Fill Finish Manufacturing Market Size Share Competitive Landscape And Trend Analysis Report Report

RA01048

Fill Finish Manufacturing Market Size, Share, Competitive Landscape, and Trend Analysis Report by Product, Application, End Use, and Region: Global Opportunity Analysis and Industry Forecast, 2024-2033

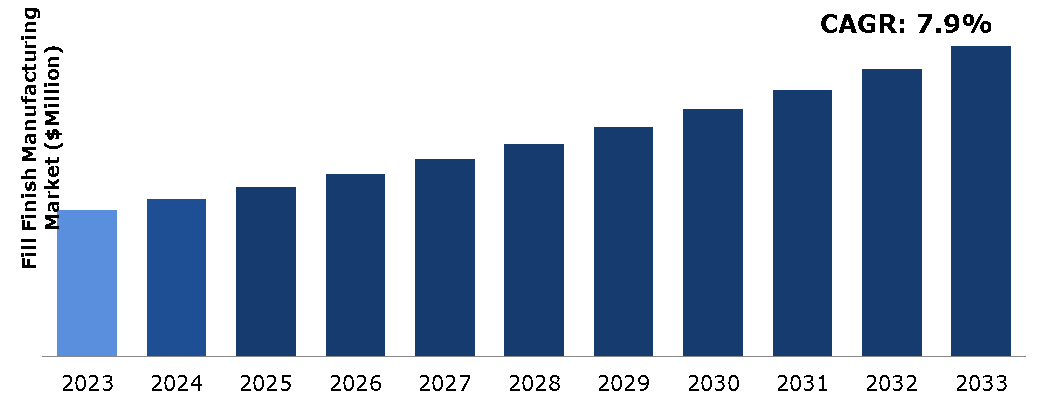

The fill finish manufacturing market was valued at $10,282.00 million in 2023 and is estimated to reach $21,891.48 million by 2033, exhibiting a CAGR of 7.9% from 2024 to 2033.

Market Introduction and Definition

Fill-finish manufacturing is a critical step in the production of pharmaceutical products, particularly injectable drugs and biologics. It involves the final processes that prepare the products for distribution and administration to patients. This step involves transferring the bulk drug substance into its final container, such as vials, syringes, or cartridges. The process must be precise to ensure each container has the correct dosage. Containers are then labeled with essential information, including the drug name, dosage, batch number, expiration date, and other regulatory requirements. Each container is inspected for quality assurance. This may involve checking for particulate matter, proper fill levels, and integrity of the seal.

Key Takeaways

- The fill finish manufacturing market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In June 2023, Catalent Inc. unveiled an expansion of its OneBio Suite, integrating development, manufacturing, and supply services for a range of biologic therapies, including antibodies, recombinant proteins, cell and gene therapies, and mRNA. This strategic initiative strengthens Catalent's ability to provide holistic solutions for biopharmaceutical development and manufacturing, reinforcing its competitive position in the industry.

- In February 2021, Cytiva completed the acquisition of Vanrx Pharmasystems, a Canadian company specializing in sterile filling equipment for syringes, vials, and cartridges. This strategic move is aimed at enhancing Cytiva's ability to offer effective solutions to biomanufacturers by reducing risks and improving efficiency in the filling process for patient treatments.

- In October 2021, Aenova Group boosted its sterile fill and finish capabilities in Latina, Italy, by introducing a cutting-edge, high-speed flexible line dedicated to prefilled syringes and vials. This expansion provides space for producing over 180 million prefilled syringes and upwards of 80 million vials.

- In September 2022, BD (Becton, Dickinson and Company), a leading global medical technology company, introduced a next-generation glass prefillable syringe (PFS) that sets a new standard in performance for vaccine PFS with new and tightened specifications for processability, cosmetics, contamination and integrity.

Key Market Dynamics

The growing incidence of chronic diseases, including cancer, diabetes, and autoimmune disorders, is significantly boosting the demand for injectable drugs. These conditions often necessitate long-term treatment regimens where injectable medications play a critical role in managing patient health. Many injectable drugs are biologics, which are complex and require stringent manufacturing processes to maintain their safety and efficacy. The precise nature of fill finish processes ensures that these biologics meet necessary standards, further driving demand in the market. The biopharmaceutical industry is expanding, with more companies entering the market and increasing production volumes. This surge in biopharmaceutical products requires robust fill finish manufacturing capabilities to meet the growing demand.

