Blood Platelet Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01114

Blood Platelet Market Size, Share, Competitive Landscape, and Trend Analysis Report by Platelet Type, Application, End User, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

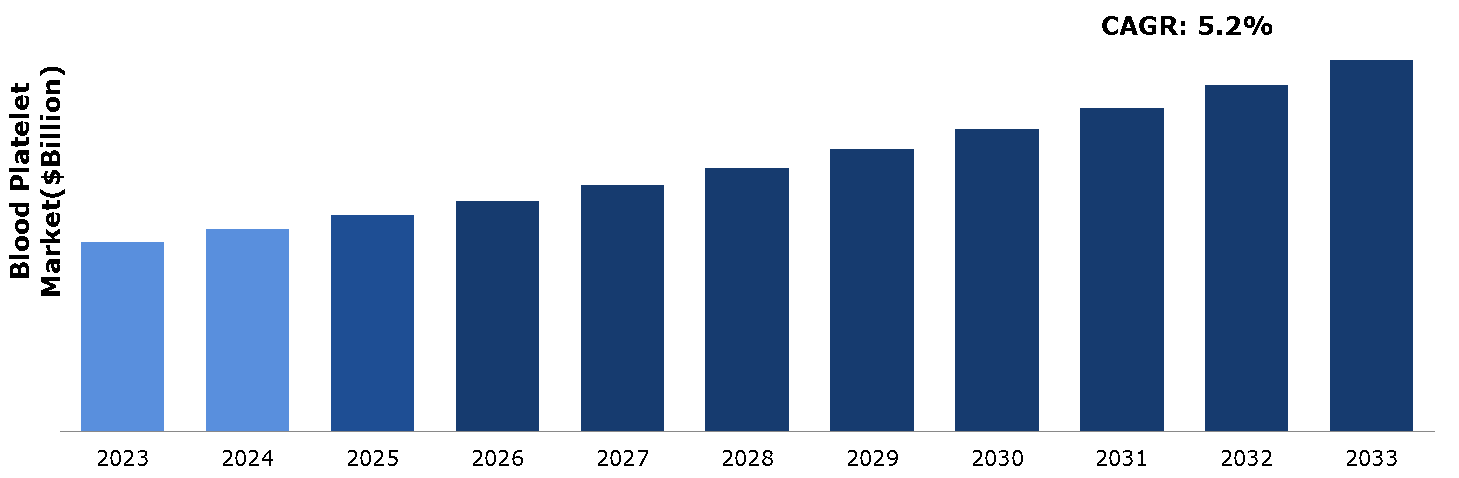

The blood platelet market was valued at $5.57 billion in 2023 and is estimated to reach $9.19 billion by 2033, exhibiting a CAGR of 5.2% from 2024 to 2033.

Overview of Blood Platelets

Blood platelets, also known as thrombocytes, are crucial components of the circulatory system. These tiny cell fragments lack a nucleus but play a major role in hemostasis, the process of blood clotting. Derived from megakaryocytes in bone marrow, platelets are released into the bloodstream to respond immediately to vascular injury. Upon encountering damaged blood vessels, platelets adhere to the site and aggregate to form a plug, stopping bleeding. Additionally, they release various factors that promote clotting, such as thromboxane A2 and serotonin. Platelets also contribute to wound healing and tissue repair. Despite their small size, platelets are indispensable for maintaining vascular integrity and preventing excessive blood loss, making them vital components of the body's defense mechanisms.

Key Takeaways

- The blood platelet market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major blood platelet industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In April 2024, ADF medical researchers, in collaboration with the University of Oxford, worked on an advanced study funded by a $1.8 million grant from the Medical Research Future Fund. Focused on critically ill patients, particularly those in intensive care post-major trauma, the study aims to determine the optimal threshold for platelet transfusions. Platelets, vital for clotting and vessel repair, often reduce in such patients, increasing bleeding risks. By pinpointing the precise platelet level necessitating transfusion, the research seeks to balance the benefits against potential complications like allergic reactions. This advanced effort promises to refine critical care protocols, enhancing patient outcomes.

