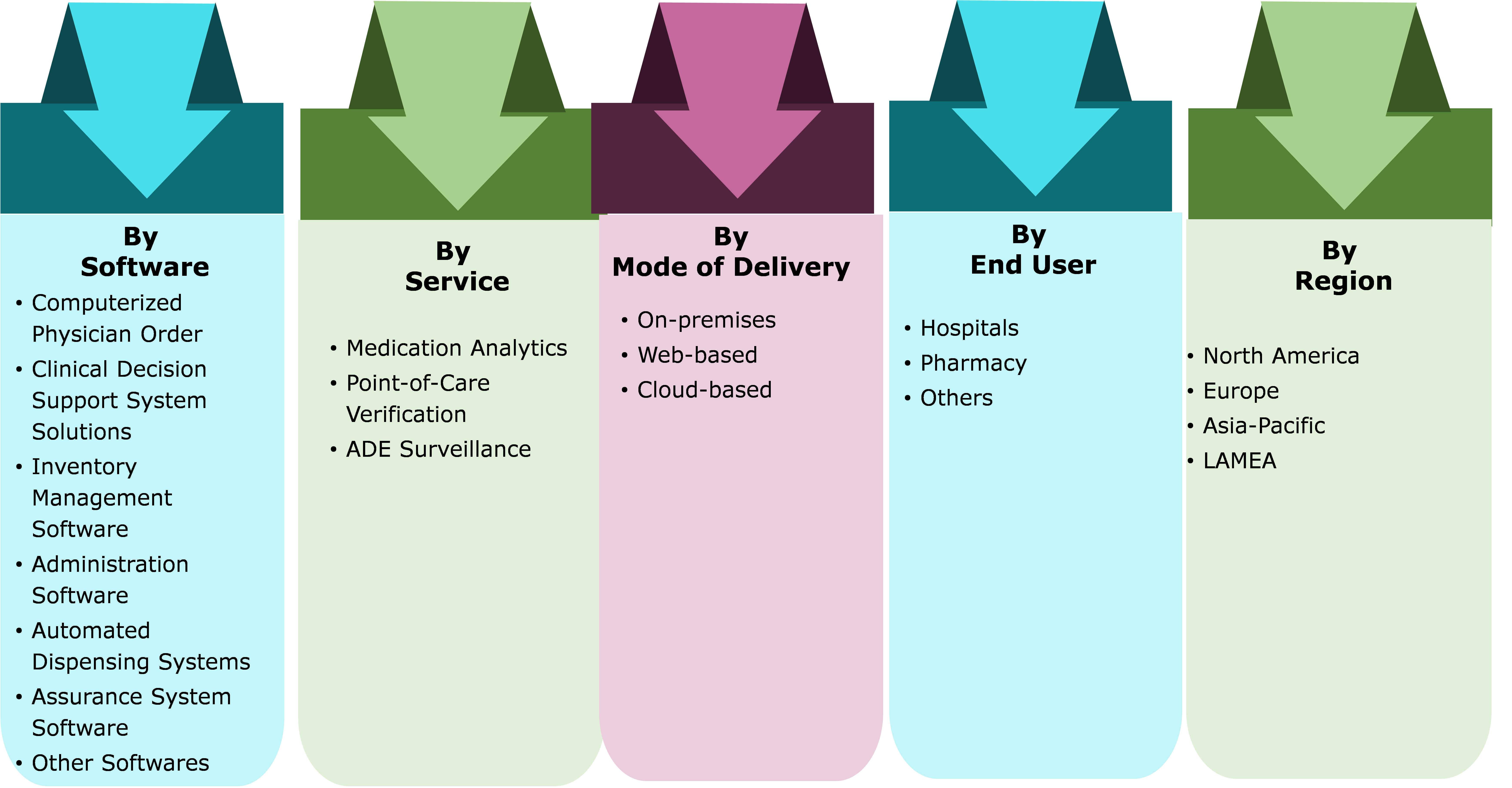

The medication management market is segmented into software, service, mode of delivery, end user, and region. On the basis of software, the market is divided into computerized physician order, clinical decision support system solutions, inventory management software, administration software, automated dispensing systems, assurance system software, and other software. On the basis of service, the market is divided into medication analytics, point-of-care verification, and ADE surveillance. On the basis of mode of delivery, the market is divided into on-premises, web-based, and cloud-based. On the basis of end user, the market is divided into hospitals, pharmacy, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

The pharmaceutical industry in India has experienced a remarkable surge, with the country establishing itself as a global leader in healthcare solutions. With a projected growth from $40 billion in 2021 to an expected $130 billion in 2030, and ambitious projections reaching $450 billion by 2047, India's pharmaceutical sector is poised for significant expansion.