One of the primary concerns is the stringent regulatory compliance. Regulatory bodies like the FDA and EMA play crucial roles in ensuring the safety, efficacy, and quality of pharmaceutical products. However, their rigorous standards often entail extensive documentation, testing, and adherence to specific protocols, which can significantly increase compliance costs for manufacturers. Moreover, regulatory requirements are subject to constant updates and changes, necessitating continuous monitoring and adaptation by manufacturers.

Continuous innovation in fill-finish technologies, such as robotics, isolator technology, and single-use systems, enhances efficiency, reduces contamination risks, and lowers manufacturing costs. Companies investing in these technologies can gain a competitive edge in the market. Isolator technology creates a controlled environment, minimizing the risk of contamination during the fill-finish process. This is crucial in industries like pharmaceuticals, where product purity is paramount. By investing in such advanced systems, companies can ensure the integrity of their products and meet stringent regulatory requirements. Technological advancements often come hand in hand with improved monitoring and control capabilities. Enhanced automation and data analytics enable real-time monitoring of critical parameters, ensuring compliance with regulatory standards and maintaining product quality. This level of oversight not only reduces the risk of product recalls but also enhances customer trust and brand reputation.

Public Policies of Global Fill Finish Manufacturing Market

Public policies for the fill finish manufacturing market are crucial in pharmaceutical production where the final drug product is placed into containers, sealed, and prepared for distribution.

Good Manufacturing Practices (GMP): Enforced by agencies like the FDA (U.S.), EMA (Europe), and others globally, GMP guidelines ensure that pharmaceutical products are consistently produced and controlled according to quality standards. These include stringent requirements for cleanliness, equipment maintenance, and employee training.

Advanced Manufacturing Technologies: Governments encourage the adoption of cutting-edge technologies like single-use systems, continuous manufacturing, and automation to enhance efficiency and reduce contamination risks.

Market Segmentation

The fill finish manufacturing market is segmented into product, application, end use, and region. On the basis of product, the market is divided into consumables and instruments. On the basis of application, the market is classified into parenteral drug delivery, biologics manufacturing, personalized medicines, and others. By end use, the market is classified into pharmaceutical and biopharmaceutical companies, contract manufacturing organizations, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Canada has stringent regulations governing pharmaceutical manufacturing, ensuring product safety and quality. Changes in regulations can significantly impact fill-finish operations. Canada's aging population increases the demand for pharmaceuticals, driving growth in the fill-finish manufacturing market. The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases necessitates a steady supply of medications, boosting the need for fill-finish services. Canada has entered into various trade agreements, such as the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive Economic and Trade Agreement (CETA) with the European Union. These agreements provide Canadian manufacturers with preferential access to large consumer markets, enhancing their competitiveness on the global stage. The country boasts a well-educated and skilled workforce, which is crucial for advanced manufacturing processes. Canada's emphasis on education and training contributes to a labor force that is capable of handling sophisticated manufacturing technologies and processes. Canada enjoys a stable political environment, which is conducive to business operations and investment. A transparent regulatory framework and respect for intellectual property rights provide manufacturers with the confidence to invest in the country.

On May 4, 2023, Moderna, Inc., a trailblazing biotech firm specializing in messenger RNA (mRNA) therapies and vaccines, announced a significant partnership with Novocol Pharma, headquartered in Ontario. The agreement spans a considerable duration and entails Novocol Pharma, a prominent contract development and manufacturing organization (CDMO) specializing in sterile injectables, to oversee the aseptic filling, labeling, and packaging of mRNA-based respiratory vaccines projected to be manufactured in Canada.

Competitive Landscape

The major players operating in the fill finish manufacturing market include Boehringer Ingelheim, Baxter International Inc., Catalent, Inc., Eurofins Scientific S.E., Fresenius SE & Co. KGaA, MabPlex International Co., Ltd., Novartis AG, Recro Pharma, Inc., Recipharm, and Symbiosis Pharmaceuticals Pvt. Ltd.

Recent Key Strategies and Developments

- In September 2023, Syntegon Technology GmbH, a leading provider of process and packaging technology worldwide, unveiled its latest advancements in filling and processing small and micro batches at CPHI Barcelona 2023 in Spain, which took place in October 24-26, 2023. There is a significant market demand for equipment tailored for small batch sizes, not just for research and development purposes but also for the commercial manufacturing of liquid and solid pharmaceuticals.

- In February 2022, Moderna and Thermo Fisher Scientific initiated a lasting strategic partnership aimed at enhancing the capabilities of aseptic fill-finish manufacturing for Spikevax, COVID-19 vaccines, and various mRNA therapies within the United States.

