Oral Care Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01208

Oral Care Market Size, Share, Competitive Landscape, and Trend Analysis Report by Product Type, Distribution Channel, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

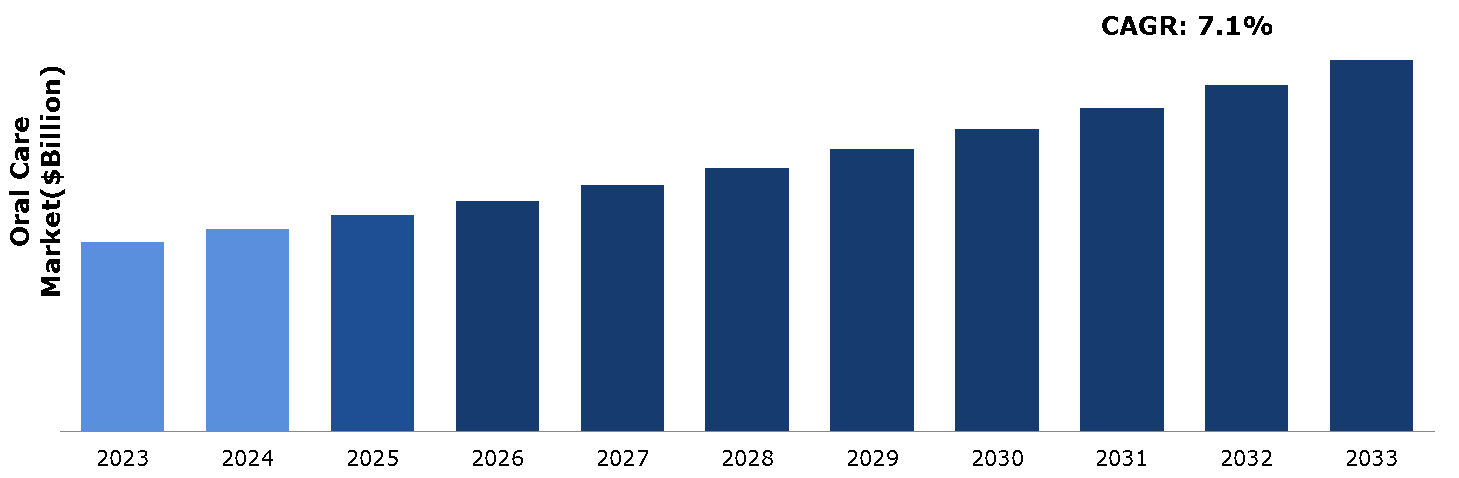

The oral care market was valued at $36.72 billion in 2023 and is estimated to reach $72.53 billion by 2033, exhibiting a CAGR of 7.1% from 2024 to 2033.

Overview of Oral care

Oral care encompasses daily practices and specialized products to maintain oral hygiene and prevent dental complications. Key products include toothbrushes, toothpaste, dental floss, mouthwash, and interdental brushes. Effective oral care prevents common issues such as cavities, gum disease, and bad breath. Complications from neglecting oral hygiene include tooth decay, periodontal disease, and oral infections, which can lead to more severe health problems like cardiovascular disease and diabetes. Regular brushing, flossing, and professional dental check-ups are crucial for maintaining oral health. The benefits of proper oral care extend beyond a healthy mouth, contributing to overall well-being, and reduced healthcare costs by preventing severe dental issues. Consistent and comprehensive oral hygiene practices ensure a healthy, pain-free mouth and enhance overall health quality.

Key Takeaways

- The oral care treatment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major oral care treatment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In November 2023, Lion Corporation launched nationwide sales of Dent Health Medicated Toothpaste DX, featuring a high-adhesion formula designed to prevent periodontitis and cavities, thereby protecting weakened gums and teeth. The toothpaste contains isopropyl methylphenol (IPMP) and lauroyl sarcosine sodium salt (LSS) to effectively eliminate bacteria that cause gingivitis and bad breath. It also includes tranexamic acid (TXA) to control gum swelling and bleeding, and vitamin E (tocopherol acetate) to invigorate gums by promoting blood circulation. In addition, fluoride strengthens enamel to prevent cavities. This comprehensive formula targets the main factors contributing to tooth loss.

Key Market Dynamics

The rising prevalence of dental caries is significantly driving the growth of the oral care market. According to a March 2023 WHO publication, approximately 2 billion people worldwide are affected by caries in their permanent teeth, while 514 million children suffer from caries in their primary teeth. This rising rate of dental decay highlights the urgent need for effective oral care solutions, driving advancements, and investments in the industry to address this widespread health issue. As the global population continues to suffer from dental caries, the demand for comprehensive oral hygiene products is expected to increase.

Moreover, limited access to dental services in rural and low-income communities significantly hampers the growth of the oral care market. These regions often lack adequate dental professionals and facilities, impeding residents from receiving proper oral care. For instance, rural areas in many developing countries face severe shortages of dentists, leading to untreated dental issues and a reliance on ineffective home remedies.