India's prominence in the global pharmaceutical supply chain, addressing over 60% of the worldwide demand for vaccines and meeting 40% of the generic demand in the US, underscores its pivotal role in healthcare delivery.

The adoption of advanced technologies like machine learning and artificial intelligence, alongside investments in automation and digitization, is transforming pharmaceutical supply chains, making them more agile, transparent, and resilient.

The growth and transformation of India's pharmaceutical industry are expected to drive demand for medication management solutions. As the industry expands and becomes more complex, the need for efficient medication management becomes increasingly crucial. Medication management solutions can help streamline processes, ensure compliance with regulatory standards, and enhance supply chain visibility.

By leveraging technology-enabled solutions like track-and-trace systems and blockchain, the pharmaceutical industry can mitigate the risk of counterfeit products and optimize medication management practices.

Overall, India's pharmaceutical industry presents significant opportunities for growth and innovation in medication management.

Competitive Landscape

The major players operating in the medication management market include CareFusion, Allscripts, Cerner Corporation, Talyst, LLC., McKesson Corporation, Becton, GE Healthcare, QuadraMed Affinity Corporation, Omnicell, Inc., and others.

Recent Key Strategies and Developments

- In February 2024, a new RFID-based system technology described in the MedCity News, the leading news platform, has pioneered patient's safety. The medication management technology is being widely used by companies namely Omnicell, BD, McKesson, and others. Revolutionizing medication management, the innovative RFID-based system aims to enhance patient safety by providing seamless tracking and monitoring of medications throughout healthcare systems. With the potential to reduce errors and improve efficiency, these systems offer real-time insights into medication lifecycles, ensuring patients receive accurate and safe treatment.

- In February 2024, Emory Healthcare leveraged artificial intelligence to enhance medication management, ensuring patient safety and improving efficiency. With advanced technology, medication history data is seamlessly integrated into the Epic EHR, reducing manual entry and potential errors. AI interprets prescription instructions, standardizes terminology, and provides cost transparency, empowering clinicians to make informed decisions.

Key Sources Referred

- National Institutes of Health (NIH)

- World Health Organization (WHO)

- National Library of Medicine

- WebMD LLC.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the medication management market segments, current trends, estimations, and dynamics of the medication management market analysis from 2023 to 2033 to identify the prevailing medication management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medication management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global medication management market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medication management market trends, key players, market segments, application areas, and market growth strategies.

In addition to providing a detailed analysis of key players in the global market, the report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Software |

|

| Segmentation by Service |

|

| Segmentation by Mode of Delivery |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market Definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on the Medication Management Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Medication Management Market Analysis, by Software

5.1. Overview

5.2. Computerized Physician Order

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Clinical Decision Support System Solutions

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Inventory Management Software

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Administration Software

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Automated Dispensing Systems

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2023-2033

5.6.3. Market share analysis, by country, 2023-2033

5.7. Assurance System Software

5.7.1. Definition, key trends, growth factors, and opportunities

5.7.2. Market size analysis, by region, 2023-2033

5.7.3. Market share analysis, by country, 2023-2033

5.8. Other Software

5.8.1. Definition, key trends, growth factors, and opportunities

5.8.2. Market size analysis, by region, 2023-2033

5.8.3. Market share analysis, by country, 2023-2033

5.9. Research Dive Exclusive Insights

5.9.1. Market attractiveness

5.9.2. Competition heatmap

6. Medication Management Market Analysis, by Service

6.1. Overview

6.2. Medication Analytics

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Point-Of-Care Verification

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. ADE Surveillance

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2023-2033

6.4.3. Market share analysis, by country, 2023-2033

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Medication Management Market Analysis, by Mode of Delivery

7.1. Overview

7.2. On-premises

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Web-based

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Cloud-based

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Medication Management Market Analysis, by End User

8.1. Overview

8.2. Hospitals

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2023-2033

8.2.3. Market share analysis, by country, 2023-2033

8.3. Pharmacy

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2023-2033

8.3.3. Market share analysis, by country, 2023-2033

8.4. Others

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2023-2033

8.4.3. Market share analysis, by country, 2023-2033

8.5. Research Dive Exclusive Insights

8.5.1. Market attractiveness

8.5.2. Competition heatmap

9. Medication Management Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Software, 2023-2033

9.1.1.2. Market size analysis, by Service, 2023-2033

9.1.1.3. Market size analysis, by Mode of Delivery, 2023-2033

9.1.1.4. Market size analysis, by End User, 2023-2033

9.1.2. Canada

9.1.2.1. Market size analysis, by Software, 2023-2033

9.1.2.2. Market size analysis, by Service, 2023-2033

9.1.2.3. Market size analysis, by Mode of Delivery, 2023-2033

9.1.2.4. Market size analysis, by End User, 2023-2033

9.1.3. Mexico

9.1.3.1. Market size analysis, by Software, 2023-2033

9.1.3.2. Market size analysis, by Service, 2023-2033

9.1.3.3. Market size analysis, by Mode of Delivery, 2023-2033

9.1.3.4. Market size analysis, by End User, 2023-2033

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Software, 2023-2033

9.2.1.2. Market size analysis, by Service, 2023-2033

9.2.1.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.1.4. Market size analysis, by End User, 2023-2033