- In August 2023, researchers from UC San Francisco and the University of Queensland identified platelet factor 4 (PF4), released by blood platelets, as important in rejuvenating the brain. PF4, traditionally signaling the immune system and clotting blood, emerges as a common link in anti-aging hormone klotho, young blood infusions, and exercise. This discovery provides emphasis on potential therapies to revive brain function, offering hope for combating age-related cognitive decline. PF4's ability to both invigorate aged brains and enhance youthful ones highlights its significance in discovering opportunities for novel treatments aimed at restoring cognitive vitality.

Key Market Dynamics

The rising awareness about blood donations and platelet transfusions has seen a significant rise in recent years. This surge can be attributed to various educational campaigns and advocacy efforts highlighting the critical need for these life-saving procedures. With increased awareness, more people are stepping forward to donate blood and platelets, thereby helping to meet the constant demand in healthcare settings. In the UK, NHS Blood and Transplant data reveals a significant shift in the demographics of blood donors over the past five years. The proportion of 17–24-year-olds contributing to the donor base has notably decreased from 13.07% in 2017/18 to 7.2% in 2022/23. Conversely, older donors aged 45 and above have seen a consistent increase, comprising 51.1% of donors in 2022/23, up from 48.7% in 2018/19. This shift highlights a changing dynamic in blood donation patterns, with efforts likely needed to engage younger demographics to maintain an effective and diverse donor pool. Moreover, community engagement initiatives and the spreading of accurate information have played vital roles in encouraging regular donations. As a result, societies are witnessing a positive shift towards a culture of voluntary blood and platelet donation, ultimately saving countless lives.

Moreover, the blood platelet market faces a significant challenge as the high risk of disease transmission threatens its growth. Concerns over potential infections have hampered the market's expansion efforts, prompting rigorous safety measures and stringent regulations to mitigate transmission risks and reassure consumers.

However, the increasing number of surgical procedures for chronic diseases such as cancer, cardiovascular conditions and others will significantly boost global demand for blood platelets in the coming years. This surge is driven by the essential role of platelets in ensuring successful surgeries and patient recovery.

Sickle Cell Disease Analysis

Sickle cell disease demands a continuous supply of blood platelets to manage its complications. These platelets play a crucial role in preventing excessive bleeding and supporting overall health in individuals with this condition. Without a steady infusion of platelets, patients face increased risks of complications such as organ damage and stroke due to sickle-shaped red blood cells blocking blood flow. Therefore, regular transfusions become a lifeline for those battling this genetic disorder, offering hope for improved quality of life and better disease management.

Sickle cell disease alters the shape of red blood cells, turning them into rigid, crescent forms due to a genetic mutation. Unlike normal, flexible cells, these sickled ones obstruct blood vessels, impeding oxygen flow throughout the body. This inherited disorder affects hemoglobin, essential for oxygen transport. Sickle cell disease, once reliant on bone marrow transplants, now offers hope through two FDA-approved therapies. One inserts a gene while the other modifies an existing one. Research also focuses on gene-related treatments.

According to National Heart, Lung, and Blood Institute April 2024 publication, sickle cell disease affecting over 100,000 Americans and 20 million globally, excessively impacts individuals of African descent. Approximately 1 in 13 Black babies possess the sickle cell trait, while 1 in every 365 Black newborns are diagnosed with sickle cell disease in the United States.

Market Segmentation

The blood platelet market is segmented into platelet type, application, end user, and region. On the basis of platelet type, the market is divided into whole blood derived platelets, and apheresis derived platelets. As per application, the market is segregated into platelet function disorder, hemophilia, thrombocytopenia, and perioperative indication. On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, blood banks, research laboratories, specialty clinics, cancer treatment centers, trauma centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

China is observing significant growth in its blood platelet market due to various factors, including advancements in medical technology, an increase in healthcare expenditure, and a rising prevalence of chronic diseases requiring platelet transfusions. The expansion of the healthcare infrastructure and heightened awareness of blood-related disorders are further propelling this market. For instance, the introduction of state-of-the-art blood collection and storage techniques has improved the efficiency and safety of platelet transfusions. A recent development exemplifying this trend is the establishment of new blood donation centers equipped with advanced apheresis machines, which enhance platelet collection efficiency.

Additionally, government initiatives aimed at improving blood donation rates and ensuring a steady supply of blood components are propelling the market growth.