Innovations in oral care technology, like electric toothbrushes, water flossers, and smart dental devices, are attracting tech-savvy consumers seeking efficient oral hygiene solutions. This trend is poised to significantly boost the expansion of the oral care market in the upcoming years. With a focus on effectiveness and convenience, these advanced products cater to modern lifestyles, offering enhanced cleaning capabilities and personalized care. As technology continues to advance, the combination of oral health and innovation promises a favorable landscape, where consumers are increasingly empowered to prioritize and maintain their dental well-being with ease.

Public Policy Analysis

Since its inaugural oral health policy in 2003, the American Academy of Pediatrics (AAP) has continued to address oral health matters through subsequent policies. By 2023, the AAP's professionals have developed a total of eight policies, demonstrating a sustained commitment toward promoting oral health among children and adolescents, they are given below:

- 2023 - Maintaining and Improving the Oral Health of Young Children

- 2021 - Early Childhood Caries in Indigenous Communities

- 2021 - Management of Dental Trauma in a Primary Care Setting (reaffirmed in 2021)

- 2020 - Fluoride Use in Caries Prevention in the Primary Care Setting

- 2019 (w/AAPD) - Guidelines for Monitoring and Management of Pediatric Patients Before, During, and After Sedation for Diagnostic and Therapeutic Procedures

- 2017 - Oral and Dental Aspects of Child Abuse and Neglect

- 2017 - The Primary Care Pediatrician and the Care of Children with Cleft Lip and/or Cleft Palate

- 2013 - Oral Health Care for Children with Developmental Disabilities

Maintaining and improving the oral health of young children 2023 policy talks about early childhood dental caries, one of the prevalent chronic disease among children, often caused due to limited access to oral health care. Addressing this, pediatricians and dental professionals can play major roles by supporting children's oral health across various levels - within their practices, communities, and in governmental fields. The Campaign for Dental Health (CDH) emerged with a mission to guarantee universal access to the most efficient, cost-effective, and fair method for safeguarding teeth against decay: community water fluoridation. By supporting this cause, CDH aims to bridge gaps in oral health care accessibility for people of all ages.

Market Segmentation

The oral care market is segmented into product type, distribution channel, and region. On the basis of product type, the market is divided into toothbrush, toothpaste, mouthwash, denture products, and other dental accessories. As per distribution channel, the market is classified into online retail stores, convenience stores, supermarkets/hypermarkets, pharmacies & drug stores, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In the UK, unmet dental needs pose a significant challenge across all age groups. Government data from 2021-22 highlights tooth decay as the leading cause for hospital admissions among 6 to 10-year-olds. The UK Oral Health Foundation highlights this issue, noting that children miss an average of three school days annually due to dental issues. In addition, in 2022, 31% of adults require treatment for dental caries, while 74% have undergone tooth extraction for dental reasons.

In addition, data from the National Health Service (NHS) indicates a significant uptick in the number of individuals seeking treatment for these conditions over the past few years. This rise in oral health problems has directly correlated with increased consumer demand for a variety of oral care products, including toothpaste, mouthwash, and dental floss. Manufacturers and retailers have responded by expanding their product lines and marketing efforts to meet the growing needs of consumers dealing with oral health concerns.

- In March 2023, Oral-B launched THE BIG RETHINK campaign in the UK, aiming for equitable oral care for all. Teaming up with the International Association for Disability and Oral Health (iADH), they launched the positive practices program. This initiative trains dental practices to be more inclusive and adept at catering to patients with disabilities. Through education and adaptation, Oral-B seeks to enhance oral health outcomes for individuals with diverse needs. The partnership reflects a commitment toward understanding and addressing the physical and mental challenges faced by this community, ensuring that everyone, regardless of ability, receives quality dental care.

Competitive Landscape

The major players operating in the oral care market include Colgate-Palmolive Company, Church & Dwight Co., Inc., GSK plc, Unilever PLC, Johnson & Johnson Services, Inc., Lion Corporation, Procter & Gamble, GC Corporation, Henkel AG & Co. KGaA, and Sunstar Suisse S.A.

Other players in the oral care market include Oral B and Reckitt Benckiser Group plc.

Recent Key Strategies and Developments

- In January 2024, Lion Corporation introduced the OCH-TUNE brand, reshaping oral care with its innovative focus on style. Divided into fast and slow styles, each offers tailored options in toothpaste, toothbrushes, and mouthwashes. Fast products, like the toothpaste and toothbrush, prioritize rapid, refreshing cleaning with quick foaming and multi-clean designs. In contrast, slow variants emphasize meticulous care, featuring dense foam and a double-rich toothbrush design for thorough yet gentle brushing. The accompanying mouthwashes further enhance the experience, with fast delivering instant cooling and slow offering a mild, careful sensation. This dual-style approach grants consumers the flexibility to craft their oral care routine according to their preference, ensuring versatility and efficacy.