9.2.2. UK

9.2.2.1. Market size analysis, by Software, 2023-2033

9.2.2.2. Market size analysis, by Service, 2023-2033

9.2.2.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.2.4. Market size analysis, by End User, 2023-2033

9.2.3. France

9.2.3.1. Market size analysis, by Software, 2023-2033

9.2.3.2. Market size analysis, by Service, 2023-2033

9.2.3.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.3.4. Market size analysis, by End User, 2023-2033

9.2.4. Spain

9.2.4.1. Market size analysis, by Software, 2023-2033

9.2.4.2. Market size analysis, by Service, 2023-2033

9.2.4.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.4.4. Market size analysis, by End User, 2023-2033

9.2.5. Italy

9.2.5.1. Market size analysis, by Software, 2023-2033

9.2.5.2. Market size analysis, by Service, 2023-2033

9.2.5.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.5.4. Market size analysis, by End User, 2023-2033

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Software, 2023-2033

9.2.6.2. Market size analysis, by Service, 2023-2033

9.2.6.3. Market size analysis, by Mode of Delivery, 2023-2033

9.2.6.4. Market size analysis, by End User, 2023-2033

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia-Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Software, 2023-2033

9.3.1.2. Market size analysis, by Service, 2023-2033

9.3.1.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.1.4. Market size analysis, by End User, 2023-2033

9.3.2. Japan

9.3.2.1. Market size analysis, by Software, 2023-2033

9.3.2.2. Market size analysis, by Service, 2023-2033

9.3.2.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.2.4. Market size analysis, by End User, 2023-2033

9.3.3. India

9.3.3.1. Market size analysis, by Software, 2023-2033

9.3.3.2. Market size analysis, by Service, 2023-2033

9.3.3.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.3.4. Market size analysis, by End User, 2023-2033

9.3.4. Australia

9.3.4.1. Market size analysis, by Software, 2023-2033

9.3.4.2. Market size analysis, by Service, 2023-2033

9.3.4.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.4.4. Market size analysis, by End User, 2023-2033

9.3.5. South Korea

9.3.5.1. Market size analysis, by Software, 2023-2033

9.3.5.2. Market size analysis, by Service, 2023-2033

9.3.5.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.5.4. Market size analysis, by End User, 2023-2033

9.3.6. Rest of Asia-Pacific

9.3.6.1. Market size analysis, by Software, 2023-2033

9.3.6.2. Market size analysis, by Service, 2023-2033

9.3.6.3. Market size analysis, by Mode of Delivery, 2023-2033

9.3.6.4. Market size analysis, by End User, 2023-2033

9.3.7. Research Dive Exclusive Insights

9.3.7.1. Market attractiveness

9.3.7.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Software, 2023-2033

9.4.1.2. Market size analysis, by Service, 2023-2033

9.4.1.3. Market size analysis, by Mode of Delivery, 2023-2033

9.4.1.4. Market size analysis, by End User, 2023-2033

9.4.2. UAE

9.4.2.1. Market size analysis, by Software, 2023-2033

9.4.2.2. Market size analysis, by Service, 2023-2033

9.4.2.3. Market size analysis, by Mode of Delivery, 2023-2033

9.4.2.4. Market size analysis, by End User, 2023-2033

9.4.3. Saudi Arabia

9.4.3.1. Market size analysis, by Software, 2023-2033

9.4.3.2. Market size analysis, by Service, 2023-2033

9.4.3.3. Market size analysis, by Mode of Delivery, 2023-2033

9.4.3.4. Market size analysis, by End User, 2023-2033

9.4.4. South Africa

9.4.4.1. Market size analysis, by Software, 2023-2033

9.4.4.2. Market size analysis, by Service, 2023-2033

9.4.4.3. Market size analysis, by Mode of Delivery, 2023-2033

9.4.4.4. Market size analysis, by End User, 2023-2033

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Software, 2023-2033

9.4.5.2. Market size analysis, by Service, 2023-2033

9.4.5.3. Market size analysis, by Mode of Delivery, 2023-2033

9.4.5.4. Market size analysis, by End User, 2023-2033

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2023

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2023

11. Company Profiles

11.1. CareFusion

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Allscripts

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Cerner Corporation

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Talyst, LLC.

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. McKesson Corporation

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Becton

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. GE Healthcare

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. QuadraMed Affinity Corporation

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. Omnicell, Inc.

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com