In January 2023, HUTCHMED (China) Limited (HUTCHMED) announced that the New Drug Application (NDA) for sovleplenib, a novel, selective oral inhibitor targeting spleen tyrosine kinase (Syk), has been accepted for review and granted priority review by the China National Medical Products Administration (NMPA). Sovleplenib is being developed for the treatment of adult patients with primary immune thrombocytopenia (ITP) as well as other hematological malignancies and immune diseases. This priority review status highlights the potential significance of sovleplenib in addressing extreme medical needs in these patient populations.

Competitive Landscape

The major players operating in the blood platelet market include American Association of Blood Banks (AABB), America’s Blood Centers, French Red Cross, Canadian Blood Services, Japanese Red Cross Society, European Blood Alliance, OneBlood, American National Red Cross, Australian Red Cross, and Blood Bank of Alaska. Other players in the blood platelet market include Indian Red Cross Society, and Brazilian Red Cross.

Recent Key Strategies and Developments

- In February 2023, Terumo Blood and Cell Technologies received FDA clearance for its IMUGARD WB Platelet Pooling Set, marking its official launch. The IMUGARD set is the first in the U.S. to extend the shelf life of whole blood-derived platelets from five days to seven days. This advancement offers a crucial alternative source of platelet supply, addressing the growing demand amid a persistent shortage of blood donors. By enhancing the longevity of platelet storage, IMUGARD is expected to improve supply challenges and ensure more reliable availability of these vital blood components, representing a significant step forward in blood management and transfusion practices.

- In February 2024, America’s Blood Centers (ABC) launched its 2024 Advocacy Agenda, outlining key federal legislative and regulatory priorities for community blood centers. Developed with input from the ABC Board of Directors, Policy Council, and member blood centers, the agenda highlights necessary legislative and regulatory solutions. Serving as a guide for ABC's advocacy efforts, it highlights the critical role of blood for patients, communities, and the healthcare system. ABC aims to work with the Administration, Congress, and industry stakeholders to raise awareness and promote the essential contribution of blood donation in maintaining health and saving lives.

Key Sources Referred

- American Association of Blood Banks (AABB)

- America’s Blood Centers

- European Blood Alliance

- French Red Cross

- Helmer Scientific

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the blood platelet market segments, current trends, estimations, and dynamics of the blood platelet market analysis from 2023 to 2033 to identify the prevailing blood platelet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blood platelet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global blood platelet market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blood platelet market trends, key players, market segments, application areas, and market growth strategies.

The market study comprises of all latest technological advancements, including the latest market development by major players operating in the market. Furthermore, the study also comprises detailed major disease analysis.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Platelet Type |

|

| Segmentation by Application |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Patent matrix

4.4.3. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

5. Blood Platelet Market Analysis, by Platelet Type

5.1. Overview

5.2. Whole Blood Derived Platelets

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2023-2033

5.2.3. Market share analysis, by country, 2023-2033

5.3. Apheresis Derived Platelets

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2023-2033

5.3.3. Market share analysis, by country, 2023-2033

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Blood Platelet Market Analysis, by Application

6.1. Overview

6.2. Platelet Function Disorder

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2023-2033

6.2.3. Market share analysis, by country, 2023-2033

6.3. Hemophilia

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2023-2033

6.3.3. Market share analysis, by country, 2023-2033

6.4. Thrombocytopenia

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2023-2033

6.4.3. Market share analysis, by country, 2023-2033

6.5. Perioperative Indication

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2023-2033

6.5.3. Market share analysis, by country, 2023-2033

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Blood Platelet Market Analysis, by End User