- In October 2023, Zydus Lifesciences Limited, via its subsidiary Zydus Pharmaceuticals UK Limited, acquired the UK-based LiqMeds Group, renowned for its expertise in developing, manufacturing, and supplying oral liquid products globally. The acquisition includes LM Manufacturing Limited, operating a manufacturing site in Weedon, Northampton, UK, supplying the U.S. and the UK markets. Zydus would pay an initial sum of approximately $85 million, with additional yearly earn-outs until 2026 based on predefined milestones. This strategic move is expected to enhance Zydus' earnings per share (EPS) from the first year of ownership, solidifying its position in the global life sciences arena.

Key Sources Referred

- World Bank

- World Dental Federation (FDI)

- International Association for Dental Research (IADR)

- American Dental Association (ADA)

- GSK plc

- Oral B

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the oral care treatment market segments, current trends, estimations, and dynamics of the oral care treatment market analysis from 2023 to 2033 to identify the prevailing oral care treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oral care treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global oral care treatment market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oral care treatment market trends, key players, market segments, application areas, and market growth strategies.

The market study comprises of all latest technological advancements, including the latest market development by major players operating in the market. Furthermore, the study also comprises detailed public policy analysis.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of manufacturers

4.3.2. List of customers

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Oral Care Market Analysis, by Product Type

5.1. Overview

5.2. Toothbrush

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Toothpaste

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Mouthwash

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2023-2033

5.4.3. Market share analysis, by country, 2023-2033

5.5. Denture Products

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2023-2033

5.5.3. Market share analysis, by country, 2023-2033

5.6. Other Dental Accessories

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2023-2033

5.6.3. Market share analysis, by country, 2023-2033

5.7. Research Dive Exclusive Insights

5.7.1. Market attractiveness

5.7.2. Competition heatmap

6. Oral Care Market Analysis, by Distribution Channel

6.1. Overview

6.2. Online Retail Stores

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Convenience Stores

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Supermarkets/Hypermarkets

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2023-2033

6.4.3. Market share analysis, by country, 2023-2033

6.5. Pharmacies & Drug Stores

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2023-2033

6.5.3. Market share analysis, by country, 2023-2033

6.6. Others

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2023-2033

6.6.3. Market share analysis, by country, 2023-2033

6.7. Research Dive Exclusive Insights

6.7.1. Market attractiveness

6.7.2. Competition heatmap

7. Oral Care Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Product Type, 2023-2033

7.1.1.2. Market size analysis, by Distribution Channel, 2023-2033

7.1.2. Canada

7.1.2.1. Market size analysis, by Product Type, 2023-2033

7.1.2.2. Market size analysis, by Distribution Channel, 2023-2033

7.1.3. Mexico

7.1.3.1. Market size analysis, by Product Type, 2023-2033

7.1.3.2. Market size analysis, by Distribution Channel, 2023-2033

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Product Type, 2023-2033

7.2.1.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.2. UK

7.2.2.1. Market size analysis, by Product Type, 2023-2033

7.2.2.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.3. France

7.2.3.1. Market size analysis, by Product Type, 2023-2033

7.2.3.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.4. Spain

7.2.4.1. Market size analysis, by Product Type, 2023-2033

7.2.4.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.5. Italy

7.2.5.1. Market size analysis, by Product Type, 2023-2033

7.2.5.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Product Type, 2023-2033

7.2.6.2. Market size analysis, by Distribution Channel, 2023-2033

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Product Type, 2023-2033

7.3.1.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.2. Japan

7.3.2.1. Market size analysis, by Product Type, 2023-2033

7.3.2.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.3. India

7.3.3.1. Market size analysis, by Product Type, 2023-2033

7.3.3.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.4. Australia

7.3.4.1. Market size analysis, by Product Type, 2023-2033

7.3.4.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.5. South Korea

7.3.5.1. Market size analysis, by Product Type, 2023-2033

7.3.5.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Product Type, 2023-2033

7.3.6.2. Market size analysis, by Distribution Channel, 2023-2033

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Product Type, 2023-2033

7.4.1.2. Market size analysis, by Distribution Channel, 2023-2033

7.4.2. UAE

7.4.2.1. Market size analysis, by Product Type, 2023-2033

7.4.2.2. Market size analysis, by Distribution Channel, 2023-2033

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Product Type, 2023-2033

7.4.3.2. Market size analysis, by Distribution Channel, 2023-2033

7.4.4. South Africa

7.4.4.1. Market size analysis, by Product Type, 2023-2033

7.4.4.2. Market size analysis, by Distribution Channel, 2023-2033

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Product Type, 2023-2033

7.4.5.2. Market size analysis, by Distribution Channel, 2023-2033

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Colgate-Palmolive Company

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Church & Dwight Co., Inc.

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. GSK plc

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Unilever PLC

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Johnson & Johnson Services, Inc.

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Lion Corporation

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Procter & Gamble

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. GC Corporation

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Henkel AG & Co. KGaA

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Sunstar Suisse S.A.

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com