Key Sources Referred

- FDA (Food and Drug Administration)

- ICH (International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use)

- USP (United States Pharmacopeia)

- EMA (European Medicines Agency)

- National Regulatory Authorities (NRAs)

- ISO (International Organization for Standardization)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the fill finish manufacturing market segments, current trends, estimations, and dynamics of the fill finish manufacturing market analysis from 2023 to 2033 to identify the prevailing fill finish manufacturing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fill finish manufacturing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global fill finish manufacturing market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the above-mentioned points, the report includes the analysis of the regional as well as global fill finish manufacturing market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Application |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Fill Finish Manufacturing Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Fill Finish Manufacturing Market Analysis, by Product

5.1. Overview

5.2. Consumables

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Instruments

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Fill Finish Manufacturing Market Analysis, by Application

6.1. Overview

6.2. Parenteral Drug Delivery

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Biologics Manufacturing

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Personalized Medicines

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Others

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Fill Finish Manufacturing Market Analysis, by End Use

7.1. Overview

7.2. Pharmaceutical And Biopharmaceutical Companies

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Contract Manufacturing Organizations

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Others

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Fill Finish Manufacturing Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product, 2022-2032

8.1.1.2. Market size analysis, by Application, 2022-2032

8.1.1.3. Market size analysis, by End-use, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Product, 2022-2032

8.1.2.2. Market size analysis, by Application, 2022-2032

8.1.2.3. Market size analysis, by End-use, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product, 2022-2032

8.1.3.2. Market size analysis, by Application, 2022-2032

8.1.3.3. Market size analysis, by End-use, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product, 2022-2032

8.2.1.2. Market size analysis, by Application, 2022-2032

8.2.1.3. Market size analysis, by End-use, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Product, 2022-2032

8.2.2.2. Market size analysis, by Application, 2022-2032

8.2.2.3. Market size analysis, by End-use, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Product, 2022-2032

8.2.3.2. Market size analysis, by Application, 2022-2032

8.2.3.3. Market size analysis, by End-use, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Product, 2022-2032

8.2.4.2. Market size analysis, by Application, 2022-2032

8.2.4.3. Market size analysis, by End-use, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Product, 2022-2032

8.2.5.2. Market size analysis, by Application, 2022-2032

8.2.5.3. Market size analysis, by End-use, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product, 2022-2032

8.2.6.2. Market size analysis, by Application, 2022-2032

8.2.6.3. Market size analysis, by End-use, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product, 2022-2032

8.3.1.2. Market size analysis, by Application, 2022-2032

8.3.1.3. Market size analysis, by End-use, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Product, 2022-2032

8.3.2.2. Market size analysis, by Application, 2022-2032

8.3.2.3. Market size analysis, by End-use, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Product, 2022-2032

8.3.3.2. Market size analysis, by Application, 2022-2032

8.3.3.3. Market size analysis, by End-use, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Product, 2022-2032

8.3.4.2. Market size analysis, by Application, 2022-2032

8.3.4.3. Market size analysis, by End-use, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Product, 2022-2032

8.3.5.2. Market size analysis, by Application, 2022-2032

8.3.5.3. Market size analysis, by End-use, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Product, 2022-2032

8.3.6.2. Market size analysis, by Application, 2022-2032

8.3.6.3. Market size analysis, by End-use, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product, 2022-2032

8.4.1.2. Market size analysis, by Application, 2022-2032

8.4.1.3. Market size analysis, by End-use, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Product, 2022-2032

8.4.2.2. Market size analysis, by Application, 2022-2032

8.4.2.3. Market size analysis, by End-use, 2022-2032

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Product, 2022-2032

8.4.3.2. Market size analysis, by Application, 2022-2032

8.4.3.3. Market size analysis, by End-use, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Product, 2022-2032

8.4.4.2. Market size analysis, by Application, 2022-2032

8.4.4.3. Market size analysis, by End-use, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product, 2022-2032

8.4.5.2. Market size analysis, by Application, 2022-2032

8.4.5.3. Market size analysis, by End-use, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Boehringer Ingelheim

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Baxter International Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Catalent, Inc.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Eurofins Scientific S.E.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Fresenius SE & Co. KGaA

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. MabPlex International Co., Ltd.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Novartis AG

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Recro Pharma, Inc.

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Recipharm

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Symbiosis Pharmaceuticals Pvt. Ltd

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com