7.1. Overview

7.2. Hospitals

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2023-2033

7.2.3. Market share analysis, by country, 2023-2033

7.3. Ambulatory Surgical Centers

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2023-2033

7.3.3. Market share analysis, by country, 2023-2033

7.4. Blood Banks

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2023-2033

7.4.3. Market share analysis, by country, 2023-2033

7.5. Research Laboratories

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2023-2033

7.5.3. Market share analysis, by country, 2023-2033

7.6. Specialty Clinics

7.6.1. Definition, key trends, growth factors, and opportunities

7.6.2. Market size analysis, by region, 2023-2033

7.6.3. Market share analysis, by country, 2023-2033

7.7. Cancer Treatment Centers

7.7.1. Definition, key trends, growth factors, and opportunities

7.7.2. Market size analysis, by region, 2023-2033

7.7.3. Market share analysis, by country, 2023-2033

7.8. Trauma Centers

7.8.1. Definition, key trends, growth factors, and opportunities

7.8.2. Market size analysis, by region, 2023-2033

7.8.3. Market share analysis, by country, 2023-2033

7.9. Others

7.9.1. Definition, key trends, growth factors, and opportunities

7.9.2. Market size analysis, by region, 2023-2033

7.9.3. Market share analysis, by country, 2023-2033

7.10. Research Dive Exclusive Insights

7.10.1. Market attractiveness

7.10.2. Competition heatmap

8. Blood Platelet Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Platelet Type, 2023-2033

8.1.1.2. Market size analysis, by Application, 2023-2033

8.1.1.3. Market size analysis, by End User, 2023-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Platelet Type, 2023-2033

8.1.2.2. Market size analysis, by Application, 2023-2033

8.1.2.3. Market size analysis, by End User, 2023-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Platelet Type, 2023-2033

8.1.3.2. Market size analysis, by Application, 2023-2033

8.1.3.3. Market size analysis, by End User, 2023-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Platelet Type, 2023-2033

8.2.1.2. Market size analysis, by Application, 2023-2033

8.2.1.3. Market size analysis, by End User, 2023-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Platelet Type, 2023-2033

8.2.2.2. Market size analysis, by Application, 2023-2033

8.2.2.3. Market size analysis, by End User, 2023-2033

8.2.3. France

8.2.3.1. Market size analysis, by Platelet Type, 2023-2033

8.2.3.2. Market size analysis, by Application, 2023-2033

8.2.3.3. Market size analysis, by End User, 2023-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Platelet Type, 2023-2033

8.2.4.2. Market size analysis, by Application, 2023-2033

8.2.4.3. Market size analysis, by End User, 2023-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Platelet Type, 2023-2033

8.2.5.2. Market size analysis, by Application, 2023-2033

8.2.5.3. Market size analysis, by End User, 2023-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Platelet Type, 2023-2033

8.2.6.2. Market size analysis, by Application, 2023-2033

8.2.6.3. Market size analysis, by End User, 2023-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Platelet Type, 2023-2033

8.3.1.2. Market size analysis, by Application, 2023-2033

8.3.1.3. Market size analysis, by End User, 2023-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Platelet Type, 2023-2033

8.3.2.2. Market size analysis, by Application, 2023-2033

8.3.2.3. Market size analysis, by End User, 2023-2033

8.3.3. India

8.3.3.1. Market size analysis, by Platelet Type, 2023-2033

8.3.3.2. Market size analysis, by Application, 2023-2033

8.3.3.3. Market size analysis, by End User, 2023-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Platelet Type, 2023-2033

8.3.4.2. Market size analysis, by Application, 2023-2033

8.3.4.3. Market size analysis, by End User, 2023-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Platelet Type, 2023-2033

8.3.5.2. Market size analysis, by Application, 2023-2033

8.3.5.3. Market size analysis, by End User, 2023-2033

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Platelet Type, 2023-2033

8.3.6.2. Market size analysis, by Application, 2023-2033

8.3.6.3. Market size analysis, by End User, 2023-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Platelet Type, 2023-2033

8.4.1.2. Market size analysis, by Application, 2023-2033

8.4.1.3. Market size analysis, by End User, 2023-2033

8.4.2. UAE

8.4.2.1. Market size analysis, by Platelet Type, 2023-2033

8.4.2.2. Market size analysis, by Application, 2023-2033

8.4.2.3. Market size analysis, by End User, 2023-2033

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Platelet Type, 2023-2033

8.4.3.2. Market size analysis, by Application, 2023-2033

8.4.3.3. Market size analysis, by End User, 2023-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Platelet Type, 2023-2033

8.4.4.2. Market size analysis, by Application, 2023-2033

8.4.4.3. Market size analysis, by End User, 2023-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Platelet Type, 2023-2033

8.4.5.2. Market size analysis, by Application, 2023-2033

8.4.5.3. Market size analysis, by End User, 2023-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. American Association of Blood Banks (AABB)

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. America’s Blood Centers

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. French Red Cross

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Canadian Blood Services

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Japanese Red Cross Society

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. European Blood Alliance

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. OneBlood

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. American National Red Cross

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Australian Red Cross

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Blood Bank of Alaska

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com